Steemit Crypto Academy Week 7 Task: Money Management & Portfolio Management | lecture by @stream4u

Introduction

Hello Steemians,

Welcome to another week in the Steemit crypto academy. I attended the lecture by the crypto professor @stream4u as the professor based his teachings on Money management and Portfolio management. This blog is my homework task after the completion of the lesson.

Discussed Money Management.

.jpeg)

Source

Within these few weeks of my attendance into the crypto academy classes, I have learnt that to be successful in either buying or selling an asset one needs technical knowledge. You have to know when and how to invest your money. With that in mind, we can boldly say Money Management is the proper allocation of resources into other investments at the right time at the right place to avoid unnecessary loses. Or it is the process of dividing your total capital into the different part so that you can invest them differently I.e not gathering your entire eggs in one basket.

plan on your Money Management

Before this time, I don't have much idea how about manage or plan my money. Though with my little knowledge of cryptocurrency, I know that there are many risks involved. So you will agree with me that I have not put in proper measure to ensure I secure my money. But since the whole of this lecture started daily I get a new idea on how to manage my resource. Last week I learnt about using a watchlist to monitor cryptocurrency am interested in. Today I have learnt that I need to divide my resource into at least 4 parts. So that I can invest them in small, mid-term and long-term trading respectively. I want to believe that after today I will not have any course to regret. More also, with the help of the watchlist, I can effectively monitor the coin I wish to invest in until an opportunity surfaces for me to either buy or sell.

Discussed Portfolio Management, if you have an investment and if it is okay with you then show portfolio and explore it briefly.

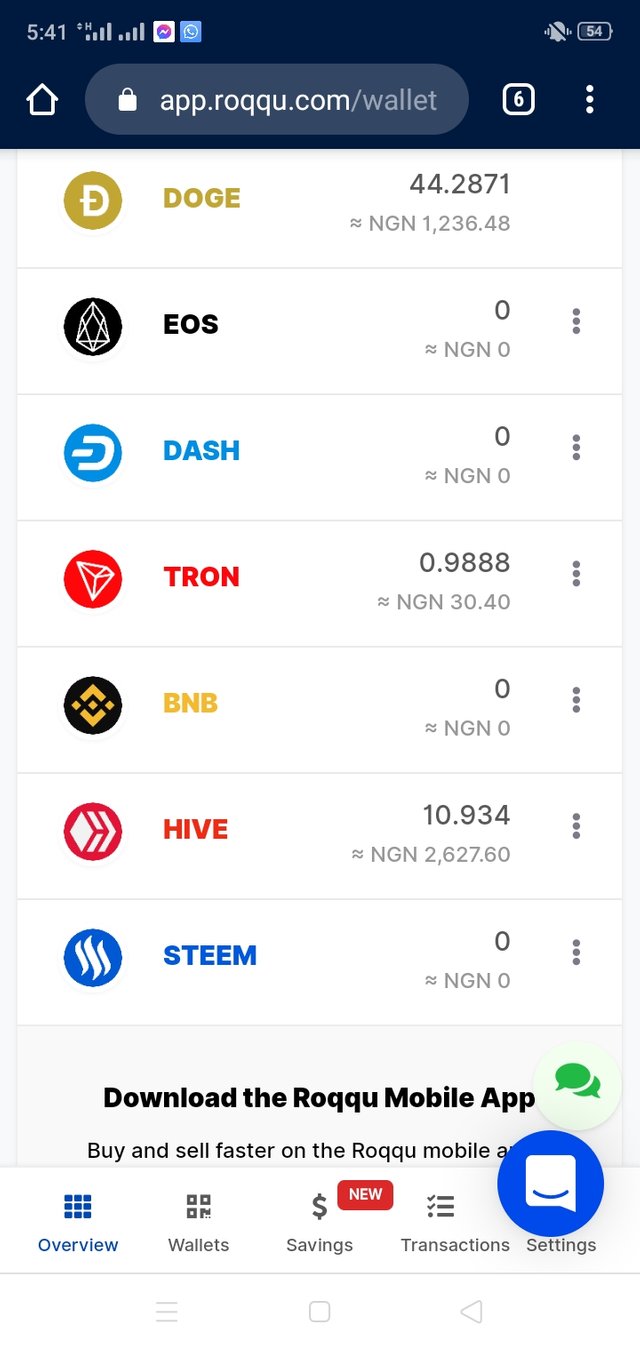

Portfolio management is managing assets in the investment portfolio to maximise the returns in the investment. Furthermore, portfolio management involves making investment decisions considering the risk involved and potential returns on a particular asset. Portfolio management is the collection of assets I've bought after making some analysis on some particular assets. Recall that when I was discussing money management I said it's always advisable not to gather all your eggs in one basket. Now where the toughest decision lies is knowing the portion of your capital to invest in a different asset as many risks is also associated with it. I will be showing my investment in an exchange below.

From the image above, I diversify my investment into different cryptocurrency. These investment decisions are based on the technical and fundamental analysis carried out carefully on the projects. Similarly, the majority of the cryptocurrency I invested in is the medium capital (DOGE, TRX, HIVE) which still have great potential to increase their market capitalization in the future as the projects are still at the development stage. Truth is said, my investment will take a longer time to fetch me much profit but am still certain that I made these investments with the risk in mind. Here in this investment, I considered Risk Capital in my investment.

plan on your Portfolio Management.

From my portfolio above, I have concluded that I am not practising good portfolio management. The reason is that I only invested in medium capital without considering large and small respectively. My plans on portfolio management are to fully understand the basics of the projects I’m investing in. More also, I will be able to practice money management in the future to break down my capital into four and invest them into large, mid and small capital business respectively.

When was the last investment failed and Why? (those who have experienced this can provide views.)

Well, I have never experienced any fail investment before, the reason is not far fetched. I recently learnt about cryptocurrency a few months ago and because of that, I have not encountered any fail investment since I joined. Though recently I have some pending issues with my Roqqu wallet, due to the band of crypto transactions in my dear country Nigeria, some amount of money I placed on withdrawal is still hanging till this moment.

Conclusion

In conclusion, It's important to mention here that all investment comes with its own risk especially in digital assets which has very high volatility, an investor should be careful in making research and seeking advice from professionals before investing in any asset. Investing in a diverse source can help prevent huge loses that’s why one needs a portfolio to manage his or her assets effectively. I want to appreciate in a more special way professor @stream4u for this wonderful lecture, it's a great one and I look forward to learning more from the professor and other Steemit professors.

Special regards;

Cc: @steemcurator01

Cc: @steemcurator02

Cc: @steemitblog

Cc: @stream4u

Cc: @trafalgar

Hi @predomina

Thank you for joining Steemit Crypto Academy and participated in the Homework Task 7.

Your Homework task 7 verification has been done by @Stream4u, hope you have enjoyed and learned something new in the 7th course.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

Thank you sir. Sure I have learnt a whole lot in the week 7 lecture.