Crypto Academy / Season 3 / Week 8 / Homework Post For Professor @yohan2on

Hello everyone.

It is another great week. Welcome greetings to all Professors, students and the entire steemit community. The past seven (7) weeks in Crypto Academy have been awesome.

I am privileged to attend Professor @yohan2on class for the week 8 task. Prof. taught "Risk Management in Trading." He explained vividly how important management of risk is in trading.

At the end of the lecture, he asked two questions in which each student is expected to answer. These questions are listed below.

1- Define the following Trading terminologies;

Buy stop

Sell stop

Buy limit

Sell limit

Trailing stop loss

Margin call

(I will also expect an illustration for each of the first 4 terminologies listed above in addition to your explanation)

2 - Practically demonstrate your understanding of Risk management in Trading.

- Briefly talk about Risk management

- Be creative (I will expect some illustrations)

- Use a Moving averages trading strategy on any of the crypto trading charts to demonstrate your understanding of Risk management. (screenshots needed)

So, I will be taking these questions one after the other. Follow me closely.

Question 1

Define the following Trading terminologies:

- Buy stop

- Sell stop

- Buy limit

- Sell limit

- Trailing stop loss

- Margin call

(I will also expect an illustration for each of the first 4 terminologies listed above in addition to your explanation)

Buy Stop

Buy stop is a type of order where the execution will be activated when the price of an asset rises above a certain level more than where it is at the present point. In essence, it is an order to buy an asset above the current level of price.

Traders often use or set "buy stop" order when they want to join a buy trade or bullish trend after the price rises above a certain level. It's important to know that before they place a buy stop order, they must have done their analysis and be sure that once the price gets to that certain level, it will continue to go up. Let see the image below.

.png)

Fig. 1: Buy Stop Illustration/trading view.com

Before a buy stop order can be activated, price of an asset must rise above where the traders meet it.

In fig. 1 above, let's say you meet the market at point 2 indicated by "you meet market here", and you are interested in buying the asset when it breaks the resistance level indicated by " blue horizontal line." You know that ideally, price should not break the resistance if it should sell. However, you know that if it should break it, then, the price will continue to rally up. Then what traders do so they will not be left out is that they open buy stop order.

Buy stop order is normally used by traders who can not be monitoring the movement of price every time. If it is people or traders who can be monitoring the movement of price, they will wait until price gets to that place and place instant execution.

Sell Stop

This is a type of order placed below the price for a future execution. Here, traders place sell stop order when the price is still above their area of interest. Traders often place sell stop order when they want to join a bearish trend when the price of an asset falls below certain level.

The screenshot below illustrates sell stop order

.png)

Fig. 2: Sell Stop Illustration/trading view.com

In fig 2 above, let's assume you meet price at at "1" and you are interested in selling the asset if it breaks the support indicated by the blue horizontal line. Then what you will do is to open a sell stop order below the support, at 2 indicated by "place sell stop here."

Buy Limit

A buy limit order is a type of order placed below the price with the aim to buy at discounted price. Traders use this type of order when they wants to buy at a very cheap price so they can maximize profit and minimize loss. For example, a pair of shoe is currently at $10 and me as a buyer doesn't want to buy at that current price, I want to buy at $5. Then I would have to wait until the price falls to $5. When it gets to $5, I can buy 2 pairs with just $10, whereas when the price was at $10, I could only buy 1 pair.

Let's see the image below.

.png)

Fig. 3: Buy Limit Illustration / tradingview.com

From fig. 3 above, let's assume that a trader meets the price of an asset at "1" and has seen from his analysis that once the price reaches a key support level indicated by that "horizontal blue line," it will reverse upward, then he would have placed a Buy Limit at "2," the key support zone.

Sell Limit

A sell limit order is a type of order placed above the price with the aim to sell when the price of an asset appreciates. This type of order is always for future. For example, a cup of rice is currently sold at $2, and a seller decides not to sell his now but when the price reaches $3. In that case, he would have to wait until the price of rice inflates to $3. So also it is in finance trading, a trader may decides to sell an asset when the prices rises to a certain level.

.png)

Fig. 4: Sell Limit Illustration / tradingview.com

In Fig. 4 above, we meet the price of an asset at "1" and having known that there is a resistance level above the price which may likely reverse the price, we will place a "sell limit" at "2" , the key resistance level.

Placing sell limit order above the current price, "1" will enable us sell at premium. Selling at premium means we want to sell at a price where we will have maximum profit.

Trailing stop loss

Trailing stop loss is a process of strategically adjusting stop loss when the price has either rises above or falls below certain level of the entry point. Traders often trail their stop loss in order to protect the trade. The aim behind trailing the stop loss is to lock in profits so that if the trade reverses and go against the trader he will not be in loss.

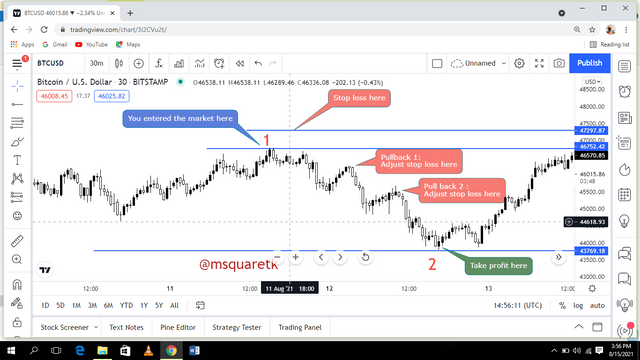

The image below illustrates how a stop loss should be trailed in a bearish trend.

.png)

Fig. 5: Trailing Stop Loss / tradingview.com

In fig. 5 above, let's assume you enter a trade at "1" indicated by (you entered the market here), and stop loss just above the your entry point. As it's seen, the price falls to a certain area and pull back or retraced, you can adjust your stop loss by putting it at that current high, Lower High. Then when the price falls and creates another Lower high corresponding to the previous one, then you adjust your stop loss there. That's how you will be be doing it up until it reaches your take profit.

Margin call

In finance trading, we register ourselves under brokers so we can participate in trading. Individuals like us, retail traders don't have sufficient amount to participate in trading. We don't have enough power to enter into trading. The brokers are like banks who have enough money who can borrow us so we can also participate in taking trades.

When a traders decides to register an account with a broker, he usually pays a certain amount of money. The amount he pays will let the brokers empower him so that he can also participate in taking trades. The amount he pays will form his equity.

This deposited amount with brokers will enable him to have margin in his account. (Margin is the minimum amount of money or capital require to place a trade)

Margin call occurs when an account has no free margin to execute a trade (free margin is margin minus equity). This means a trader has no money in his account to open trades and therefore it I expected of him to deposit more money.

Brokers will often alert you when the margin level of your account has fallen below the minimum threshold.

Question 2

Practically demonstrate your understanding of Risk management in Trading.

- Briefly talk about Risk management

[Be creative (I will expect some illustrations]

- Use a Moving averages trading strategy on any of the crypto trading charts to demonstrate your understanding of Risk management.(screenshots needed)

In finance trading, one of the most important things traders need to learn is how to manage risk if he will stay long in the market.

Risk management is the process of strategically managing and protecting one's account in order to maximize profit and minimize loss.

It is pertinent to know that traders need to devise ways by which he will manage his account so as to have stability and minimize profit.

The aim behind risk management is to minimize loss as low as possible. In finance trading, loss is inevitable, but when a trader have a proper risk management, he will minimize loss and thereby maximize profit.

A trader can manage his risk by doing these:

Have a Trade Plan

This is one of the first things a trader needs to do I order to have a proper risk management. This is often the first plan. You don't go into hunting without devising ways to hunt. You will get wounded if you do. So how do we plan our trades?

We have thousand of assets to trade and many markets. A trader must first know which market he wants to go to. I'm going to be trading cryptocurrencies, currencies or stocks. He must first decides that. After deciding which market to go, he needs to also know that he cannot trade all asset in cryptocurrencies. It is impossible!

The the next thing to do is to add the crypto assets he want to be trading to his portfolio. He will be carefully analysis both with technical and fundamental and monitoring these assets. He can also use watchlist to do this. Having a watchlist will help traders organize himself to able to check what is important to him.

It is important that traders plan their trade. No matter how good the strategy the trader is using is, if he doesn't have a plan such as as knowing the market to trade, deciding which crypto pairs to be trading, having a portfolio and watchlist etc., he would always end up frustrated and not making profit or being profitable as he ought to.

Another important thing in planning your trade is to know what type of trader you are. This is very important! Are you the type of trader who doesn't like to be looking at the chart every time. Then you may not enjoy intra day or scalping. So, you need to decide for yourself so you won't get disorganized.

What Can You Risk

Thanks next thing to do is to decide how much he is able to risk. The most frustrated traders are those who have no sense of what they can risk. Before you even deposit with a broker, you must know you can risk the entire amount you want to deposit. That's why it is not advisable to put all your life savings on trading. For example if all you have is $20,000 and you can give $2,000 free to a stranger, that means if $2,000 leaves your hand, it won't affect you, then you can go ahead fund your account with a broker.

Then after deciding on amount you are willing to use to fund your account, you need to decide the amount you can lose per trade. Failure to do this may end you up in blowing your account.

Let's take for example you funded your account with $1,000. And you have decided that, you want to be risking just 2% of the entire amount. This means, you want to be risking 2/100 ×$1,000 which is $20. It means per trade, you can lose $20. Cool! You know what this means? You will be able to trade for 50 times before your entire capital is exhausted only if all trades go against you.

If you want to go further, you will have to decide how many trades you want to be taking per day. You may decide to be taking just two trades per day. Which means no matter how promising a trade may look like, once you have taken two trades, you are out of the market and you will close your gadgets.

Setting Stop Loss and Take Profit

One of the things that will help traders in managing their risk is the use of stop loss and take profit. It is only a gambler that will take trades without setting stop loss. The use of stop loss will enable to minimize loss when trade go against a trader. But for someone who doesn't set stop loss, his entire account may be burned.

Setting take profit is also very important. Taking profit is to know when to exit the market and allow market to breathe. When a trader doesn't set take profit, the trade may reverse, even after he has been in profit, and go against him.

Managing Trade

It's also important that traders manage their trade properly after the open a position. You don't just open a position without monitoring how the price is doing. If not all the times at least once in way. The reason for monitoring is to watch your strategy as the trade is running. For example, you are use stochastic indicators to enter a buy trade and you know if the golden cross should occur at overbought region, the trade may reverse. As soon as you see it enters and price hasn't reached your TP, you can lock in some profits by trailing your stop loss or take partial profit.

The process of adjust stop loss strategically above the entery point is referred to as trailing stop loss. And taking partial profit is removing some profits out so if the trades didn't get to TP before it reverses against you, you will still be in profit.

Use a Moving averages trading strategy on any of the crypto trading charts to demonstrate your understanding of Risk management.

For this task, I am going to use meta trader 4 (MT4) platform.

On mt4 platform, click on the pair you want to add moving average to. For me, I want to use ETHUSD. Upon clicking on it the chart will open, click on "f" circled with red in fig below at the right side of the chart. You may find yours at the top if your chart is in Portrait form.

Fig. 6: ETHUSD plain Chart/ Mt4

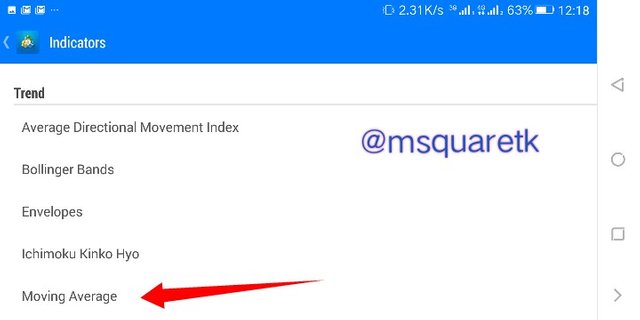

Upon clicking on taht "f" icon, aa page will appear containing list of indicators. Navigate to the trend indicator and click on "moving average."

Fig. 7: Indicator Tab / Mt4

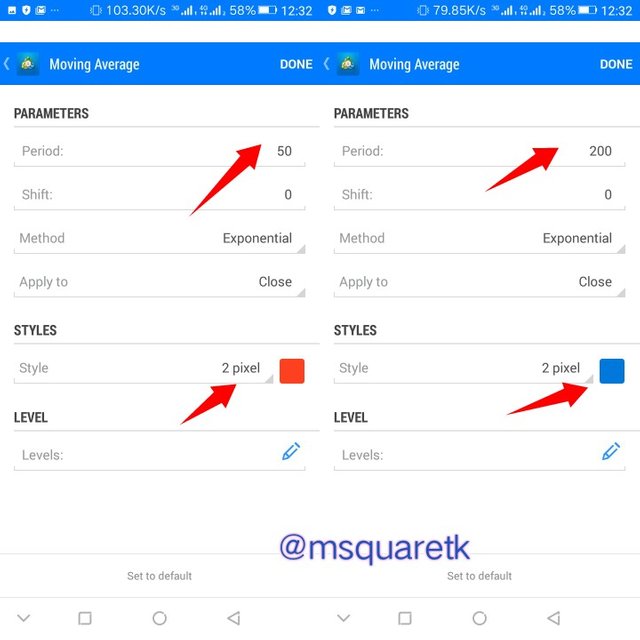

Once you click on it, you will see where to edit your indicators. Enter the length or period of your moving average, choose color, method and all other things. Then click "Ok". Repeat the process to add the second moving average. In the fig below, I'm choosing 200 and 50 as the length and exponential as the method, and blue color for 200MA and red color for 50MA.

Fig. 8: Moving Average Indicator settings / Mt4

Then once you set everything perfectly, click done or OK. The moving average would have been added to the chart. Let's see how they are on the chart in the fig below.

Fig. 9: 200 MA and 50MA on ETHUSD chart / Mt4

Then we are done with adding moving average to the chart.

Now let's see how these indicator can be used to demonstrate understanding of risk management.

Fig. 10: MA Strategy to Demonstrate Understanding of Risk Management / Mt4

In fig. 10 above, the asset ETHUSD has been in downtrend for some time. We know that when market has been in Downtrend for a long time, it will come to a time where reversal will happen. When reversal wants to occur, the moving averages often cross. The cross is known as golden cross.

As Soon as the golden cross occurred, I will take a buy trade(Instant execution) and put my stop loss below the golden cross knowing that if it price should fall below the cross, the buy is invalidated and take profit at the closet resistance level.

In fig. 10 above, after the golden cross, I simulated a buy trade. I entered a buy at a price 2207.70 and put stop looking at a price 2051.19 and take profit at 2884.88.

Let's quickly do simple calculation to know what I am risking and what i will be getting.

Entery Price – Stop Loss price = Risk

2207.70 – 2051.19 = 156. 5 approximate to 157

Hence , Risk = 157 pips.

Also, for the reward:

Take Profit point – Entery Point = Reward

2884.88 – 2207.70 = 677.18 Approximate to 677

Hence, Reward = 677 pips

As it can be seen from the calculation, I'm risking 157 pips to get 677 pips.

Now the risk- reward ratio will be:

157/677 which is about 1:4.3 approximate to 1:4

So, this means, I am risking 1 to get 4.

Practically, let's say I use standard lot size (1 lot), if the trade go against me, I will lose $157 and if it goes in my direction, I will have profit of $677.

We can see the importance of setting stop loss and take profit. It will help us maximize profit and minimize loss.

Conclusion

Risk Management is an important aspect of trading which every trader needs to learn at early stage of their trading. If a trader has a proper risk management, he will stay very long in the market. Risk Management will help trader minimize loss and maximize profit.

If a trader doesn't have proper risk management, he will always end himself up in frustration. It doesn't matter how mighty his strategy is, if he doesn't put this thing into practice, he will always experience losses more than profits. It is therefore pertinent that each trader learns risk management properly.

Thanks to Professor @yohan2on for taking us the course "Risk Management." I must say I have learnt one or two things. It's always great to learn new things. Thank you, Prof.

CC:@yohan2on

Written by @msquaretk

Hi @msquaretk

Thanks for participating in the Steemit Crypto Academy

Feedback

This is excellent work. Well done with your practical study on Risk management.

Thank you Professor @yohan2on for the review. I am glad I attended your class. Your methodology of teaching is great. Well-done, Prof.