RISK MANAGEMENT AND TRADE CRITERIA / CRYPTO ACADEMY / S5W7/ HOMEWORK POST FOR @reminiscence01

Introduction

Seasons' greetings and welcome to my week 7 homework post for Professor @reminiscence01 which he lectured about Risk Management and Trade Criteria.

source

source

What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?.

Explain the following Risk Management tools and give an illustrative example of each of them.

a) 1% Rule.

b) Risk-reward ratio.

c) Stoploss and take profit.

Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required).

a) Trend Reversal using Market Structure.

b) Trend Continuation using Market Structure.

The following are expected from the trade.

Explain the trade criteria.

Explain how much you are risking on the $100 account using the 1% rule.

Calculate the risk-reward ratio for the trade to determine stoploss and take profit positions.

Place your stoploss and take profit position using the exit criteria for market structure.

1. What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?

A lot of investors that are involved in crypto trading encounter so many losses, and that is because they don't have the proper knowledge on risk management before they began to trade.

Risks in crypto trading have to do with the tendency of a trader to lose all or part of his deposited funds, and then risk management in crypto trading is the ability of a trader to identify potential losses and control them by taking appropriate measures.

As the world keeps growing, so does the crypto space and from the outside people think crypto trading is all about the grains and profits without putting the risks involved. Little or no risk management will lead to a trader losing a huge amount or all of his deposited funds. To prevent all these losses is why risk management and following the guidelines of risk management is essential to push in more profits and block any incoming risk to the minimum.

Imagine being new to crypto trading without the knowledge of risk management and then after funding your wallet, you decide to buy United Farmers Finance (UFF) token at $0.48 with all your funds and then some days after, the price drops by 95% to $0.02009. What this means is, you've lost 95% of your whole deposited funds.

.png) source

source Proper risk management will educate you on how not to invest more than 1-3% of your funds on a single coin In case that particular coin decides to dip in market price, you'll only be losing 1-3% of your capital. If you want to make sure profits then invest maybe 2% each from your funds on 50 different coins or 1% each on 100 different coins, by doing this the profits would be covering the losses if there's any.

Observing the market and knowing when to stop and rest to get your mental health back is also another importance of risk management in the financial world to avoid and prevent overtrading, which might lead to a trader losing everything he has in his account.

2. Explain the following Risk Management tools and give an illustrative example of each of them. a) 1% Rule. b) Risk-reward ratio. c) Stoploss and take profit.

1% Rule:

source

source Where newbie traders make mistakes is by risking a large percentage of their capital on one trade, this is where the 1% Rule from risk management tools comes into the picture. 1% Rule is like a practice in which a trader puts 1-3% of his whole funds on the line for a single trade. This is important because risks during trades are inevitable, you never know when you would encounter losses in a trade. So should the trade go sideway, you will just be losing 1-3% of your funds and you'll be left with 97-99% to enter other trades.

For Example:

You fund your crypto trading account with $400, and you intend to risk 2% from it to open 2 trading positions;

Therefore, 2% of $400 = $8

$8 on 2 trading positions ($8 x 2) = $16

Now, if you should lose 4x in a row;

Then, -$16 x 4 = -$64 of losses

You will now be left with a total of ($400 - $64 = $336 ) in your account.

Following the 1% Rule before entering a trade, is going to help the trader reduce his losses if there is going to be any. A trader that obeys the 1% Rule cannot be compared with another trader that risks about 20-30% of his total capital on a single trade. Risking 30% of $400 to open a single trade can lead to a loss of $120 from that $400, leaving a total of $280 left in his account. This is not a good way to participate in crypto trading.

Risk-reward ratio:

source

source Having two trades that come back with a profit and loss means there isn't going to be any progress in your trading journey. The risk-reward ratio has to do with how a trader calculates and knows where to position his stop-loss and take profit.

A scenario of a bad risk-reward ratio is when a trader targets a profit that is the same value as if he should hit a loss, and that is the 1:1 risk-reward ratio. This means opening a buy order at a price of $4, placing the take-profit at $6 and stop-loss at $2.

It has been advised by significant crypto trading experts that the best risk-reward ratio is the 1:2 risk-reward ratio. What this means is the take-profit of the trade would be x2 of any predicted loss.

For Example:

If a trader should open a trade with $50 then places the stop-loss at $40 to ensure his losses does not exceed $10, and then take-profit is set at $70 to earn an expected profit of $20 (as $10 x 2 = $20) if the trader predicts the price of will hit and goes beyond $70 in a few weeks or months. Now, this is a typical example of the 1:2 risk-reward ratio as the trader is only risking a loss of $10 for an expected profit of $20.

Some traders might still advise having a 1:4 risk-reward ratio or more, but by doing this there is an increase in the probability of the trade not hitting its take-profit position. That is why the 1:2 risk-reward ratio is highly recommended.

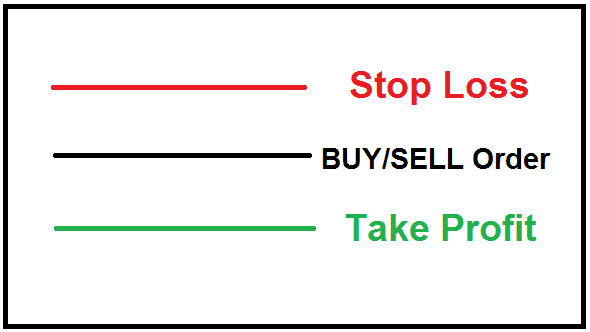

Stoploss and take profit:

source

source Before opening a trade, it is necessary to determine and set the points of your take-profit and stop-loss orders. If you don't do this and the market goes against you, you might lose all your capital in that trade. Even when the market movies according to your predictions, because you might not always be available to monitor and close the trade, it might decide to drop down to your point of entry, which means zero (0) profits but then again it can drop below your entry point and that means automatically you have entered a loss.

Take-profit and stop-loss orders are automated risk management tools that are used to manage your trading positions. Take-profit order automatically closes a trade when the price of the targeted profit that was placed is reached. The stop-loss order also works in a not so different way, to close an opened trade when there is a loss not to go beyond the price level a trader was willing to risk on the trade.

For Example:

A trader observes a bullish run in the market on a 4H chart, then he proceeds to open a buy position. Now to set his take-profit and stop-loss, he follows the rules of the 1:2 risk-reward ratio. Assuming he predicts that the market is going to remain bullish on that 4H chart for about 40% or more than his take-profit would be 30% above his entry point and his stop-loss order would be placed 15% below his entry point. What this means is that the trade would automatically close when there is a profit of +30% or when there is a loss of -15%.

3. Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required). a) Trend Reversal using Market Structure. b) Trend Continuation using Market Structure.

So I opened a demo account with a deposit of $100 in it, Below is a screenshot of my account balance before I entered the trades:

.png) source

source

a) Trend Reversal using Market Structure:

Explain the trade criteria:

The market trend of BTC/USD kept going up to down then down to up just like that in price on the 5m charts, this makes it a trend reversal.

Explain how much you are risking on the $100 account using the 1% rule:

On this BTC/USD trade, I will be risking just 1% of my $100 capital, which means if the trade should hit stop-loss, I will only lose $1 from $100 leaving $99 for me to key into other trade opportunities.

.png) source

source

Calculate the risk-reward ratio for the trade to determine stoploss and take profit positions:

On this buy trade, I worked with a 1:2 risk-reward ratio. I bought BTC/USD @47404, then form the calculations of my risk-reward reward ratio while also following the 1% rule, I had my stop-loss @47325 and my take-profit @47563. This means that my expected profit is x2 of my expected loss.

.png) source

source

Place your stoploss and take profit position using the exit criteria for market structure:

Look at my stop-loss @47325 on the screenshot below which I placed under the newly formed support on the 5m chart, then my take-profit @47563 was placed from the calculations of my 1:2 risk-reward ratio.

.png) source

source

b) Trend Continuation using Market Structure:

Explain the trade criteria:

The market trend of ADA/USDT kept on going down in price, creating a downtrend of lower lows, and lower highs on the 1 Day chart.

Explain how much you are risking on the $100 account using the 1% rule:

I was risking just 1% of my $100 which is $1 on this ADA/USDT trade If I should hit a loss. Following the 1% rule on this trade gives me a remainder of $99 to venture into other trade opportunities in the market.

Calculate the risk-reward ratio for the trade to determine stoploss and take profit positions:

Also on this trade, I followed strictly the 1:2 risk-reward ratio. By entering the ADA/USDT market with a sell order at @1.362 then my anticipated profit @1.288 which will be x2 of my loss that I place at 1.388.

.png) source

source

Place your stoploss and take profit position using the exit criteria for market structure:

I set my stop-loss using the exit criteria of a sell order which means putting my stop-loss price above the newly found resistance @1.388, now following the 1% rule and my initial 1:2 risk-reward ratio, I placed my take-profit @1.288.

.png) source

source

Screenshot below shows my account history and my account balance:

.png) source

source

Conclusion

I read and understood this lecture very well, now I know how what risk management is and how important it is to crypto trading. There will always be risks when you are in the trading market but proper risk management knowledge can help in minimizing those crypto trading risks to the lowest.

I know now how necessary it is to follow the risk management tools like the 1% rule, by fixing your expected loss at just 1% of your account balance and then the risk-reward ratio which was recommended to be a 1:2 risk-reward ratio on every trade, making anticipated profit 2x your anticipated loss.

I tested all these out on my $100 demo trading account on TradingView - I opened two trades, although both came out as losses that were just 2% of my account balance, now I have $98.61 left to enter other trading opportunities.

Thank you for reading through, and I'm grateful to Professor @reminiscence01 for this beneficial lecture.

.png)

.png)

Hello @ofalamin , I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.