Steemit Crypto Academy Contest / S1W4 – Reviewing the Instability of the Crypto Market by @patjewell

Image Source

It is true that we have seen a sharp decline in most of the cryptocurrency markets but it is not new and it is for sure not going to go away.

It is a reality that all traders have to face.

What I think of the sharp decline in prices

With a husband as a trader there is really not any difference for me than seeing it as a normal up and down like in any other stock, bond, Forex or whatever market you might be trading on.

The day an investor decide to start trading it is a risk he or she has to face. Meltdown of markets has been there since the very start when it was introduced into the system. It can happen today, it can happen tomorrow or the day after that. Every investor or trader lives with the risk.

As time change with each second the same is applicable to rules and regulations. You think you have something covered and then the next thing happens or get changed. The world of traders are constantly on the move against ups and downs!

Of importance to me is the steps that investors can take to minimize their risks.

What are the causes for the meltdown?

I know that it is stated that it all started with the U.S. Federal Reserve fight against inflation and their effort to balance the markets but for me there are two valuable reasons that stood out;

1. Taking risk

Investors are taking more risks by using debt to fund their trades. We have seen a similar situation when the stock market crash in 2008. I remember clearly how Fannie Mae and Freddie Mac made it possible for potential traders to borrow against mortgage loans while their credit scores were low.

You are doomed for success when you borrow to make money and you are for sure going to pull those around you down with you.

2. Loss of confidence

Economically it is a difficult time for many countries. We have seen the rise in oil and fuel prices, shortage of electricity supplies and corruption, all facts contributing to the economy of a country. We have also seen governments of countries following the doings of other countries.

I do believe that when the Chinese government told their local financial institutions last year to stop accepting crypto currencies in China it was the start of the loss of confidence. It is all a game of “Simon says”.

Selling of shares just to get out of the market is not the correct option!

As for how long the meltdown will continue for, if I had a crystal ball I would have been able to tell you. At this this stage it is a guessing game. I do however feel that we will see those spikes but it will take a couple of months to recover in full.

Then again, we only need one simple tweet from Elon Musk and the market can fully recover in a matter of seconds.

Why doesn't this drop in the price of a few coins decrease their trading volume (eg: Bitcoin)?

When entering the world of markets, investing and trading you must have a clear understanding of how it works and the relationship between key factors like risk, price, volume, volatility and others.

Do you homework before you start!

Image Source

The most widely analyses being used by traders or investors is the relationship between price and volume.

Technically speaking;

Volume – should increase in an upward market or trend and should decrease in a downward market or trend.

However over the years it has proven that it is not always the case. The volume and price relationship also depends on the investigation of the market and the assets.

Cryptocurrencies has still not gain the respect to be seen as so called “money” but they are considered financial assets. This results in traders or investors looking for those opportunities to buy and ideally the opportunity to is when prices are low.

The current market can for sure create a sense for trading interest.

How will they deal with this market instability?

In the case of Bitcoin I believe there is not much they can currently do than to sit tight.

As most experts believe it is more the economic factors which caused the current instability it should not be a problem for Bitcoin specifically.

It was found from reports that I have read that factors like exchange rates, oil and fuel prices and market indexes doesn’t affects Bitcoin on the long term. Source: Ciaian, P., Rajcaniova, M., & Kancs, D. (2016). The economics of Bitcoin price formation. Applied Economics, 48(19), 1799–1815.

What is the relationship between the current instability and the downfall of the Terra ecosystem and its Luna currency?

We have seen investors in a panic stage due to the drop of a stablecoin TerraUSD and Terra Luna which is the sister currency with the latter now worthless. This resulted in other cryptocurrencies like Bitcoin and STEEM also taking a knock.

A stablecoin, like TerraUS, was designed to the opposite of Bitcoin. They are supposed to be less volatile and they are fixed to another asset like the USD. Investors who gets on board with stablecoins therefor avoid the up and downs of a market.

In the world of cryptocurrency 1 TerraUSD is supposed to be worth exactly 1 USD. The price of Luna on the other hand can fluctuate. What these two sister companies does is that they use Luna as a counterweight to maintain the price of TerraUSD agains the USD.

However, we saw this balancing taking a tumble.

Most investors kept TerraUSD in Anchor Protocol (a savings and lending platform on the Terra Blockchain) as some sort of a savings account. Previously Anchor paid a 20% interest rate. This was then replaced in March with a variable rate.

Last week large amounts of TerraUSD were transferred and withdrawn from Anchor. Investors started to panic we a result that we saw three things happening;

- Investors started to sell their TerraUSD and Luna tokens

- Investors started to swap their TerraUSD for other stablecoins

- Investors started burning TerraUSD for Luna

When the supply for Luna expand it caused the price to come down dramatically with the result that both TerraUSD and Luna crashed as the two companies could no longer maintain the balancing act

Do I think TerraUSD and Luna will recover?

“Short-term stumbles do not define what you can accomplish,” and “It’s how you respond that matters.” This according to founder Do Kwon.

These are words easily spoken.

As many investors has lost all they had I cannot help but to compare it with a similar situation we had with a stock listed on our local stock exchange the JSE (Johannesburg Stock Exchange), Steinhof. South Africans lost millions on this stock by selling of their stocks for whatever they could get after a corruption scandal hit the company.

After nearly 5 years Steinhof is back on the “stocks to watch” list.

In my opinion it is possible that we will see a recovery but it is going to take some time and I doubt that it will recover to its fullest.

Where I stand with STEEM and the current instability of the market

No, it has not cause me to stress and it is mainly due to the following reasons;

- I have not invested in Steem besides my time

- I am in Steemit for the long run and not for the quick buck

Yes, I am still confident in STEEM and Steemit.

Only by looking at the white paper published in August 2017 and the aim behind Steem I’m not going anywhere!

“Steem aims to support social media and online communities by returning much of its value to the people who provide valuable contributions by rewarding them with cryptocurrency, and through this process create a currency that is able to reach a broad market, including people who have yet to participate in any cryptocurrency economy.”

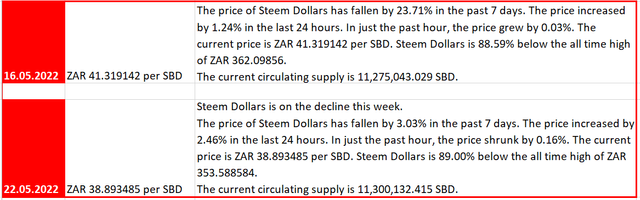

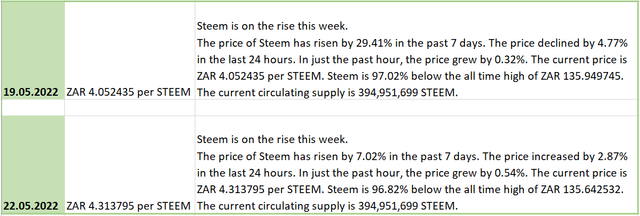

Since the start of the challenge I kept a keen eye on both SBD and Steem through the Coinbase platform and I gladly share two days of the week on each one with you.

SBD:

Steem:

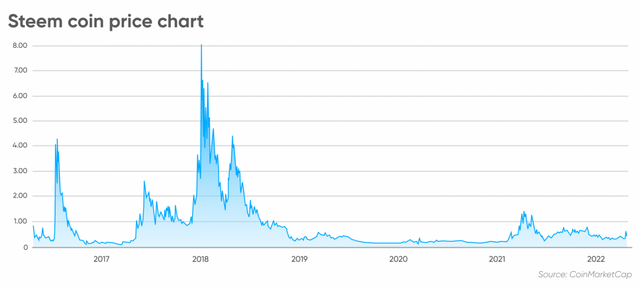

I also had a look a predictions made by DigitalCoinPrice and Wallet Investor

| Company | Predictions |

|---|---|

| Wallet Investor | The expectation was for the coin price to fall over the next few months. The site believes steem will hit a maximum price of $0.5079 on 7 May before falling back and dropping a decimal place in July, ending that month at $0.0313 and staying at around that level, not recovering until the end of December, when it expects it to close out the year at $0.334. |

| DigitalCoinPrice | The forecaster said that the coin’s target price could reach $0.54 in 2022, $0.60 in 2023, $0.60 in 2024, $0.79 in 2025, $0.73 in 2026, $0.94 in 2027, $1.274 in 2028, $1.65 in 2029, $1.87 in 2030, and $2.12 in 2031. |

Image Source

I don't know about you but I am staying!

Image Source

Woow I'm impressed with the way you have taken to explain this and I agree with you. I didn't know your husband is a trader. This is great, I'm sure your husband has taught you very well how to effectively trade

Another impressive explainations about the causes of downfall of crypto currency and the possible solution about resolving the instability

In general, let's pray and hope for the stability of this current DIP in crypto currency because I have heard alot of news surrounding this current DIP.

Thank you for the compliments. My husband doesn’t want to teach me. He says I’n too impatient for trading 🙈

He once opened a demo account for me and I lost all the funds within the hour..

I suppose I am now learning the right way.

Give me another month and I will try it again.

Thank you for visiting!

🙆🙆😂😂😂🤣🤣🤣 Jesus are you sure??? That means you really are impatient. Trading requires alot of patience and time dedication before you can be able to understand the market movement and predict it appropriately

Woow this is great 😃. I'm happy to hear this. It will be great if I see you succeeding in trading

This is really amazing post I love the presentation and work you put in and the analysis you did, this made the post really informative and presentable. Thanks for sharing

Thank you! As a newbie to the crypto world these challenges took a lot of hours from me but I have read and learned. I’m getting there 😊

You have done a good research here. The up and down in the crypto market is not new and its not going to end here and it is not wise enough to borrow to invest into the system as the saying always is, invest what you can let go.

Thank you for sharing ma

It is for my to say thank you for reading, supporting and engaging with my post. Thank you!

My husband use to trade with CFD’s and burned his fingers a couple of time.

CFD with no stop losses is just as bad as borrowing

Hahahaha, he should know better by now then

Thank you moma

Your so clever dear, To be honest I still.don't have any knowledge about market crypto and block chain..i wish I could learn more to understand about it all. Best luck for you my friend..

Don't worry, you are no the only one! It is all new to me also. I should say, it was all new to me.

I have learned such a lot during the last month when I had to do the challenge that one of these days I'm going to be an expert in the making. (•ิ‿•ิ)

Thank you for your support!

My pleasure dear..

I really liked reading your article because it gives hope, and it is hope based on the reality of the markets and the risks involved. Instability is "normal".

I think you did a great analysis.

I hope these days pass soon, I just regret not having enough cash to invest in these times of low priced coins 😂

Thanks for sharing.

I wish you much success 😊🌼

Thank you for reading my post and engaging with it. I appreciate it.

I also wish I could have bought now but who knows, there might just be a next time.

One thing we can say is that the markets are never boring 😊

That's true 😊