Steemit Crypto Academy Contest / S15W2 - Stock to Flow Model

Hello and Greeting to all of you guys. Have a awesome day for all of you buddies. Am really happy to see this contest because this is challenging and thrilled for me who want to learn about the cryptocurrency and I know everyone in this community is very excited to see this Contest. Last time I posted my post very late here but now I completed this post in two days of hardworking in this project about the S2F model.

The Stock- to- Flow( S2F) model is like a tool used to "Measure how scarce and precious something is especially for assets like Bitcoin". As we discuss about the scarcity and supply about Bitcoin in previous challenge you can chek the information from there. It compares the amount of that asset already available(called the stock) to the new amount produced over time(called the flow). For Bitcoin this means looking at how numerous bitcoins are out there now compared to how numerous new ones are made eachyear.However, it suggests the asset is more scarce, and people often think that could make it more precious over time, If the S2F ratio is high.

The Stock- to- Flow model gained popularity because it helps predict or estimate the unborn value of assets, especially for Bitcoin. People use it to understand how Bitcoin's scarcity might affect its value, kind of like how we think about gold. The idea is that the scarcer something is, the further people might want it, and that could drive up its price. So, the Stock- to- Flow model is a way for investors and analysts to guess or estimate how precious an asset like Bitcoin might become in the future based on its current supply and how important new supply is coming in.

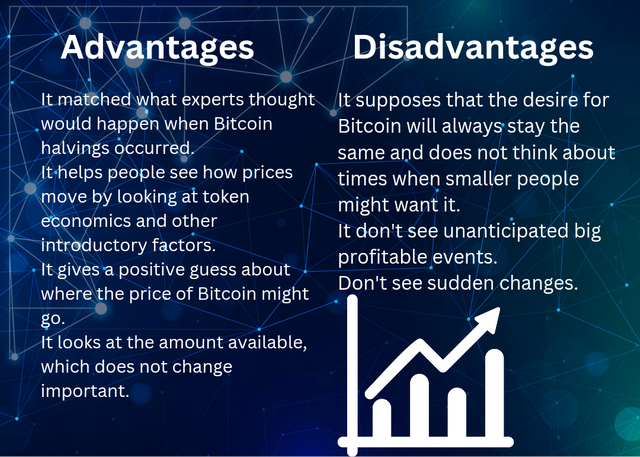

As you know, anything that has advantages, on the other hand, has some disadvantages, even if those disadvantages are small to no extent, but they are counted in the extent of disadvantage. And so along with the advantages of stock-to-flow, there are also some disadvantages which I will tell you both its advantages and disadvantages below.

Advantages

- It matched what experts thought would happen when Bitcoin halvings occurred.

- It helps people see how prices move by looking at token economics and other introductory factors.

- It gives a positive guess about where the price of Bitcoin might go.

- It looks at the amount available, which does not change important.

Disadvantages

- It supposes that the desire for Bitcoin will always stay the same and does not think about times when smaller people might want it.

- It does not think about how prices can change a lot in the market and that really affects price of Bitcoin.

- It does not account for unanticipated big profitable events.

- As I told you in point one above it can't cover sudden ups and downs or any such changes in any cryptocurrency.

After looking at its benefits, we also saw some of its disadvantages and because of this, I want to tell you that whenever you invest, do not look at any one model or any single indicator. Rather, use multiple models, which increases the accuracy of your trades and also increases the rate of profit

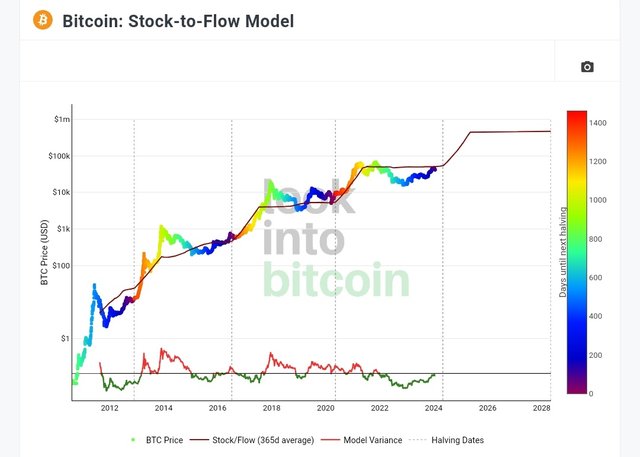

The Stock- to- Flow( S2F) model is often imaged on a chart to illustrate the relationship between the existing supply of Bitcoin( stock) and the new supply created over time( flow). Thex-axis generally represents time, divided into intervals similar as months or years, while the y- axis shows the S2F ratio. The chart demonstrates how the scarcity of Bitcoin evolves based on its production rate.

Source

During Bitcoin halvings, which occur roughly every four years, the S2F ratio increases significantly. This is due to the reduced rate of new Bitcoin issuance, leading to a more pronounced scarcity. The S2F chart aims to capture these crucial events, showcasing how the market perceives scarcity and implicit value.

However, it's essential to note that the S2F model has its limitations. It tends to overlook market volatility, black swan events, and fluctuations in demand. While the chart may align with literal trends, it does not guarantee accurate predictions, as it assumes a harmonious relationship between stock and flow.

Investors and analysts use the S2F chart to assess the implicit impact of scarcity on Bitcoin's value. It serves as a visual tool to understand how the market reacts to changes in supply dynamics, providing insights into implicit price movements over time.

Source

Source

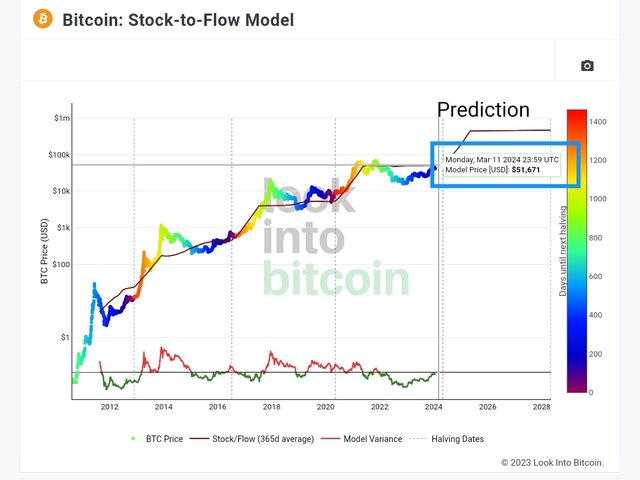

By the help of S2F we can determine the trend like I simply tap on the graph line and it predict the upcoming value and price of Bitcoin as you can see baove in the chart. The date now is January 24, 2024 but it predict the value for March 11, 2024.

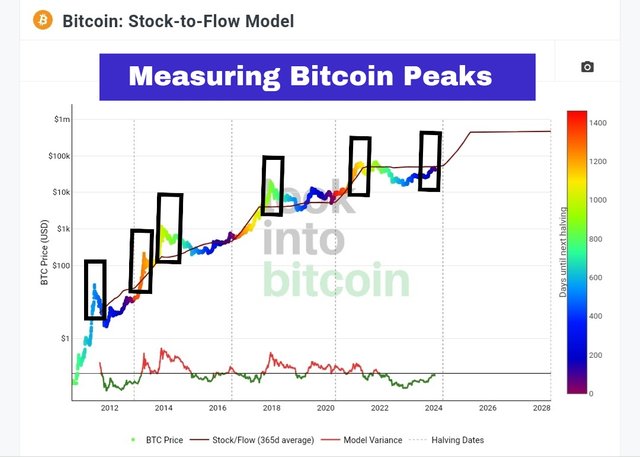

Let chek the peaks which happens in the history of Bitcoin. As you can see it predicted the 4 times peaks earlier and now at 2024 its also have to happen in this chart so its very profitable for all the crypto traders.

Applying the Stock- to- Flow( S2F) model to STEEM, or any other cryptocurrency besides Bitcoin, isn't straightforward, and there are several reasons for this

- Unique Token Economics

The S2F model relies on the scarcity of the assets which is influenced by its production rate and supplies. In the case of STEEM token which we earn from Steemit, its token economically and issuance mechanisms differ significantly from the mechanism of theBitcoin. The factors acts like staking of steem coins and inflation rates in market and reward distribution play a very important and pivotal role in the making direct application challenging in the market of STEEM.

- Market Sentiment and Adoption

The S2F model does not work in regard for market sentiment and adoption and which are essential drivers of cryptocurrency value and impacts a lot on these values. There is no influence in StEEM token like the Bitcoin as like the Scarcity of Bitcoin.

- Different Use Cases

Cryptocurrencies serve a lot of purposes and their values of these assets are influenced by different factors. While Bitcoin is frequently compared to precious coin like Bitcoin and seen as store of the value. The STEEM is more aligned with content creation and social media interactions on its blockchain system. The utility and demand dynamics are very distinct which are affecting how scarcity might impact on the value of the STEEM token.

- Development and Technological Changes

Cryptocurrency projects update and so on, change and go through technology phases, which also increase the opportunities to make predictions and also use various tools to understand what these technologies are. By following the charts, you can see when and how the token may go up or down and how much its price may gain or lose.

- There is very difficulty to know about the daily mining of the STEEM token but on the other hand we can easily know about the total daily mining of the Bitcoin. The reward system is also different from STEEM as we talk about it earlier.

So these are some things which enough to understand about these facts about Stock to Flow Model, its chart and prediction from chart, Bitcoin's scarcity and also This model can apply on our STEEM token.

I am very happy to complete this challenging post I think that this is my biggest achievement ever because I don't have any physical teacher to talk about these things and am learning these things with all of you the community member the post of @hamzayousafzai and @ngoenyi is very beneficial for me, the things which I don't get from anywhere its become very easy for me by seeing there posts. I really love to be a part of this community. Please ignore my mistakes.

And Now I would like to invite some friends to take part here:

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

@numanbhutta Just wanted to drop by and say your post on the Stock to Flow model is incredibly well explained! I appreciate the effort you put into breaking down the advantages and disadvantages. It's insightful and makes the topic more accessible. Best of luck in the contest!

Thankyou brother

Es muy válido tu recomendación de no fiarse de un solo modelo o indicador, sin que debes utilizar otros modelos para aumentar tu precisión y apreciación a la hora de decidir invertir.

El gráfico del análisis nos demuestra que pese a sus limitaciones estos pronósticos se han cumplido, claro está que no es perfecto pero apunta hacia la misma dirección y en muchos casos con poco margen de error, lo cual también sorprende a muchos que un modelo con fundamentos solo en la escasez pueda lograr tanto.

Gracias por participar con sabiduría.

Saludos y mucho éxitos.

Yoh are absolutely right and I can understand that you thoroughly visited my post and thanks a lot for reviewing my post.

¡Saludos y feliz día!

Among all strategies use in analysing the wide volatile crypto market,

Stock to Flow model stand Great and outstanding.

It help determine the halving season, scarcity of commodity, possible prediction of market prices and lot more.

Going through your analysis, I'm super excited 😆 and love your presentation.

These details are so perfect.

Checking your graph analysis of Bitcoin, it indeed show you understand this perfectly.

Good luck 🤞

Thanks a lot brother for reviewing my post.

Greetings friend,

Your knowledge of the S2F model is commendable, bearing to the fact that you just learnt it from fellow participants posts.

The Stock-to-Flow (S2F) model is like a tool that helps us measure how scarce and valuable something is, especially for assets like Bitcoin. It compares the amount of Bitcoin that already exists (called the stock) to the amount of new Bitcoin being created over time (called the flow). By looking at how many Bitcoins are currently available compared to how many new ones are being made each year, we can get an idea of how scarce the asset is.

The Stock-to-Flow model gained popularity because it helps us predict or estimate the future value of assets, particularly for Bitcoin. It helps us understand how Bitcoin's scarcity might impact its value, similar to how we think about gold. The basic idea is that the rarer something is, the more people might desire it, potentially driving up its price. So, the Stock-to-Flow model is a way for investors and analysts to make educated guesses about how valuable an asset like Bitcoin could become in the future based on its current supply and the rate of new supply coming in.

Good luck and all the best in the contest pal.

Yeah of course thats true for the stock to Flow model and am agreed on your comment.

Your advice on diversifying the use of multiple models when investing is an important reminder for everyone in the cryptocurrency space.

Relying on a single indicator can have its limitations, and incorporating various models enhances accuracy and profit potential. Thanks for analyzing this aspect.

Yes of course my brother you really study this post deeply. Am really thankful to view and give a reasonable comment at my post.

Thanks a lot brother.

Thank you for sharing your insights on the Stock-to-Flow model. Your detailed explanation of its advantages,m disadvantages and application to Bitcoin and STEEM is insightful. It's great to see your commitment to learning about cryptocurrency and participating in the community. Best of luck in the contest!

Yeah Of course my brother STEEM is really insightful and beneficial for all the user who are working on this blockchain. Thanks a lot for comment at my post. 💗

Indeed I also really love what he did on his article because it shares vital data or information in a professional manner.

Greetings, my friend @numanbhutta! Your detailed analysis of the Stock-to-Flow model showcases a commendable understanding. The insights on Bitcoin's scarcity and its application to STEEM are enlightening. All the best in the contest, success for you! 👍

Yeah you are write and am glad to see you here at my post. I also Appreciate your work. But I have some quarries about this community but time by time I will get knowledge about that. In'Shaa'Allah 🥰

Hello dear friend greetings to you, Hope you are having good days there.

You said that the Stock- to- Flow model is a tool used to "Measure how scarce and precious something is, especially for assets like Bitcoin". Yes you are right, this mathod was first design for BTC. Too many analyst use it for their analysis. It works on scarcity and overloading of stock or commodity. For long time analysis, I think this is too good to be used.

The best post dear, best wishes for the contest.