Yield Farming - Yearn Finance - Crypto Academy S5W3 - Homework Post for @imagen

Introduction

Hello crypto Lovers,

The week is moving nice at this end. How about your end there? This week marks the third week of season 5 in steemit crypto academy. I am Kehinde Micheal and my username is msquaretwins here on this platform. I have gone through the lecture presented by professor @imagen on "Yield Farming - Yearn Finance" in the intermediate class. Therefore, in this post I will be answering the question posted in the homework section.

1.Describe the differences between Staking and Yield Farming.

This question has asked us to differentiate between yield farming and staking. Now let's first define the two before we establish the unique differences between them.

Yield Farming

Yield farming is one of the new concepts in the world of cryptocurrency. It is a way of making reward in with cryptocurrency. Yield farming is otherwise called liquidity mining. In short, it can be defined as process of getting more reward by holding cryptocurrency. In that case, it means locking up of crypto asset for some time to get reward.

Yield farming is a method use in crypto world where investors which are called Liquidity Provider (LP) supply their crypto asset to the system liquidity pool for certain period of time for the aim of getting interest. The liquidity pool in this case is smart contract that contain crypto funds. The reward that the liquidity provider get after the set time period may come in form of crypto generated by the platform or fee from other means.

More so, the reward of the liquidity provider may be paid to them in multiple token an this token may also be used on other platform to provide liquidity as well. Much of the Defi project are currently using ethereum blockchain and so also is yield farming, and as such ERC-20 token is used for it. This therefore means that the reward is form of ERC-20 token.

The total amount of crypto or asset locked on a yield farming platform can be measured by Total Value Locked (TVL). And this also tells us how healthy the platform is. The tool that is used to measure interest or reward given to liquidity provider are Annual Percentage Yield (APY) and

Annual Percentage Rate (APR). The difference between APY and APR is that while APY put into consideration the effect of compounding, APR does not put into consideration the effect of compounding.

Staking

Staking in cryptocurrency involves the process of locking up crypto asset to give security and support the functionalities of a blockchain. It involves locking a funds on the pool which helps validator to validate block and at every validation of block, a reward is given to the validator from the pool.

In some blockchain platform, both block validators and users can do staking to support the platform. For example, in Audius platform, a decentralized music platform where music creators can upload their work and claim ownership of it, both node operators and users can stake their token called AUDIO token to support the security of the platform. In this platform, node operators stake directly, but users do their staling by delegating AUDIO token to any of the node operator and then slash the reward according to the token delegated.

The method of locking cryptocurrency to achieve fast validating of block is used in most blockchain that used proof of stake which is a counterpart consensus mechanism to proof of work where validation of block requires complex mathematical puzzle and a sophisticated computer hardware.

Below is the tabulated differences between Staking and Yield Farming

| Staking | Yield Farming |

|---|---|

| Staking is done by block validator or node operator with the aim of supporting the blockchain security and operation while also earning block reward. | Yield farming is planned and done by user with the purpose of earning reward. |

| Reward in staking reward is usually set to 5% or at most 15% in most platform. | Yield farming is more profitable as the reward from it can reach 100%. |

| Staking is associated with the blockchain and as such it has a very regulated policy | Yield farming is linked to a Defi project like smart contract and it may be hacked if the Defi or smart contract program used is not properly done. |

| The reward gotten by validator in staking depends on the network incentive. | The reward in yield farming depends on the liquidity pool, and it may vary from time to time base on the amount of fund in the pool. |

2. Login to Yearn Finance. Fully explore the platform and indicate its functions. Describe the process for trading on the platform (wallet connection, funds transfer, available options) Show screenshots.

• To perform this task, we go to yearn finance website.

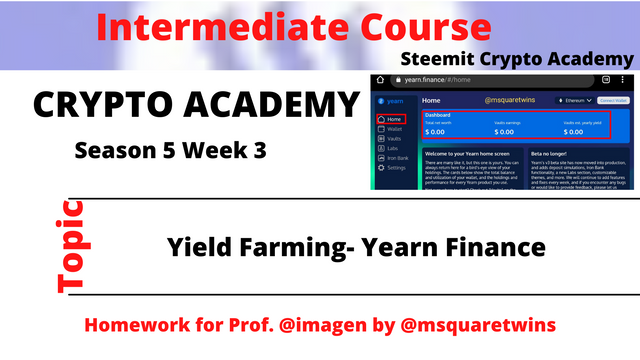

• Home Page Feature: When you click this link, the home page of the platform will be displayed for you as uploaded below.

• In home page, you will see dashboard, your earning and the yield.

source

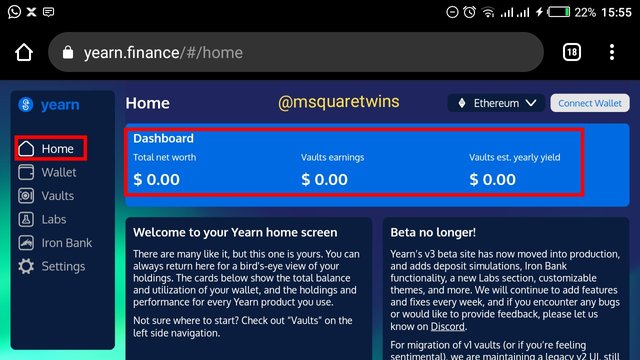

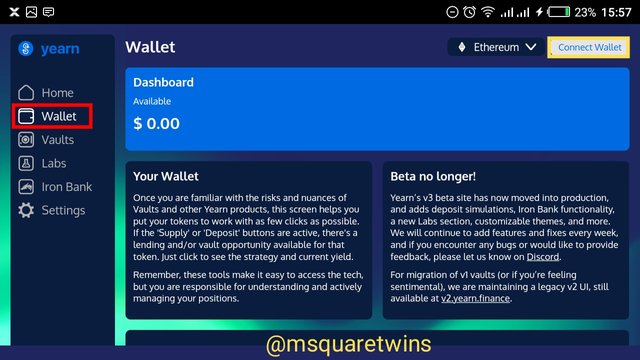

sourceWallet feature: When you click this feature, you will see wallet that you have connected to the yield finance platform. We will talk about how to connect wallet later. Thie wallet feature is uploaded below.

source

*Vaults feature: This feature helps investor to deposit crypto asset or fund from their wallet to the platform and they get reward. This feature is uploaded below.

source

sourceLab feature: This features display all information and important update on the yield finance platform. It is uploaded below.

source

sourceIron Bank feature: This feature allows investors to borrow crypto asset while using crypto as collateral. Also, investors can also supply their crypto asset and earn reward in form of crypto.

source

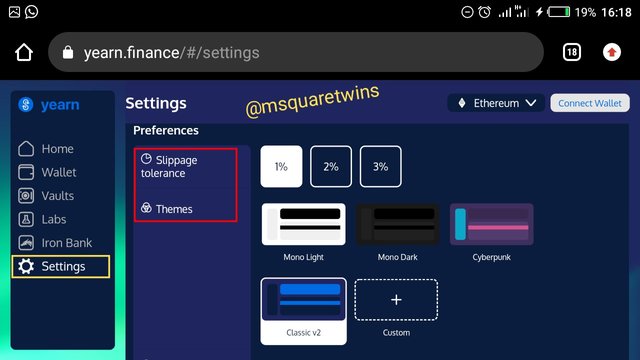

sourceSetting feature: This feature allow user to set preference, set the color and do all sort of setting on the platform. The page is uploaded below.

source

sourceNow, let's us explain how to connect wallet on Yearn finance.

Connecting Wallet to Yearn Finance Platform

• To connect wallet to the yearn finance platform, click wallet, and then click ""connect wallet"* at the top right corner as indicated by a yellow box in the screenshot below.

source

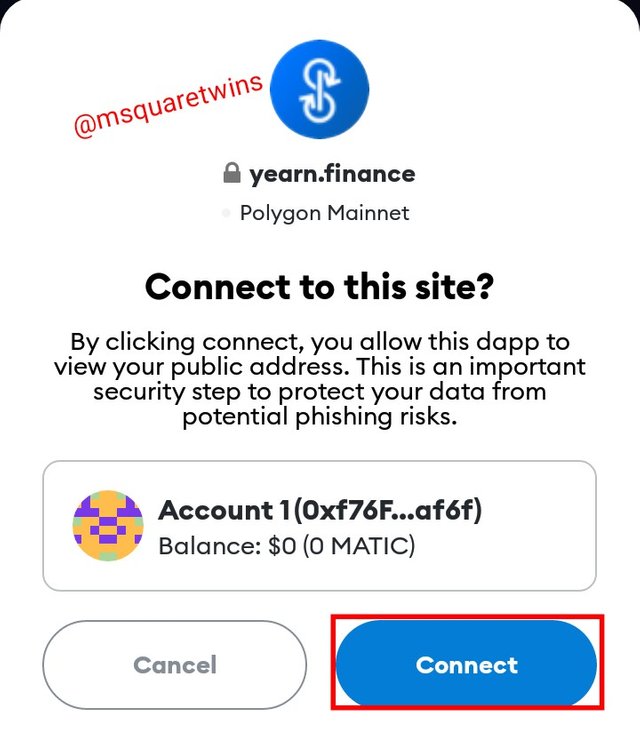

source• Then select a wallet from the list of wallet displayed. In my case, I will connect metamask wallet as indicated by a red box.

source

source• After that, click connect to connect your wallet as indicated in the screenshot below.

source

source• Then, we can see that the wallet has been connected successfully to the yearn finance platform. This is uploaded below.

source

sourceDeposit and Transfer of Fund on Yearn Finance

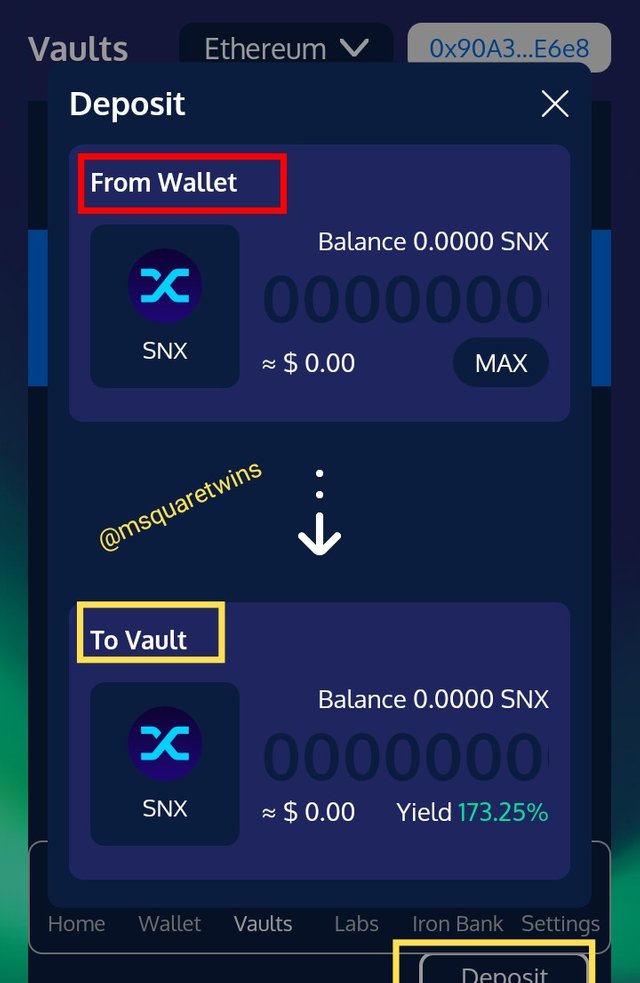

To deposit fund to or withdraw fund from the yearn platform, click vault as indicated in the screenshot below by a yellow box. After that, select the pool or project you want to deposit to as indicated by a red box.

source

sourceAs seen in the screenshot below, we can see that we want to make deposit from wallet to vaults. This means that we want to lock the asset to gain a reward of 173.25%. Enter amount of asset you want to lock and then click deposit

source

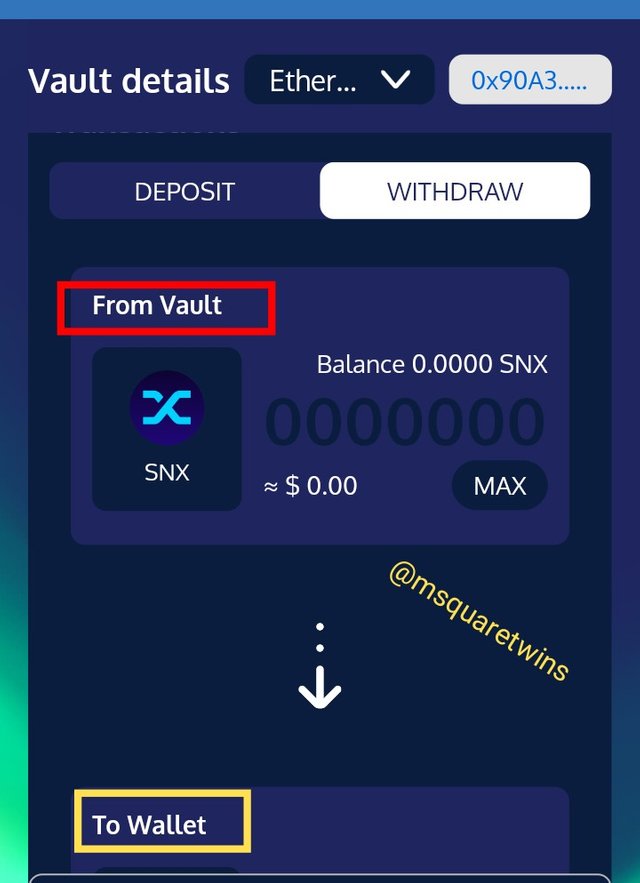

sourceFor withdrawal, we do it the same way we deposit but in this case, we have to click withdraw. As we cam see, it means we want to withdraw locked asset from vault to our wallet

source

sourceLending and Borrowing on Yearn Finance

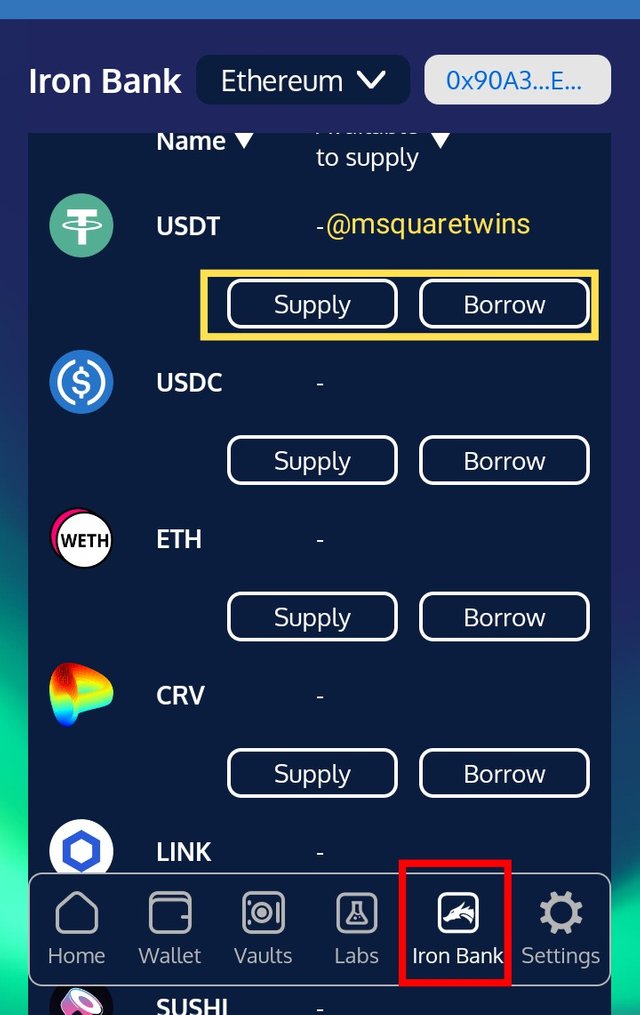

To supply crypto asset for lending or to borrow crypto asset on yearn finance, click Iron Bank as indicated box in the screenshot.

• Then, click supply, then a page where you will enter the amount of crypto to be supplied will be displayed for you.

source

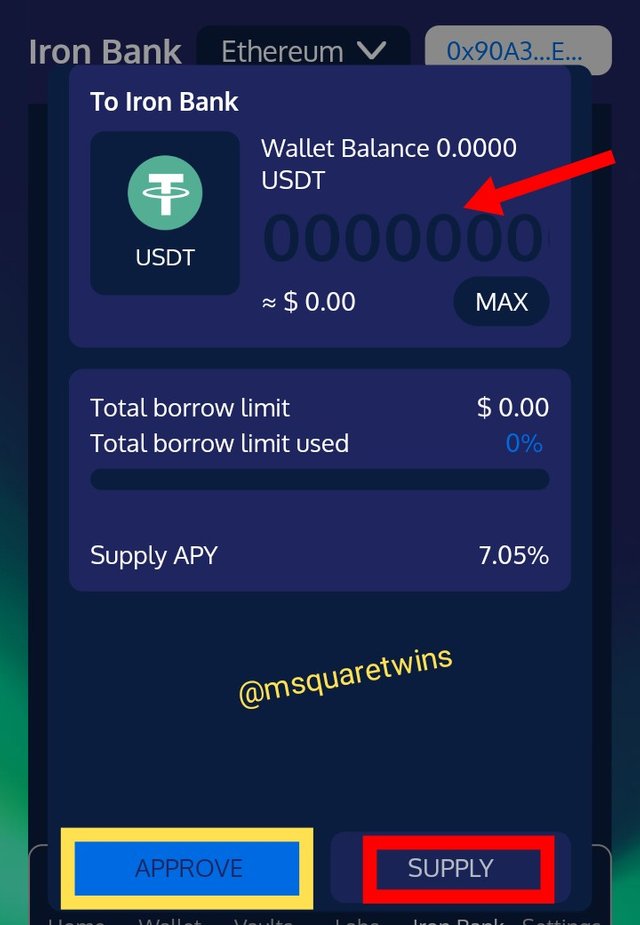

sourceThen enter the amount and click approve, then you will approve it with your wallet, and finally click supply. That means you have successfully supplied crypto to the yield finance wallet.

source

sourceThen, to borrow, simply click borrow. Then enter the amount you wish to borrow and then click borrow button as indicated by a yellow arrow in the screenshot below.

source

source

3. What is collateralization in Yield Farming? What is function?

In yield farming, investors can supply their crypto asset and lend it to others to get interest from it. Apart from lending, borrowing of crypto asset is also possible. To borrow, investor will need to use his deposited crypto on the platform as collateral. This is what is called collateralization in yield farming.

This concepts is just the same as the one used in traditional bank where a man who goes to bank to get a loan would be ask to use something equal or greater than the amount he wants to borrow as collateral. This provide a security of the money the bank is giving out. In the same way, collateral is used in yield farming but only crypto asset is used as collateral.

The main function of collateral in yield farming is that it provide security for the system. It also help the sytem not to experience liquidation. More so, It serves as insurance for the crypto asset borrowed. The collateralization ratio used depends on the each platform. For instance, if the collateralization ratio in a platform is 100%, this would mean that if you deposit $80 you can only borrow a crypto asset that is less than or equal to $40.

4. At the time of writing your assignment, what is the TVL of the DeFi ecosystem? What is the TVL of the Yearn Finance protocol? What is the Market Cap / TVL ratio of the YFI token? Show screenshots.

DeFi Ecosystem TVL

At the time of writing this task, the Total Value Locked in USD of the DeFi ecosystem is $107.85 Billion

source

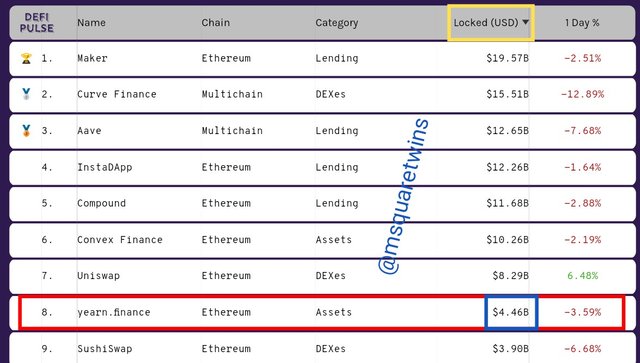

sourceTVL of Yearn finance

At the time of writing this task, the Total Value Locked (TVL) of yearn finance is $4.46 Billion

source

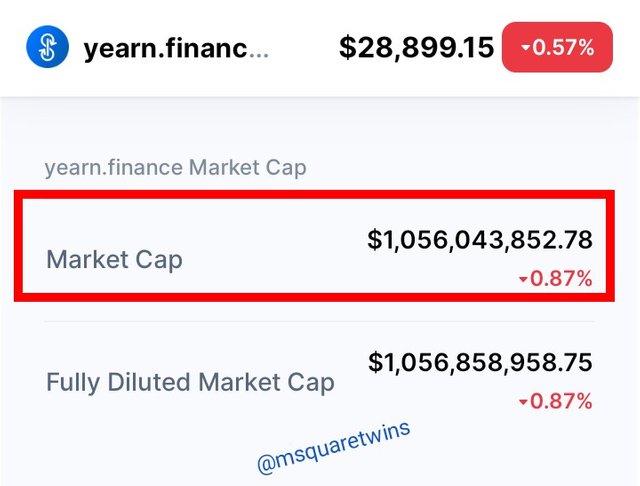

sourceThe market capitalization of YFI token is $1,056,043,852.78 as indicated in the screenshot below by a red box.

source

sourceNow, let's calculate the Market cap/TVL ratio of the YFI token.

From the informatio supplied with screenshot above,

Market cap of YFI = $1,056,043,852.78

TVL of YFI = $4.46 Billion = 4,460,000,000

Market cap/TVL ratio = Market cap/TVL

Market cap/TVL ratio = 1,056,043,852.78/4,460,000,000

= 0.23678113291

Market cap/TVL ratio ≈ 0.24

4.1. The YFI token, is it overvalued or undervalued? State the reasons.

The YFI token is currently undervalue. The reason being that the market capitalization and the total locked value of this crypto is less than 1. A DeFi token is said to be overvalued If the Market cap/TLV is equal or greater than 1, while it is undervalued if the ratio between it market capitalization and the total value locked is less than 1. As we can see, in the case of YFI, the ratio is 0.24 which is less than 1. Therefore YFI is undervalued.

5. If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment in the actuality? Explain the reasons.

On August 1, the price of bitcoin closed at $41,454.10 as indicated in the screenshot below by a blue box. Today, being December 2nd 2021, the current price of bitcoin is $ 57,237.27 as indicated by a red box in the screenshot nelow. Therefore, bitcoin experienced 38.07% increase.

source

sourceFor Yearn Finance, the price closed at $33,559.56 on August 1 as indicated by a blue box in the screenshot below. Today, 2nd December 2021, the current price of yearn finance is $28,772.00. With this, yearn finance token experience -14.26 % from August 1 till today.

source

sourceBTC Total yield= $500 + (500 x %increase)

= 500 +(500 x 38.07/100)

= 500 +190.35

= $690.35

YFI Total yield = $500 +(500 x % increase)

= 500 +(500 x -14.26/100)

= 500 + (-71.3)

= 500 - 71.3

= $428.7

Total yield of BTC and YFI after inveatment = $690.35 + $428.7

= $1,119.05

Return on Investment (ROI) = Total yield - initial capital

ROI = $1,118.05 - $,1000

ROI = $118.05

6. In your personal opinion, what are the risks of Yield Farming? Give reasons for your answer.

There is no business that foes not have it own risk. In fact crypto currency trading is far more risky because of volatility that is associated with it. So, yield farming has it own risk. Below are some of the risk in yield farming.

Program Failure may cost loss of Funds:- DeFi application are built on code, and as such if the code is not properly written, it may cause failure and a failure in code could cause an attack of the platform and that in turn may lead to a loss of fund deposited and invested on the platform.

Risk associated with Liquidation:- Another risk of investing in the yield farming is liquidation risk. The liquidation is a situation where the amount of collateral drop significantly below the price of loan, at this time, the collateral does not appropriate to the loan. This means that the collateral could not secure the loan and therefore the investor take the loss.

Risk with Price Fluctuation: Price fluctuation is another risk with yield farming. Price can increase or decrease at anytime. If an investor has been making profit and sundenly there is price fluctuation which go against him, he may incur a huge loss.

Conclusion

Yield farming is one of the new project that still yet to be understood by so many investors. With a proper knowledge and planning, an investor may earn cool reward from it. It is similar to staking in that it is also a process of locking up a crypto asset for the purpose of earning interest but it is different from it because, while staking is done by block validator to support blockchaim and it operation, yield farming is carried out by each user based on his analysis with the aim of earning interest.

In this post, I have explain the different between staking and yield farming. I have also explored the yearn finance platform with detail explanation of different features on the platform. Lastly, I have checked for TVL for entire DeFi ecosytem and yearn finance.

Special thanks to Profeasor @imagen for this wonderful lecture.

Cc:- @imagen