Crypto Academy Season 3 Week 5. Topic: Psychology and Market Cycle - by Professor @allbert. Homework task - by @pangoli

.jpg)

Image: My own work

Hey guys...

It's been an amazing time learning about the different stages Inna market cycle with professor @allbert. I now understand the force behind my penchant likeness for buying into the market when the party is almost over, or jumping out of the boat just before it starts sailing.

Doing the homework task helped me reminisce on everything that was done in class. I hope you get value as you read.

Q1: Explain in your own words what FOMO is, wherein the cycle it occurs, and why.

In a bid to explain what FOMO is, I'd explore two scenarios as follows:

First scenario

Ever been in a situation where you waited for price to hit a certain low point, and it, instead, kept moving up and making higher highs; then you defy your convictions that it will ever come down, and jump in so you don't get left out entirely? That defines a FOMO behavior.

Second scenario

Ever been on social media, and suddenly see people reporting their gains from a certain coin they bought; and you immediately feel the impulse to buy the same coin so you also have your share of the pie? That's also a FOMO behavior.

FOMO is a simple acronym that explains impatience in traders' attitude towards the market, or an attitude of jumping on a trend without proper knowledge of where it is going. It is an acronym coined from the words, Fear Of Missing Out .

As the name implies, FOMO represents an emotion often displayed by the two categories of traders presented in the scenarios above:

1. The impatient ones: these are experienced traders who missed out on the early moves of the market during an upward rally. This set of traders are really just waiting for a second chance to gain a good entry into the market, and might fall might become victims of a FOMO behavior if the price rally persists.

2. The ignorant ones: these are the traders who don't have adequate knowledge of the markets, and rely on social media trends to make impulsive trade decisions. This category of traders usually buy crypto assets once they've seen reports of its gains on the media. They buy with expectations that the price will keep going up.

However, when price doesn't go in the expected direction, which is oftentimes the case, they are caught in a situation where the market dumps on them and runs them into losses.

Where in the cycle does it occur?

Image: My own work

FOMO often plays out near the cusp of an uptrend. In my own opinion, from the stage of Believe, the experienced trader gets to wait for a favourable entry point - a retracement. When price, instead keeps creeping upward into the Thrill stage, the experienced but impatient trader would buy out of FOMO.

Once price gets to the Euphoria stage, the news making rounds on the media pushes the ignorant trader into buying out of FOMO. It is obvious already that both sets of traders are buying their assets at points where prices are already very high.

Meanwhile, the whales have already started taking partial profits near the top of the market, as the traders are buying in out of FOMO. The whale sell-off increases the circulating supply of the crypto asset and pushes price down.

Why does it occur

FOMO is an emotion triggered by a sudden buying pressure in the market. This sudden buying pressure pushes asset's prices to new high levels, and an average investor/trader experiences a sudden urge to jump in and make some gains off the price rally.

Q2: Explain in your own words what FUD is, wherein the cycle it occurs, and why.

On the flip side of a FOMO is a FUD, an acronym for Fear Uncertainty and Doubt. The FUD acronym summarizes the emotional sentiments around a downward trending market.

People don't like to see their money vanish into thin air. Especially in the crypto space, where an asset can lose as much as 50% of its value in a bear cycle. Since a bear cycle usually follow after a serious bullish rally, people display "Doubt" at first, hoping it's just a minor pullback. Then they become "Uncertain" when the downward trend persist.

Their reducing asset value becomes a concern, and any further downward movement causes them to jump out of the market in "Fear" so they don't lose everything. Usually, this point of decision comes near the bottom of the downtrend - where price is getting ready for another upward rally or, where the whales are gathering their bags for another profitable ride.

Where in the cycle does it occur?

Image: My own work

From my observation, FUD sets in at the "anxiety" phase of the market, where a price decline takes longer than expected to recover; and terminates at the "capitulation" phase of the market cycle where traders are withdrawing all that's left of their funds after accumulating losses from the bearish rally.

Q3: Choose two crypto-asset and through screenshots explain in which emotional phase of the cycle it is and why. Must be different phases

For this illustration, I will be looking at the BTC/USDT pair, as well as the DOT/USDT pair.

Analysis A - BTC/USDT

Note: The Analysis is done on a daily timeframe.

Image: My own work

From the BTC/USDT price chart, the price is seen to had already reached its highest point - Point "A" - at the Euphoria stage of the bullish rally. Being a point where whales take profits and the rest of the market continue with bullish sentiment, there is a consolidation, followed by the beginning of a downtrend.

At point B - the stage of complacency, traders have seen a little drop in their portfolio but are still hopeful that it is just a retracement. The price consolidates a little and there is another huge drop at point C - the stage of anxiety. The traders have become concerned that the dip is taking longer than expected to recover and are considering closing in on their positions to minimize losses.

At point D - the stage of Denial, traders are only hanging by a thread as the losses become even more obvious. A further sell pressure drives price down to point E - the stage of panic. At this point, some traders are fed up and have closed their positions. This selling spree drives the price further down to point F - Capitulation.

At the capitulation phase, traders have made huge losses already, having sold-off their assets at about the lowest price point. A little more downside and pullbacks drives price down to G - the anger stage and H - the depression stage. As seen on the chart, BTC/USDT is currently at point "I" - which represents a stage of Disbelief.

The traders had sold off their assets just before the bottom of the downtrend, hoping that the market will keep going down. From point "I" the whales have resumed buying and prices are picking up again. However, traders here do not believe the move as authentic, they shrug it off, and another FOMO-FUD cycle resumes.

Analysis B - DOT/USDT

N/B: The Analysis on DOT/USDT is done on the 4-hour time frame.

Image: My own work

From the chart, the asset pair is resuming an upward rally after a sustained downtrend. With some consistent upward push in price, the market has already gotten past the stages of Hope, Optimism and Belief at points A, B, and C, respectively. Some traders have already bought into the trend, this buying pressure will take price to its next stage in the cycle - the Thrill stage. In summary, the market is in the late stage of Believe. That is, the market is caught between the Believe stage and Thrill stage.

Q4: Based on the analysis done in question 3, and the principles learned in class, make a purchase of 1 cryptocurrency in the correct market cycle.

For my purchase, I will be buying $10 worth of the DOT/USDT pair on the Binance exchange.

Note: Purchase below $10 is not allowed on the Binance spot market

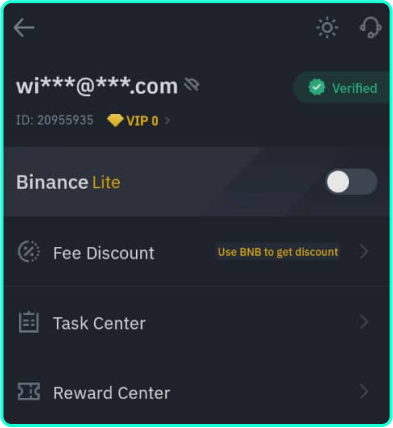

Before I proceed, here is a screenshot of my verified Binance account.

Image: My own work

I used My Binance exchange account to purchase DOT. My purchase decision is due to the upcoming DOT parachain auction, which will see DOT gain significant value.

Note: My Binance account has already been set up and logged in.

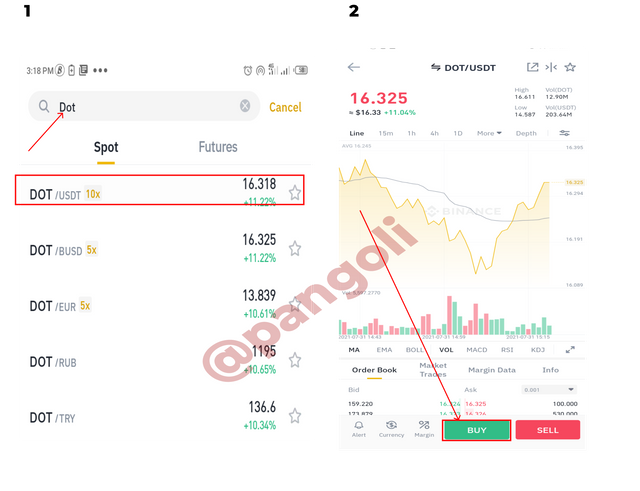

Image: My own work

I proceeded to Binance exchange and searched for DOT as shown by the arrow in the screenshot 1, then I clicked on the "Buy" button as displayed in screenshot 2.

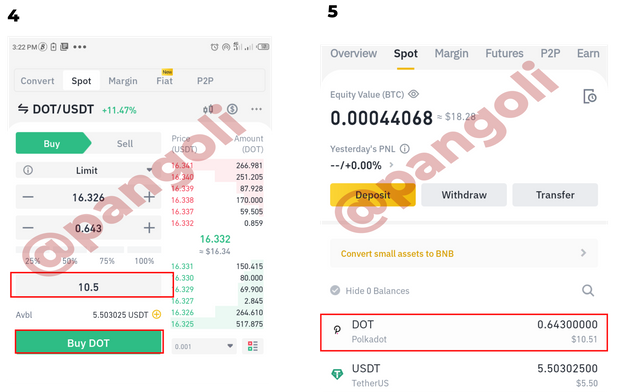

Image: My own work

I purchased 10USDT worth of DOT since 5USD purchases were not allowed in the spot trading, and a screenshot of My purchased DOT as reflected in my spot wallet is presented as well.

Conclusion

The knowledge of the market cycle and sentiments is a must-have for any trader who wants to stay profitable in the market. When properly applied, these two concepts can give a trader proper information about when to enter the market or leave; when to hodl or take some profit.

Overall, the knowledge of the market cycle and sentiments help the informed trader understand the market beyond the candlesticks.

Thank you for reading.

Hello, @ Thank you for participating in Steemit Crypto Academy season 3 week 5.