Bitcoin's Trajectory - Crypto Academy S4W5 - Homework Post for @imagen

Hello guys...

It's been an amazing week of lecture with Professor @imagen. Below is my submission for the homework task.

Q1a.) How many times has Bitcoin been "halved"?

Image | Europeanbusinessreview.com

Before I dive into answering the question. Let's get a little perspective about the concept of halving in the crypto space. Just as the name has rightly put it, halving means dividing into two equal parts. In the crypto space, It is a well known and very much anticipated event that happens once in (approximately) every four years.

During a typical halving event, the mining rewards of the Bitcoin Network validators get slashed by half. Hence, the term halving.

As an incentive structure that is embedded in the source code of the Bitcoin protocol, the supply schedule guiding the emission of new bitcoins into circulation is deflationary. By deflationary, it implies that the amount of new bitcoins released into circulation should decrease over time.

The halving is programmed to trigger on the the bitcoin network approximately every four years, once the #210,000th block is mined following the previous halving.

From January 2009, when the Bitcoin's Genesis block was mined, there have been 3 halving events, with the third and most recent one happening in May 2020.

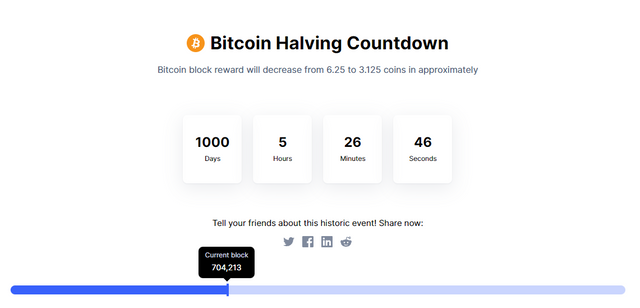

b.) When is the next expected?

Since halving events are programmed to occur by default after every 210,000th Bitcoin block has been mined, general expectations hold that the next halving will follow the sequence displayed in the table below

| Date | Event | Reward per block |

|---|---|---|

| 3/01/2009 | Genesis block got mined | 50 BTC |

| 28/11/2012 | First halving | 25 BTC |

| 09/07/2016 | Second halving | 12.5 BTC |

| 11/05/2020 | Third halving | 6.25 BTC |

| ??/??/2024 | Next halving | 3.125 BTC |

Apparently, we can see that the cycle doesn't get to a full 4 years before the halving occurs. For the most part, it has been consistently 3 years and about 9 months. There have been several speculations on the particular date for the next Bitcoin halving. Coinmarketcap.com gives the prediction below:

Image|coinmarketcap.com

According to the countdown here, the next halving is expected to take place on the 04/05/2024. However, we will get to know for a fact when the halving event comes.

c.) What is the current amount that Bitcoin miners receive?

The current amount that bitcoin miners receive is in tandem with the mining rewards from the third halving (see table above). Once a block is successfully validated and added to the chain on the bitcoin network, the miner that solved the Proof-of-Work consensus gets 3.125 bitcoins as reward.

d.) Mention at least 2 cryptocurrencies that are or have halved.

Some cryptocurrencies operate with the same supply economics as Bitcoin. That is, they are built to have a gradually decreasing supply quantity as a result of the halving that is programmed to happen on their network.

Most of the cryptocurrencies that adopt the concept of halving as part of their economic function include:

Bitcoin SATOSHI's Vision ($BSV)

Image |crypto-news-flash.com

BSV is a fork of Bitcoin Cash ($BCH). It had its first halving in April 2020, where miner's rewards got reduced from 12.5 BSV/block to 6.25 BSV/block.

Litecoin ($LTC)

Image |cdn.gobankingrates.com

Just like BSV, Litecoin has the same halving concept as that of BITCOIN. Litecoin has gone through two successful halving episodes in 2015 and 2019 respectively. This halving saw mining reward reduce from 50 LTC/block to 25 LTC/block on the first halving, and then to 12.5 LTC/block where it currently settles.

Q2a.) What are consensus mechanisms?

Image |openledger.info

Consensus mechanism simply defines how the participants of a blockchain network agree on who should make changes - add a new block or make updates- to the blockchain.

In the decentralized world of blockchains where there are no authorities to preside over the decision making processes, a set of rules exist in the form of a computer program to ensure the legitimacy of contributions from each network participant. These rules are called consensus mechanisms.

Acting as guiding principles, consensus mechanisms help to maintain and secure the self-regulating system of blockchains, which functions on a global scale with no governing authorities.

There are various kinds of consensus mechanism, and each of them differ in terms of their working principles. The most outstanding consensus mechanisms for blockchains include the Proof-of-Work (PoW) and the Proof-of-Stake (PoS).

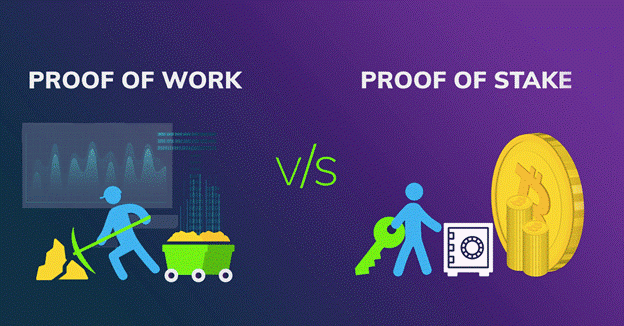

b.) How do Proof-of-Work and Proof-of-Staking differ?

The PoW and PoS consensus mechanisms differ in many aspects. Let's start with a basic definition and operating principle of both:

Proof-of-Work (PoW)

Image | coin.space

This consensus mechanism algorithm works by posing complex mathematical problems for the network nodes to solve. Network participants often compete to solve the puzzle based on their computing power, and the first node to find a solution to the problem becomes the node with the right to add a new block to the blockchain. Being the node that solved the PoW, there are earnings called mining rewards to claim.

This the consensus mechanism is what the Bitcoin Network uses. To solve the PoW on the Bitcoin Network, nodes are tasked to find a number - the Nonce - that will meet a set of pre-determined conditions. Once the Nonce is found, the Proof-of-Work is solved, and miner gets bitcoins as reward.

Generally, the PoW consensus mechanism gets discredited on the basis of energy consumption and processing speed. It consumes energy and does not support as much transactions to make their network scalable.

Proof-of-Stake (PoS)

This is an alternative consensus algorithm that seem to capitalize on some of the weaknesses of the Proof-of-Work. The proof of stake (PoS) consensus algorithm has a low-cost advantages and consumes low-energy, when compared to the PoW algorithm.

In the PoS consensus, a network participant gets to take part in maintaining the blockchain based on the number of virtual currencies they hold. In other words, responsibilities are assigned in proportion to the number of assets by a network node. These assets get locked up in exchange for a right to participate in the network governance.

PoS is generally viewed as a better alternative as it enables a faster processing speed and consumes less energy. Also, unlike the PoW, it doesn't require much computing power to stand a chance at winning in a PoS consensus model.

A brief summary of the differences between PoW and PoS consensus mechanisms is given below:

| Proof-of-Work (e.g. Bitcoin) | Proof-of-Stake ( e.g Cardano) |

|---|---|

| Capital intensive | Low cost implications |

| Energy consuming | Consumes less energy |

| Low transaction speed | Moderately high transaction speed |

| Requires high computing power | Does not require high computing power |

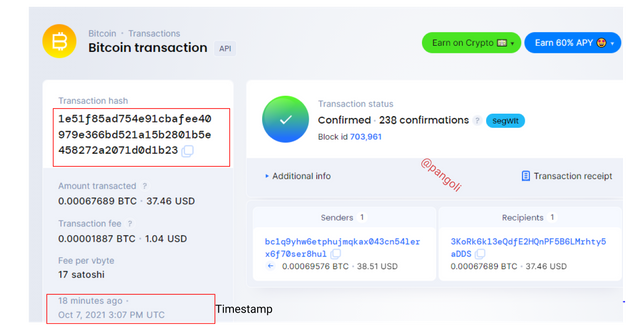

Q3.) Enter the Bitcoin explorer and indicate the hash corresponding to the last transaction. Show Screenshot

To access the Bitcoin block explorer, I first of all visited the site blockchair.com/Bitcoin. On the landing page, there is a display of block and transactions information, I clicked on the transaction hash to expand the details about the transaction. See screenshot below...

Image |blockchair.com

From the screenshot, the current hash corresponding to the current transaction is

"1e51f85ad754e91cbafee40979e366bd521a15b2801b5e458272a2071d0d1b23.". We can see when this transaction was verified in the timestamp, and its corresponding block on the bitcoin blockchain.

Q4.) About Altcoin Season

Image| yourcryptolibrary.com

To give a little bit of perspective, let's get to know what altcoins are. The word "altcoins" is used to describe every other cryptocurrencies aside bitcoin. Although this definition seem to have gained some adjustment in recent times to mean "every cryptocurrency outside the primary coins like Bitcoin, Ethereum, and USDT," I will proceed with the first definition.

What is meant by Altcoin Season?

Altcoin Season refers to a period in the crypto market cycle when altcoins record their highest bullish moves for the season.

Oftentimes, when Bitcoin - which is the principal cryptocurrency - begins to lose its market dominance, people tend to switch over to altcoins to continue chasing some gains. This switch often results in people buying into altcoins such that their prices rise in random successions, leading to the what we refer to as an altcoin season (or alt season for short) .

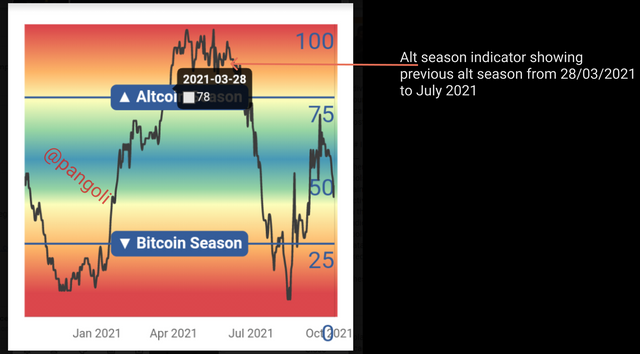

Are we currently in Altcoin Season?

To determine if the market is currently in an Altcoin season, there are some indicators to look out for. These Indicators include Bitcoin dominance Indicator, Bitcoin/Altcoin market cap divergence, etc. However, there are some websites that have aggregated these individual indicators to create something more conscise and easy to understand.

One of those websites is blockchaincenter.net. Below are screenshots of the current position of the market according to the website at the time this article was written.

Image | blockchair.co

The index is measured in percentage from 0 to 100%. Values below 25% indicates that the market is in the bitcoin season; and values above 75% indicates that the market is in Altcoin season. Values between 25% and 75% represent a neutral state in the market.

The screenshot shows that the current level of the market, at the time of writing, is 45%. This indicates that the market is in the neutral zone, but gradually declining into the Bitcoin season.

When was the last Altcoin Season?

Image | blockchair.com

From the screenshot above, the last altcoin season, indicated by the peak above the 75% level, was experienced between March and July of 2021.

Mention and show 2 charts of Altcoins followed by their growth in the most recent Season. Give reasons for your answer.

The section below presents selected altcoins and their charts showing their growth in the most recent season.

Binance coin (BNB)

Image | Tradingview.com

In the last altcoin season, the BNB coin recorded significant growth due to the increase in Total Value Locked (TVL) in the DApps that are built on the Binance Smart chain. This caused the price of BNB coin to rally from about $60 all the up to $500+. As shown on the screenshot above, the BNB token did an approximate 1500% increase in value.

Pancakeswap token (CAKE)

Image | Tradingview.com

Pancakeswap token (CAKE) did an upward rally amounting to about 300% increase in its value. From the screenshot, it can be observed that the rally kicked off when the price of CAKE was about $9, and reached a peak at about $40 In the last altcoin season.

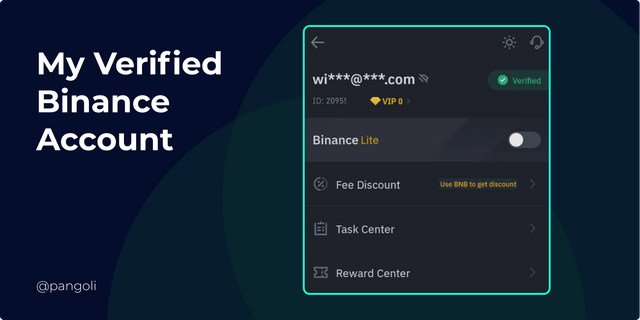

Q5.) Make a 15 USD purchase of any cryptocurrency from your verified exchange account

Note: The coin should not be among the top 25 on coinmarketcap. Also, SBD, tron or steem are not allowed.

Before I proceed with the purchase, here is a screenshot of my verified Binance account:

Image | Binance.com

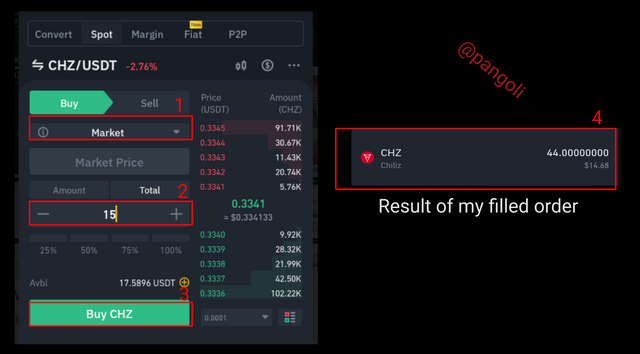

To proceed with the question, I have made a $15 purchase of the Chiliz (CHZ) token. The details of my purchase is presented below:

Image | Binance.com

From the screenshot, I first of all set my order type to "Market order". Then I proceeded to fill in my order quantity, and completed the transaction by clicking the "Buy" button. My filled order is displayed on the second panel ( it is a little below $15 due to charges and short-term price fluctuation).

Why did you choose this coin?

I chose the coin because I have done my research on it and realized that it is an authentic project. It has been listed on reputable exchanges like Coinbase, Binance and Huobi; which gives it more market credibility.

Also the price has just retraced from its all-time-high to a point where it is more comfortable for people who missed the first move to make an entry.

What is the purpose?

Image | chiliz.com

Chiliz is an NFT token that is focused on the sports and entertainment sector. The large fan base behind these two sectors is capable of exploding the value of the token once it gains mainstream adoption.

Who are its founders / developers?

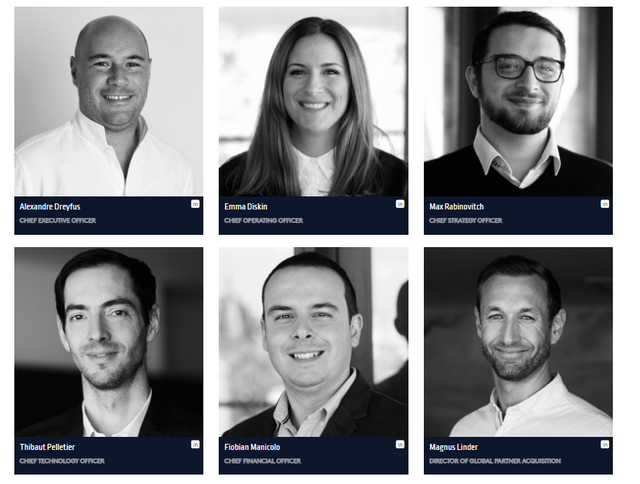

Image | Chiliz.com

The Chiliz team is comprised of professionals across 27 different nationalities and is constantly growing. The screenshot above shows a cross section of the team behind the project.

Indicate the currency's ATH and its current price. Show Screenshots.

Image | Binance.com

From the screenshot above, we can see that Chiliz token had done an upward rally to a $0.38 price point before declining to its current price at $0.3347.

Conclusion

The crypto space is one that works with events and cyclical seasons. An understanding on these events and cyclical seasons can be the one thing that ensures a trader/investors continued profitable streak.

While halving events can be an early indicator for traders/investors to get positioned for long-term gains, cyclical seasons like the altcoin season can help them maintain profitable portfolios in and out of bitcoin season.

Thanks for reading...

References

https://blockchair.com/bitcoin/transaction

https://www.tradingview.com/chart

https://investopedia.com

https://babypips.com

https://coinmarketcap.com

Cc:-

@imagen

@steemcurator2

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.