Steemit Crypto Academy Contest / S1W4 – Reviewing the Instability of the Crypto Market by @preshymukel

Hello Steemians, I am glad to be participating in the Steemit engagement challenge of the Steemit Cryptoacademy in the Season 1 Week 4.

The contest for this week is “Instability of the Crypto Market". It is a very interesting topic as it concerns the current price condition of cryptocurrencies in the financial market.

Below is the details of my post.

Most of the cryptocurrency market is currently experiencing a sharp decline, especially in recent days. What do you think of this drop? State its causes and how long do you think it will continue in this downtrend?

What I think about the crypto drop

Firstly, in understanding the fluctuations in the price of cryptocurrencies, it is no news that the cryptocurrencies are volatile in nature. The prices of cryptocurrencies readily changes from one price to another, from high to low and vise versa.

Secondly, the crypto ecosystems are decentralized systems, meaning they’re not controlled by any central authority. A centralized authority can off course help improve the value of coin by placing a fixed value on the coin, but since cryptocurrencies are decentralized, the values tend to fluctuate as no one is in control.

The current drop in crypto is therefore not an unexpected one, because as we all know the crypto market values are not fixed; they drop and they increase.

I think that a number of persons are in a panic state, asking if this current state of cryptocurrencies will come to end. While some others are comfortable with it knowing that the crypto market is a volatile one, and believing that the market will bounce back again in no time. Some are even seeing this current state of market as an opportunity to invest in cryptocurrencies and accumulate more coins for future gain.

What’s the cause of the recent drop in cryptocurrencies

Before I go into the causes of the recent drop in cryptocurrencies I’ll like to point out some sources through which cryptocurrencies derive their values, and these are;

- Supply and demand: The law of supply and demand also applies in the crypto market just like every other things wanted by people. If the demand of any cryptocurrency becomes higher than supply, the price of the cryptocurrency goes up. And if the supply becomes higher than the demand the price of the cryptocurrency drops.

- Availability a cryptocurrency on an exchange

- Cost of production

- Governance

- Competition

- Regulation

Now into what I think is the main source/cause of the recent drop

First, I mentioned earlier that one of the source cryptocurrencies derived their value is regulation. This regulation source comes into play in the current drop of cryptocurrencies when the Chinese government ban the use of cryptocurrencies. China was once the capital of Bitcoin trading in the world, the ban of crypto in China therefore created crypto FUD among investors and traders. This resulted to some investors selling off their Bitcoins due to fear, uncertainty and doubt leading to a drop in the value of Bitcoin.

There has been losses recently in the price of Bitcoin which are pointed down to the ban of crypto in China, which also left a negative impact on other cryptocurrencies regarding the fact that the values of other cryptocurrencies are directly dependent on the value of Bitcoin been that it is the first cryptocurrency.

Secondly, the Russia,s invasion of Ukraine also brought about uncertainty in the crypto market, as many investors were selling off their coins to at least make ends meet amid a war without a sight of an end. This also dropped the value of cryptocurrencies drastically.

The market has remained unsettled until the recent news about the meltdown of the Terra ecosystem which has also lead to a drastic drop in the price of cryptocurrencies.

This whole issue started when an attack was launched on the stable coin (TerraUSD) of Terra network . This attack led to the drop of the stable coin from $1 to $9.98, this thereby led to dumping of the coin by users. The dumping of the Terra stable coin thereby affected the entire ecosystem and the price of LUNA was not excluded.

So many investors who were affected with the dumping of TerraUSD and even other investors in crypto space panicked with fear, uncertainty and doubts of cryptocurrencies as a whole. This resulted to the selling off of crypto assets by most investors thereby causing more decline in the price of cryptocurrencies.

How long will this continue in this downtrend

How long this downtrend will continue cannot easily be established looking at all that has happened lately in the crypto markets.

I think that sooner or later the market will stabilize again considering the volatility nature of cryptocurrencies, a downtrend will surely one day return to an uptrend.

Why doesn't this drop in the price of a few coins decrease their trading volume (eg: Bitcoin)? How will they deal with this market instability?

The trading volume of a coin simply refers to its trading activity, that is the amount of buying and selling of the coin within a particular period in time. The trading volume of a coin is gotten from the number of completed trades in the market at a particular given time. For instance, if a total number of 100BTC are traded (buying and selling) in a week, it can be said that the trading volume of BTC in that week is 100.

Trading volume of a coin can help traders determine the liquidity of the coin at any given time.

The reason why the drop did not reduce the trading volume of some coins such as BTC is because a whole lot of buying and selling of these coins is still going on.

While some investors are selling off their coins due to fear, uncertainty and doubts, others are actually seeing the drop as a great opportunity to enter the market by buying and holding these coins for future gains. This is thereby maintaining the trading volumes of these coins causing it not to decrease due to the drop.

What is the relationship between the current instability and the downfall of the Terra ecosystem and its Luna currency? Do you think its price will bounce back? If so, tell us how and when?

TerraUSD (UST) and LUNA are the native tokens of the Terra blockchain network, the values of both tokens has been stable regardless of all the recent happenings in the cryptocurrency market.

This showed the role of Terra network in dealing with price instability. This success history led UST to becoming the fourth biggest stable coin.

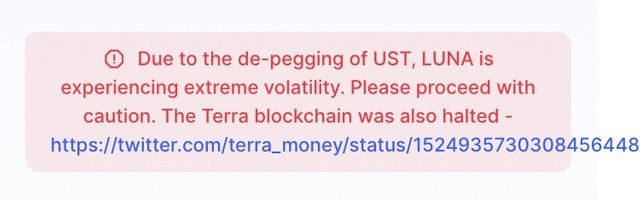

All of these changed when an attack was launch at the Terra network, and the price of the Terra stable coin (UST) which was supposed to prevent instability dropped from $1 to $0.98

The price of UST tracks that of US dollar, the UST is therefore peg to the US dollar; that is 1 UST is equal to $1.

What caused the instability in the price of the UST is the method used in maintaining the stable coin. The TerraUSD (UST) is a algorithmic stabilized coin. This involves the use of smart contract based algorithm to maintain the price of UST, by pegging the price of UST to $1 by burning and also the burning of LUNA worth $1 in order to mint to new UST.

Thus if the supply of LUNA increases and its price decreases below $1, LUNA holders will therefore be at loss by burning $1 worth of LUNA to mint UST less than one.

The attack on the Terra ecosystem thereby made holders of UST to sell off their coins and this led to the drop of UST which also affected the burning and the minting mechanism. The price of LUNA further drops as holders dumps it for other more stable coins.

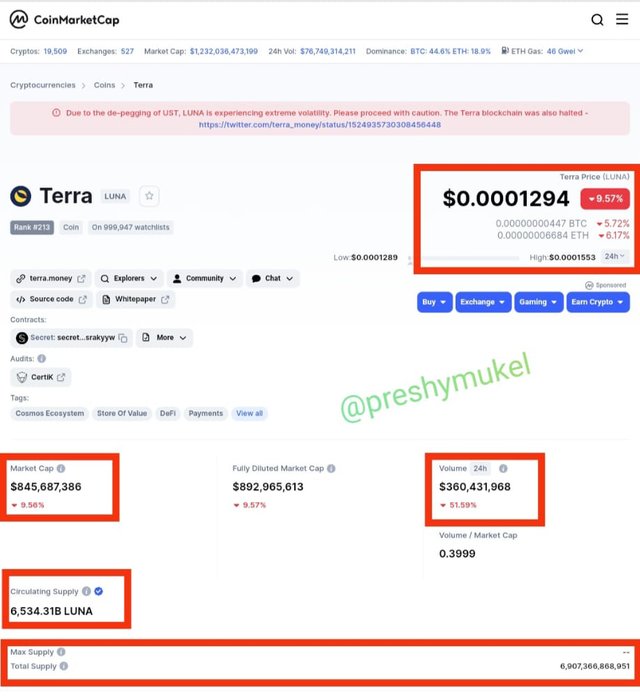

Valuation of LUNA on CoinMarketCap

Do you think its price will bounce back and How?

In my opinion, I don’t think the price of LUNA will bounce back anytime soon. Reason is because most investors are faced with fear, uncertainty and doubt about the growth of LUNA considering the losses LUNA holders had in recent days in the course of the attack.

Also considering the fact that LUNA is an algorithmic stable coins and, algorithmic stable coins are designed with no guarantee, it will therefore be hard for investors to trust the project and be confident in it again.

The main reason for the drop in the price of LUNA is its current high rate of supply. For the price of LUNA to be able to bounce back, the current supply of LUNA which is very high has to be reduced and this can be achieved by burning a high number of LUNA which cannot be easily achieved.

Some exchange also announced the discontinuous trading of LUNA, this is not a good one for the Terra network, and in my own opinion I think it will take a long time for LUNA to bounce back to $1.

Below is what I saw once I searched and opened the LUNA coin on CoinMarketCap.

CoinMarketCap

Our Steem ecosystem, like most currencies, has been affected by this market downturn, has this caused you as a user some stress? Or are you still confident in this project? Give your opinion, specifying the arguments that support your review

The downtrend in the crypto market has indeed also affected the Steem ecosystem just like every other cryptocurrency. The downtrend has affected the native token (Steem) of the ecosystem, this drop did not leave the stable coins (SBD) of the ecosystem behind.

The occurrence of the downtrend dropped the price of Steem and its stable coin (SBD) to a value below -40%, this drop in price of Steem and SBD led to a debt ratio above 27% which on a norms in an uptrend market is usually below 9%.

An increase in debt ratio above 10% show a serious decline in price of the steem ecosystem coins, and this increase in debt ratio will affect the production of SBD in the post of user, this means that the production of SBD will be suspended until the debt ratio gets back to below 9% again, then everything will stabilize again. But until then the amount of curation on users post will be negatively affected by the downtrend, the payout on users post will be greatly reduced.

I wouldn’t say the occurrence has caused me any stress as a user on the steem ecosystem, because I have not been active on the Steemit platform for sometime now, I lost my mobile phone a month ago and due this reason I was inactive on the Steemit platform until I got a new mobile phone last week. I was able to make just one post on the platform as of last week which has not paid out. I guess I’ll feel the negative impact of the downtrend when my post pays out..

Conclusion

Crypto investment is a good one but before investing in cryptocurrencies, it is important for one to note that the crypto market is highly volatile as the market is unregulated. It is also necessary to note and understand the principle of supply and demand and other sources that gives cryptocurrencies value.

This will help in making good investment decisions in the crypto world.

You have written very well, your work is well arranged and detailed. You have also proven to us your understanding of the current crypto market instability.

The crypto market is indeed unpredictable, reason why we should always invest with caution.

In the case of Terra ecosystem meltdown some investors almost took their lives due to the losses.

My heart goes to all victims of this LUNA crash, also to the to Team behind the LUNA project, we hope that a miracle happens and it bounce back to normal so that both investors and the Terra network team can smile again.

Thanks @estyroberts for visiting my blog. Your comment is highly appropriated

You did a great job in explaining and motivating yourself. If I had one wish it would be for a crystal ball so that I could see what the future will bring for the markets (•ิ‿•ิ)

We can just keep our fingers cross and BELIEVE!

Thanks @patjewell for reading through my post🥰😍