Steemit Crypto Academy | Season 2: Week7 || Exchange order book and its Use and How to place different orders?

Question no 1 :

What is meant by order book and how crypto order book differs from our local market. explain with examples?

Order book:

In any market or in any business, a businessman always keep record of his selling goods and of his buying goods. As you can see the word “ORDER BOOK” is proclaiming itself by word order book. We can simply acknowledge it by the “where the record of things of a particular business is exhibited”

Let us discuss some main difference between local market order book and crypto market order book. Local market order book is combined total numbers of shopkeepers and total number of buyers of goods, that at how many price the different shopkeepers are selling their goods while at what price the buyers are buying goods, the book where whole this record is maintained is known as local market order book.

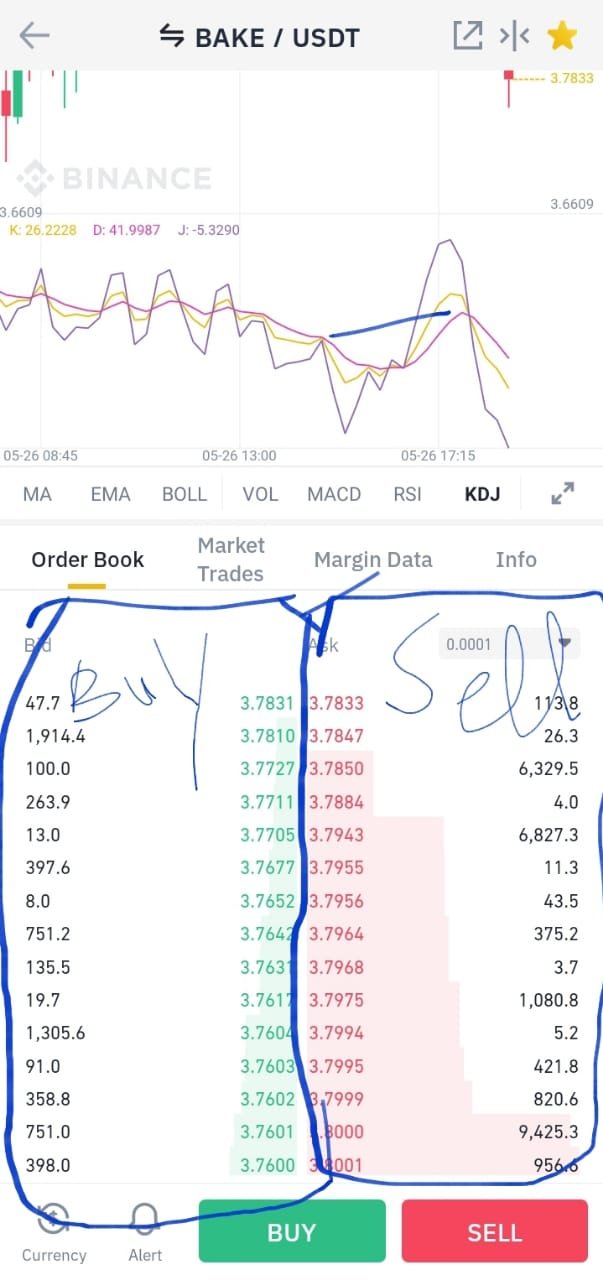

When we discuss the crypto market order book, as you know that in crypto market we have to buy certain coin with other some other stable or unstable coin, usually stable coin like usdt, busd. Let’s clarify this thing with a example that suppose that we want to buy a coin like “BAKE” so we have to select the pair with BAKE to trade like there are many options available e.g usdt, busd, btc, different exchanges offers different options. So when we select that particular pair in any exchange there will be the order book consisting of two options buy order and sell order usually representing with green and red color respectively.

So, in this order book different buyers and sellers of this particular coin with particular pair is showing. So, this is the main difference in crypto market order book there is different order book for different selected pair of coin. This order book exhibit the total number of buy and sell.

Question no 2 :

Explain how to find order book in any exchange through screenshot and also describe every step with text and also explain the words that are given below.(Answer must be written in own words)

Pairs

Support and Resistance

Limit Order

market order

HOW TO FIND ORDER BOOK:

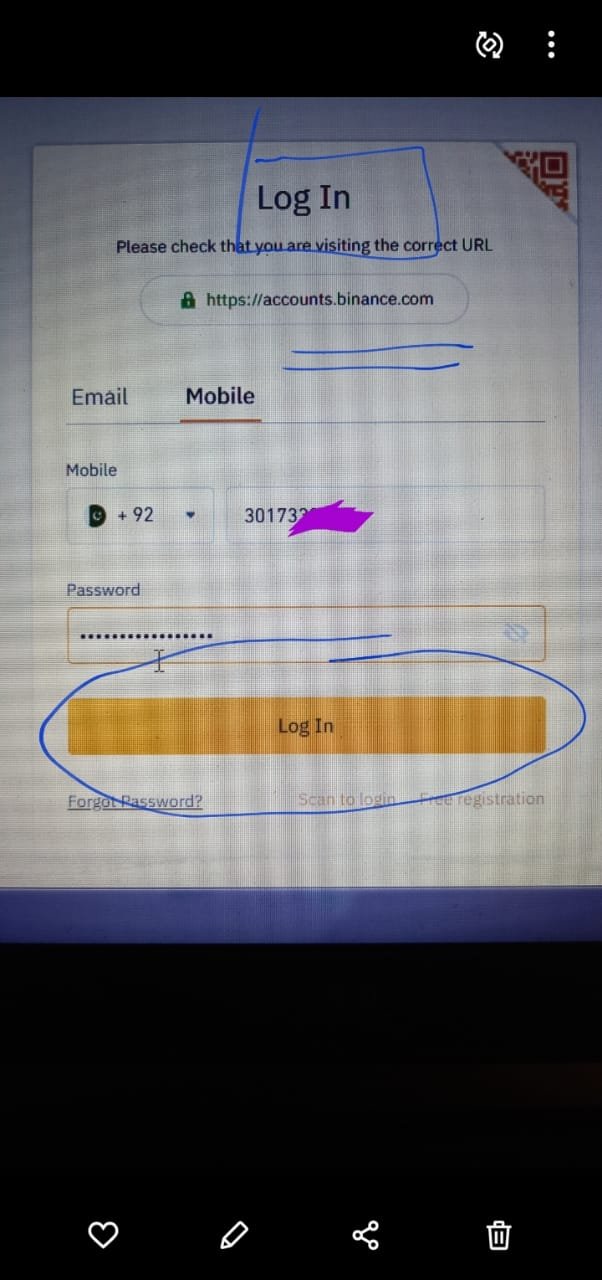

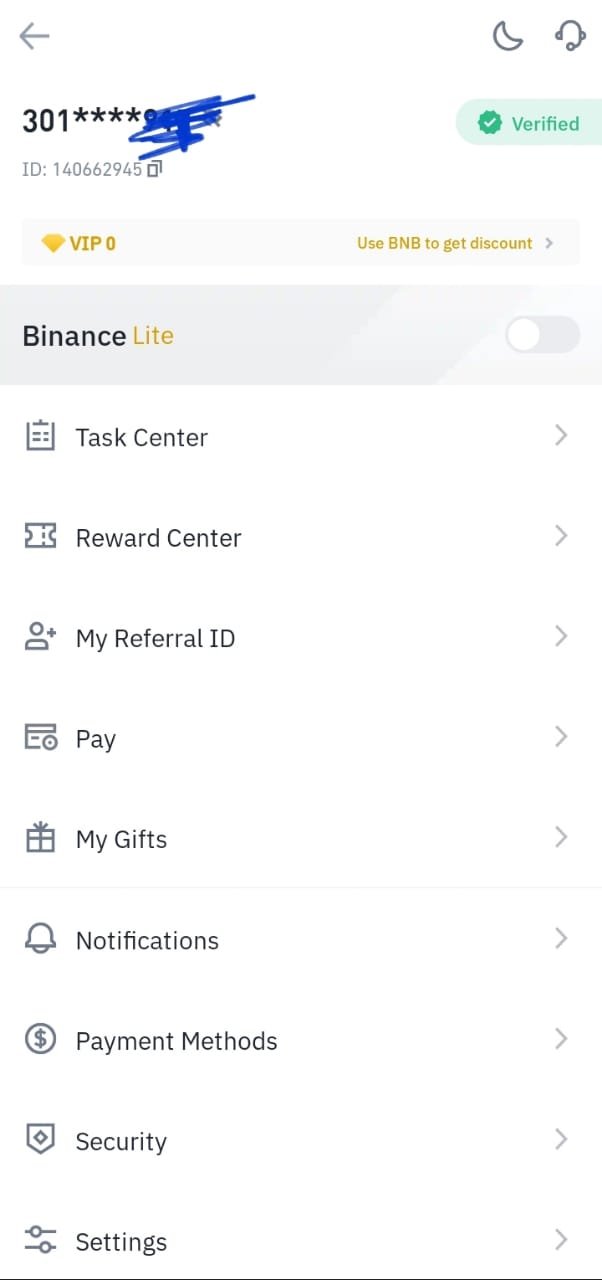

Let us discuss how to find order book, first of all I want to tell that I am using Binance exchange, first of all download the binance app or visit website www.binance.com , if account is created already then you may login or you can register first and then you can login to app,

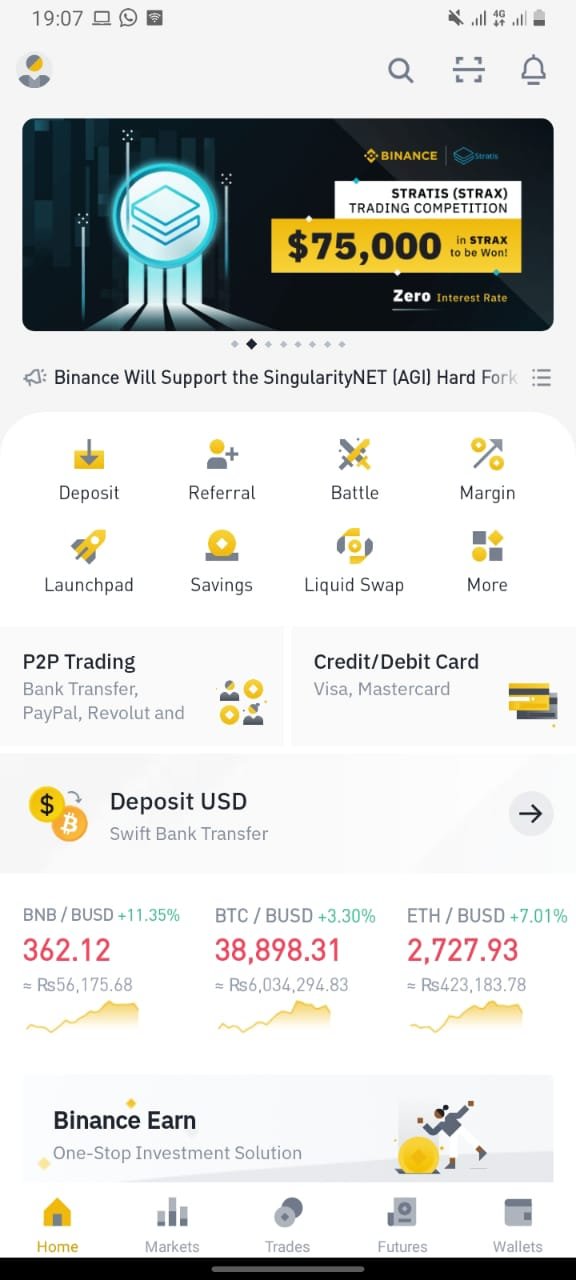

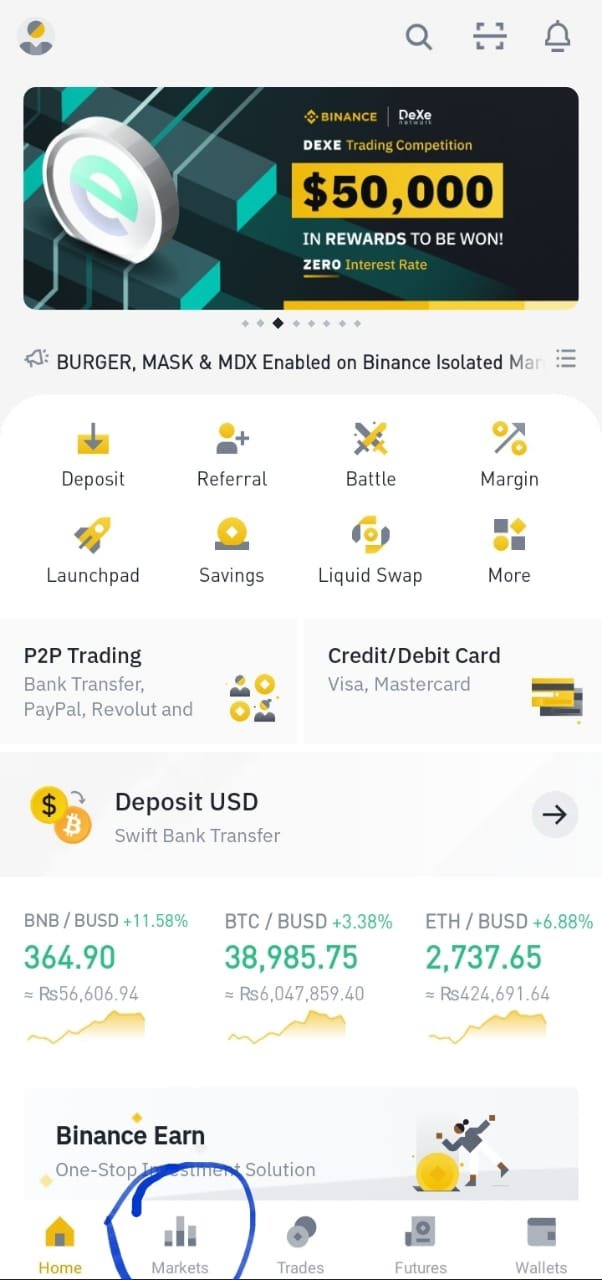

after logging in, the main following main interface will show,

There are different options HOME, MARKET, TRADE, FUTURE AND WALLETS in the down bottom, there is also a profile option, notification option and many of other options, let’s get to the main point.

Then we will select for the market option,

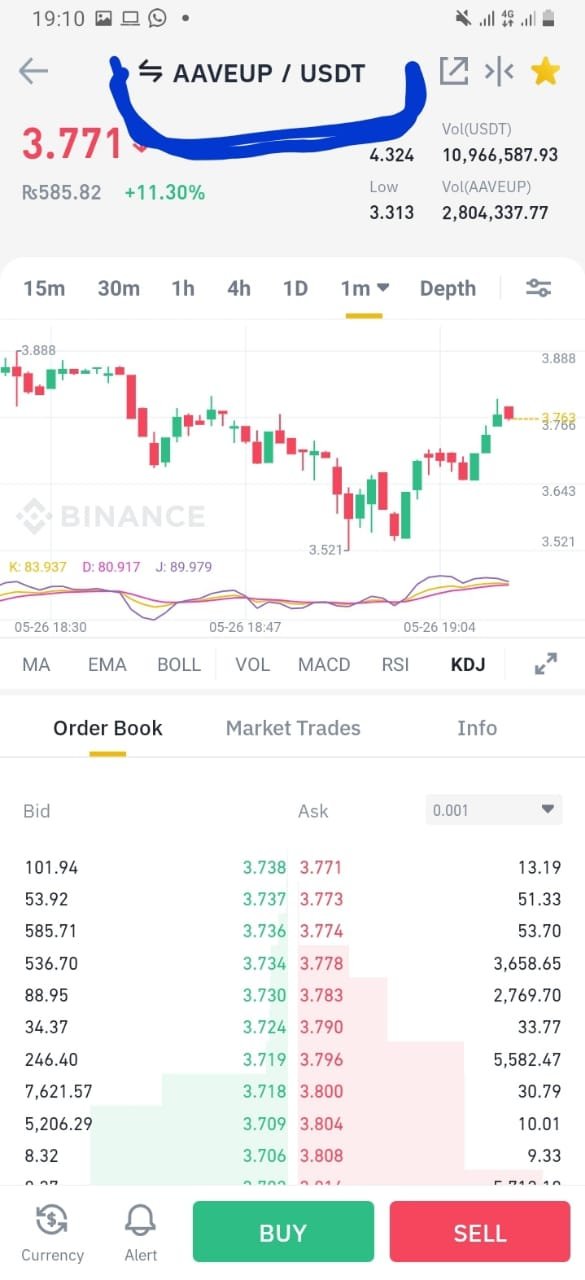

after that there will be the option for search coin pair option on the top , we can search any pair from that option, I have went for AAVEUP/USDT pair.

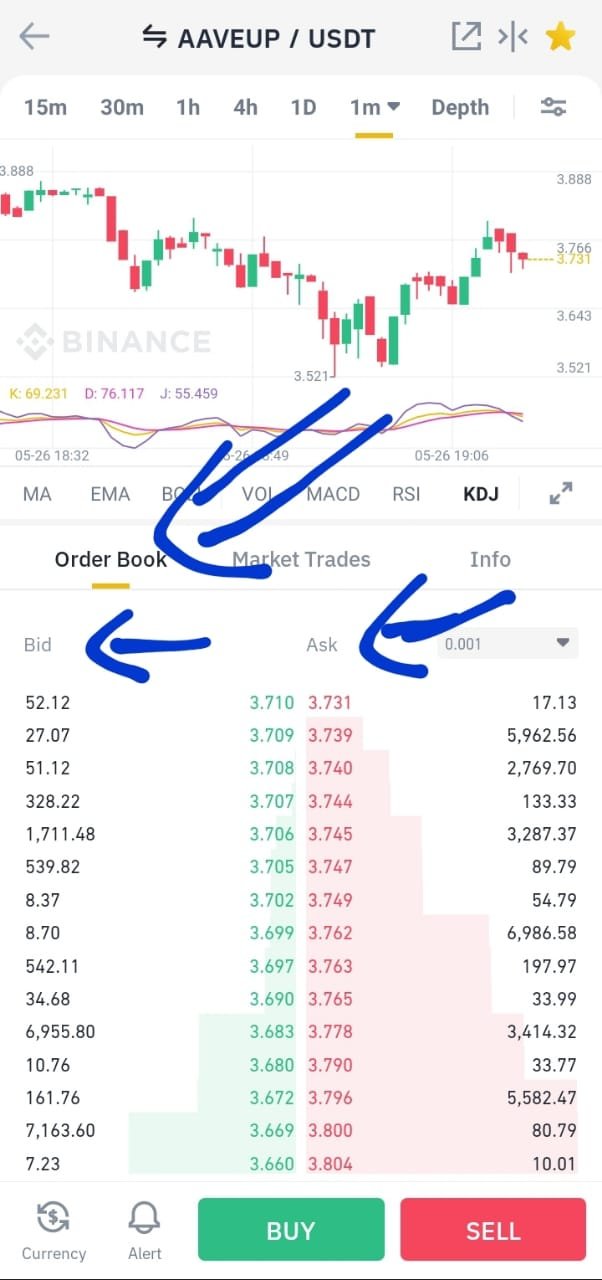

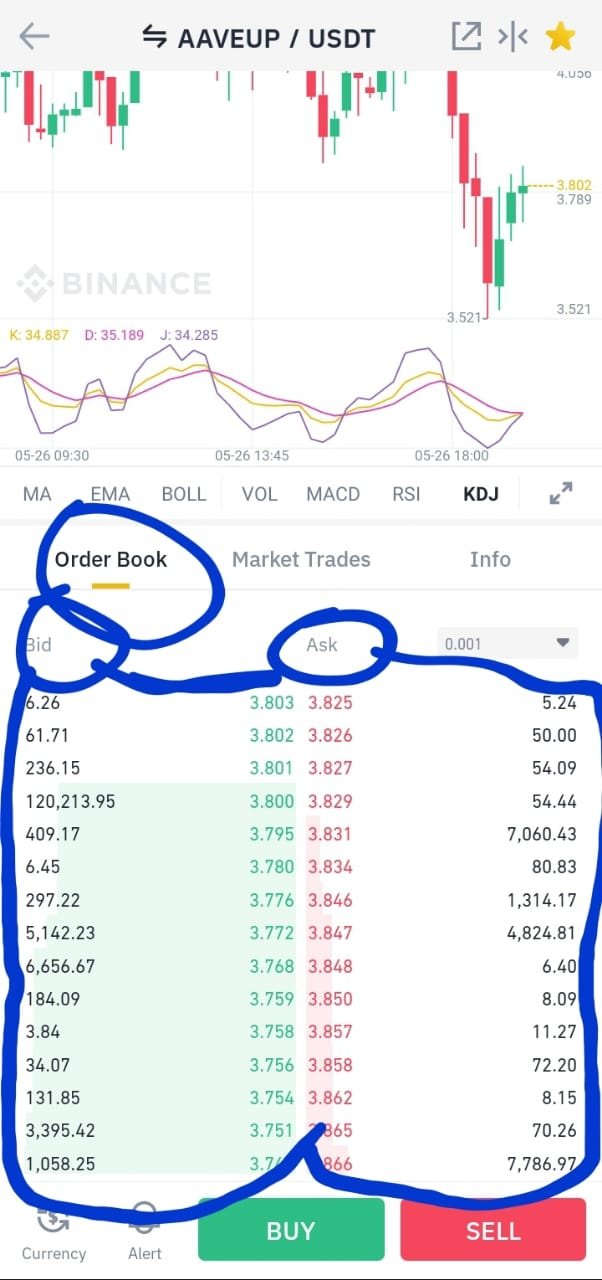

below that there is the option of order book and you can see the Bid and Ask there, Bid option means people are buying that coin and ask means sellers are selling that coin and usually representing green for Bids/buy and Red for Ask/sell. As shown in the following screenshot.

Pairs:

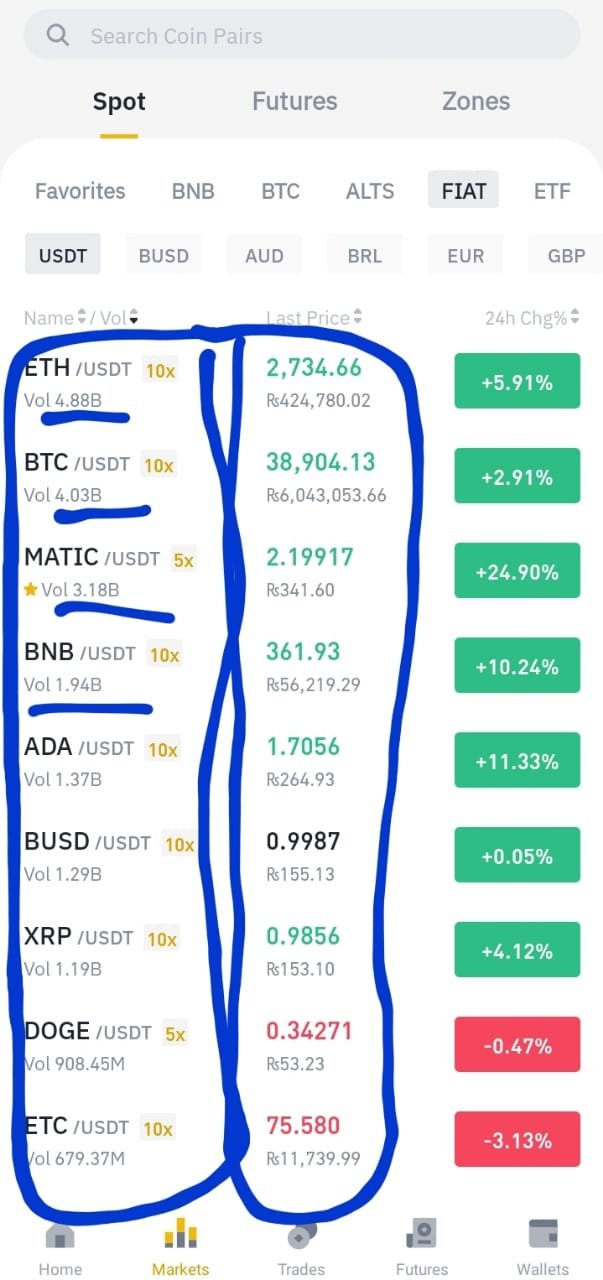

As you know we have already discussed a lot about pairs. Lets clarify this more.

In crypto market you have to trade in pairs for example if you want to buy BTC then you have to give USDT in return. There are many pair available for each type of coin in a same exchange and on different exchanges. For example in our local market if buy something like fruit, shoes, clothes, any technology related devices like tabs, laptops anything that is available in local market to buy that any particular thing we have to give money to buy that particular thing. Similarly, in crypto market we have to exchange coins in order to buy other coin. In this contest, hundreds of crypto pairs are available. Hope so, you understand the pair. For your ease I am attaching the screenshot of different pairs.

Support and resistance:

Let us clarify this topic simply, support and resistance is a very fundamental part of trading and many experts have their own different views and has their own way of teaching this important topic, basically, you can refer the support level as lowest level, depending on recent low record and downtrend, while Resistance level is refer as highest level depending on recent high record and uptrend.

On support level, a bullish trend is expected or you can say uptrend because many of the experts think that this is the lowest value where most of the buyers buy the coins because they think that this is the low value and it is rule of crypto market when most buyers buy the coin then the value of the coin rises.

And a reverse level is referred as the level when the traders thinks that this is the high level where most of traders sell their coins and downtrend is expected because when most of the traders sell their coins then the value of coin decreases.

Limit order:

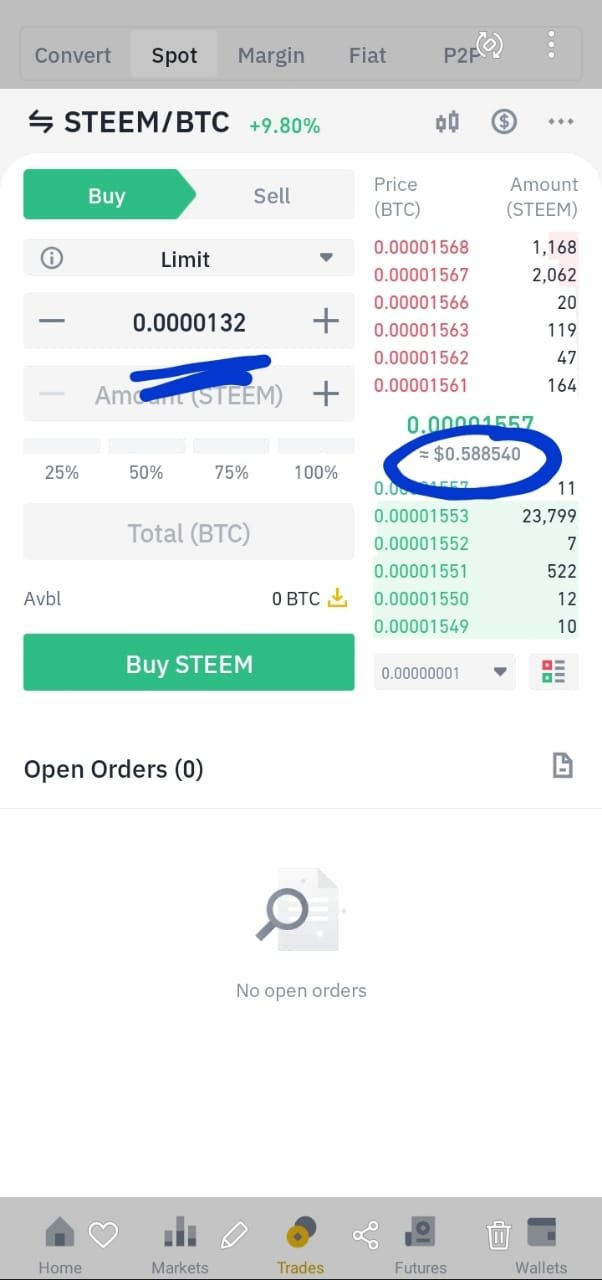

As it is shown by the name that limit order is the order where limit is applied to buy any pair of coin, this is most important and common type of open order used by most of the traders. let’s us analyze the limit order by a example;

For example:

I want to buy STEEM and you can see the current price of STEEM $0.586 and I want to buy the STEEM at $0.49 so, limit order allows me to do this that I put the limit and whenever market value came down to my set limit then Binance will automatically buy that coin and there is the same case with sell limit.

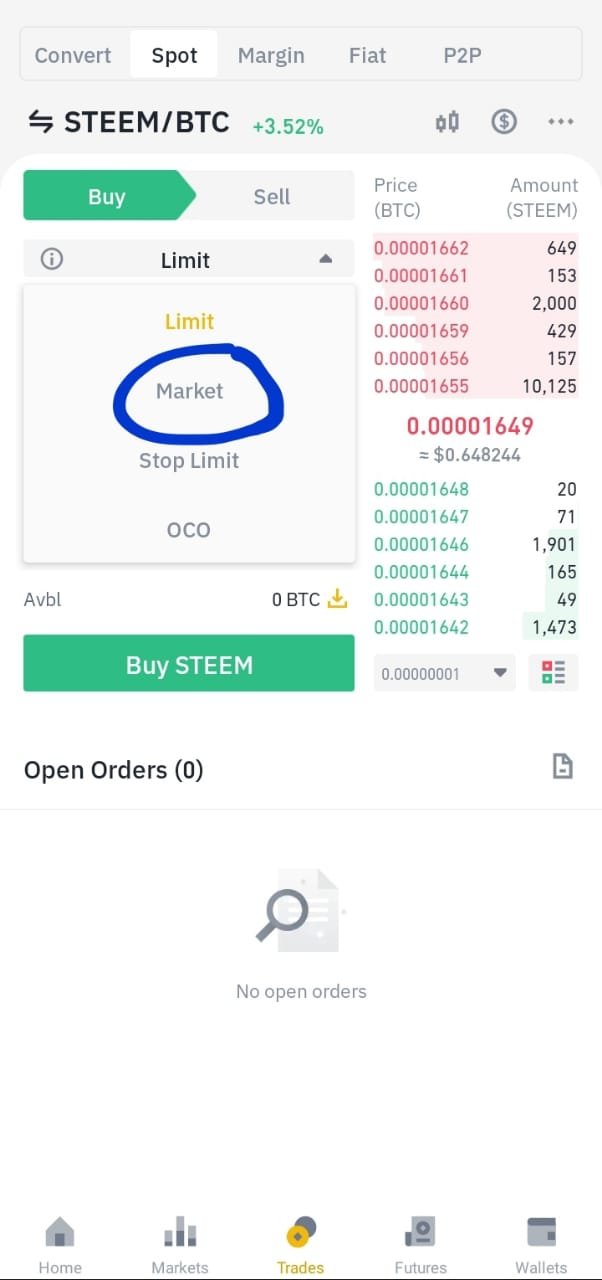

Market order:

Market order is the order which allows you to buy/sell the any specific coin at the market price means that price of that particular coin which is existing at that stage. So when you select for market order the coin’s buying or selling procedure or you can say that your order full filled quickly as you have choose for market order.

Question no 3 :

Explain the important future of order book with the help of screenshot. In the meantime, a screenshot of your exchange account verified profile should appear (Answer must be written in own words)

Order book is the book where all the record of recent transactions is being exhibited in real time. It includes all the details of buy and sell orders made by any of traders on that exchange. Experts believes that there are many factors in order book which help the trader whether to buy or sell any particular coin.

Order book is something that gives the trader 1st impression that what will be market trend of any particular coin.

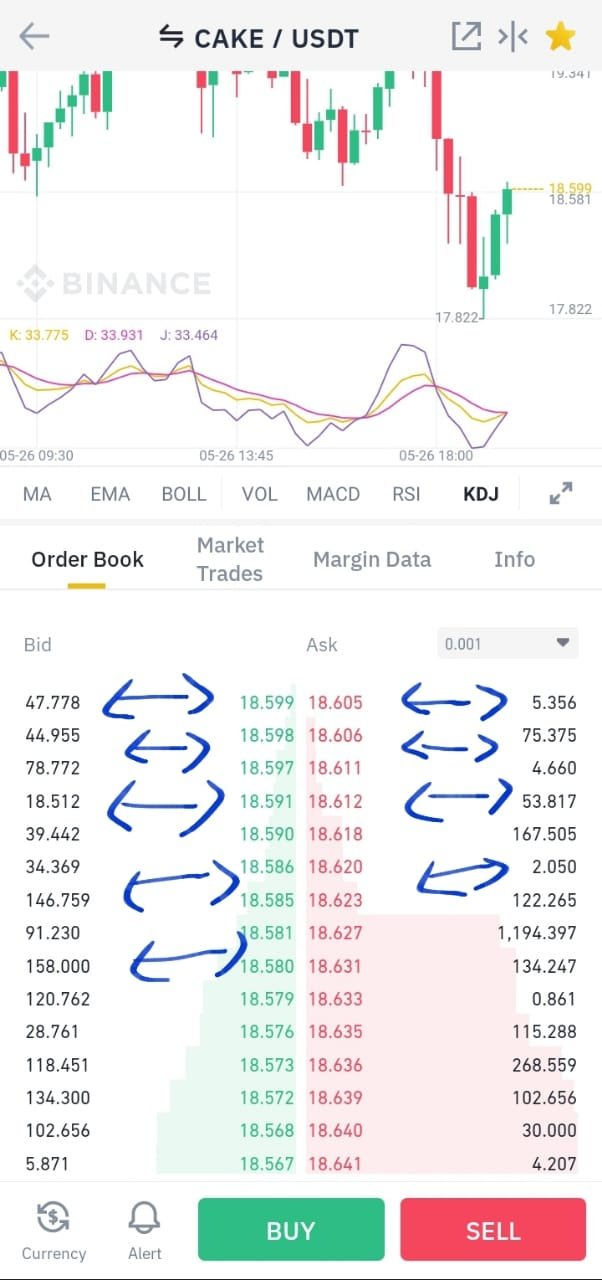

In order book, usually in most of the exchanges, there are two most dominant things that you can see are bid and ask, in simple words, bid represents to buy orders while ask represents sell orders.

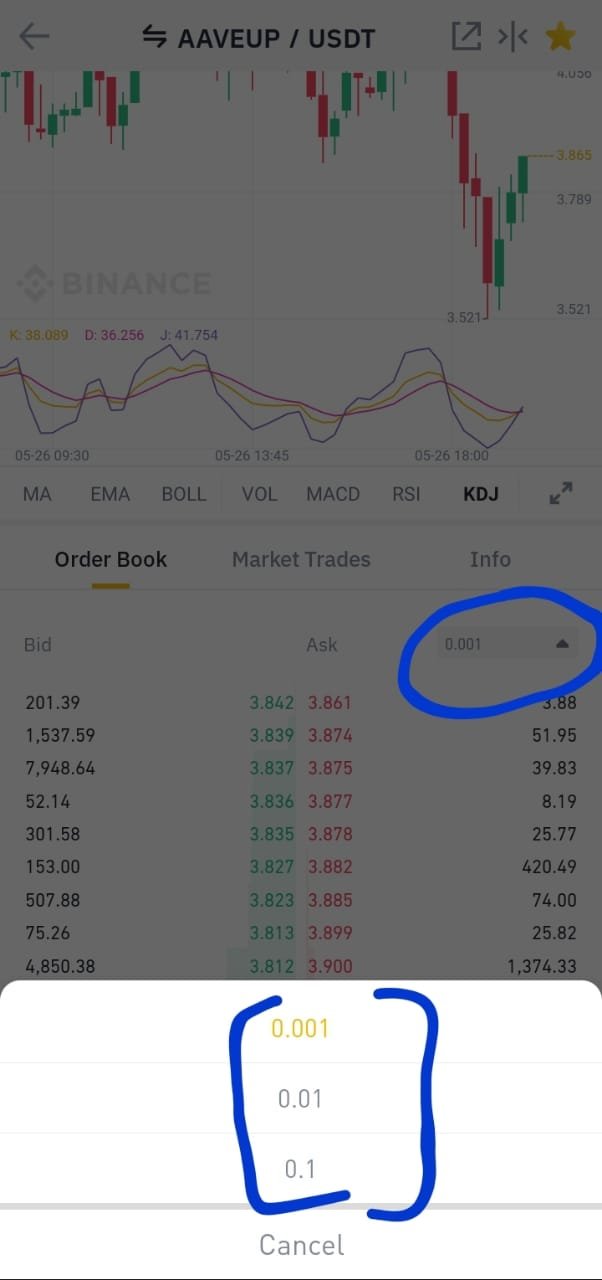

And there are some factors also that gives you easiness to analyze the order book. First of all, usually in most of the exchanges green color is used for buy orders and Red color is used for sell orders. And in the top middle there is an option that also gives you the option that to what decimal point you want to see the values in the order book, this is also the best option that one can use according to his need.

There is also one important thing that is also the in fact main theme of the order book is, that it shows the value of the coin at which buyers or sellers are buying or selling the coin and also show that how many coins are they selling and buying.

This is really the useable information for any of the trader. Many of the experts of these crypto electronic exchanges believes that all these information of buy or sell and their nitty-gritty are managed by a system known as MATCHING ENGINE.

In the last as said by the respected professor to show your verified exchange account, so , here is the snap of my verified exchange account that I have made round about two or three weeks ago after inspired by the crypto professors.

Question no 4 :

How to place Buy and Sell orders in Stop-limit trade and OCO ,? explain through screenshots with verified exchange account. you can use any verified exchange account.(Answer must be written in own words)

Stop limit order:

Stop limit order is the order when a trader put a limit on his buy or sell order in stop limit. Stop limits provides trader, the more precise and ambiguous control over his/her trades. First you have to put the stop limit to your buy or sell order and then you have to put the limit of your order where you want to execute your order. And when the price met the stop limit it activates your order as limit order and when the price met the limit that a trader have put to execute his order, and when that price is met, order executed automatically.

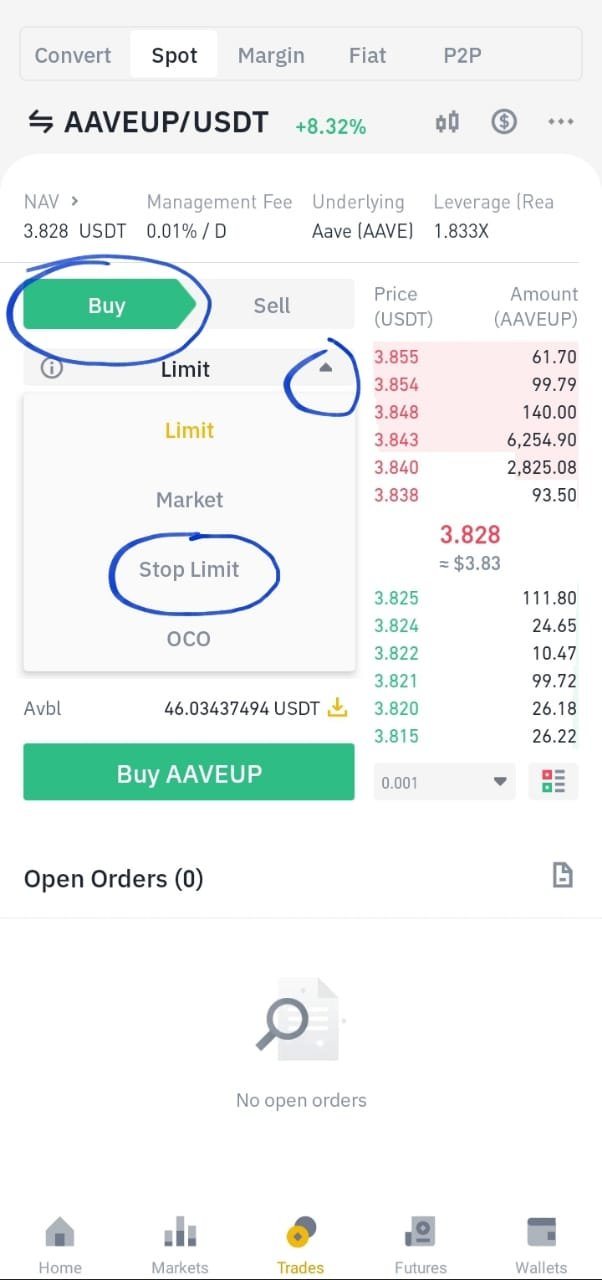

Stop limit buy order:

First of all you have to select any pair of the coin that you want to trade and then you have to choose whether you want to buy or sell that particular coin. And after that you have to select the stop limit order as shown in the snap,

And then you have to set the limit of stop(in other words where you want to execute your order as limit order) after that you have to put the limit your order that where you want to buy the coin. as shown in the snap

And here you can also set the amount your order that how many coins you want to buy.

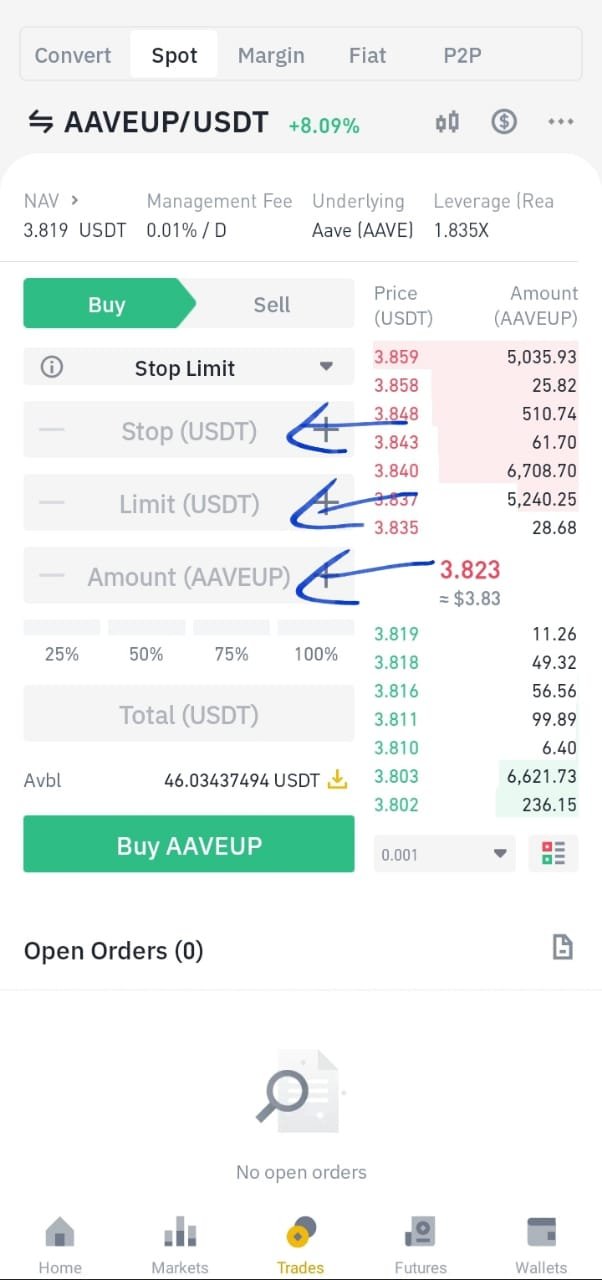

Stop limit sell order:

As described above there is the similar procedure for stop limit sell order only you have to do is to select sell button when you want to sell your coin, and after that there is the same procedure, that, set stop limit, limit and amount your selling coins. And then order proceeds in the same way as of stop limit buy order.

For your understanding attaching the snap of stop limit sell order.

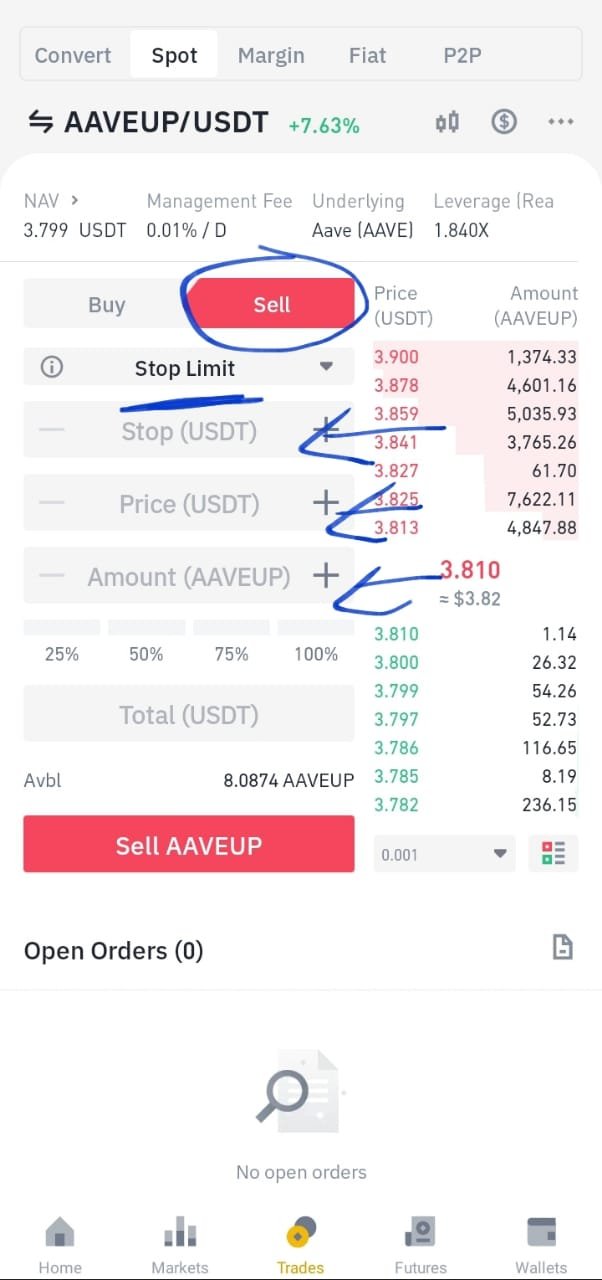

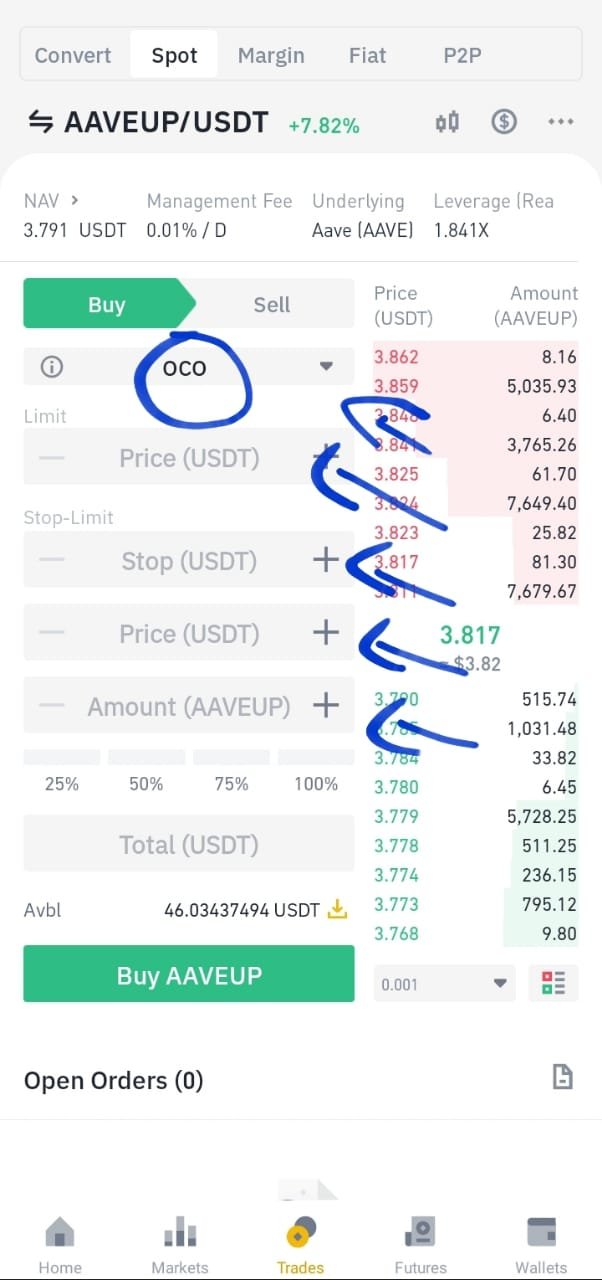

OCO:

OCO stands for “one cancels the other”

First of all I’ll show you the snap of OCO and then I’ll explain the OCO, so you can understand easily. Let’s have look at the snap;

First of all, select the pair you want to trade for, select the type of order that is OCO,

Now, as you can see in the snap, there are some boxes, here you have to set your values that at what value you want to stop your order as stop limit and where you want to buy or sell your order as limit, the one thing that OCO provides specially is that you can also set the value to avoid from loss, for example you are putting sell OCO order and market is crashing or you can say that there is the possibility of bearish trend, so, here if your values does not match the selling limits then here you can set the limit which can prevents you from loss. In this way, any limit will met the other limit will be cancelled. In this way, OCO order is very reliable and give the trader more precise control over his trades.

Question no 5 :

How order book help in trading to gain profit and protect from loss?share technical view point, that help to explore the answer (answer should be written in own words that show your experience and understanding)

For anyone to become a perfect trader and to gain reasonable profit on his trades and to stave of his assets from loss it is very necessary for every trader to fully and thoroughly analyze the order book. Order book gives whole information about that coin, order book prevents from loss in way that includes many factors such as,

it shows the real time value of all trades of which that different traders are performing,

and if a trader analyze it carefully he can understand, whether this is time for any coin to buy or sell or not.

If the numbers of buyers are more and they are buying more coins then sellers then some can predict that may the market follow the bullish trend

And if the number of sellers are more which a trader analyze very deeply in order book and a trader analyze that sellers are selling more coins than the buyers that are buying, so, a trader can expect the bearish trend in the market. After this a trader can decide on the basis of record of traders showing in the order book that whether this is the best time to buy or sell crypto or not.

And when you put your cursor on the buy or sell orders it also gives you the average buying price in buy orders and average sell price in sell orders. This is something that can also gives the trader an idea that what is the minimum and maximum value at which buyers or sellers are buying or selling their orders.

There are some technical indicators like MA stands for moving average, And EMA stands for exponential moving average these indicators show the average change in price of coins and shows that what is the current moving average of that selected coin.

Other indicators like volume of the coin, shows that what is the recent volume of the coin which helps in taking decision to buy or sell the coin.

There is indicator KDJ which helps to indicates the trend and volatility of the market on the basis of data represents by kdj.

So, these some above mentioned things are reasons that can help a trader to make his decision to buy or sell the coin. in this way, order book helps to gain profit and to prevent our assets from being washed off.

Conclusion:

As a concluding point of view about this whole lecture is that as for as my trading experience is concerned, I wasn’t sure about stop limit order and OCO order and regardless of all these I didn’t know anything about ORDER BOOK, but this lecture removes many of confusions and explore almost everything about the order book and types of order and made me able to trade more precisely and more perfectly. Thank you professor @yousafharoonkhan

The main thing that I have learnt from the lecture is the use of order book is very integral and intrinsic in the crypto market because it gives a lot of information about trend of traders whether it is about buyers or sellers else, it gives the average value of buyers and traders in real time, and there are lot of more things that indicates the market trends in coming time that can help us understand the market and to manage our portfolio more absolute and reliable.

But as a concluding statement, as you know, there in nothing full and final in crypto market, everything can happen and these are just some tips and tricks and some tools explained by the experts that sometime works 100% but some time not. So, it is very essential for trader to analyze the order book to make his trading experience more comfortable.

Sir @mubeenaslam

Your post is very informative.

I really like your post.

Please keep it up.

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

question is short you did not explain all points ,more detailed answers are needed so that the answer to the question is clear.

If you look at feature in the order book, you will see a lot of technical and simple advance feature. You have not searched for futures in detail. it is very much important to explore the order book to use the feature that will help you in trade

How an order book can help a trader make a profit , you did not explain well, your answer was very much short , need more detail to explore this question۔

You have not specified the OCO order correctly and if you look at the screenshot it is incomplete and you have not specified your order in the text format, .

it is necessary to answer every question according to given points, you did not cover all points in given homeowrk

Thank you very much for participating in this class. I hope you have benefited from this class.

grade ;4.7