Fibonacci Tools - Steemit Crypto Academy |S6W4| - Homework Post for Professor @pelon53

Welcome to week 4 and I am so excited to be writing again after being down the previous week, today we will be studying an interesting topic about the fibonacci. let's use the questions as our guidelines for study

.jpg)

Generally, when a trending market slows down, it will bounce back up as profit-taking sets in and as traders find an opportunity to enter the market in the direction of the trend for a cheaper price.

Traders use the Fibonacci retracement as a way to identify key price levels for entry and profit targets. The Fibonacci retracement is drawn on the chart, taken from the highs and lows, to find levels of support and resistance using different horizontal levels to also detect reversals.

To use the Fibonacci retracement tool, you need to locate two recent highs and two recent lows. Other levels on the Fibonacci tools can indicate where price is likely to reverse.

lets look at an example below

Using the Fibonacci retracement tool in your chart, we can see where the reversal point occurs. There is a key pivot level of resistance on the Fibonacci sequence at 0.382.

The Fibonacci extension tool is to used in conjunction with Fibonacci retracement, after you've identified the reversal point. As we saw above, the Fibonacci extension tool can be used as an entry point for trades. You know when it is time to exit before you invest too much because of Fibonacci extension you can set profit targets for your positions.

Similar to Fibonacci retracement levels that serve as a profit target, Fibonacci extension levels that serve as profit targets. Those levels provide an indication of the maximum possible price increase.

We need to identify the start of the trend which can be marked as (a), the end of the trend marked as (b), and finally the end of the pullback marked as (c). After that, the Fibonacci extension tool now displays the Fibs levels where price is likely to reach before a pullback. Let's look at an example on a chart.

The chart illustrates when prices reversed back to the original direction of a downtrend. After retracing, we can see that price was extended 0.786 levels before a reversal. This level is a potential sell trade position.

You need to be aware of all the levels on the Fibonacci tools because they are all significant. If you see candlestick reversal patterns approaching a Fibonacci level, it could be an indicator to buy or sell.

A Fibonacci retracement is a popular technical analysis tool that utilizes the recent highs and lows in price movement. The Fibonacci retracement formula can be calculated as follows:

RX = X + {[1 - % Retrace1 / 100] * [Y-X]}

where

X = X is seen as the beginning of a new trend on the asset

Y = Y is seen as the pullback price

from the XRP/USDT chat above, we can see that X = 0.7878 and Y = 0.6779, let's calculate using the formula above,

RX = X + {[1 - % Retrace1 / 100] * [Y-X]}. therefore, we will be calculating the fibonacci levels at different levels 0.618 and 0.236

here we will start with 0.618

RX = 0.7878 + {[1- 0.618] * [0.6779 - 0.7878]}

RX = 0.7878 + {[0.382] * [-0.1099]}

RX = 0.7878 + (-0.0419)

RX = 0.7459 USDT

look at the image below as we can see the values.

here we will calculate for 0.236

RX = 0.7878 + {[1- 0.236] * [0.6779 - 0.7878]}

RX = 0.7878 + {[0.764] * [-0.1099]

RX = 0.7878 + (-0.0839)

RX = 0.7039

as we can see in the chart above

In the above calculation, you can see that the Fibonacci retracement levels of 0.618 and 0.236 match where the stock price ends up at those two points.

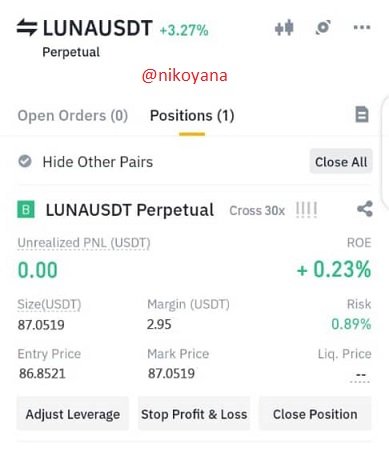

From the LUNA/USDT chart above, we can see that the price action was on a bullish trend until it got to the point X and there was a retracement changing the direction to the bearish trend. we can also see the support as indicated above on the chart.

As we can see above that the price rested on the fibonacci level of 0.786 acting as a support. because we expect a reversal, we will be placing our stop loss and take profit at a 1:2 RRR as we can see below

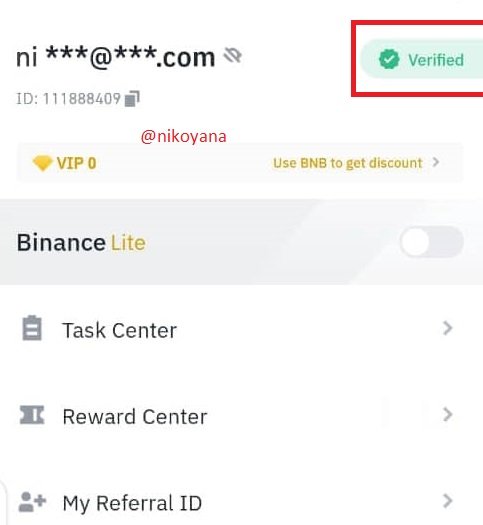

Immediately, I rushed to my binance to initiate the trade on futures. below is the image of my verified account

.jpeg)

below is the details of my trade

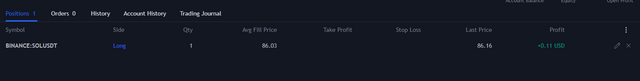

Here I will give a demo trade using the Fibonacci extension

From the SOL/USDT Chart above we can notice a bullish movement on the chart creating series of higher highs and higher lows. which after the price had a pull back creating a reversal. I initiated the stop loss and take profit and added the fibonacci extension as we can see

The Fibonacci extension drawn on the chart predicted price to reach before a retracement to level 1, which was where I set my take-profit position.

Below are the details of the Trade

Fibonacci tools are great technical analysis tools in the market today. Fibonacci retracement is a good way to spot support and resistances during pullbacks in a trending market. A trader could then find an entry position as well as take profit positions in the market.

You can also use Fibonacci retracement levels that predict after a pullback in the price of an asset. You should divine trend continuation signals before taking a trade, but you need to be careful since the price can still reverse at any of these levels.

AMAZING REGARDS

@PELON53

IMAGE REFERENCE : tradingview