HomeWorkPost-- SteemitCryptoAcademy S4W4 - Crypto Asset Diversification & Arbitrage Trading [@fredquantum ]

The lecture was really amazing Professor @fredquantum and I learn so much. I would like to try the strategies and Arbitrage trading. Here is my homework.

1. Explain Crypto Assets Diversification.

Crypto Assets Diversification is also shorted by CAD and it is very helpful for the investors to get the maximum gain with less risk. Diversification is already clear by its name that here we need to diversify our investment into multiple parts which simply means if we have some amount to invest then we will buy 4-5 assets with an equal amount. Robert is a working professional and he wants to make an investment, in this case, he has two options either he can invest all the money in a single asset or he can invest it into multiple assets.

image source

If Robert invests all of his money in a single asset so he is being too risky here because if the price of the asset crashed due to some reasons like Overall Market Crash, News, Ban, Delisting from the big exchange, Team separation etc then Robert will be rekt here. As the professor taught in the Class that we should never put all of our eggs in a single pot and if the pot got broken or leaked then all eggs gonna be broken and even you won't be able to make Omlet here.

In the second scenario if he is putting all his investment into different coins let's suppose 4 coins as per 1-4 Rule then even if one of them crashed badly so the loss would be minimal as other coins hopefully will be stable or in the profit zone. As every coin has different Fundamental & Technical.

2. What are the Benefits/effects of Diversifying one's assets?

Benefits:

- When we divide our investment then our risk will reduce.

- We can save our capital from wipe up.

- Crash in a single asset won't impact you too much.

- As all the asset has different Fundamental and Technical so their movement will different so what will happen.

Impact:

- It will limit your profit suppose if one coin is pumped to 50% then your entire portfolio won't be 1.5x it will be up by 12.5% as per 1-4 Rule.

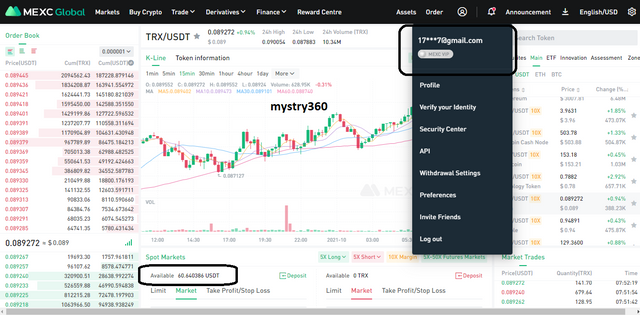

3. Construct Crypto Assets Diversification according to the 1 - 4 Rule - Choose 4 crypto-assets (State the reasons for choosing them), discuss each of the assets, and perform a detailed fundamental/technical analysis on them. Invest a part of at least 15 USD into each of the assets based on the diversification constructed earlier, proper stop loss and take profit levels must be put into place. A real trade on a centralized exchange is expected here. (Graphics/Screenshots/Charts are required). Note that: You are expected to show your verified account screenshot, your reservoir, and the steps involved while investing (For example, if you are investing a part of 15 USD at a time, then, the reservoir must have been 60 USD clearly shown, you can use Fiat or Stablecoin for construction).

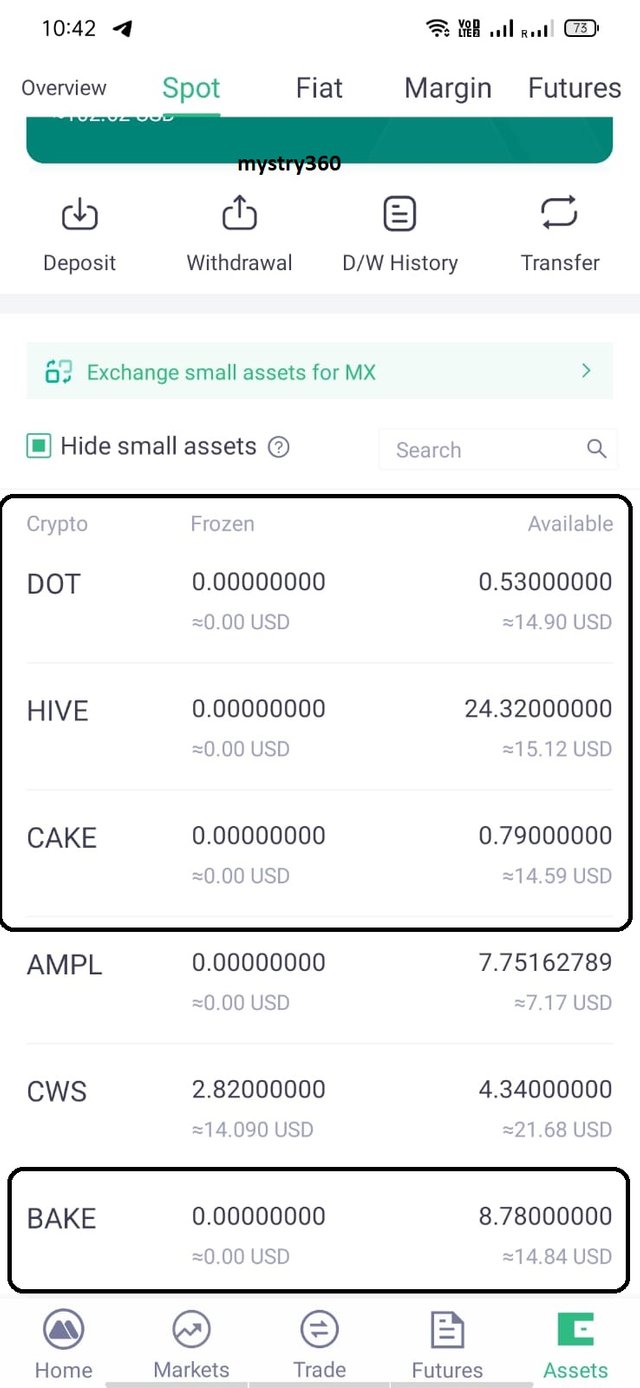

I have shorted 4 coins to implement 1-4 Rule in my real life. I have deposited $60.00 in my wallet where iw ill be putting $15 in each coin for the long-term investment.

.png)

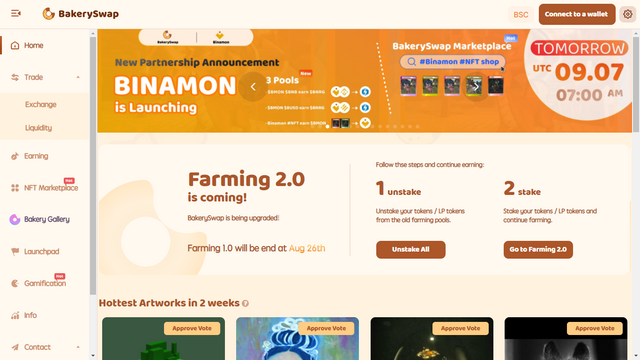

1. BAKE

Fundamental View:

Bakeryswap is one of the best Projects running on the Binance Chain Ecosystem and it is aDex where we can swap coins. It is growing rapidly and also bringing a lot of features like Farming 2.0 and Staking, Good APY, Launchpad, NFT marketplace . I love this project and its native Tokens BAKE is currently available at a very good DIP and it can be a very good pick for me.

Technical View:

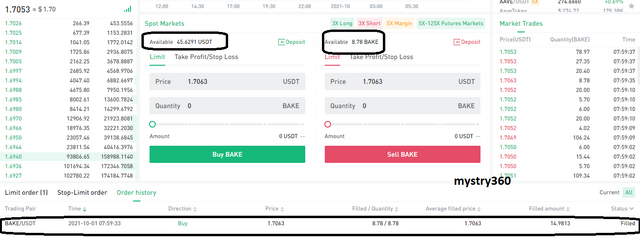

.png)

This looks good from a technical point of view too, as you can see this is currently bouncing from the Demand zone also forming Triangle on 4 hr timeframe. I am buying BAKE at 1.7063 with the SL below 1.30 and keeping the min Target 50% gain from here.

.png)

2. CAKE

.png)

image source

at

Fundamental View:

This is another very strong project over Binance Smart Chain (BSC) which is growing rapidly and can be considered as a very good gem to give a good return. I am more interested in investing in a project which has a very good use case. Pancake has currently 2.8 Million users and 9.3 Billion Dollar value of assets is staked. Also, there are offering to get passive income through staking and Cake-BNB staking is giving 50% APR which is a great thing. I am also planning to stake my idle money on Pankcake to get some revenue.

Technical View:

.png)

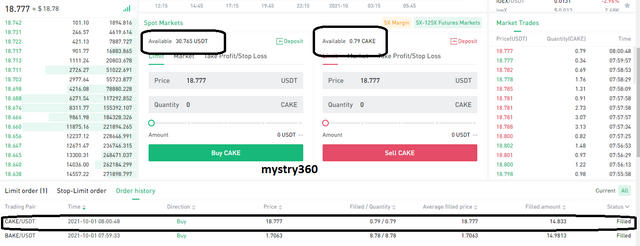

It is available at a very good DIP and forming a Symmetrical triangle pattern which is a bullish pattern if BTC will be stable then it will give breakout upside as per the triangle it is ready to give 40% in short term. I am buying CAKE at $18.77 with the SL below 15.00 and keeping the min Target 40% gain from here in short term. Even if Cake hits my Stop loss then I will be happy and will accumulate near $10.00 which is the major support.

.png)

3. HIVE

.png)

image source

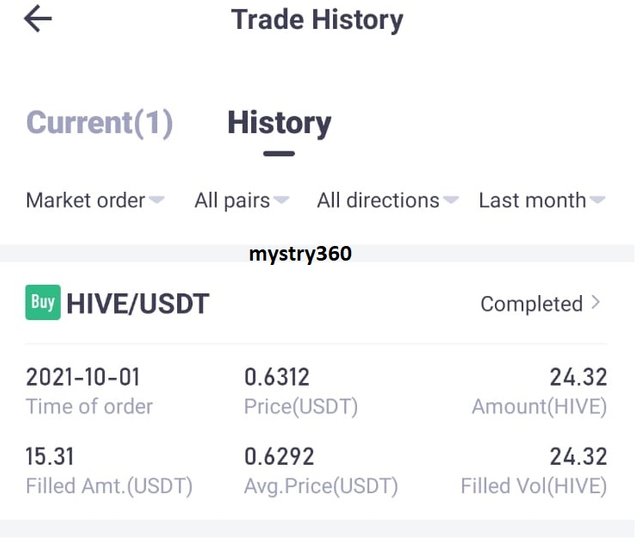

Fundamental View: I hope everyone is aware of the story behind the Hive Blockchain, the reason I selected Hive in my 1-4 Rule is that it is the replica of STeem Blockchain and there are so many new daps are being developed on the Hive blockchain. The number of transactions is increasing and Splinterland, SPS airdrop makes it even more famous and there is more development on the way. Whenever Hive starts moving it gives a very good move 30-40% in a day. Hive Blockchain is Fast, Scalable, Powerful for Web3.0.

Technical View:

.png)

In the chat, you can see it is bouncing from the major support zone which is $0.50 also breaking out the Triangle pattern. It can give a good gain in a short time if BTC gets stable. I am buying CAKE at $0.6291 with the SL below $0.50 and keeping the min Target 40% gain from here in short term.

4. Polka DOT

.png)

image source

Fundamental View:

This can be a very good pick for the long-term investment I am personally holding DOT in my long-term bag and forget it for 3 years. It is founded by the Ehetereum Co-founder Dr. Gavin Wood and aiming to develop a Scalable, Fast & Cost-effective Ecosystem for Web3.0 and some people also call DOT as Ethereum Killer. I am happy that this is in my long-term bag and I am expecting an ETH-like move-in DOT in upcoming years.

Technical View:

.png)

In the chart, you can see on the weekly timeframe it shown a very good move and now retrace around 0.38 fib level which is considered as a very good retracement now it is ready for the next leg up. Even on the daily Timeframe, it is on the local demand zone.

.png)

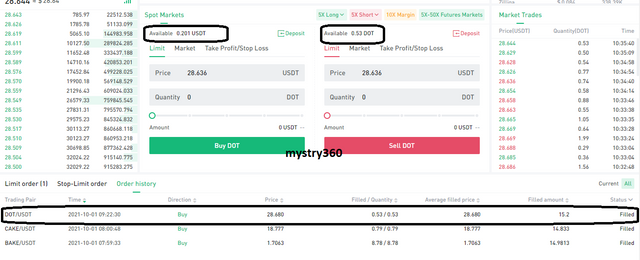

I am buying DOT at $28.68 with the SL below $23.00 and keeping the min Target a new All time high.

.png)

1-4 Portfolio

4. Explain Arbitrage Trading in Cryptocurrency and its benefits.

Arbitrage trading is one of the underrated trading types, in this trading style we simply buy a Coin from Exchange A at a cheaper price and sell it at a higher price on Exchange B. This trading style type doesn't require any kind of Technical or Fundamental analysis, one can quickly identify the opportunity on various exchanges and can take advantage of this simple concept. We often see the price difference of the same asset on various exchanges, it happens because of the Lidquidity, Bid & Ask prices and one who is smart enough, good in research can take advantage of this trading technique.

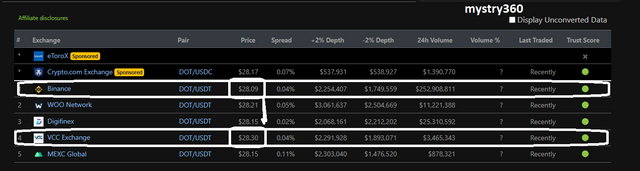

You can see here is the difference between the prices, in this case, what we can do is to Buy DOT from Binance and sell it on VCC Exchange on a higher price.

.png)

What research we should do before jumping into the trade-

- The very first thing we needed to check is the Popularity of the Exchange

- The liquidity should be good and the difference between Bid & Ask price should be negligible.

- Transaction fee and Time

- The ROI (Return On Investment)

Benefits of Arbitage Trading-

- This is a simple concept as it requires no Technical and Fundamental Knowledge.

- if you are trading in Crypto then you will get plenty of opportunities

- Trading in Crypto can give you chances to trade 24/7

- It can be a good source of passive income.

5. Discuss with illustration how to take advantage of Exchange Arbitrage.

In this picture, you can see how actually it works and we also spotted opportunities on Binance and VCC exchange. The person bought an asset from Exchange 1 at $95 and Sold it on Exchange 2 at $100. So the difference between these buy/sell is our profit. This is what we are supposed to do in Arbitrage trading.

In the above picture, we have seen the price of DOT at Binane is $28.09 so I will be buying 100 DOT on Binance and transfer it to the VCC exchange to sell at $28.30.

Total Trade value on Binance= $28.09 * 100= $2809

Now Let me transfer it on VCC exchange to sell-

Total Trade value on VCC= $28.30 * 100= 2830

I am assuming the transaction fee is 0.1 Dot ($2.809) so,

Total Profit= Amount (After selling on Exchange B)- {Amount (Exchange B) + Transaction Fees + Trading Fee}

I will avoid the trading fee here to make the calculation simple,

Total Profit= $2830-$2809- $2.809= 18.191

6. Creatively discuss Triangular Arbitrage in Cryptocurrency. How to identify Triangular Arbitrage opportunities and the risks involved.

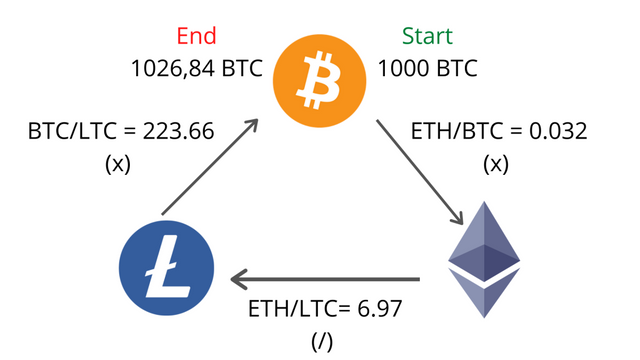

Triangular Arbitrage trading is the type of Arbitrage trade where we will take advantage of the price difference in different pairs. The best part of Triangular Arbitrage trading we don't need to pay any Transaction fee or wait for a long time. It will be very quick and we need to make 3 trades to complete the process. This is how it will look like in pictorial presentation-

Here, I spotted a small triangular Trading Opportunity-

.png)

Let's suppose, I have enough BTC to buy ETH-

Step-1: BTC/ETH, I will buy 1 ETH worth of 0.069285 BTC.

Step-2:ETH/USDT, I will sell 1 ETH worth of $2978.42

Step-3: BTC/USDt, Now I will buy BTC back with $2979.42 so as per current market price in this trade I will get total 0.06938 BTC. ($2978.42/$42982.50= 0.06938)

Total Profit= Last Amount- Intial Amount

Total Profit= 0.06938-0.069285= 0.000095 BTC.

Risk Involved in Triangular Trading-

- Fluctuation in price may impact our Profit as we are working on a small price change

- It requires good capital to earn a reasonable profit.

- We need to be very quick to take Triangular Trades

Conclusion

CAD is a very good way to make investments and it may seem less profitable initially however in the long term you will profit. It reduces the risk and helps us in creating wealth. Arbitrage trading is good for those who are very quick in grabbing opportunities it involves risk too sudden momentum in the price may lead to loss as withdrawal from one exchange to another exchange will take time.