Crypto Academy Week 11 - Homework Post for [@alphafx]: Trading and Holding - Two Sides of a Coin

It is not possible to talk about the cryptocurrency markets without asking ourselves a simple but very important question: Trading or Holding?

Homework

Do you hold any coins? Talk about the wallet type you prefer/would prefer holding in

When I began to learn about cryptocurrencies, I had no idea of everything what that world was, nor what it represented or could help me achieve. Later, with the passing of the weeks, months and years I began to understand the enormous potential that cryptocurrencies had, but this was (more than by study); for the use that I was making of many cryptocurrencies respectively.

Since then, I have always bought and owned cryptocurrencies. Right now, I am the owner of a small amount of Tether, Dogecoin, Litecoin, Steem, SBD, and bitcoin. I like to have my capital distributed among several projects (those mentioned and some others), for the purpose of diversifying my investment portfolio and also, so that I can better manage risk. This is because my investment capital is not very large and I try to take proper care of it.

And precisely, to take care of my capital, I prefer Cold Wallets (of the Offline Software Wallets type and also paper wallets); since I consider that they are the best and safest to store my cryptocurrencies.

They may not be the most versatile, comfortable, or popular options; but in terms of security, I don't think anyone can object against these options.

With screenshots, show how to perform spot trading on any pair of your choice.

To operate with cryptocurrency pairs we must always go to an online exchange. There is no safer or better alternative for this than the exchanges already established in the market; since buying from an individual directly is always a risk, because it depends on the good faith of strangers; but with an exchange; these risks are eliminated, since it is the exchange itself that mediates the operations between the different parts of the operation

And all exchanges have a similar performance or operation (what tends to vary a bit is the way of showing in their own user interfaces the different elements that are common to all exchanges). Therefore, by knowing how to operate in an exchange, technically we will already know the essentials to operate in all, regardless of which it is.

The main thing that we can always see in every exchange is a list of the available pairs and their respectives prices; sales and purchase order listings; buttons to select the mode of operation (market orders and limit orders), price performance graphs; and the part where we must say how much token or cryptocurrency we want to buy and at what price.

Understanding everything I have just said, I will now explain to you how to perform spot trading in any pair of your choice through Probit exchange.

As you can imagine, before making any operation in any exchange, you must have previously joined it and completed the registration. Then you open your account session and only this way you will be able to do any operation you wish, from as many are available.

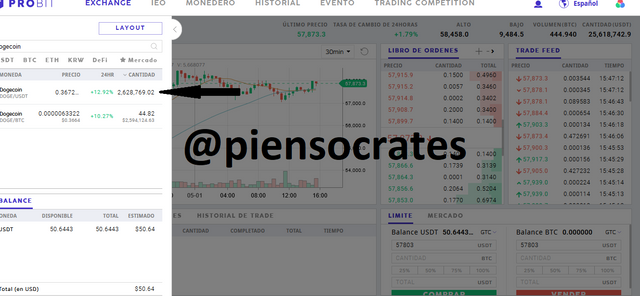

Partial screenshot of the probit exchange interface

You will then see something like the image above; where you will proceed to say the currency or pair you want to trade. In my case, I will pretend that I want to trade the Doge / USDT pair.

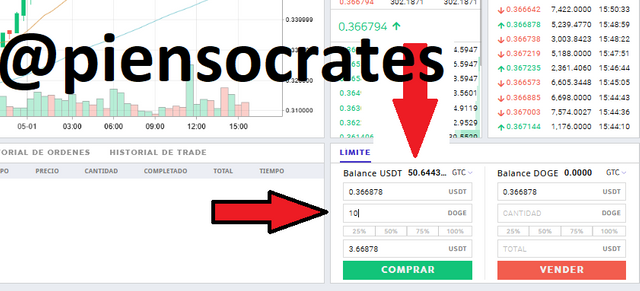

Partial screenshot of the probit exchange interface

By clicking on the desired pair, I get to the section where are all the details and sections to operate (for purchase and sale).

Screenshot of the probit exchange interface

Lets Suppose I want to buy 10 doge at the current price; then I put it in this section, and the platform will tell me what it costs. In this case, it's only $ 3.66878.

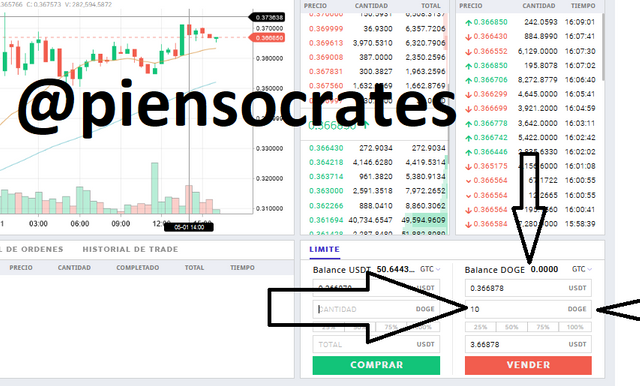

Partial screenshot of the probit exchange interface

Then, I click on "Buy Doge" and voila, the order is active. And as soon as the order is executed, I will have my doges on my balance.

The same applies to the case where you want to sell doge. In that case, I put the sell order in which I establish the price at which I want to sell and the quantity (I must have doge available to be able to sell, obviously). And once I have established all this, I click on "Sell Doge" and with that I will have placed my sell order.

Partial screenshot of the probit exchange interface

In this case I have explained it in a hypothetical way because at the moment I do not have doges in my account, but if I had, the procedure to sell them would be the one already mentioned.

By the way, the orders for this pair are in this case Limit, which means that we can set a price higher, lower or equal to the current market price if we want to.

In some other pairs (even within this same exchange) there is the option of market orders, which when setting it for an operation, simply allows us to carry it out at the current market price.

Holding or trading, which do you prefer and why?

Without a doubt, I prefer to hold; since I am the type of person who likes to sleep at night and not worry all the time about what the market will or will not do. I think that the hold is a safer and more profitable option in the long term and many times I have been able to verify it myself in the case of Bitcoin and ETH and many other cryptocurrencies. Take for example what happened recently with Doge; who did buy Doge for hold when it barely cost 2 or 3 cents; now they benefit from the fact that it costs about 36 cents; and if you are patient, you will most likely see Doge reach new heights (I think he will continue to climb).

The only thing they had to do those (who bought Doge for 2 or 3 cents and now sell it for 36 cents) was just waiting until that happened. Of course, doing hold of any crypto successlfully it will depending of many factors; but overall, I prefer it because I think it's worth it.

Summary or conclusions

In short, I am a cautious type of investor, who likes cold wallets, and the holding company.

I certainly know how to trade, but I don't feel as comfortable spending my time doing it. Maybe that could change in the future, but who knows?

I am also conservative in terms of the amount of cryptocurrencies that I buy and store and the projects that I decide to support, because I know that this market is somewhat risky in which you have to be very attentive to all the possibilities and although is true that there are chances of winning in everything, there are also chances of losing; So that is why (and because of the experience that I have already acquired in that regard over the years) is why I am cautious in my preferences in everything related to cryptocurrencies.

Well, this is my participation in the Crypto Academy, in this week 11, and doing this task for @alphafx (Nigeria). Until next time!

Scoring