Crypto Academy /Season 3 - week 5 / Homework Submission post for Professor @allbert / Psychology and Market Cycle / by @ononiwujoel

Hi Professor @allbert, I am @ononiwujoel one of your students in Crypto Academy and a member of the steemit platform. This is my homework submission post from your lecture Psychology and Market Cycle.

Introduction

When it comes to stock trading and understanding how the market works, there are many popular indicators borne out of technical and fundamental analysis which are most commonly used by traders but apart from this technical indicators there is also another very important factor that largely affects and explains decisions made by traders and the entire Market by extension and this is the sentimental analysis which is based on Psychology or the prevailing sentiments among the traders.

Psychology of the market refers to the mindset of traders in the market which includes their biases, emotions, opinions, noise and sentiments. The psychology of a market can be seen through the decisions traders during trading at different points depending on the movement of prices in the market.

With the advent of cryptocurrencies into the finance markets we have experienced a massive surge of interest in stock trading and crypto exchanges from many people that were not really into trading before now. This means we now have far higher population of crypto enthusiasts trading on the markets and of cause also influencing the psychology and price movement in the market so this topic is very important.

1-Explain in your own words what FOMO is, wherein the cycle it occurs, and why. (crypto chart screenshot explanations needed)

FOMO

FOMO is a short form for the term "Fear of missing out". It is an emotional position in which a trader buys an asset because it's on a trending bullish run and many people around the trader are probably benefiting or have benefitted from it, so the trader now joins in the trend so as not to be left out of the profit making booty. So in this position we can clearly see that the purchase of assets is based on emotions, sentiments and market noise without any real technical analysis of market price movement.

This emotions-driven trading decisions (FOMO) is very common among newbies in the crypto market and there are high chances that most professional and experienced traders today were once victims of the FOMO tendency. This is because it is an emotional bias and of course people are easily controlled by their emotions, infact it takes a high level of discipline and awareness to be able to control your emotional bias when it comes to trading. So even till now we still have many traders falling for this jinx with every bullish trend in the market.

Another interesting observation about FOMO is that it makes traders to buy assets at the end of a bullish run or when the bullish trend is already weak and about succumbing to a resistance after which a bearish trend is likely to take place. And when this happens, the asset value starts declining and the traders start counting their losses after which other emotional biases follows like fears and regrets.

In the chart above, we can see where and how FOMO influence trader's decisions and the general market. It normally happens in the middle or end point of Bullish trend. People want to make profits especially when people around them are making or have made profits, so this makes them buy an asset when they're actually supposed to be selling or just wait for another Low to start investing.

2-Explain in your own words what FUD is, wherein the cycle it occurs, and why. (crypto chart screenshot explanations needed)

FUD

FUD is an abbreviation for Fear, Uncertainty and Doubt. These are also emotional biases that influence decisions of traders concerning their investment during a bearish trend and maximum Low.

As a matter of fact, traders that buy assets because of the FOMO mentality are more likely to experience FUD during a bearish trend more than traders buy assets with the right mindset.

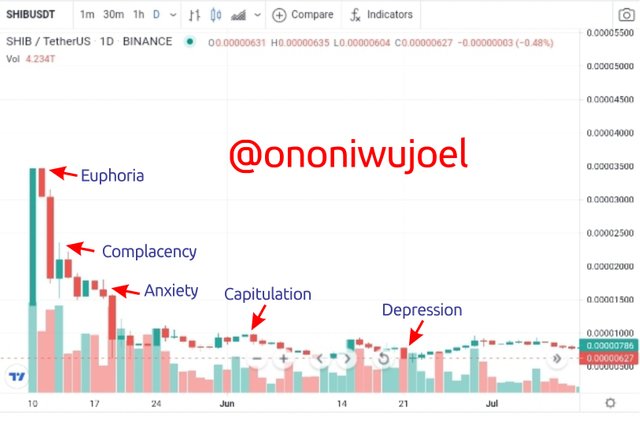

As seen in the chart above, FUD usually control majority of traders at the middle of a bearish trend and continue to increase as prices decline further, at a point it becomes depression and resentment towards the market, Whales in the network and even the government because at this stage many traders needs someone to blame for the prolonged dip even when these people and organisations have little or nothing to do with the dip.

This mentality (FUD) makes traders to start selling off their positions when prices are at the lowest points because they don't want to loose more than they believe they've already lost and by so doing they end up trading in very high losses instead of profits and this also makes them resentful towards investing in the assets again even when there are signs of another bullish trend.

FUD mentality is also very common among newbies in the crypto market and many traders have been in this position at one point or the other maybe due to lack of enlightenment on how the market actually works or because they still find it difficult to apply technical analysis when making decisions in trading rather than focusing on sentiments and public opinions in the market.

3- Choose two crypto-asset and through screenshots explain in which emotional phase of the cycle it is and why. Must be different phases

In this question I will be using Bitcoin/USDT and Dogecoin/USDT respectively to explain emotional phases in market cycle.

BTC/USDT

Analyzing the BTC/USDT chart above, we can see that Bitcoin price dropped from almost $64k down to $36k in the month of May this year which is almost half of its price earlier same month and then dropped down to below $30k this month (July) as the Bearish trend continued.

So there is already lots of negative sentiments about the market and widespread of FUD among traders and other Bitcoin and crypto enthusiasts which have of course made the Bearish trend continue the more as many people are already giving up on Bitcoin and selling off their positions for fear that it may soon drop to $5k or completely loose value soon but as we can also notice in the chart, there is recent upsurge in the price of Bitcoin which have broken through the resistance to $40k although it also briefly went back to $37k which would likely be because many traders are selling their positions for fear of another downwards movement of prices but all the same this recent movement is a sign of the possibility of another bullish trend and of course people are already having that feeling of Hope optimism which will likely soon be followed by a thrill if the price should climb to $45k.

So for now, the most common opinion of Bitcoin traders towards the market is that of Hope and optimism because of the recent signs of another bullish trend and we are to get ready for another market cycle which will of cause include FOMO once Bitcoin goes above $45k and the market cycle continues.

DOGE/USDT

If we analyse the doge/USDT chart above, we will observe that the dogecoin was trading at almost $0.6 earlier in the month of May but went through a bearish trend same month which left it trading at almost half its former price $0.37, there were other upwards movements after that but it's still in a Bearish trend.

Now with this observations we can easily tell that during the bearish in the month of May, many traders were already trading with the FOMO mentality and greed to make more profits which led them to continue buying dogecoin even when the bullish was exhausted and couldn't withstand the resistance anymore.

We can also see the complacency in traders when dogecoin was trading at $0.4 after rising from around $0.3 which made them to even buy more positions hoping for more upwards movement in prices but the support couldn't even hold up and the following bearish saw dogecoin trading at $0.15. At this point there is FUD and many are selling whatever is left of their funds so that they can go look for something else to do with their time instead of crypto.

But then at the end of the trend, we can see prices at $0.2 and there are little signs of another likely to be bullish trend which is also fueled by the recent price upsurge in Bitcoin. So at this point in the market cycle the most common opinion of traders is Depression and Doubt which may likely become Hope if the prices grow further and then Thrill if the price gets to $0.4.

And the market cycle continues.

4- Based on the analysis done in question 3, and the principles learned in class, make the purchase of 1 cryptocurrency in the correct market cycle. The minimum amount of 5USD (mandatory), add screenshots of the operation and the validated account.

In this section I'll be purchasing Dogecoin while showing the process involved.

I choose dogecoin because currently dogecoin just rose a little above its last lowest position this year so I believe there is likely to be an upwards movement of dogecoin price especially with speculations about another Bitcoin trend in the crypto market because dogecoin is an Altcoin and whenever there is a bullish in Bitcoin and Ethereum there is likely to be a bullish in Altcoins like dogecoin.

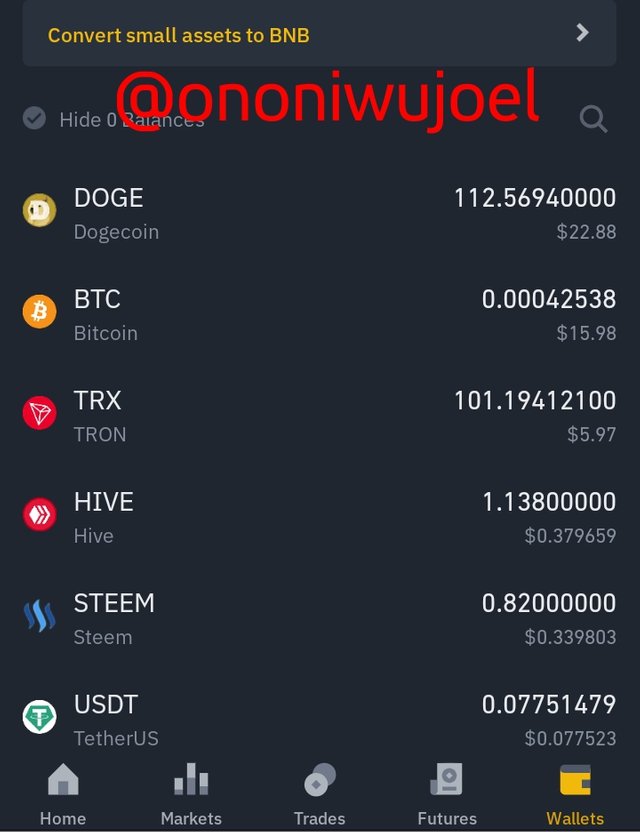

- My Binance account

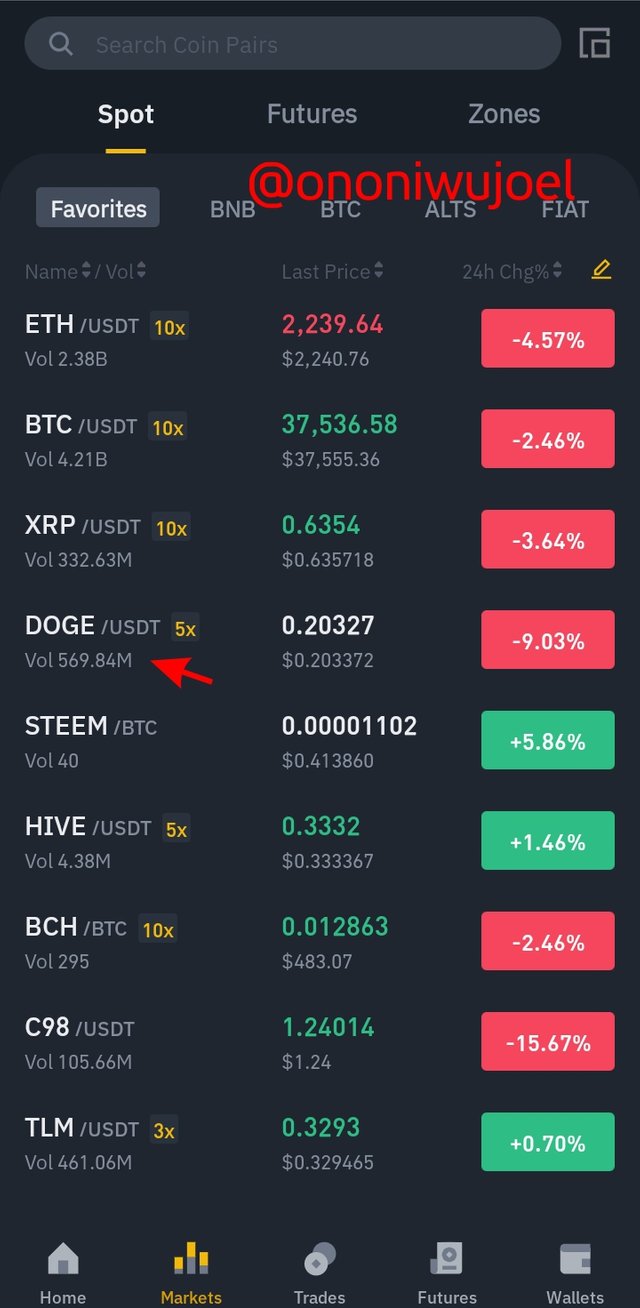

- First step is click on Markets and select DOGE/USDT. As you can see dogecoin is already in my favourites

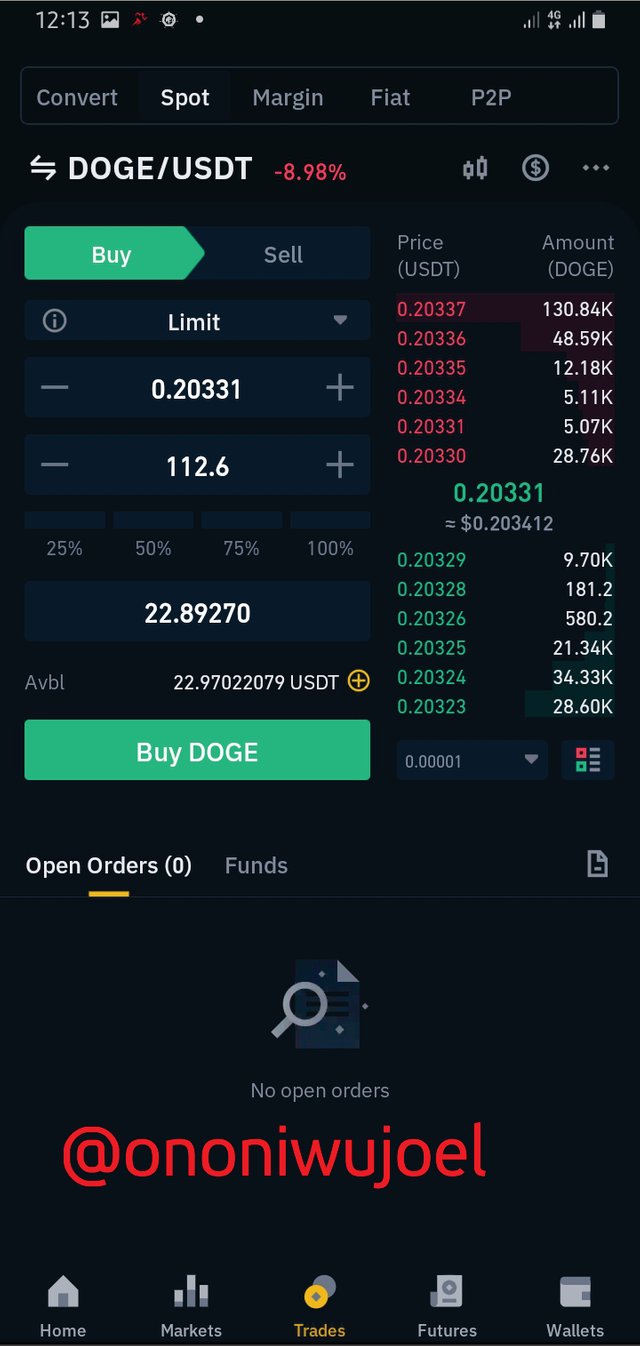

- Having open DOGE/USDT overview next step is to click on the buy option. As you can see Dogecoin is worth $0.2 as at when I bought

- in this section, you can now fill in the amount you want to buy. I'm buying 112.6 Dogecoin worth $22. 8. After filling in the amount click on buy doge

- Transactions is confirmed and here we are

Conclusion

Understanding Market cycle and its psychology especially the sentimental analysis section of it goes a long way to help traders make the right decisions when trading and develop the spirit of professionalism not being controlled by their emotions or desire to make unbelievable profits.

It is also observable that traders that are driven by FOMO and greed when making investments are very likely to fall into FUD at the end of the day because both are emotional biases and are very related. While FOMO makes traders to buy positions at the wrong time when they should actually be selling, FUD in the other hand makes them sell positions at the wrong time when they should actually be buying. So in the long run such traders tend to loose at both ends.

It was a great lecture and I learnt a lot.

Cc: Professor @allbert

Hello @ononiwujoel, Thank you for participating in Steemit Crypto Academy season 3 week 5.

Thanks a lot Professor @allbert for the corrections.

I'll do a better work next time