Steemit Crypto Acdemy Season 2 - Homework Task for (@kouba01)

Greetings to all. Thanks to prof @kouba01 for the lecture. After reading over and trying my best to understand his piece, i was able to complete my homework task and now ready to present it.

Before we start, we need to know what cryptocurrency is .When we trade items, the payments is normally mechanized by either a bank or a financial service that issues credit cards. There are many problems associated with this. The first problem is that, those banks or financial companies might take a portion of the transaction. Also we are obliged to put our trust into these financial companies to protect our personal data from hackers. Lastly, a whole lot of international payments takes longer time to process and also at higher charges.

In order to solve these problems we could make use of a unique currency that is based on science and also secured. This is a way of protecting our data using mathematics. This currency is called a cryptocurrency. When sending of this money is made, the money goes directly to the person without intermediaries such as the banks. With this charges are much lower and faster transactions as compared to the normal way of sending money. This has made it possible to people without bank account to be able to trade over the internet. There are also a couple of risk associated with this. When you lose your password to your crypto wallet, you lose all your money. Not just that, payments are untraceable and so anyone at all can make payments including scammers and hackers.

Question 1: What is cryptocurrency CFD?

Now that we have an idea of what a cryptocurrency is, let’s get into the real task; what is cryptocurrency CFD? CFD is the short form of Contract for Differences. What actually this means is that, you can trade a different financial tool and gaining from the difference in the price in which you open the trade against the price at which you close it.

Let me try to break that down into much simpler words. When trading a CFD, you are signing a contract that says you should exchange the difference in the price change of a commodity between the time the contract is being signed and time the contract is ending. You only make profit when price movements go into accordance of your forecast otherwise, you made a loss. Agents who provide these exchanges are called brokers and those who buy them are called investors. Simple as that.

How do cryptocurrency CFDs operates?

With all that is being said, one must be wondering and questioning his or herself how does CFDs works. CFD is a decentralized system and operates on the blockchain platform. In simple understanding of how they work, this is more or less like a bet, since there is a deal of paying the price difference between brokers and investors. If your prediction goes in favor of the price change within the given time, the broker pays the difference and if it goes in the opposite, the investor pays the difference.

For instance, if you are thinking the price of an asset will rise within a particular time, you can place a deal on that with the broker of that particular asset. This means you are opening for a long position and if this prediction happens to be right, the broker pays you the difference. On the other hand, if you forecast on going short or long and happens to be wrong, you lose the money that you used in the investment.

Question 2: How do I know if cryptocurrency CFDs are suitable for my trading strategy?

Investing into CFDs could be much harder and risky than it looks. According to me, there are many facts that I will consider before venturing into the investment of CFDs.

Firstly, I will give CFDs a try when I know I am good at comparing numerical results of assets within a particular given time. If I am so good at studying and comparing how prices change within a short time, I will consider CFDs suitable for my trading techniques.

Secondly, I should have the vim to take risks. Risk taking is one of the major problem when dealing with investments like CFDs. If I find myself very scared of losing my money, then CFDs is defiantly not my field of investing.

Also, I should have a very good idea of how long and short investment work. With the knowledge of this, I will again consider CFDs suitable for me to trade.

In addition, knowing the kind and brokers of assets I will be dealing with is also a very vital point in getting to know if CFDs matches my investing strategy or not. There are many brokers out there offering a wide range of assets. These assets work differently and so I must know the kind of asset I will be dealing with.

Lastly, I should be able to meet the requirements that brokers need in order for me to be able to buy CFDs from them. Also, I should be able to afford and deposit the down payments they require. All brokers offers their down payment differently.

Putting all that is said into action, I will be able to know whether or not CFDs are suitable for my trading strategy or not.

Question 3: Are CFDs risky financial products?

YESS!!! In fact they are the most risky investment I have ever heard of. Investing into CFDs can make you a millionaire within a short time of investment. It’s the same way they can make you lose millions or even all your money within some minutes. Investing into these does not matter whether you are a pro in investments or not. If you make the slightest mistake, it will go against you probably even more than you think.

It is estimated that, 75% of those investing into CFDs makes loss each and every day. Because of how risky is it not allowed in the United States of America and also in Hong Kong. This alone gives you are clue as to how risky of CFDs are.

Like I said already it looks like betting and you can imagine how much bets can make you lose.

Question 4: Do all brokers offer cryptocurrency CFDs?

NO! Not all brokers offer CFDs. As the crypto space is becoming bigger and bigger each day, new brokers see to it why they should also offer CFD assets to investors. Some of the known brokers that offer CFDs are ; Avatrade, Pepperstone, and BDSwiss.

This broker is recognized as one of the leading forex brokers. It was launched in the year 2006. Since then, it’s able to amass 4 offices all around the world sited at Australia, Britain, Japan and Ireland. Avatrade accepts all kind of investors and also supports a wide range of currencies.

This broker is based in Australia and was launched in 2010. Pepperstone has many users in Europe that trades in line with the regulations that are made by the European Securities and also the Financial Conduct Authority. Pepperstone is strictly for investors who are experienced in CFDs.

This is also a popular broker in the CFD market. It was launched in the year 2012. It is recorded that it has 1 million trading accounts. BDSwiss has 10 offices all around the world.

Question 5: Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

I will be using ExpertOption to demonstrate how to trade with cryptocurrency CFDs. As you trade you are able to see other investors to trading. Let’s get right into it.

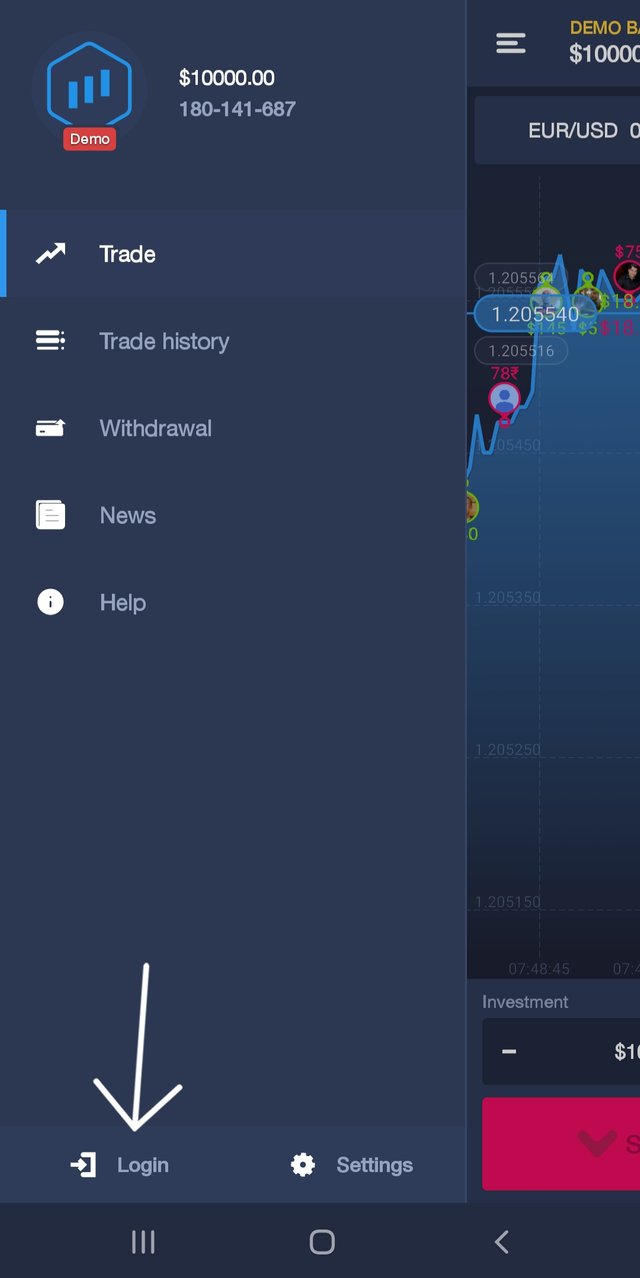

Step 1: After downloading the app, open it and look at the bottom left corner. There you will see a login tap.

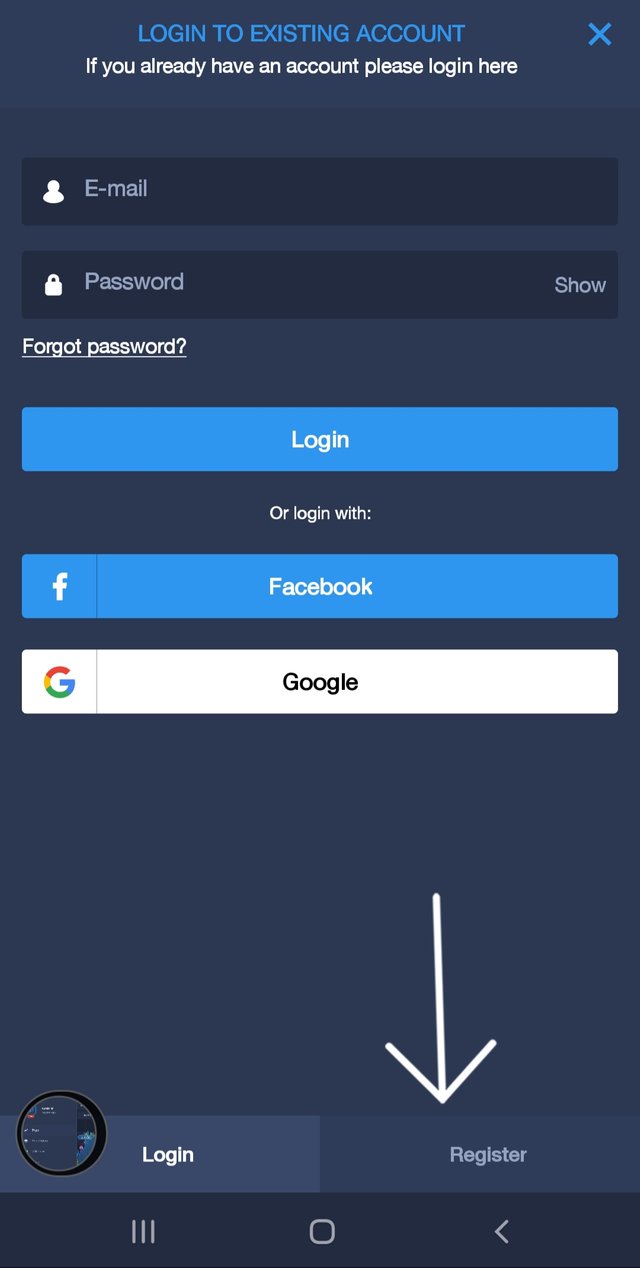

Step 2: click on the sign up button to get an ExpertOption account. You’re given the chance to use either Gmail, Facebook or even register with an email. I will be choosing Gmail because that what I think is secured.

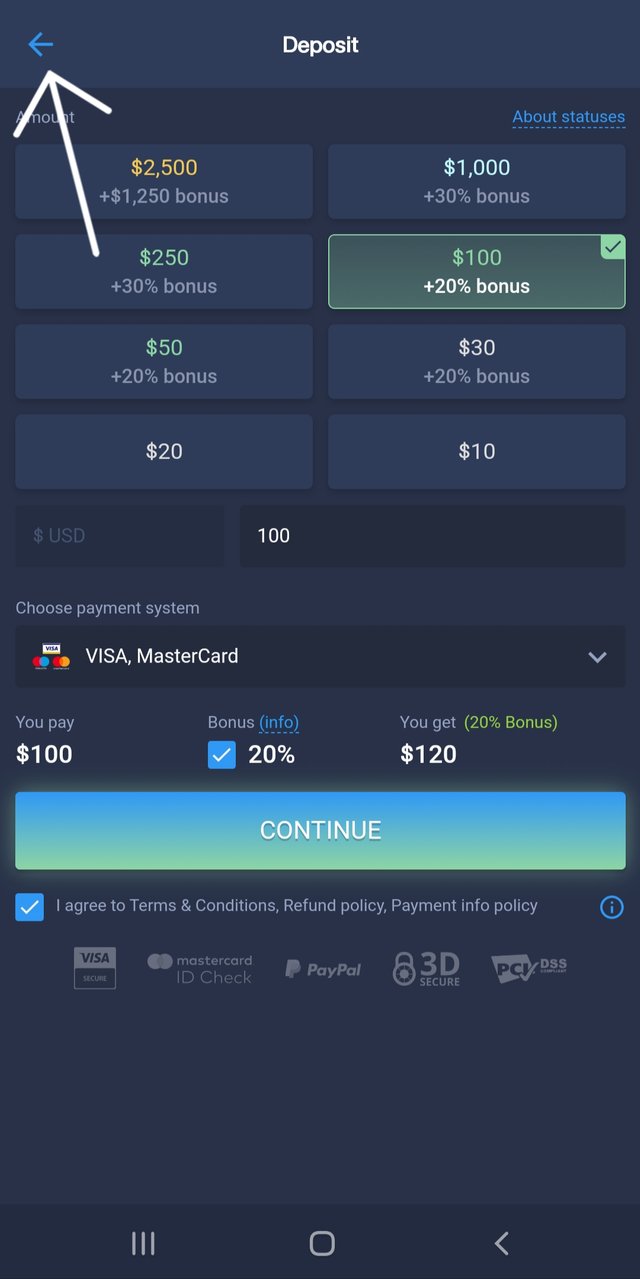

Step 3: After finishing registering, you will see a prompt asking you to deposit. Their lowest deposit is $10, because we are using a demo account, there will be no need for that.

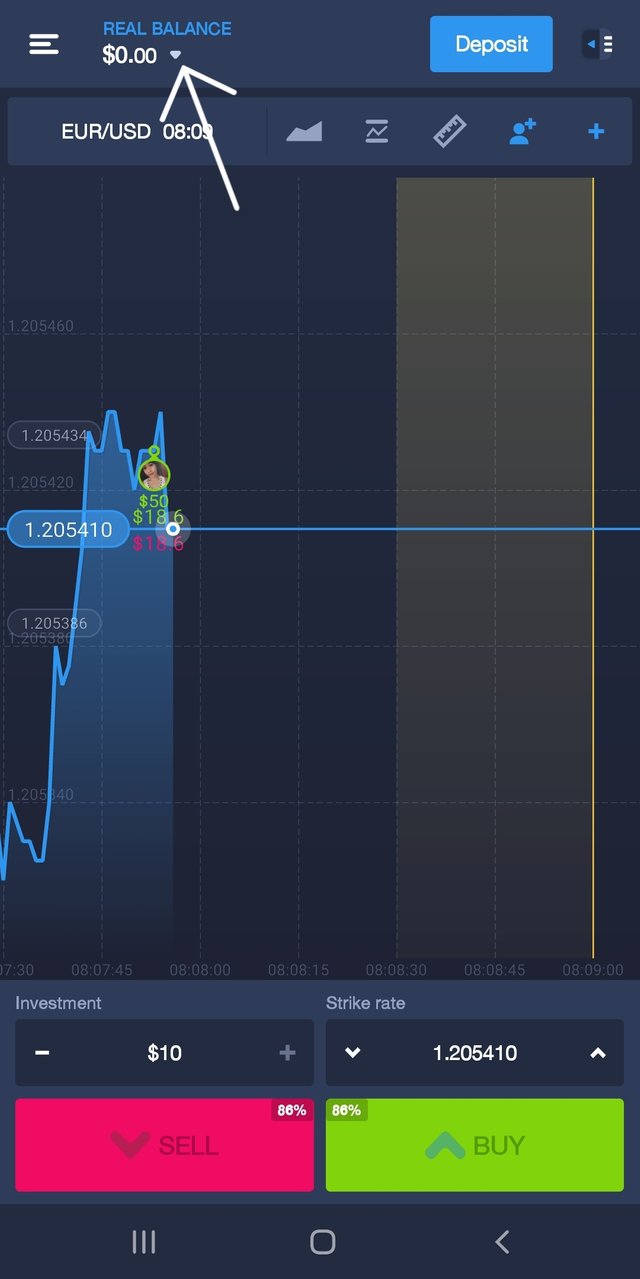

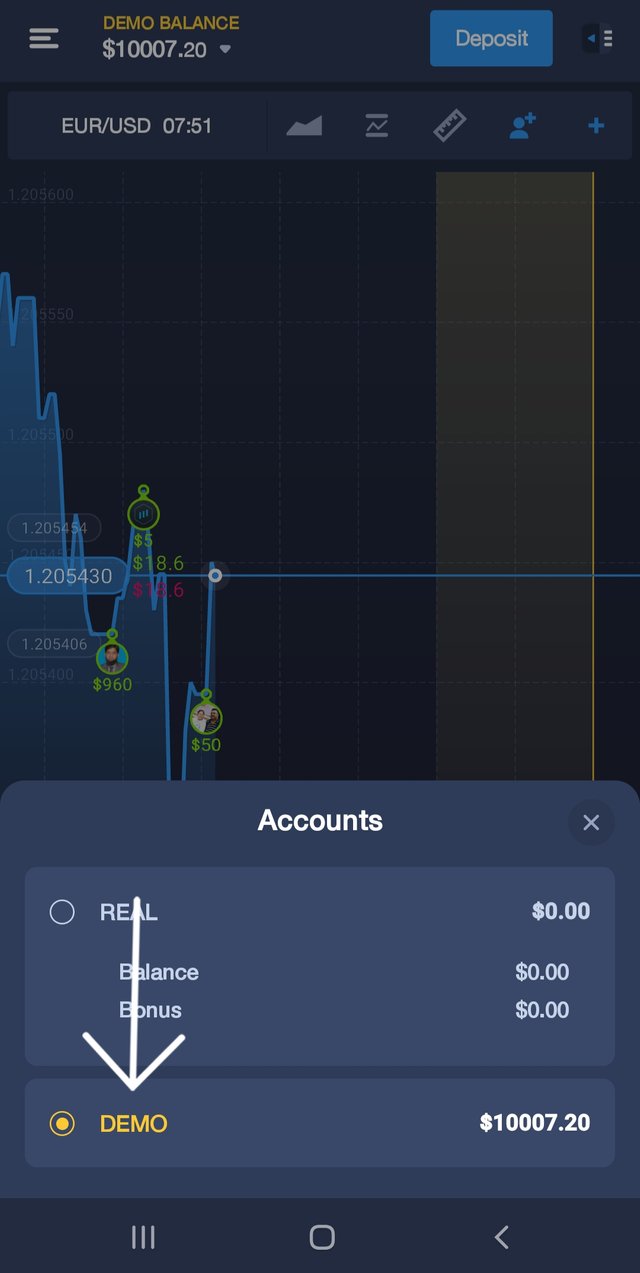

Step 4: Click on the down pointing arrow to switch from real account to demo account.

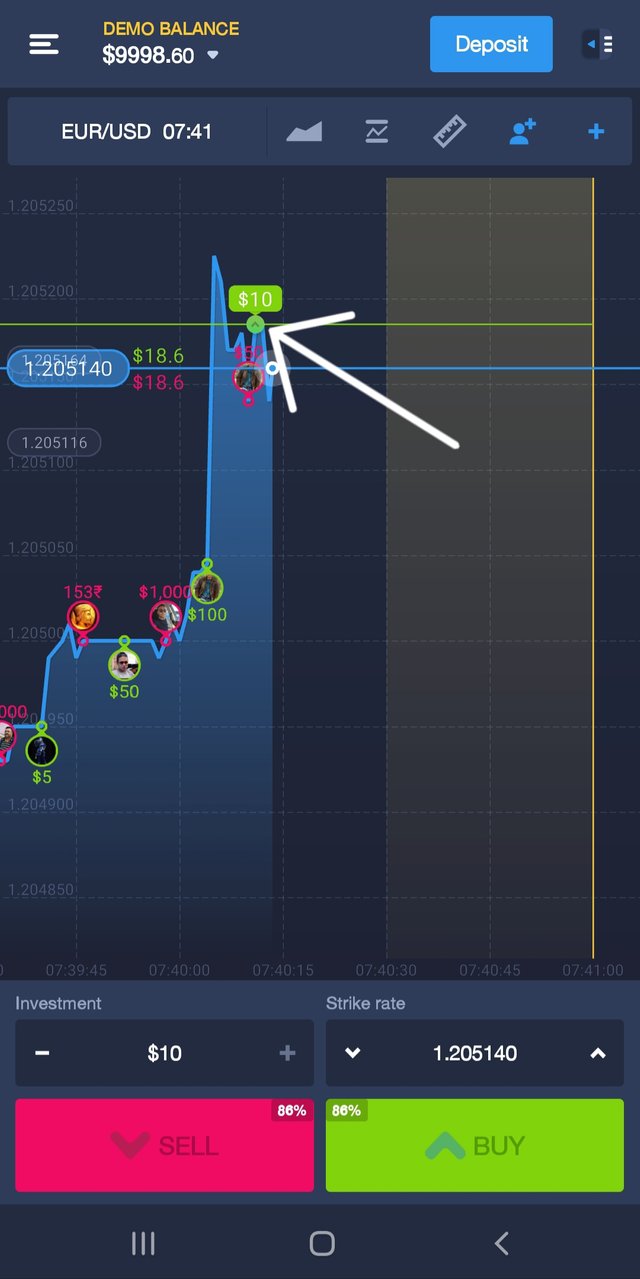

Step 5: At this step, you are required to make your decision either to go long or go short and also select the amount you want to invest.

Lets start by going long with a $10 investment. The green line shows my point of investment. If the blue dot in the graph falls above the green line, then I have made profits and I will be paid by the difference.

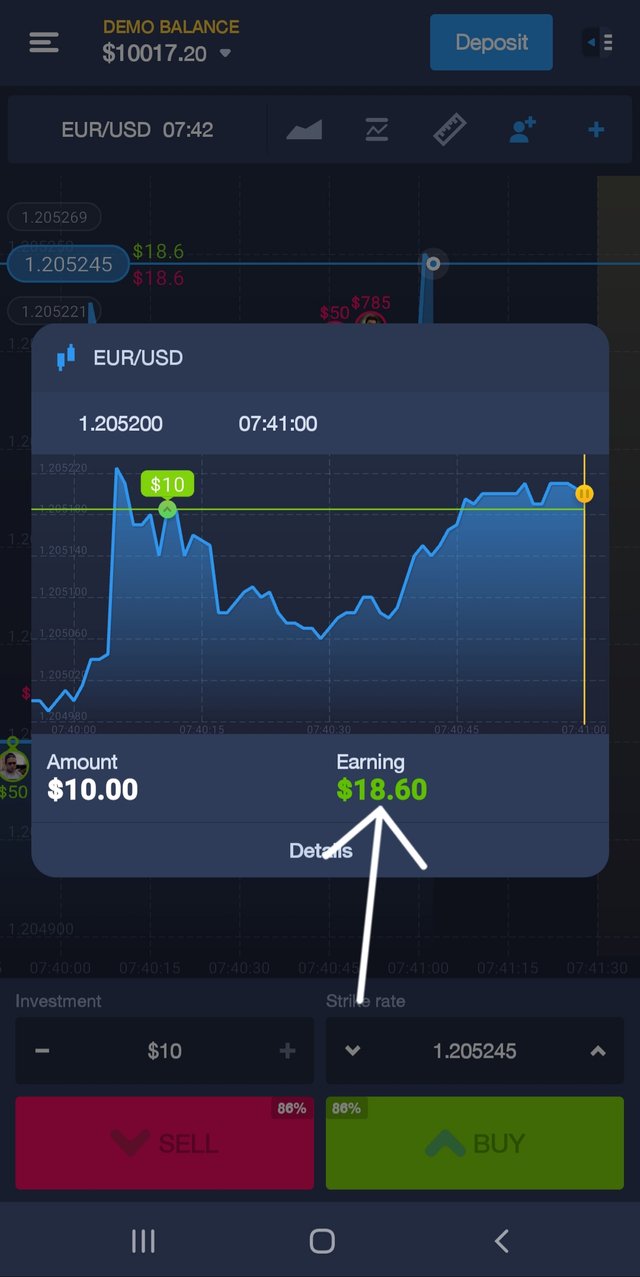

As you can see below, I have made my profits since the price movements goes by my forecast. I have earned 8 dollars in addition to the $10 I used in investing making it a sum of $18.

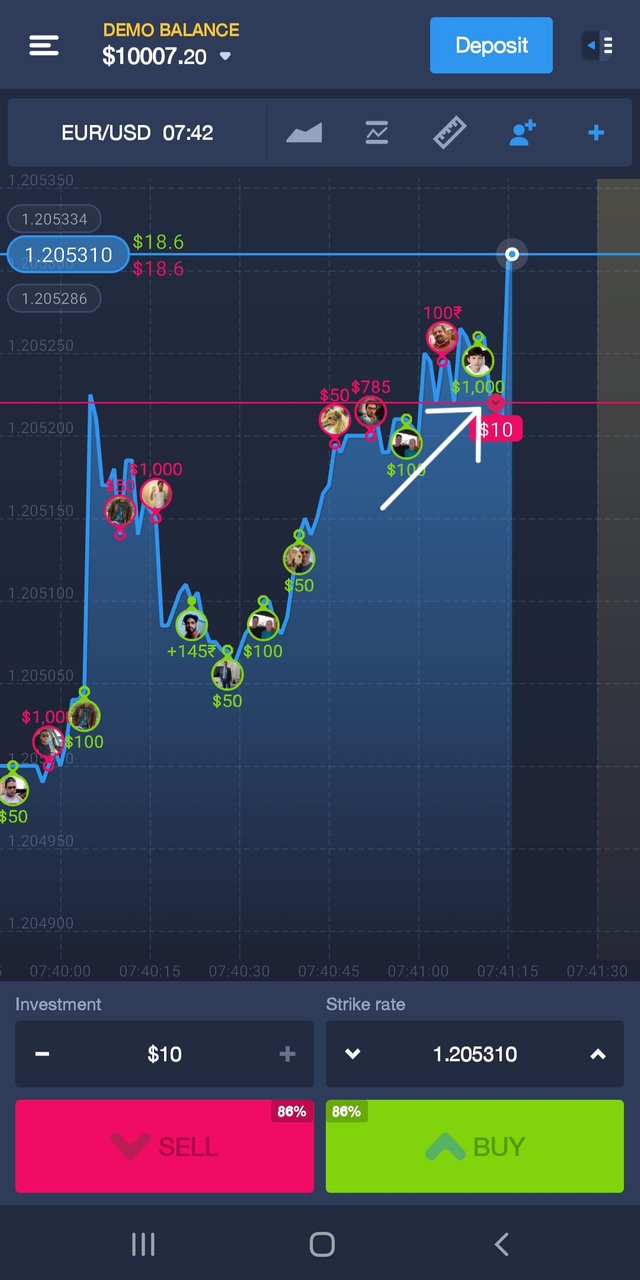

On the other hand, if I decide to go short, meaning I am selling and it is represented by red horizontal line. So in case the blue line stops above the red line, I have lost and if it stops under the red line within the time given, I’ve made profit.

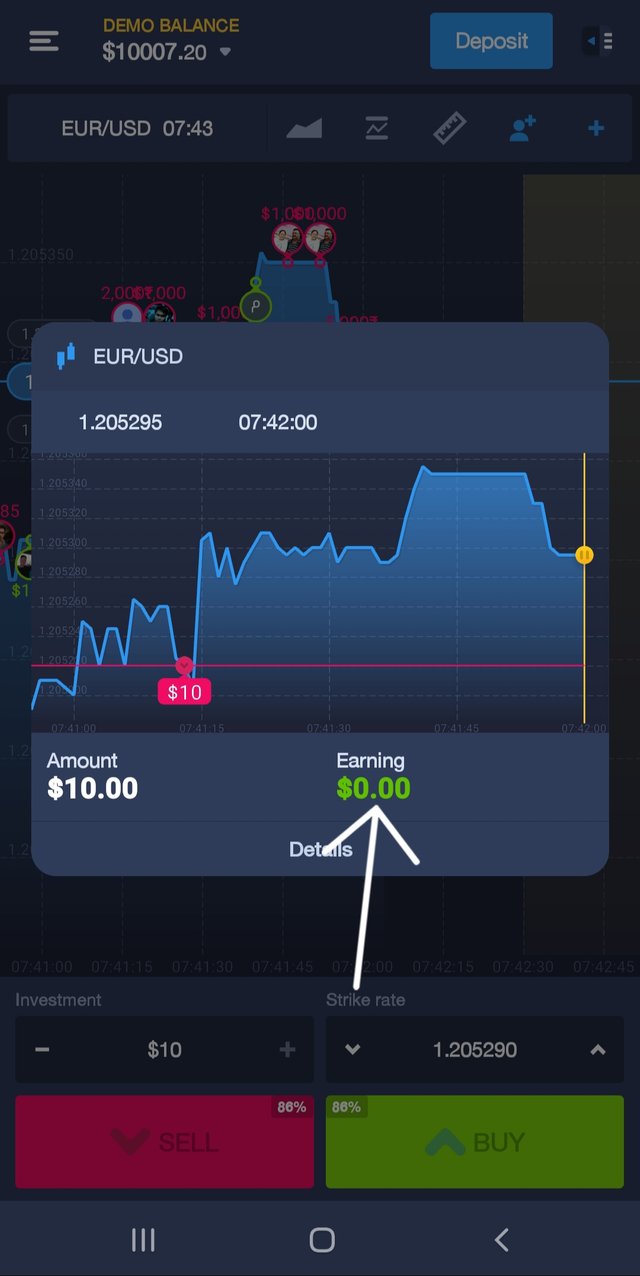

In the screenshot below, the blue dot ended being on top of the red line and so I have earned nothing and also lost the $10 I used to invest.

Conclusion

I will conclude by saying investing in CFDs are risky but its worth the try. As we know that the can lead to excess loss within a short time, it simply telling us to avoid it at all cost when we don’t know anything relating to them. I will really like to give it a try in future.

Thank you! @kouba01

Hello @nav1,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 7/10 rating, according to the following scale:

My review :

Good content article, thank you for sharing your experience with another broker.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Thanks for the correction @kouba01. I just wanted readers who don’t have understanding at all of how CFDs work get the basic idea. I appreciate 🙏