Crypto Academy Season 3 Week 1. Whales : The Driver Of Cryptocurrency Value - by Professor @Wahyunahrul

Hello everyone...

It feels really good to participate in the crypto academy homework post for week 1 in season 3. It has been a value-packed encounter in the classroom with professor @Wahyunahrul. We have been exposed to so much knowledge about whales, their activities in the market, and how the small investors can use whale movements to his advantage.

It is this knowledge set that I have processed and tailored to fit the homework demands. I am certain you will get value as you read.

Image: My own work

Q1: Why are whales so feared by small investors?

Anyone who has been active in the cryptocurrency circle for a while has probably come across the Twitter handle @Whale alert . Tweets from this handle often capture very voluminous single crypto transactions. One of the typical tweets could read > "10000 BTC moved to cold storage by an unknown wallet."

One might wonder how important this piece of information could be, and the potential impacts it could have on the market. Here is the drill, what we've just explained is a typical Whale Movement

Who are the whales?

The typical picture of a whale is that of an enormously big fish, whose movement is a threat to every smaller fish in the water. Bitcoin whales are similar in definition.

Investopedia refers to bitcoin whales as individuals or entities that hold large amounts of bitcoin and have the potential to manipulate the asset's valuations. Usually, they are comprised of crypto venture capital funds, corporations, early adopters, and high net-worth/institutional investors.

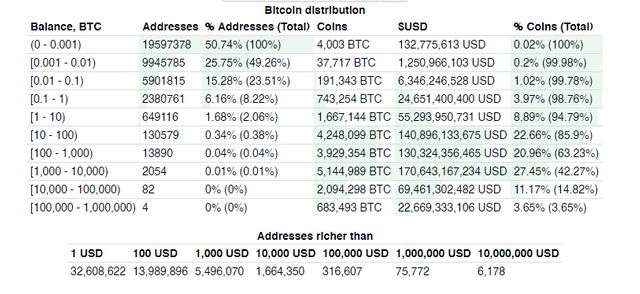

In Q1 of 2021, bitinfocharts.com published a fact-based report that just three bitcoin wallets owned 7.18% of all the bitcoin in circulation with a value of just around $74 billion, and the top 100 wallets held around one-third of all bitcoin valued at $342 billion.

Image source

Also, an article by Bitcoinist.com reveals that just 2% of all existing Bitcoin addresses have a balance of one or more bitcoins. Cointelegraph.com in a 2020 article also added:

New data suggests that “wholecoiners” — Bitcoin wallets holding 1 BTC or more — now account for 95% of the cryptocurrency’s entire capitalization. That leaves just 5% of the market cap divided among tens of millions of users with a balance below 1BTC.

Coupled with the fact that over 80% of all bitcoins are already mined, these instances reveal that the bitcoin community is made of few whales who have claims on a majority of the asset, and many small investors who do not have up to 1 BTC in their wallet.

Why are they feared by small investors?

Whales are feared in the waters because their movement can cause a dangerous stir. The small fishes might not survive the stir from whale movements because they are not agile enough to withstand the turbulence that comes with it.

It is not a different story with Bitcoin whales. Due to their voluminous possession of bitcoin, any transaction they make has a volatility or liquidity impact on the market.

Volatility Impact:

This describes the effect of a whale move on the market price of an asset. If a whale makes a sell, the market usually respond with a rippling sell pressure, leading to huge price drops commonly referred to as a fire sell or a whale dump. Same applies where a whale takes a buy, same ripple effect happens and a price pump occurs.Liquidity Impact:

This refers to whale activities that increase or decrease the amount of bitcoin in circulation. For instance, if a whale moves 10000 BTC into cold storage to hodl, it means that the amount of bitcoin in circulation has reduced by 10000 BTC. Hence, the supply of bitcoin becomes lesser than the demand, and the price goes up as a result.

However, if a whale transfers 10000 BTC to an exchange. It often implies that they want to sell, and as a result, the circulating supply will be increased. When circulating supply is increased, supply exceeds demand and drives the price down.

These are the various ways whale movements can become the smaller investor's nightmare. This is so because whale movements happen in defiance of technical analysis. Thus, pushing the smaller investors, who rely on technical analysis for their decisions, into losses.

Q2. Can we take advantage of the existence of the whale that is so feared?

Irrespective of the fact that fundamental and technical indicators are very good tools for market analysis, adding an on-chain matrix like whale movement to the pack can help an investor stay on top of the game.

If the right interpretations are given to whale movements, and actions are taken based on the underlying implications, an investor can save his bags from getting rekt.

As far as the whale movement is concerned, the investor has to go beyond Fundamental and Technical analysis. If existing on-chain analysis tools are properly utilized, Investors can always take full advantage of whale movements to remain in profit.

Q3: Find an example of a whale's cycle on a cryptocurrency chart, and do a detailed analysis of the phases in the cryptocurrency chart

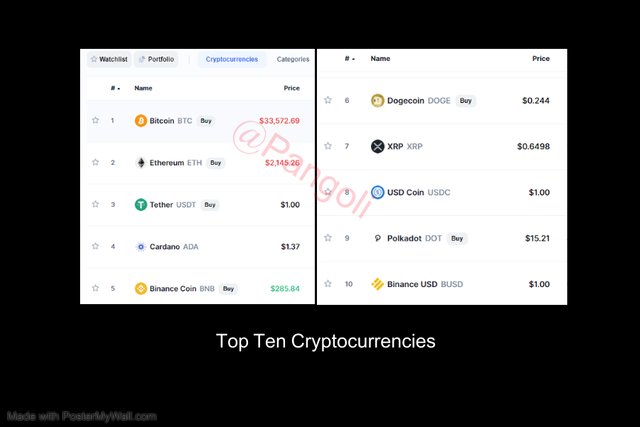

Before we proceed to the explanations proper, here is my screenshot of the latest top 10 cryptocurrencies according to coinmarketcap.com :

Image Source

A whale cycle as earlier explained by Professor @Wahyunahrul, consist of 4 stages - Accumulation, absorption or Up-trend, distribution, and downtrend. In technical analysis, this cycle is summarized in the WYCKOFF method.

Image: My own work

For my analysis, I'd use the Cake/USDT pair on the daily timeframe. Cake token is the exchange token on the Pancake swap Decentralized Exchange. More about Pancake swap here

Accumulation Phase

Image: My own work

Graph "A" represents the accumulation phase. This is the initial phase where the Whales start buying in small quantities. Assets are bought in small quantities so that there are no obvious market indications that such an activity is taking place. The market goes sideways, and an average investor/trader at this point becomes a spectator, watching to see where price will go next so he can push the buy/sell buttons.

The observable low volume in trades, and the narrow-ranged price action causes the average investor to believe that the market is quiet and without activity. Meanwhile, the whales are stocking up their bags in preparation for a run.

Absorption Phase (Uptrend)

Image: My own work

Once the whales have stocked up their bags in the accumulation phase, they begin to send out obvious market signals in the direction they want the price to go. Usually in the absorption phase - Graph "B" - the whales start buying in large quantities with an intention to create obvious bullish signals in the market. Also, the absorption phase is where the whales trigger speculating investors into moving the market in their favor.

As observed on the chart, there is an uptrend with dominant bullish(green) candles. We can also see the green volume histograms increasing significantly in size, which indicates serious market activity. In this phase, the whales accumulate gains on the assets they bought in the accumulation phase.

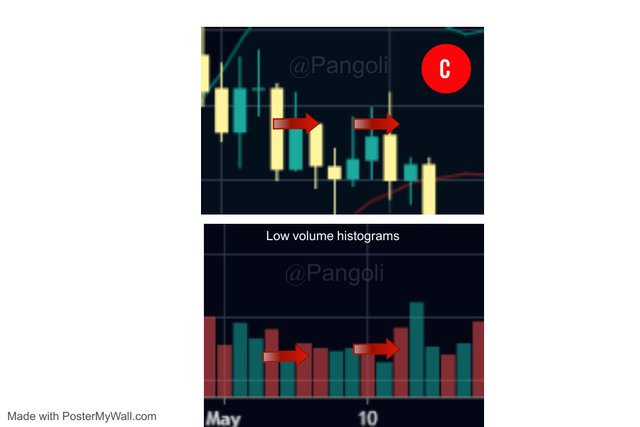

Distribution Phase

Image: My own work

In this phase - Graph "C", the whales start taking their profits. Just like the accumulation phase, they take profits in small quantities so it doesn't give off obvious market signals. Since the average investor is still trading with a bullish sentiment - buying, while the whales are taking profits - selling; the market is trapped in a resistance zone and begins to trade sideways.

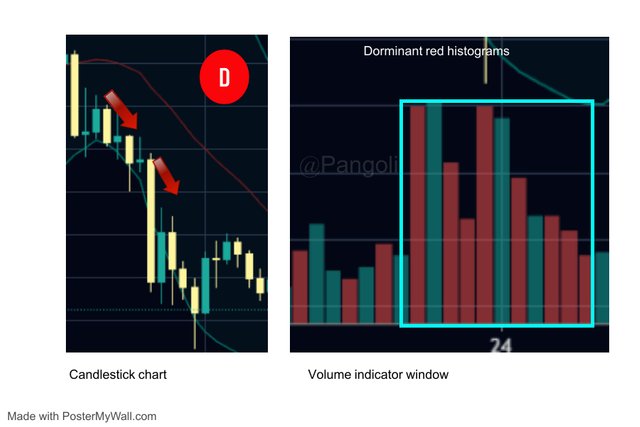

Downtrend phase

Image: My own work

Once the whales are done taking profits at their targeted price, it becomes obvious that the market liquidity (circulating supply) has been diluted and is driving down the price.

The small investors have just realized that the Whales had already sold most of their assets. As a result, these investors will begin to panic-sell their assets; further driving down the price.

This phase is called the downtrend phase - Graph "D". It is usually marked by a bearish trend where the chart shows sharp declines from previous high price levels. The volume indicator at this point is dominated by long bearish(red) histograms.

When prices have gone low enough, the whales will begin the accumulation phase again and the cycle continues.

Q4. What cryptocurrency would I choose to invest in or trade, if I were a whale explain why you chose that cryptocurrency.

As is already obvious, my choice crypto asset for analysis is the Cake token. Hence, I would invest in it if I were a whale.

My reasons for choosing this token are as follows:

Market Capitalization:

The market capitalization of the cake token at the time of analysis sits at a value of $2,442,022,527; with a token value of about $13 as at the time of analysis, this means there are still potentials for the price to go up.Yield farming and Liquidity pools:

These are options that provide an investor with the opportunity to provide their stake their tokens in lending pools and earn additional rewards in the process. Aside from the extra earnings, these pools help to reduce the circulating supply of the token, thus driving up its value.Low transaction cost:

Pancake swap is built on the smart contract compatible Binance Smart chain. The Binance Smart chain is popular for its scalability and low transaction fees.Price history: There is a reputable price history with proper

Q5. Do an analysis as a whale with the phases explained earlier on the chart of a chosen cryptocurrency, show where you will start buying the cryptocurrency, and explain how you will take profit.

If I were a whale, the process I would follow to trade the Cake/USDT pair is summarized below:

Image: My own work

- Start buying in small quantities at point "A"

- Buy larger quantities at point "B" to trigger the market.

- Buy some more at point "C" to sustain the bullish momentum.

- Do a final buy at point "D" and target point "E" to take profit

- Start taking some profits at point "E"

- Sell a larger quantity at point "F" to sustain price drop to point "G"

- Start buying in small quantities again at point "G"

Q6. Conclusion

Whale movements offer investors the opportunity to either accumulate easy gains or get rekt. The outcome depends on the investor's experience level, the information he pays attention to, and the action taken after being exposed to such information.

Paying attention to, and making good use of an on-chain indicator like the whale movement can be the single point of success for the smaller investors in a market capable of being influenced by whales.