Trading Cryptocurrencies - Crypto Academy / S4W6- Homework Post for @reminiscence01

Hi everyone...!

It's been another amazing week of lecture with professor @reminiscence01. This class has helped solidify my knowledge of the financial market, and how to play in it to my advantage. My answers to the homework task is presented below.

Q1: Explanation of terms - Spot, Futures, and Margin trading

Spot trading

Spot trading is usually the first kill of any new crypto trader. This is partly because trades in the spot market does not get liquidated or stopped out, and the price swing is moderate.

Image source

In spot trading, a trader simply buys a certain amount of crypto assets, hoping to profit from them when the value appreciates above the price point at which they were bought. Spot trades are usually executed immediately at the prevailing market rate, and is 100% based on the trader's equity.

The interesting thing about the spot market is that there is a higher possibility of ending in profit if patience is exercised, even if price drops below your purchase price. Traders are most likely going to end up in profits if they do not exit their losing trades.

| Advantage | Disadvantage |

|---|---|

| Spot trading is associated with low risk of losses | There is no provision for traders to use leverage |

| The spot market is insulated from liquidations that occur from market manipulation | It can take more time than necessary for a trader to make a reasonable amount of profit. |

Margin trading

Image source

In margin trading, a trader is given the leverage to take trades that are larger than his account size. Call it "trading with borrowed capital." For instance, if a trader has $100, and wants to take a long trade worth $1000. Margin trading allows him deposit a certain percentage of the total sum as the margin requirement, and then borrow the balance.

This form of trading is often associated with high risk because a single market move against the trader's prediction can have unbearable impacts on his account equity.

For example, if a trading platform offers a Margin ration of 1:10. This means that for a $1000 worth of trade, the trader will have to fulfill a margin requirement of $100, and then get the balance as his leverage.

If per adventure the trade goes as the trader predicted, and, let's say, he makes an 8% profit (8% of $1000 = $80), his equity will increase by the same amount. That is, he will end up with $180 after the trade. If the reverse occurs and he ends up in a losing trade, his equity also reduces by the same amount. That is, he ends up with $20 after the trade.

| Advantages | Disadvantages |

|---|---|

| It offers traders a way to earn more than their equity would naturally permit them to. | There is a high associated risk as a trader's account can get liquidated when the market move goes against the trader. |

| Traders can profit from trades without risking more capital | When trades go against a trader's prediction, the losses are entirely on the trader to bear. |

Futures trading

Image source

Unlike the previous two kinds of trading, futures trading does not directly involve the purchase of an asset. Instead, traders place bets on contracts, which are some sort of derivatives associated with a crypto asset.

In the futures market, traders place monetary bets on their expectations of the market. For instance, based on market analysis, a trader might conclude that the value of BTC will increase in a near future. So, he would go long -open a buy order- on BTC as a result.

By going long, the trader has entered a contract to sell BTC in the near future at a forward rate agreed by him. If by the time the contract expires, the of BTC is indeed higher than the price at which he bought it for, the trader sells contract at a forward premium, and takes the difference as his profit.

On the reverse, if the price of BTC at the expiration of the contract is lower than the purchase price. The trader sells the contract at a forward discount, and takes the difference as his loss.

Due to the high volatility in the futures market, new traders are often advised against getting into the turbulent waters to avoid getting drowned. However, experienced traders with very accurate analysis make fortunes from taking leveraged trades in the futures market.

| Advantages | Disadvantages |

|---|---|

| When approached with the necessary technical knowledge, futures trading can be a very easy way to make huge profits from price changes. | The high volatility associated with trading futures makes it very easy for traders to get liquidated. |

| It provides an opportunity for highly skilled traders to make leveraged bets on their market expectations | There is a huge possibility of market manipulation by the big traders. |

Q2 a) Explain the different types of orders in trading.

In the Financial Market, traders are often caught up in trying to decide whether or not to initiate an immediate trade based on the result of their market analysis. While some traders make an entry at the slightest signal, others tend to dive in after the market has already responded positively to their Analysis result.

Interestingly, the market has different "order types" that are suitable for these two category of traders. Before we proceed, we might want to know what an "order type" is. An order type simply describes how we want our trade on a particular asset pair to be executed - immediately, or at a later time.

Hence, order types, based on their execution time, are grouped into two categories, namely: Market order, and Pending order.

Market orders

Market orders get executed immediately at the nearest best market price. That is, there is no waiting period before orders are filled because orders get picked up at the prevailing market price.

For instance, if a trade is placed to buy $50 worth of the BTC/USDT pair, and the current market price of the BTC/USDT pair is $57000; the trade will be executed at the current market price and a total of 0.00087 BTC will be purchased.

Pending orders

Monitoring price action to gain a perfect entry into the market can be a hectic task sometimes. In order not spend so much time waiting on the market to play out our desired structure, we can define our conditions and set up pending orders for the market to execute.

Pending orders are typically orders that are set to be executed at a later time, after some predetermined conditions have been met. These orders are never filled at the prevailing market price. Instead, they get triggered when the price has hit a point already specified by the trader.

There are several kinds of pending orders, namely: limit orders, limit-stop orders, OCO (One Cancels the Other) orders, Stop loss orders, etc.

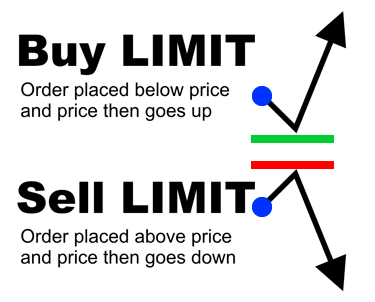

i.) Limit orders

Image source

These are market orders set to either buy an asset below the current market price or sell it above the current market price. Limit orders are a great way to catch-up with a missed market move.

Oftentimes, when the market breaks out of a certain support or resistance zone, it is usually expected that the price would retest the these previous zones before sustaining a rally up or down. At the point of retesting a previous support/resistance zone, traders can make use of the limit order to join the trend.

A buy/sell limit order is used when a trader wants to "buy/sell" an asset pair at a price that is lower/higher than the current market price. For example, if the BTC/USDT pair is in a downtrend with the current price at $55000; and the trader anticipates that the price would retrace up to $57000 before continuing the downtrend.

The trader can utilize the price retracement to gain a better entry into the downward trending market by setting a sell limit order on the BTC/USDT pair at $57000. Once the price retraces up to that point, the order gets filled.

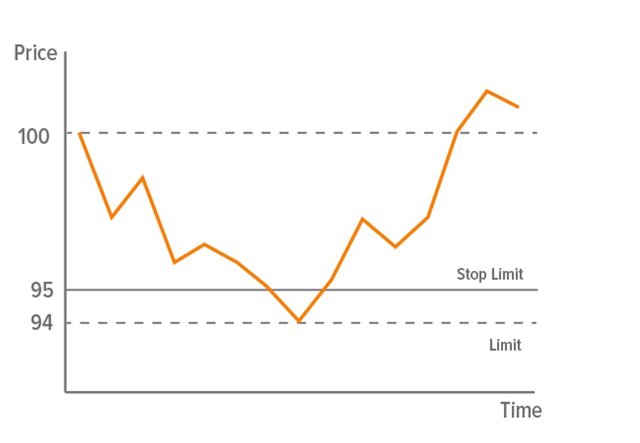

ii.) Stop-limit orders

Image source

This order type utilizes the elements of stop and limit orders in trade execution. The overall aim of this combination is to minimize the risk of liquidation on a trade. When used in a "buy" trade, it is a Stop-limit Buy Order but when used in a sell trade, it is a Stop-limit Sell Order. How does this work?

A trader executes trades with hopes that the market follows his prediction. However, market predictions, as we know it, aren't always correct and several unconsidered market factors can set a trade in an unexpected direction. Here's where a stop limit comes in handy.

A Stop-Limit order is an order to buy or sell an asset once the price reaches a specified point. Stop-limit orders works with three parameters, namely:

-The trigger price (Also called Stop Price).

- The Limit price.

- The amount of asset.

Let's say the price of Steem is currently at 0.6 USDT and we want to set an order to buy it lower for about 0.4 USDT (the limit price). We can achieve this by setting a Stop-limit buy order. In this case, we need a trigger price (The price at which our order is submitted into the market). We could decide to set a trigger price of 0.5 USDT.

So, our limit price is the actual price we want to buy Steem for (0.4 USDT). Our order details will be as follows:

Stop (USDT): 0.5

Limit (USDT): 0.4

Amount (STEEM): 2000

If the price of Steem drops to our target price of 0.5 USDT, an order to buy 2000 Steem at the limit price of 0.4 USDT will be placed. The total cost would be 800 USDT.

iii.) OCO orders

A brilliant illustration of OCO would be using a man who has a dilemma between two of his favorite meals. Let's say Bob loves having vanilla cakes and chocolate cakes, but he could never have both treats at the same time. Each cake is appealing to Bob, but picking a vanilla cake automatically means he cannot have any chocolate cake for the rest of the day, and vice versa.

This is exactly how the OCO is modeled. The validation of one condition automatically cancels the other. Hence, the name OCO - which is an acronym for 'One Cancels the Other'.

Image source

In simple terms, an OCO is an order that is set with parameters favoring the two possible movements of the market (up or down) but with a caveat that if the market goes in one direction and picks up one of the orders, the opposite order immediately terminates.

This order type combines limit and stop-limit orders such that if one of them gets filled, the other terminates automatically. It is often regarded as the easiest way to automate trade and it is perfect for trading breakouts.

The parameters set up OCO orders are as follows:

- Limit Price: The most preferred price you want to buy/sell at.

- Trigger Price (Stop limit order): The price at which the alternative trade will be placed in the market.

- Stop Limit price: The price at which the second alternative trade will be executed.

- Amount of Asset you want to buy/sell.

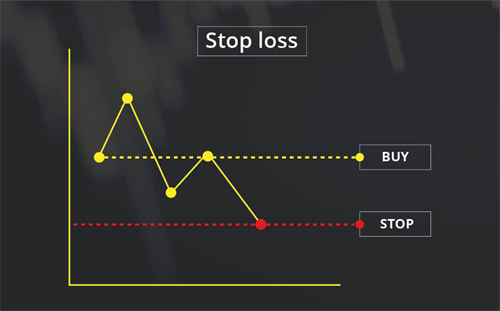

Exit orders

Image source

It is always advisable to take appropriate risk mitigation measures in the Financial Market by making use of stop orders. A typical examples of a stop order is the stop loss order.

A stop-loss order is set as a counter-measures to hedge against unbearable losses in cases where the market goes against the trader's prediction. It simply defines the amount of equity the trader is willing to lose if a trade goes against him. Beyond the defined loss limit, a trade is automatically liquidated.

Also, there is a form of stop order called the trailing stop. This involves riding with the market trend, instead of having a fixed stop-loss order. The trader here adjusts his stop-loss to follow every move in the market and locks in profits in the process, while minimizing the possibility of being thrown into losses from a price reversal.

Q2.b) How can a trader manage risk using an OCO order? (technical example needed).

An OCO order can be used as an effective tool to manage the risks involved in trading the Financial Market. Its components allow it serve various risk mitigation purposes like locking in profit, take-profit points, and loss minimization. Let's consider an example in spot trading below:

Assuming the ADA/USDT pair is currently in a downtrend. You have observed that the price is close to a support zone and might likely go up. So you bought 10 ADA tokens at $2 each, with expectations that it will soon climb to $3.

Also, since the market can do the exact opposite of what we expect, there is a possibility that the market trend will keep going down. So, there is a need to protect our trade from unbearable losses. This is where an OCO order comes into play.

To set up an OCO order using our parameters above,

- Limit price = $3

- Stop-limit order ( trigger price) = $1.8

- Stop-limit price (execution) = $1.5

- Amount (ADA) = 20

Once the order is opened, if the trade goes up as predicted. Then the "limit-sell" gets triggered at $3 and the trade becomes profitable. Consequently, the stop-limit order is cancelled automatically. The trader's profit is realized as follows:

(Selling price × Quantity) - (Purchase price × Quantity)

(3 × 20) - ($2 × 20) = $20

On the other hand, if the trade did not go as expected and price kept falling to lower levels. The Stop-limit order will get triggered at $1.8 and filled at $1.5. The limit order gets cancelled once the Stop-limit order is triggered. In this case, the trader's loss is realized as follows:

(Selling price × Quantity) - (Purchase price × Quantity)

(1.5$ × 20) - ($2 × 20) = (-10)$

Although some losses have been incurred here, it cannot be compared to what would have been obtainable if an OCO order was not in place.

Q3: Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

For this illustration, I will place my limit order on the FTM/USDT pair using the following steps:

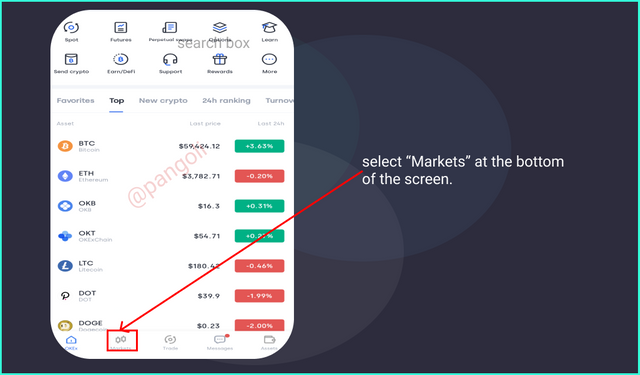

Step 1

Image source

Open the Okex exchange app and navigate to "Markets" at the bottom of the screen.

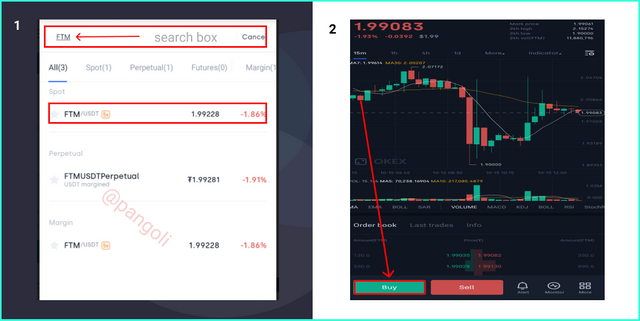

Step 2

Image source

On the Market interface, type in the symbol of your choice assert in the search box and choose accordingly. Click the "buy" button on the resulting chart interface.

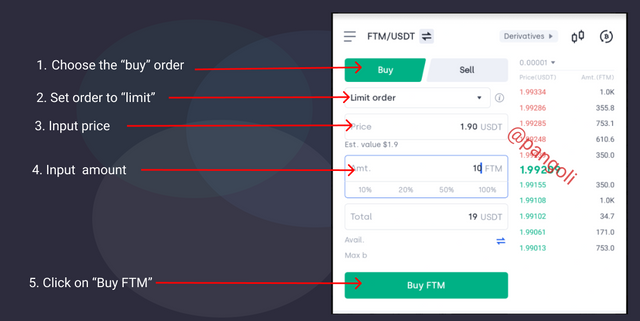

Step 3

Image source

Once the trading window for your choice asset is opened, fill in the order details as follows:

- Set order type to "Limit order"

- Set your limit price (Mine = 1.9USDT)

- Input purchase amount (Mine = 10)

- Click on "Buy Matic."

A dialog box will appear to confirm the purchase

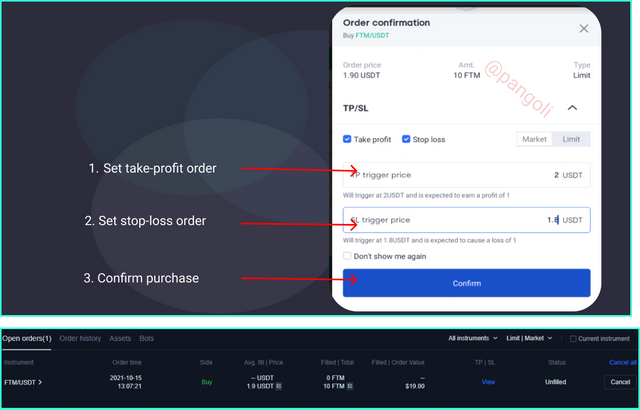

Step 4

Image source

Input exit orders and proceed to "confirm purchase." You can see the screenshot of open order displayed above.

Q4: Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset.

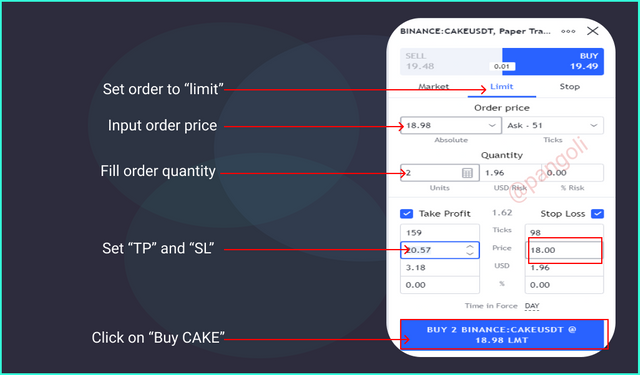

For this illustration, I will be using the Tradingview paper trading feature to do my analysis and execute a limit-buy order on the CAKE/USDT pair.

Image source

From the chart above, CAKE/USDT has just broken out of a former resistance and is currently going to retest the level. The Stochastic oscillator is already approaching the oversold region, which is an indication that the price will soon rebound in the opposite direction.

Image source

Having gotten this much information about the potential movement of the market, I went ahead to define my entry point around the key zone as seen on the price chart above. I also defined my Take-profit and Stop-loss points, and proceeded to enter it into the paper trading platform.

Image source

I filled in the necessary information and confirmed my purchase.

Why Did I choose the crypto asset?

I chose CAKE token because of its potential to appreciate in value. CAKE is the utility token of the Pancakeswap Decentralized Exchange (DEX) built on the smart contracts compatible Binance Smart Chain. Due to the low cost of transaction on the pancakeswap DEX in the DeFi ecosystem, it has gained a reputation as the biggest Defi protocol in the Binance ecosystem.

Also, as more and more assets get locked up in the DeFi protocol, it impacts positively on the value of it's utility token. The prominence of the pancakeswap DEX makes it highly liquid. Hence, there are no hindrances to exchange at any point.

ii) How it suits my trading style.

In my paper trade, I made use of support/resistance zones and the stochastic oscillator. Being a leading indicator, the stochastic oscillator gives an early signal of a trend reversal. Then, I use the support/resistance zones to confirm the signals given by the stochastic oscillator.

For instance, if the stochastic oscillator shows that the market is oversold, and the price is approaching a support level. It confirms that the current market trend is about to change in the opposite direction.

iii)Indicate the exit orders. (Screenshots required)

Image source

Following the execution of my trade, my exit orders (take-profit and stop-loss) were set at $20.57 and $18, respectively.

Conclusion

Although cryptocurrency trading can be a very rewarding occupation, it is expedient that traders understand where they stand, and what to do at any given time. This cuts across having a knowledge of the kind of market to play in, as well as the style of trade execution to adopt.

It is always advisable to start one's journey into trading with spot market trading, and only transition into other complex ones like Margin and Futures after sufficient knowledge has been gathered. Also, it will be of benefit to understand how the various types of market orders, and when to use them for maximum advantage in the market.

Thank you for reading...

Hello @pangoli , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

I'm impressed with your submission. Thank you for participating in this homework task.

Hello @pangoli , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

I'm impressed with your submission. Thank you for participating in this homework task.

Wow! I'm glad to know that my article merited a perfect score. Thank you so much for your honest review, Professor. I will keep improving on my ability.

Professor @reminiscence01, I have just observed that my homework has not yet been curated by @steemcurator02. Is it something I should worry about?

There's no need to worry. Your post will be curated.