Dynamic Risk Management In Crypto Trading

Asslamu Alikum

Greetings all, Crypto trading comes with significant risks that can be unnerving. Hacking and cyber attacks, scams and fraud, changing regulations, exchange platform risks, no guaranteed backing, and many more makes it a vulnerable space. Even if you're willing to take the leap and explore its vast and unpredictable world, crypto is not a tangible asset, there's still a lack of surety that's hard to shake off. The market has earned it's name for being highly volatile and having potentially low liquidity.

I'm here to participate in the Steemit Crypto Academy Contest "SLC S22W3", with this week's Learning Challenge Dynamic Risk Management In Crypto Trading organized in SteemitCryptoAcademy. No cap it was difficult to understand these concepts at first and the learning process was tiring, but incredibly enjoyable and rewarding, and I hate it how I took a whole day to write this post. So let's dwell.

Trading is like walking on thin ice. If you're not careful enough with your steps, the ice cover is perfectly capable to break, and drown you in a sea of losses, where you watch your investments disappear before your eyes. How can that be prevented? With understanding and caution, you can learn where to place your steps carefully, how to distribute your weight, and when to avoid certain areas with patience, altogether can help you cross the icy waters of crypto trading with less possibility of falling through.

To play it safe, start by developing a solid trading plan with effective risk management strategies. Additionally, maintain emotional control, avoid over-trading, and stay up-to-date with market trends. By combining these approaches, you'll be well-equipped to navigate the markets with confidence.

Risk management is to identify, assess, and mitigate potential risks that could negatively impact investments, businesses, or organizations. It involves a proactive and systematic approach to managing risks, with the goal of minimizing losses, maximizing returns, and increasing stability. Where knowledge is power, in crypto, Risk management is the key. Risk management involves utilizing essential tools like take-profit and stop-loss orders, risk-to-reward ratio analysis, position sizing, hedging strategies, diversification etc.

Fundamentals of Risk management!

Position sizing.

Position sizing is a strategy that helps you decide how much you are okay to risk during a trade or investment. We don't invest all of your portfolio, but instead, invest a smaller amount.

Think of it like sharing chocolates, as bribe, with a person you want to be friends with, let's say it's Sam. You give Sam all of your 10 chocolates. Which is cool (Sam will be giving you chocolates daily if he accepts your friendship) But Sam rejected your friendship offer! (sad) so now you lost all of your chocolates. What if instead of 10 you gave him 2? would you still be this sad? no because there would be some chocolates left.

That is position sizing, the number of chocolates I'm willing to risk. The loss that I'm ready to face.

Example:

I have a portfolio of 100 SBD, to manage risk in a high volatile market, I'll invest a smaller portion. Let's say, I am willing to risk 2% of my total capital.

Risk amount: Total portfolio x % I'm willing to risk

100 SBD x 2% = 2 SBD (Out of 100 SBD I'm only okay to loose 2 SBD)

Now! how much must I invest, that even if market collapse I loose only 2 SBD?

To determine that (position size) first I'll set a stop loss. let it be 5%

Position size = Risk amount / Stop-loss percentage

= 2 SBD / 5%

= 40 SBD worth of Steem

I'll invest 40 SBD, with a 5% stop-loss, limiting my potential loss to 2 SBD.

Stop-loss placement.

A stop-loss order is a crucial risk management tool in crypto trading. It helps limit losses if you're not paying attention or the market is too volatile. A such order is an instruction to sell your capital, if the market price falls to or below that level.

Imagine you're cooking pasta with your sister. You have to step away for a few minutes, so you ask her to keep an eye on it. Your sister watches the pasta and when it's done, she turns off the stove. This is like a "stop-loss" in trading.

In trading, a stop-loss is like turning off the stove when something reaches a certain limit. It helps prevent things from getting worse or "overcooked." Thus helping you limit your losses in trading.

Example:

I buy 100 Steem coins for 30 USDT (at 0.30 USDT/Steem). In hope the price goes up, but the market starts falling. To avoid big loss, I set a "stop-loss" order, and tell the exchange: "If Steem's price falls to 0.25 USDT, sell my 100 Steem coins for 25 USDT."

Now, if the market keeps falling, my Steem will be sold automatically, limiting my losses. But if the market goes back up, I can cancel my stop-loss order and hold onto my Steem.

Diversification.

Diversification is a strategy to reduce risk by spreading investments across different assets. This can be done in two ways: diversifying across coins by investing in various cryptocurrencies like Bitcoin, Ethereum, and others, or diversifying across sectors by investing in different areas such as DeFi tokens, gaming tokens, and more.

You have two keys to a room. You keep one key with you and give the other key to your friend. If your friend can't show up for some reason, you're not locked out because you have the other key.

This is similar to diversification in investing. By spreading your investments across different assets, you're creating multiple "keys" to your financial goals. If one investment doesn't perform well, the others can help you stay on track.

It's essential to avoid investing in coins that are heavily influenced by each other, like Bitcoin's impact on ETH, LTC. Understanding how different cryptocurrencies relate to each other and adjusting your strategy to minimize risk is also crucial. Another approach is to diversify across exchanges by buying the same token on different exchanges, like Binance, Bitrex, and others, which can help reduce losses if one exchange experiences issues. We can also try to sell the same coin at separate intervals, if we are content that after a certain stop-loss dip the market will be bullish.

Example:

I have 100 USDT and decide to diversify my investment as:

40 USDT to buy Steem (STEEM)

30 USDT to buy Bitcoin (BTC)

30 USDT to buy Polkadot (DOT) or Chainlink (LINK)

By spreading my investment across three different assets, I'm reducing my risk and increasing potential opportunities for growth.

Risk-Reward Ratio!

The risk-reward ratio is a simple yet powerful tool for managing risk in crypto trading. It's all about setting limits for potential gains and losses. The idea is to set a ratio of how much you're willing to risk versus how much you hope to gain. A common ratio for beginners is 1:1 or 1:2, where you risk 1% of your investment, hoping to gain 1% or 2%. As you gain experience, you can adjust your ratio, for instance, aiming for a 1:5 ratio.

To calculate Risk-Reward Ratio we use following method/formula

Risk-Reward Ratio: Potential Loss / Potential Profit.

I'll withdraw my investment as soon as the price hits any of my set targets. Either loss limit to minimize losses, or gain profit even if the candle keeps going up. The goal of risk-reward ratio is ought to, stick to a strategy to ensure safe and successful trading.

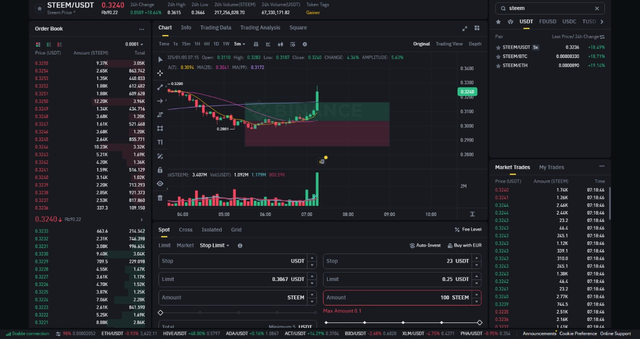

[SS] Here is a sample of how I tried R:R by highlighting above and below for profit and loss respectively, in a 5 min chart and my trade ended in profit.

Example:

I bought Steem at $0.30. I set my Stop-Loss Price to be $0.28 and Take-Profit Price to be $0.34.

Potential loss = Entry price - Stop-loss price

$0.30 - $0.28 = $0.02

Potential profit = Take-profit price - Entry price

$0.34 - $0.30 = $0.04

Calculating risk-reward ratio = Potential loss / Potential profit

= $0.02 / $0.04

= 1:2

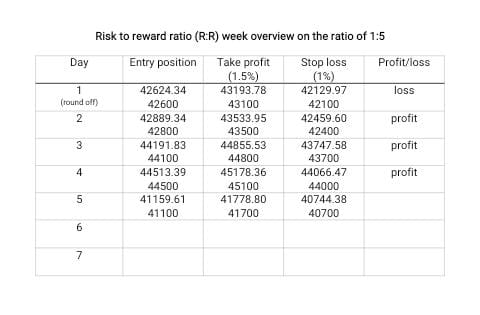

Interestingly, I only incurred loss on a single day, even without reading the charts or market trends.

The Risk to Reward ratio is 1:5.

I took this SS from a world document named 'cry', on which I used to make notes regarding crypto.

In addition to risk management strategies, analyzing and investigating the market trends thoroughly is crucial in reducing losses. To manage risks in volatile markets, traders use certain volatility indicators (ATR, RSI etc.). These indicators analyze data and display it in graphs or charts.

Volatility Indicators!

The preferred popular volatility indicators, for historical data analysis include; Bollinger Bands and Average True Range (ATR). They collect data from past hours/days and provide insights, enabling better decision-making for our trade.

Bollinger Bands

Bollinger Bands is a analysis tool that has three bands: upper, middle, and lower. The upper and lower bands are simply deviations set apart from the middle band, while the middle band is SMA/ simple moving average (it's the average closing prices of an asset over a certain time frame, like 20 hours/days).

When candles (prices) stay between the upper and lower bands, it means the market is stable and not moving much, these bands here provide resistance. If candles (prices) touch or cross the bands, it can mean a trend is starting.

- Touching the upper band can mean the asset is overbought (priced too high).

- Touching the lower band can mean the asset is oversold (priced too low).

The bands also tell us about risk:

- When the bands spread apart, it means volatility is high i.e. market is trending and less stable (risk is higher).

- When the bands come together, it means volatility is low, market is non-trending and more stable (risk is lower).

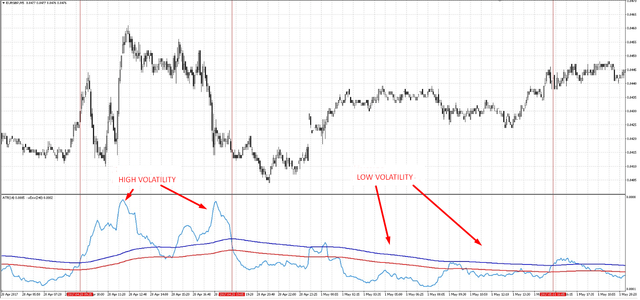

Average True Range (ATR)

The Average True Range (ATR) indicator helps us understand market volatility by measuring the average price movement over a simplified period. In simple terms, ATR tells us how much the price is moving up and down.

Here's what ATR values mean:

- High ATR: The market is very volatile, trending-market, less stable (high risk).

- Low ATR: The market is less volatile, non trending-market, more stable (low risk).

[SS]I couldn't find the ART indicator on binance, but here's Bollinger band.

Considering the chart, When bands are apart, the ATR values are typically higher indicating increased volatility, so one must reduce position size and tighten stop-loss to minimize losses. Likewise when bands are close, the ATR values are lower indicating decreased volatility, so one must increase position size and loosen stop-loss to maximize gain.

(crossing my fingers! in hope I got that correct)

By combining the volatility indicators with other technical risk management strategies, traders can develop a more comprehensive understanding. Still No strategy is completely immune to market volatility. We can't eliminate risk entirely, but we can take steps to minimize it. The key to successful trading is prioritizing capital preservation. This means protecting your investments from significant losses.

Designing a trading strategy for Steem/USDT that incorporates risk-adjusted principles. Explain how your approach adapts to different market conditions, such as sharp price swings or periods of consolidation.

Before Investing I'll

- Analyze charts for trends and patterns.

- Research current market trends.

I would like for the liquidity to be reasonable and volatility low to continue. For now to make strategy harder I'm going with a high volatile market.

I'll then analyze indicators

- RSI that checks overbought/oversold conditions.

- The Bollinger Bands are spread apart, indicating high volatility.

- ATR is High, confirming volatile market.

After investing I'll take steps to reduce the Risk (risk management)

- Due to high volatility the position size must be low.

- I'll set a favorable Risk-Reward Ratio (1:2)

- and a tight stop-loss that remains inside the upper and lower Bollinger Bands.

(I just hope I got this right because I had no idea what I was supposed to do. I don't wanna lie but crypto made me cry- almost)

Real life scenarios!!

I've never traded myself, but I used to help my mom when she traded. We were both new and learning. In the beginning, we made mistakes and didn't set stop-losses more than one times, this led to big losses. One time, our portfolio got stuck (it was invested in a single coin), for same reason, for months because selling at a low price would mean huge losses.

Another time, we had made a profit, but the market kept going up. We decided to wait rather than to sell, but then the market suddenly fell. We missed out on securing our profit. I would like to add that a few time waiting rather than selling proved beneficial too.

As time passed, my mom became more experienced and attentive to market movements. She gained a deeper understanding of the market, and I saw her make fewer mistakes.

Looking back, many of our losses could have been avoided if we had used stop-losses, diversification and followed the risk-reward ratio principle. Those lessons were invaluable, and I'm grateful for the experience!

I don't have any active social accounts except for Whatsapp. So I won't be able to share it on Twitter or any other platform.

Nafeela

I have went through your post it’s amazing. We can see your efforts and hardwork, hope it will soon pays you off. Best of luck my dear friend.

Thankyou for giving it your valuable time. Best of luck to you too.