Crypto Academy Season 2 Week 2 Homework Post for [@pelon53 ]

Hi everyone, I want to say thank you to professor @pelon53 for presenting to us this lecture. After I have read the lectures I was able to finish my weekly task and right here to give it out.

What is a token?

A token is also recognize as a digital asset that are being issued by a project. These digital assets can be used as a form of payment within that particular project. Tokens can also be an essential figure that is saved in lines of codes on a mutual database referred to as a smart contract. Blockchain is a popular platform that host millions of smart contracts. For the fact that ICO is now famous, there are several number of tokens that are being issued and presently, there are many different kind of tokens.

What is the purpose of a Token?

Tokens can be used for economic activities just like the fiat currency. They can be used for making purchases in the ecosystem of a project and can also be used to store value. This implies that can be used in trading to amass profit.

Difference between a token and a crypto coin.

Since these two are almost similar, I will like to throw more light onto that. The main difference between a token and a crypto coin is that tokens are developed and issued on an already existing blockchain whiles crypto coin on the other hand are the mother assets of the blockchain itself. With this being said I think we now have an idea of what tokens and crypto coins are.

Now that we have a basic understanding of what tokens are, we can now move forward to look at what the various types of tokens we have. These include a security token, utility token and an equity token.

What is Security Token?

Security token is a type of token that can be regarded as tradable financial assets (e.g a deal from a firm). This kind of token is developed to play the role as a form of investment. In other words, they can be used in the payment of shares, dividends and or even interest payment in such a way that it will be able to yield profit in the near future. Because security tokens are considered as a form of security, they are kept through federal securities and regulations and if the ICOs doesn’t abide by the rules and regulations, they could attract punishments.

What’s the importance of security tokens?

Below are a couple of reasons that gives an explanation to why security tokens are important in this recent world.

Security tokens has a great number of investors as at now. Since developers are given the chance to give out their deals to couple of investors, it has resulted to the growth of number of investors.

With security tokens, there are no intermediaries and so therefore there are less scam activities.

Security tokens eliminates middlemen and hence reduce fees of transactions and also makes transactions faster.

What is the weakness of security token?

Actually, there are no vast weaknesses that are associated with security tokens. The only known disadvantage is the absence of its middlemen. These intermediaries play a lot of important roles. According to sources, without them, buyers and sellers would not be able to execute the functions of the middlemen well enough and so making it a challenge.

Polymath (poly token) is a well-known example of a security token.

What is polymath?

This is a kind of security token that makes use of the ST-20 token typically to abide by the regulations of the government when issuing digital securities. This platform is a four layer platform and looks much like the ethereum but doesn’t develop utility tokens such as the ICO platform but rather promotes fairness in a firm which has a well regulated foundation. Polymath’s platform emphasizes on AML and KYC to makes sure that security laws are respected. Just like any other token, polymath tokens can be used in trading any in making payments.

How does polymath works?

In total, there are about 1 to 2 billion of Poly tokens circulating in the market right now. At the launch period of polymath, users got about 250 million tokens in total. The rest of the tokens are reserved to be used in future. If in case you need a Poly token, you will have to trade for it from the existing ones.

Where can I buy Poly tokens?

Poly tokens are available for purchase on a vast cryptocurency trading platforms. These particular tokens can be found in markets like; Binance, Uniswap, Upbit and more. You are given the chance to make payments with credit and visa cards.

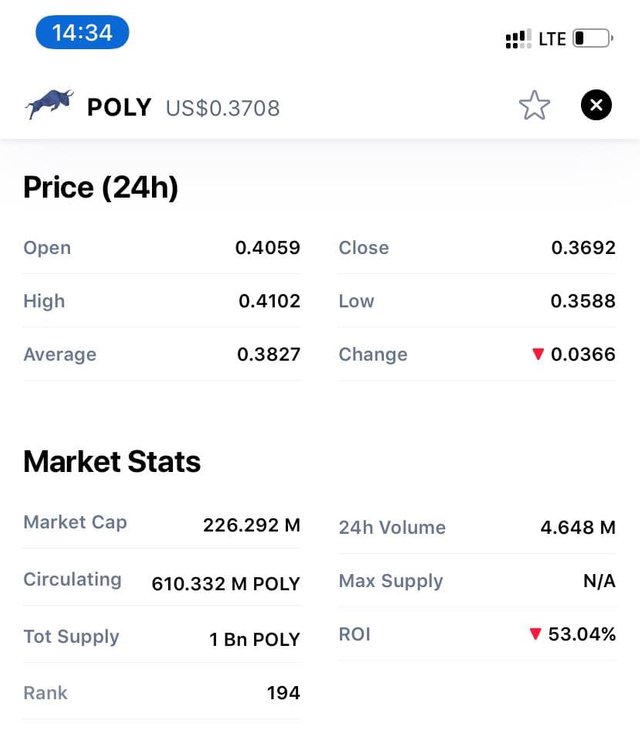

Market statistics of polymath

According to coinmarketcap, Polymath’s price is US$0.3708. It has a market cap of 226.292 million and also a total supply of 1 billion poly. It ranks 194 in coinbase market.

What is Utility Token?

With this type of token, products and services belonging to companies are given future access to. Utility token is a blockchain based assets that investors purchase with the only aim or idea of using it for something in the near future. Unlike security tokens, utility tokens are not bought with the aim of making profit but being able to use that for something else. These tokens in particular are exceptional as they have a wider range of roles they serve. They can be used to make transactions, make payments and also finance projects in the blockchain platform.

How does utility tokens work?

Let’s consider this example in order to get a detailed understanding of how the utility token works ¬– a software engineer who is developing an application could use that chance to issue utility tokens in order for fund the development of his app. Once the app is completed and launched, people who own that particular token can use those tokens to purchase some premium features of the app. This aids the developer in his process of developing the app and also giving users the chance to get access to premium features uses the utility tokens he issued.

What is the weakness of utility tokens?

Utility tokens has so many major and minor weaknesses. But I will only throw light to the main weaknesses of it.

Utility tokens only has value when its associated project is still in existence. When the project terminates, these tokens are valueless.

Value increment of this token is not possible no matter which mechanism you use.

Users in the ecosystem are not allowed to make decisions and suggestions.

Golem (GLM) is a popular example of utility token

What is Golem (GLM)?

Golem is an example of utility tokens. This makes possible of what most of us has never thought of. This gives the chance to other computers to be able to rent out their computer power to people who may need it. This is only possible in a decentralized system. Those who needs other people’s computer power can use it to complete various tasks and in the end they are being rewarded by GLM tokens. This platform is built with the aim of linking users and helping them with computational in order to complete their projects. This is just the basic knowledge behind Golem.

Where can I get Golem tokens (GLM)?

GLM will be awarded to users who have dedicated and given out part of their computer’s processing capability to developers who will need it to help them finish their ongoing projects. But it is also available in the crypto markets for sale.

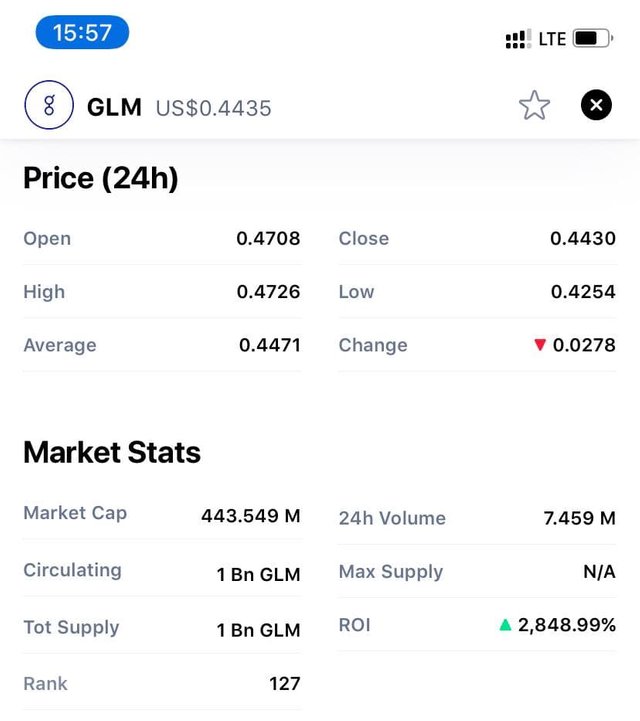

Market statistics of Golem

According to coinmarketap, presently Golem cost US$0.4471 and has a market cap of 443.549 million. It also has a total supply of 1 billion and ranks 127 on the market.

What is Equity Token?

Equity token is a type of token that gives investors or firms official rights to a sector of the blockchain platform giving them voting rights over the blockchain. Holders of equity tokens are authorize to own parts of a company’s earning and also has the right to vote on the future of that company. This kind of token is determined to be an important part of ICOs in the near future as they have an easy entry in various financial markets.

How does equity token works?

Equity tokens are safe to invest in because it is regulated and monitored by the German Securities giving investors more safety measures. The value of tokens a person owns in a company is represented by how ownership percentage is being allocated to them.

Weaknesses of Equity token

There are no known weaknesses of this kind of token yet. This is because much attention has been given to this and there are also tangible regulations to this. But as many more investors are joining it, problems might arise in the future or maybe not. Who knows?

Neufund is a popular example of this type of token

What is Neufund?

source

Neufund is a platform that operates entirely on the blockchain system. This indirectly means that it uses smart contracts in its operations. With the use of this platform, any firm or investor can issue his own tokens in order to gain more investments. These tokens produced are termed as ‘Neufund Equity Token Offering’. The Neufund platform also gives investors and companies new opportunities to try their luck on. Beginners who don’t have more knowledge on investing and also those who have less funds to start investment processes can try their hands on Neufund. This is indeed the most reliable trading platform.

Where can I find Neufund tokens?

Purchasing Neufund tokens is not a difficult task because you can get them on the various trading platforms we have. You are allowed to buy those tokens through you visa or credit card. It’s easy to do.

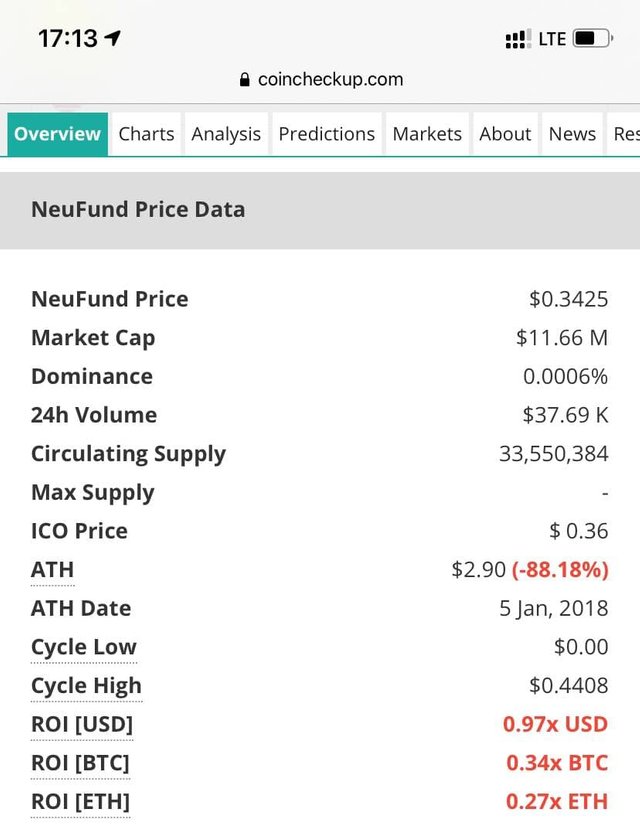

Market statistics of Neufund

According to coin-checkup, Neufund’s price is US$0.3474 and a circulating supply of 33,550,384. Its daily volume and market cap are US$35.16 thousand and US$11.66 million respectively.

Conclusion

In conclusion, investing into tokens should not be a problem at all. Looking at how safe they are, there are fewer chances of being scammed. Not just that, they are reliable to. It also appears that all the kinds of tokens have a good future and they might become the pride of ICOs.

Thank you !!!

Gracias por participar en Steemit Crypto Academy.

Buen trabajo. ESpero sigas mejorando

Calificación: 8.1

Gracias professor @pelon53