[Risk Management and Trade Criteria] || Crypto Academy S5W7 || Homework Post For Professor @reminiscence01|| BY @msalmanjaved

Hello Everyone!

Greetings to All

I Hope everyone is doing well!

Today i am going to complete the Home Work Task of Season 5 Week 7, and task is Related to "Risk Management and Trade Criteria" given by the Professor @reminiscence01.

.jpg)

Question# 1

What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?

One of the most important parts of trading is managing the risk and determining how much you can lose. Different traders deploy different strategies for risk management still others do not follow the rules of risk management and end up losing their whole capital.

Risk Management is defined as planning your trading in such a way to minimize the chances of losses even before the trade is taken. This include using a set of tools and strategies to monitor your trades and define limits in terms of both profit and loss. Defining the level of profit prevents greed and throwing a healthy trade setup into the bin and setting limits for loss make sure that you do not lose beyond your capability.

In case of Crypto Trading there are a lot of parameter which allows you to trade after complete assessment of market, analyzing the condition of market, by analyzing the trends and patterns of market in order to mitigate the chance of lose while trading. One thing is there no one can change the fate of person but proper assessment of situation by available tools and techniques can make sure the positive results at the end and this is Risk Management.

Many tools that traders use in risk management, setting stop loss and take profit levels and defining the risk and reward ratio. It is recommended for every trader to learn and have a proper knowledge of risk management way before starting actual trading. In the essence risk management allows the trader to take moves confidently and knowingly.

Some of the Major Benefits of Risk Management

Understanding of Market

Trades placed using the risk management makes sure that you understand the market structure and trends to place accurate trading points because these market structures are used in determining the stop loss and take profit levels.

Able to Perform Smartly

The most obvious benefit of risk management is that it helps in minimizing losses as traders have predefined levels where they should exit the trade there are fewer chances of losing more than what can be tolerated.

Better Decision Making

Risk management tools such as the stop loss and take profit prevents a trader from trading using the emotions and allows the user to use market data and indicator to take sensible decisions. When the price touches a certain profit or stop loss level it automatically exits the position preventing the trader from getting too greedy

Confident Moves in Trading

A trade who defines his limits using the risk management strategies do not chase the price but they chose trading pairs based on supportive market structures and they trade confidently knowing that their capital will not be impacted much even if the trade did not go in their favor.

Question# 2

Explain the following Risk Management tools and give an illustrative example of each of them ?

a) 1% Rule.

b) Risk-reward ratio.

c) Stoploss and take profit.

a) 1% Rule.

You might have noticed that while placing an order you can decide upon the risk ratio. The 1% risk ratio means that you are predefining the risk to be tolerated to be 1% of your total capital. It is a commonly used risk management strategy. This is applied to every trade you take under the following risk. This is turn defining the amount that you can tolerate to loss if the trade does not go the way you planned. The percentage however depends upon choice and many traders even use 2% or 3%.

Example

For example, I have a total of 500$ in my account the 1% will be 5$ so if a open 5 trades using the 500$ capital I will risk a total of 25$ and will lose this amount if all of the trades don’t go well.

Similarly, if I set the risk to around 10% which will be 50$ for the 5 trades that do not go well I will lose 250$ if all the trades did not do well.

b) Risk-Reward Ratio

In risk reward ratio traders are to set a ratio based on their invested amount as to how much amount they are will to get or lose. Different traders use different ratio depending upon the risk they can tolerate. The most commonly use risk reward ratios are however 1:2, 1:3. What many traders fail to understand is that these ratios should always be set prior to the trade based on the indicators and market structure. The risk should always be lower than the reward for a manageable and ideal risk management planning. Many traders even use 1:1 risk reward and in my view this setting is also justified based on the market structure and conditions.

Example

For example, if a trader wants to trade on a capital of 100$ with a 1% risk then the reward according to 1:2 ratio should be when this amount of 10$ doubles to 20$.

c) Stoploss and Take Profit

Stop loss and take profit is another very crucial risk management strategy. In this a trader sets take profit and stop loss levels in case the trade goes either way. When the trade goes in favor it exists as soon as it touches the take profit and in case the trade goes against the trader it exists as soon as it touches the stop loss. Thus, this helps the traders in both ways. In one way it prevents excessive loss and in the other it prevents the trader from becoming too greedy.

The stoploss and take profit levels are determined using the market breakouts, indicators and trends and then these levels can be used to determine the risk and reward ratios.

Many traders do not consider this important to set stop loss and take profit prior to entering the trade which is not at all recommended.

Example

traders use different indicators for setting stop loss and take profit such as the nearest support and resistance levels. The only thing to be kept in mind while setting stop loss or take profit is to not set them too tight so that the trade exists even before heading in any direction.

Question# 3

Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required) ?

a) Trend Reversal using Market Structure.

b) Trend Continuation using Market Structure.

a) Trend Reversal using Market Structure.

In the BTC/USDT chart below we can see the market was moving bearish after price correction but then the price action crossed the EMA line to go above it.

The Entry Criteria

I waited for the formation of bullish candle. Then I executed the buy order using the 1% rule. The stop loss and take profit were set around the nearest support and resistance levels.

The EXIT Criteria

After getting the profit margin which is 2% I can exit the market, but in order to take more profit we can wait for more while but as the price will start to go down as from the starting price to stop the loss we can exit from the market.

The trade details are as follows.

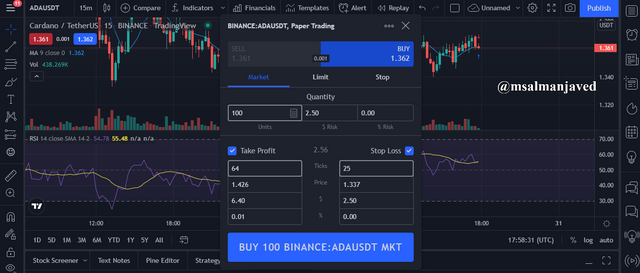

b) Trend Continuation using Market Structure.

Below I have attached a screenshot of ADA/USDT chart that is showing an uptrend. The stop loss and take profit are set around 1:1 based on the previous support and resistance levels.

Market Entry Criteria

I used the 1% rule here. The total units invested are worth around 100$. the bullish trend was confirmed using the high highs and higher lows market structure.

The EXIT Criteria

After getting the profit margin which is 2% I can exit the market, but in order to take more profit we can wait for more while but as the price will start to go down as from the starting price to stop the loss we can exit from the market.

The trading details are as follows.

The trade is done using the paper trading demo account on tradingview.com

Conclusion

Risk management is very crucial for safe trading. It brings confidence in the traders and prevent irreparable losses. Experienced traders are always found placing accurate stop loss and take profit levels and predefined risk reward ratios prior to entering a trade. There are various risk management tools that you can choose from as discussed in the post above.

I hope I would get some good remarks from professor on my effort.

Note : All screenshots are taken from tradingview.com and all the Images that i have used have been citied and source have given with every image.

Cc :

Professor:

@reminiscence01