Zethyr Finance - Crypto Academy / S4W8 - Homework Post for @fredquantum | By @moohsin

Assalamualaikum,

Hello and welcome fellow steemians to my post. I am good and healthy and I hope so that you all are also good. Today I am posting again in @cryptoacademy. I hope that you all will like it and give some of your precious time to give it a read. This is a homework post given by Professor @fredquantum in which he fully describes Zethyr Finance and how to borrow and supply on this network by linking our Tron wallet with it.

What is Zethyr Finance?

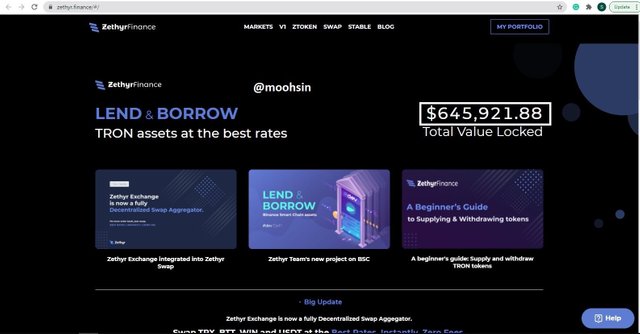

Zethyr Finance is a dApp which is a decentralized money market protocol that allows its user to swap TRON blockchain assets to other assets with less fee. Zethyr offers two main functions to its user i.e Borrow and Supply. A supplier earns deposit their tokens in the system are also observed to be rewarded in the Zethyr Finance and when a user borrows any asset he has to pay interest while returning the asset.

Zethyr Finance allows its user to use their Tron assets to collateralize and swap them with other TRX or available assets.

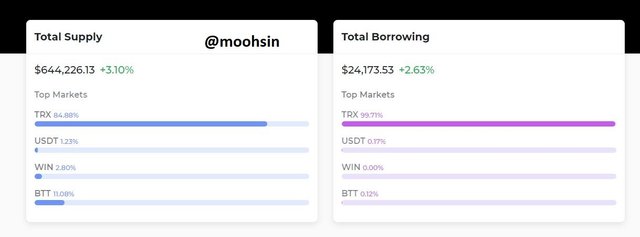

At that time, the supply and borrowing in Zethyr Finance are $644,226.13 and $24,173.53 respectively.

As of now, it supports only TRX, USDT, WIN, and BTT and is now a complete Decentralized exchange that only swaps different tokens. It provides minimal transfer fees as compared to other decentralized exchanges like JustSwap and Usswap. The main difference between JustSwap and Zethyr is that JustSwap is the product of Tron foundation but Zethyr is a third-party developed system based on Tron blockchain. ztoken are used as a liquidity token on this platform like for USDT it provides zUSDT tokens.

What are the features of Zethyr Finance? Discuss them. What's your understanding of DEX Aggregator?

Zethyr Finance have basic four features which help user to earn more profit through it. These features makes a difference for Zethyr in the dApps market.

- Supply and Borrowing

- Zethyr Swap

- Zethyr stable swap

- Zethyr token (ztoken)

Supply and Borrowing:

The main feature of Zethyr Finance is that users can supply or borrow different tokens and provide liquidity to the pool and these users are also rewarded with an APY when the token is locked. Right now, there is $634,520.65 value of assets locked.

For borrowers, there is a condition that has to be known by everyone that after borrowing the price of the assets falls then the Zethyr will automatically liquidate the assets in order to overcome the debts. We have in extension the Binance Smart Chain assets like WBNB, BUSD, CAKE, etc all in the pool.

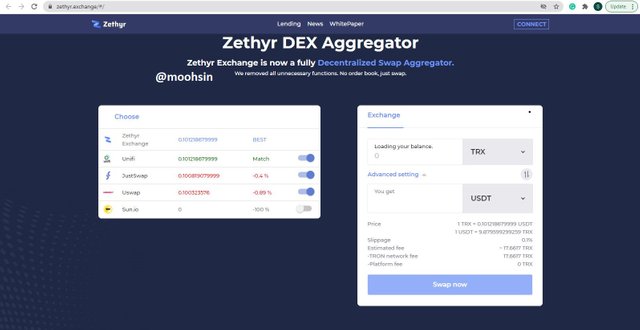

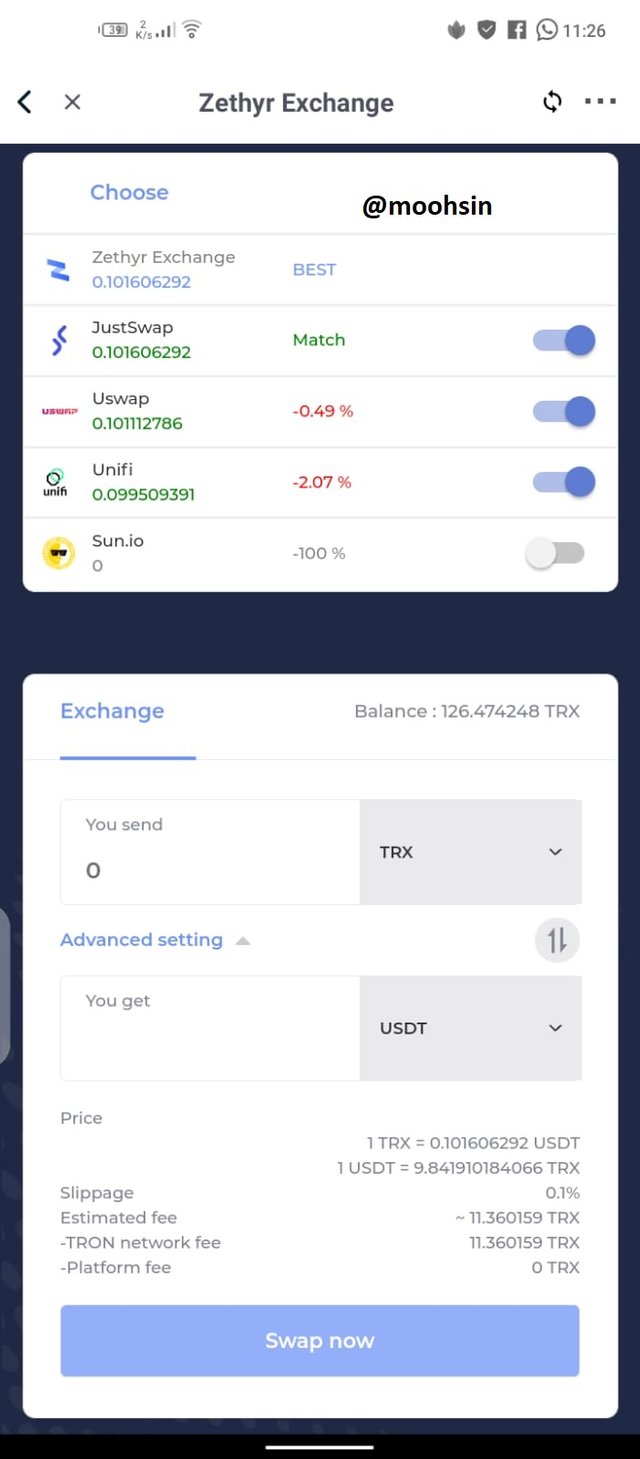

Zethyr Swap:

This is the Zethyr Swap feature that uses the Zethyr version 2.0 to swap tokens in its system. This gives instant and zero fees of Tron assets at best rates when swapped using the Binance and Justswap platforms. Zethyr allows the swap of tokens like TRX, USDT, WIN, SUN, WBTT, JST, and many more tokens.

Hers you can see that the fees of TRX to USDT swap is 17.6 TRX.

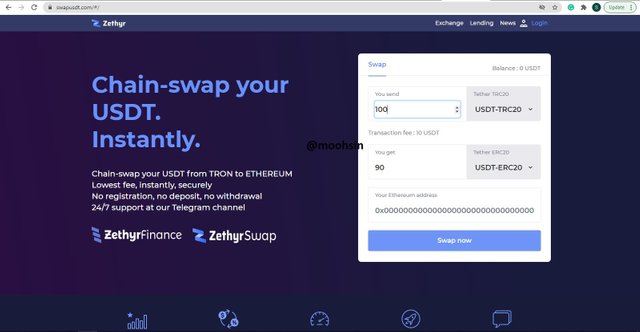

Zethyr stable swap:

The Zethyr Finance and Zethyr Swap create a Zethyr stable swap that supports stable coin cross-chain functionality. That means only stable coins can be swapped here and we all know that there is only one coin USDT that is stable so at the stable swap, the swapping of stable coins from the TRC-20 to ERC-20 in its blockchain is only provided by Zethyr Finance.

From this swap, we can interchange how much we wanted to. The transfer fee on every transaction is 10 USDT. This means we have to be intentional when using this feature given its relatively high fees. But in all, it guarantees relative scalability and security of assets.

Zethyr token (ztoken):

When we supply assets on Zethyr Finance, the supplier is rewarded with the ZTokens which conforms the TRC-20 standard and can be used just like other tokens. This can also guarantee collaterals should in case we want to borrow from Zethyr Finance.

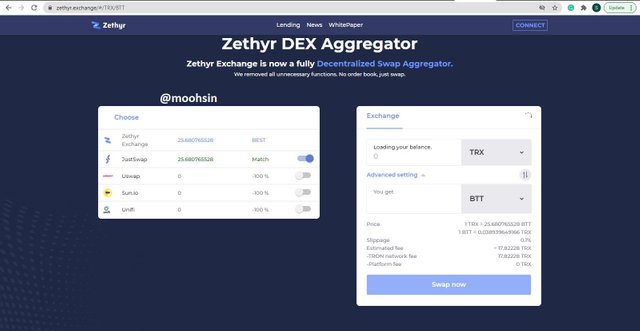

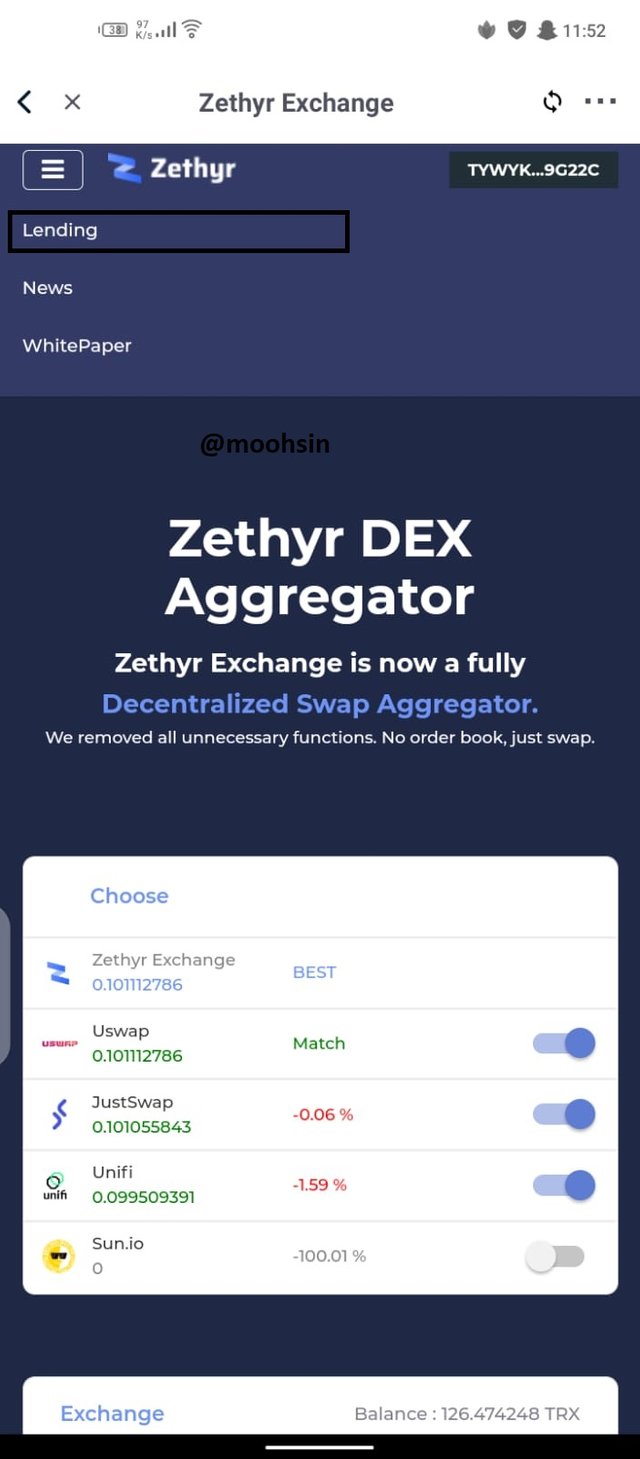

The Zethyr DEX Aggregator:

After the merger of Zethyr Exchange with Zethyr swap, a new version i.e Zethyr DEX aggregator because it aggregates various swaps and exchanges (UNISWAP, UNIFI, JISTSWAP) to keep markets liquid and ensure better price and yield. This merger gives rise to the DEX aggregator that means that the protocol does no longer uses the Order book Model for its operation rather all swap and exchange activities can now be done on the Zethyr DEX Aggregator.

As you can see that when I use BTT for exchange with TRX then it shows JustSwap as the best match because it provides exchange at the best rates that bring more scalability and easiness for users.

Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

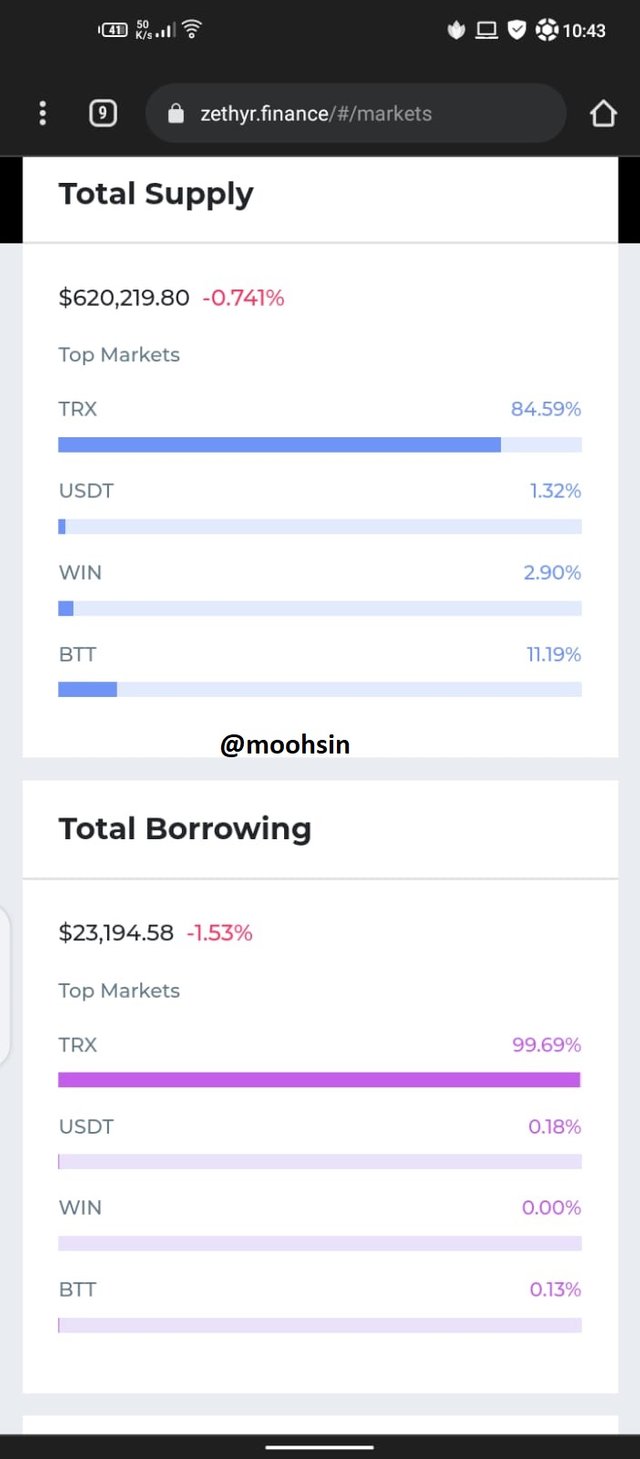

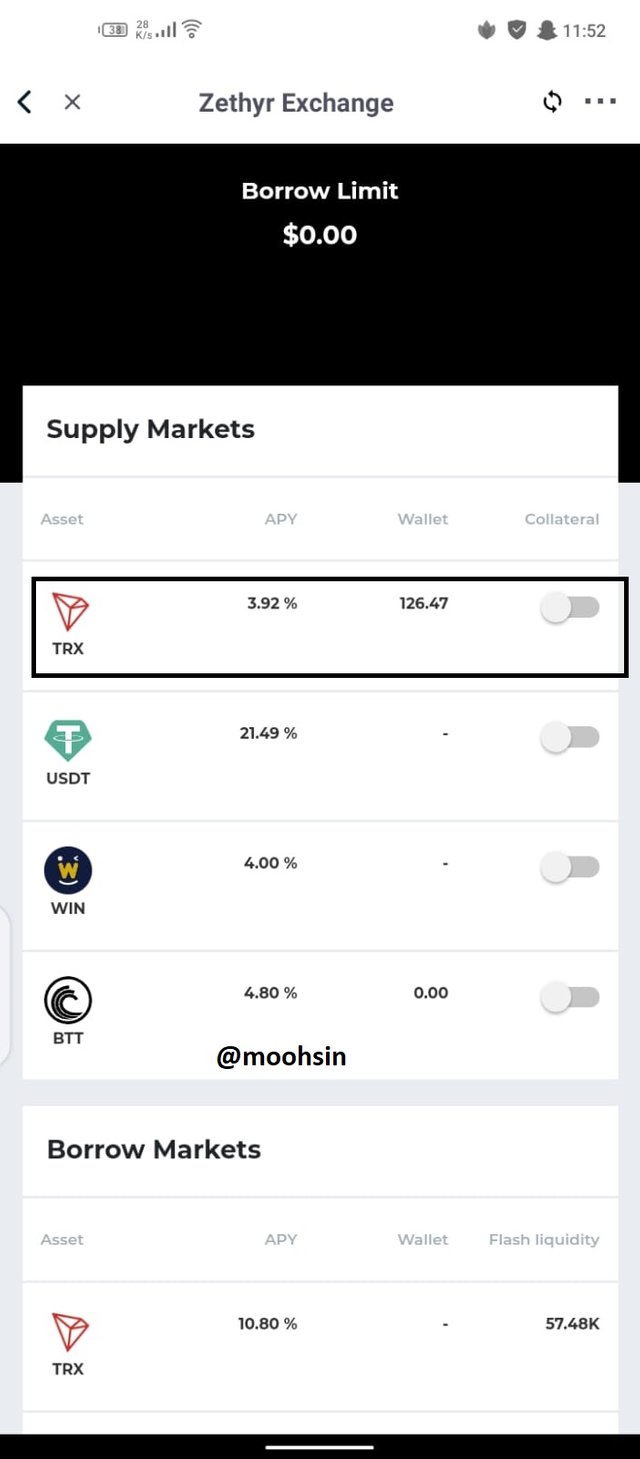

As for now I can explore markets, zethyr finance supports only four markets and they are TRX, USDT, WIN, and BTT. These four markets are available for Borrow as well as supply. In order to explore markets, we have to go on [Markets](https://zethyr.finance/#/markets) on Zethyr Finance website.

The supply market has a total supply of $620,219.80 at the time when I am writing this post and total borrowing of $23,194.58. This also went further to give is the intrinsic value of those assets that make up the Zethyr Finance ecosystem which is built on the Tron Network.

.jpeg)

| Market | total supply(in USD) | supply APY | borrow APY | total Borrow (in USD) |

|---|---|---|---|---|

| TRX | 539,175.57 | 4.55% | 10.80% | $23,470.34 |

| USDT | 6,836.59 | 26.15% | 8.00% | $41.99 |

| WIN | 13,109.21 | 13.55% | 23.00% | - |

| BTT | 68,120.40 | 6.46% | 20.00% | $29.11 |

If we compare the APY's of both supply and borrow processes we can observe that the supply %APY follows a pattern. The lower the supply percentage %APY, the higher the total supply captured.

The %APY for the given asset is observed to directly correlate with the rate of token adoption, be it in the Total Supply or total Borrowing. In addition, we can see that the USDT has the best Supply as well the best Borrowing %APY with 26.15% and 8.00% respectively.

Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

- launch the Tronlink wallet App.

- Click on the Discover icon below your screen.

- In the Discover section, go on the Exchanges bar and click on See more, and then you will find Zethyr Exchange there.

- From the landing page now, we can observe that the dApp is connected with my Tronlink wallet account.

- And when we scroll down we can see more of the screen interface with the exchange phase.

.jpeg)

.jpeg)

Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

zTokens are native tokens of Zethyr finance which we get after supplying any of the tokens available on Zethyr finance. Zethyr (ZTR) is a TRC-20 standard token given to its operation and governance built on the Tron Ecosystem. zTokens are given to users for supplying their assets in liquidity pool in the ratio of 1:1, if we supply TRX here, then we get zTRX. If we supply USDT then we get zUSDT. When we withdraw the supplied token on Zethyr platform we need to burn ZTR token by the ratio of 1:1 and the asset is released. The interest earned while supplying any token is credited automatically to the wallet in the form of Z tokens. With zTokems user can perform all the operations that can be performed with the underlying asset.

Similar to zTokens, jToken are considered equivalent to their corresponding tokens and all benefits can be availed by holding these which are acquired for supplying assets to the liquidity pool. supply of TRX to JustLend yield us jTRX in the ratio of 1:1.

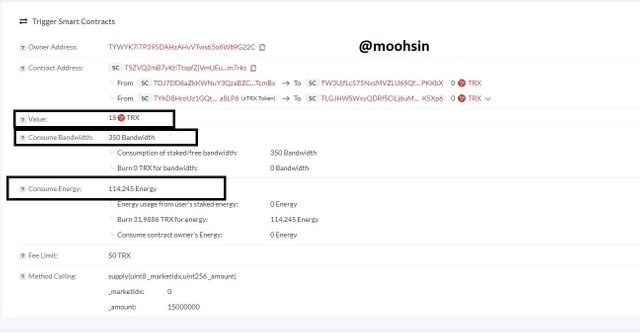

Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

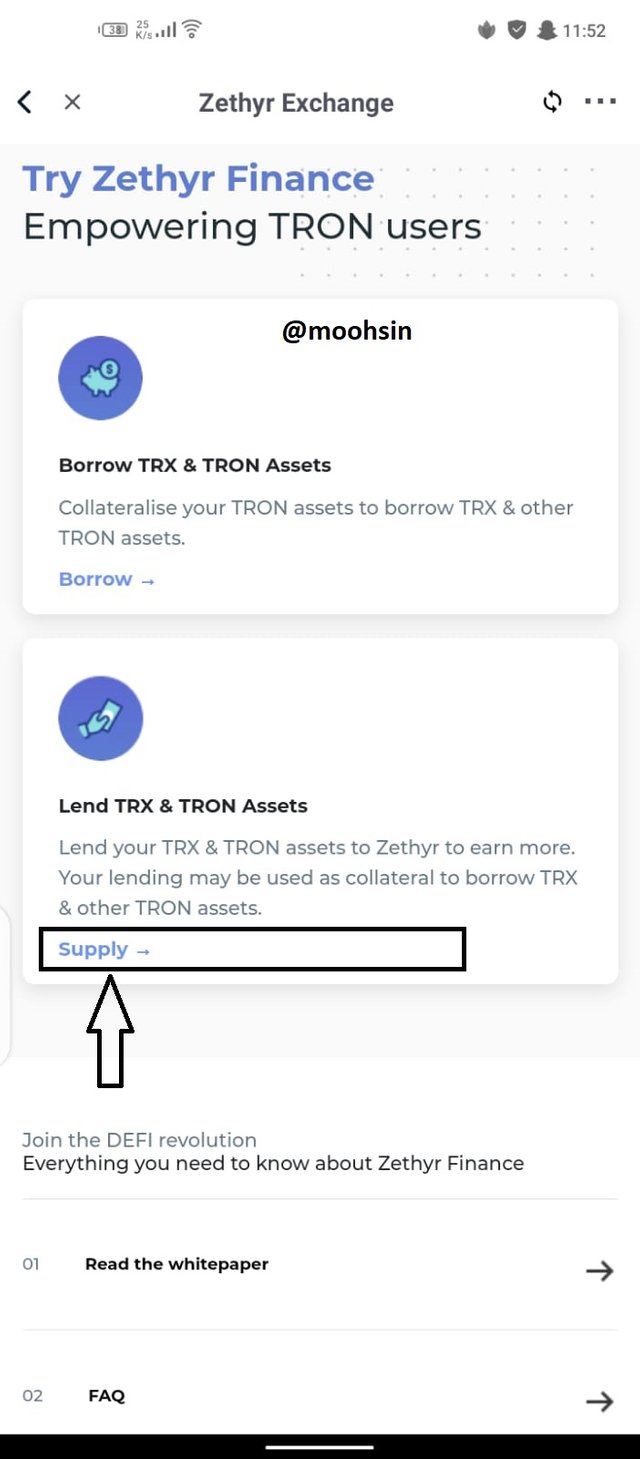

From the main page of Zethyr Finance, click on top left corner, a drop down menu will open. Select "lending *option from the menu.

On the next page , we get to see the supply and borrow balance which is zero in both the sections as I haven't performed any transaction yet . Scroll down the page and we get to see option by the name of "Supply (lend) TRX and Tron now* . Click on Supply.

We need to enable the supply option first . Click Enable and complete enable process by submitting TronLink password.

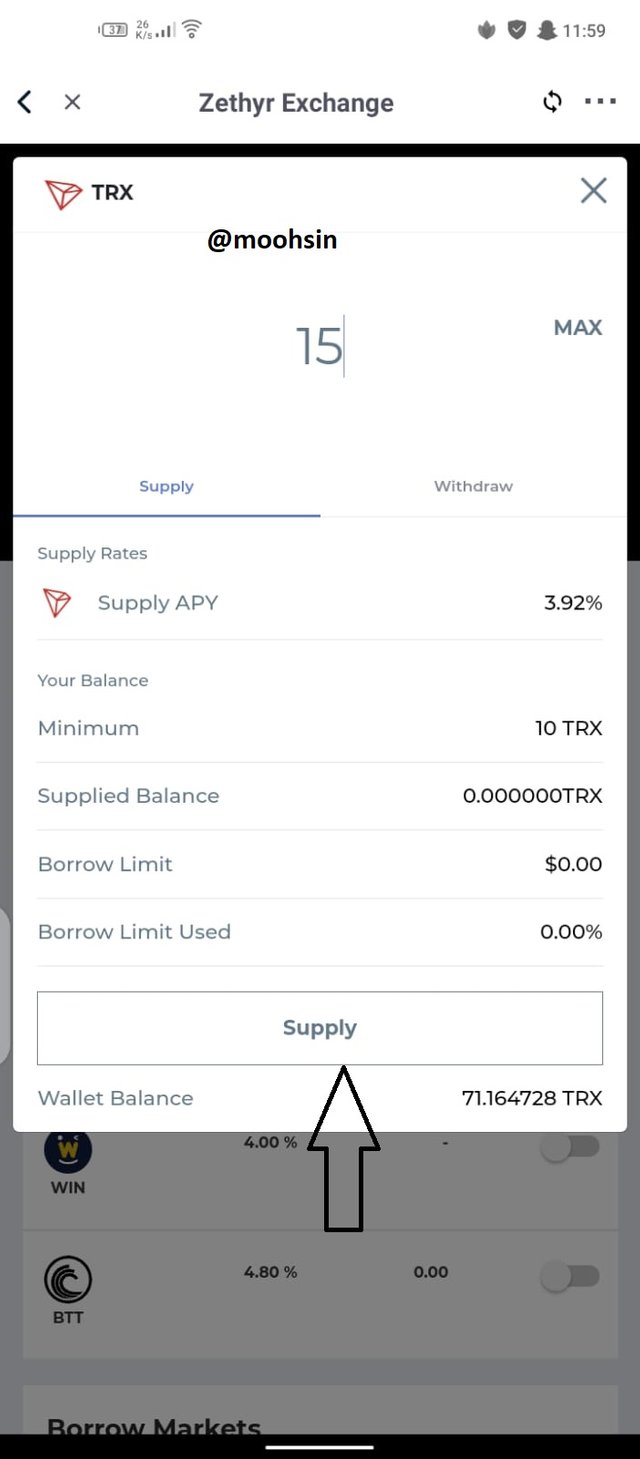

Next we get to see the list of supply markets available along with APY. I choose to supply TRX, so I clicked on TRX.

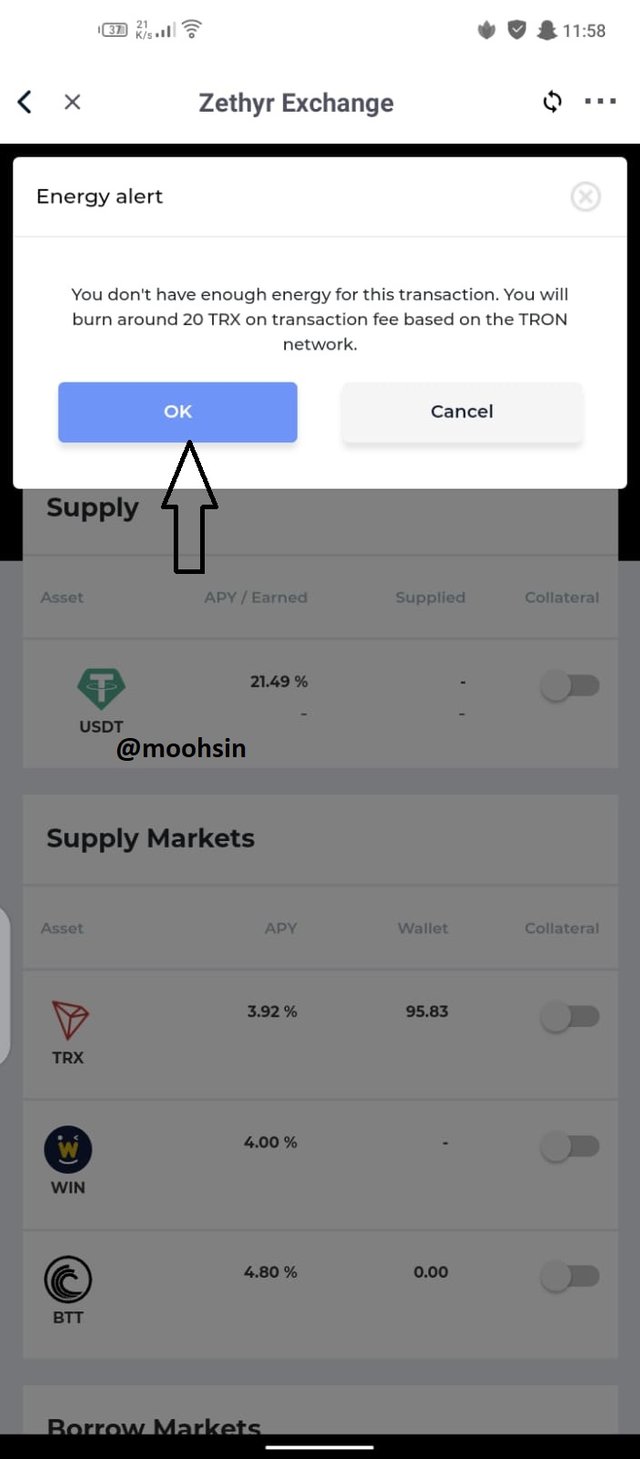

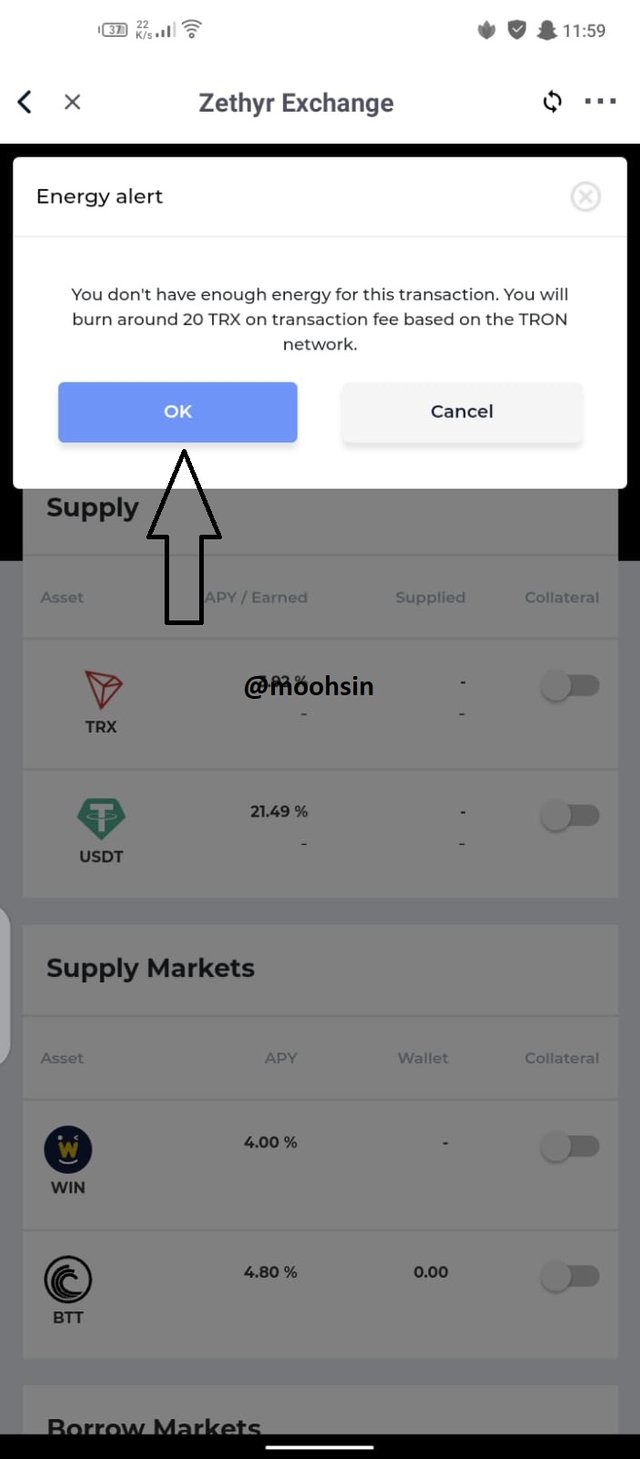

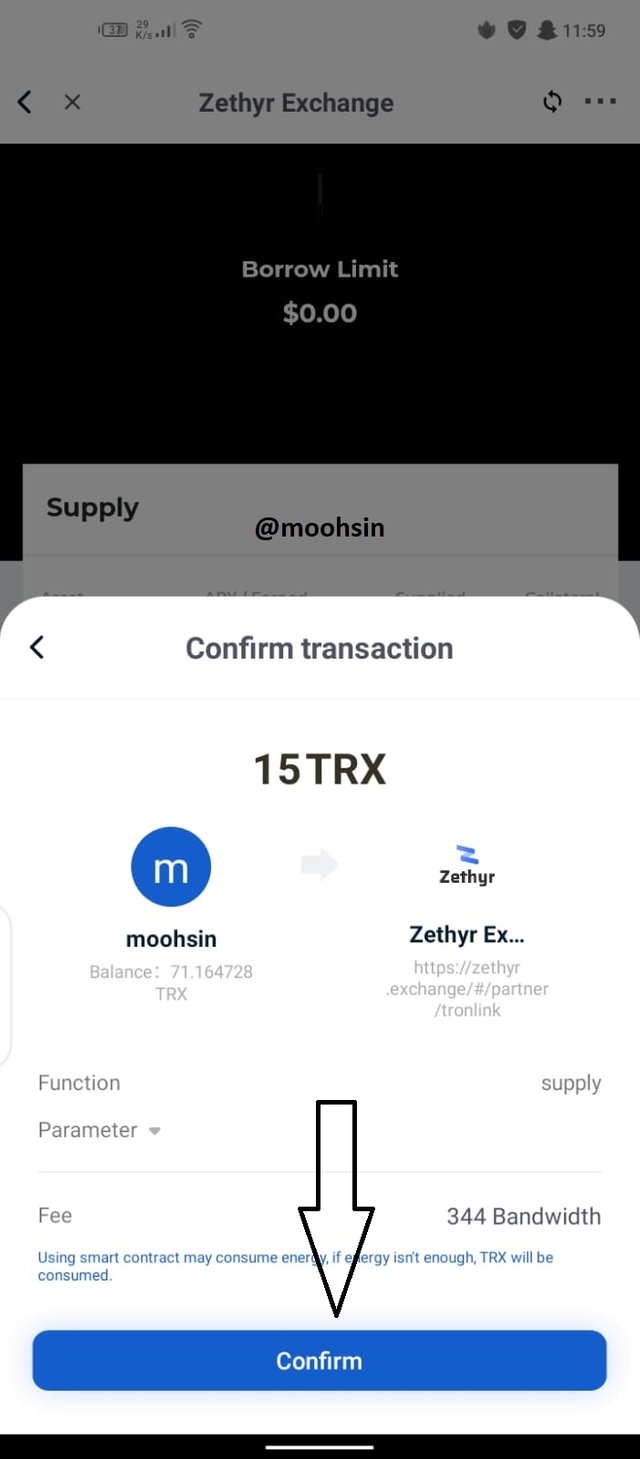

Enter the amount of TRX to be supplied and click on supply. I choose to supply 15 TRX. Next click on confirm after checking the details like energy , bandwidth and TRX .

Here are the bandwidth and energy consumed by the transactions on tronlink platform.

The link of transaction is, https://tronscan.org/#/transaction/d15e47f21b862319f3c861d459f09fb8a30ce29f9d9a1aa2a22f7eede282a1cb

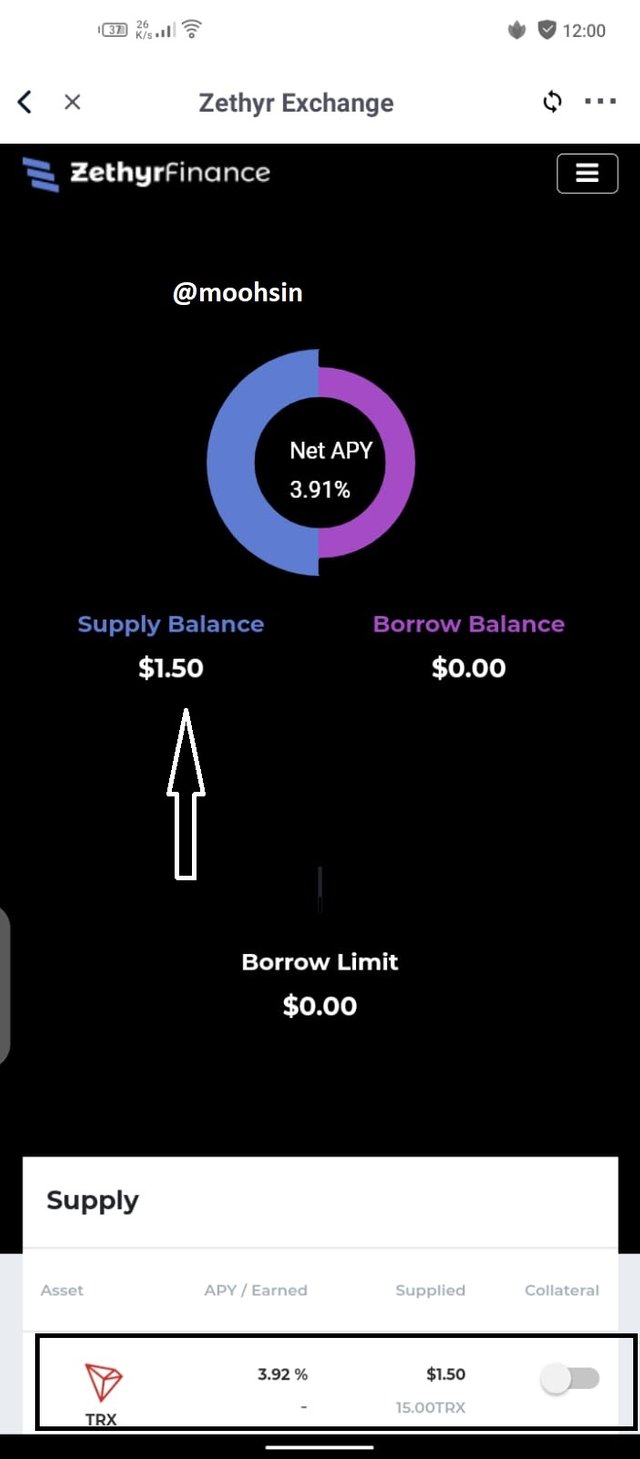

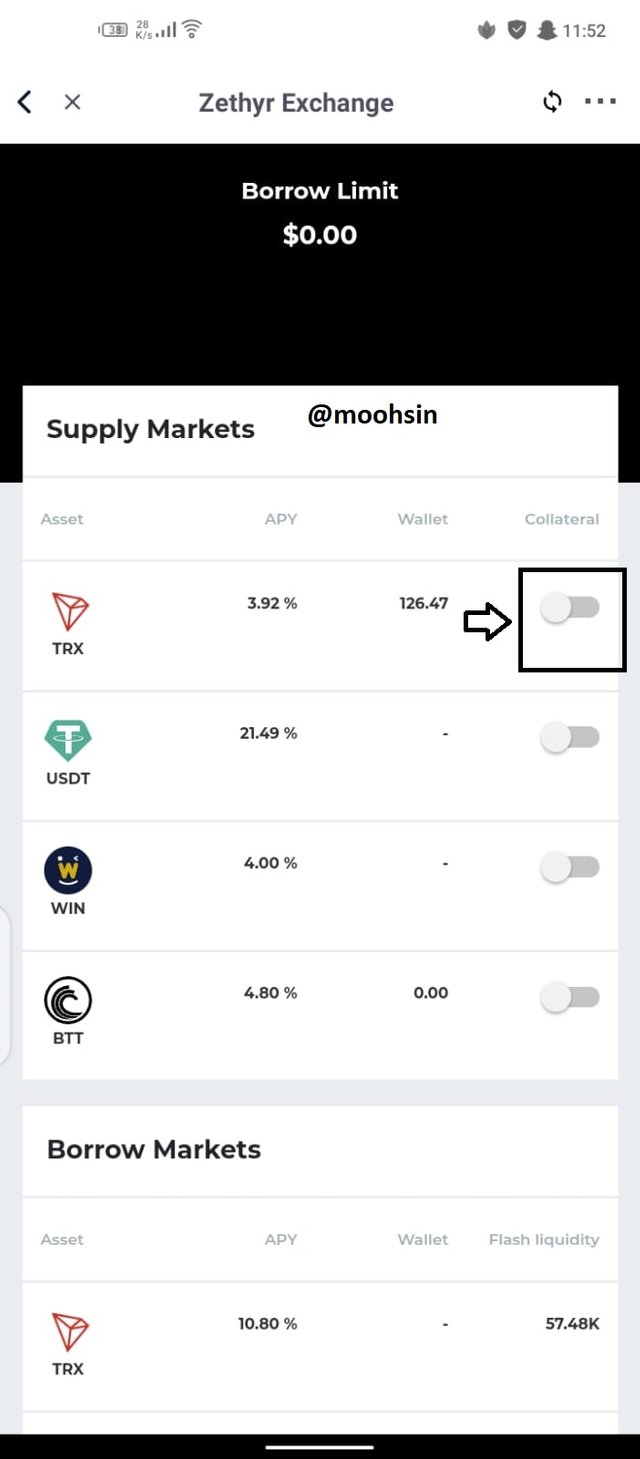

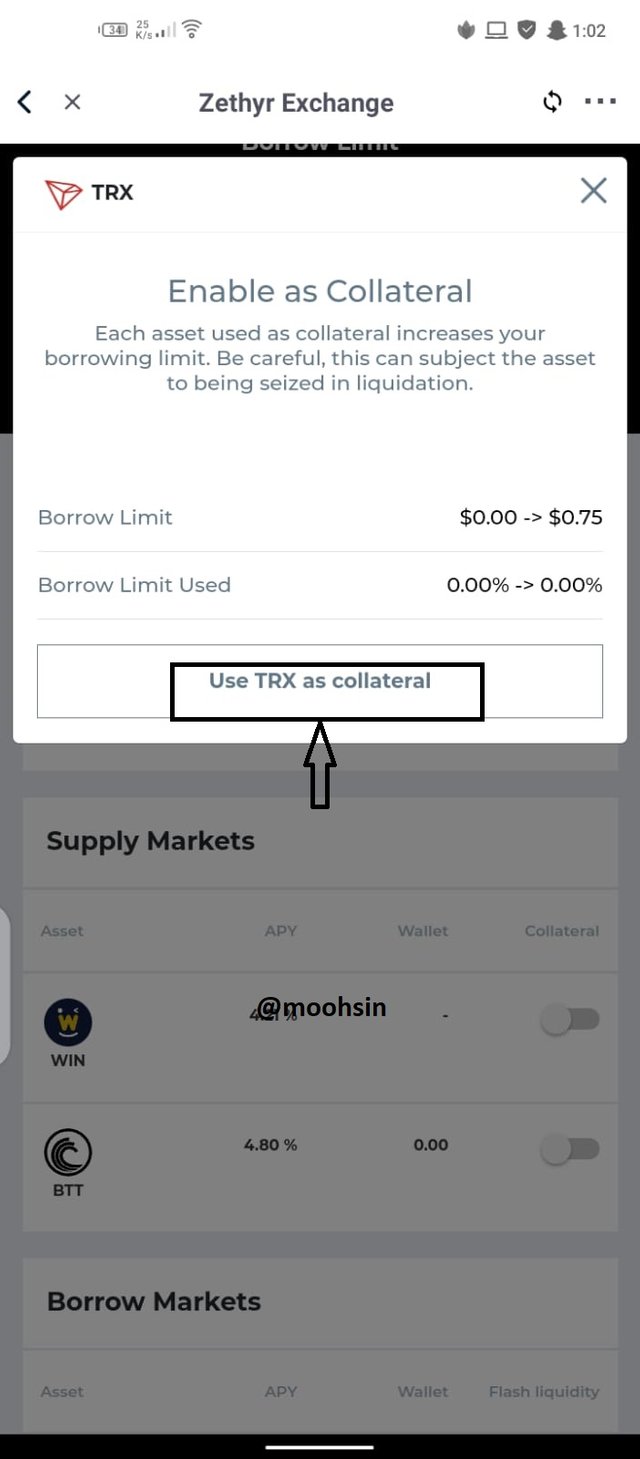

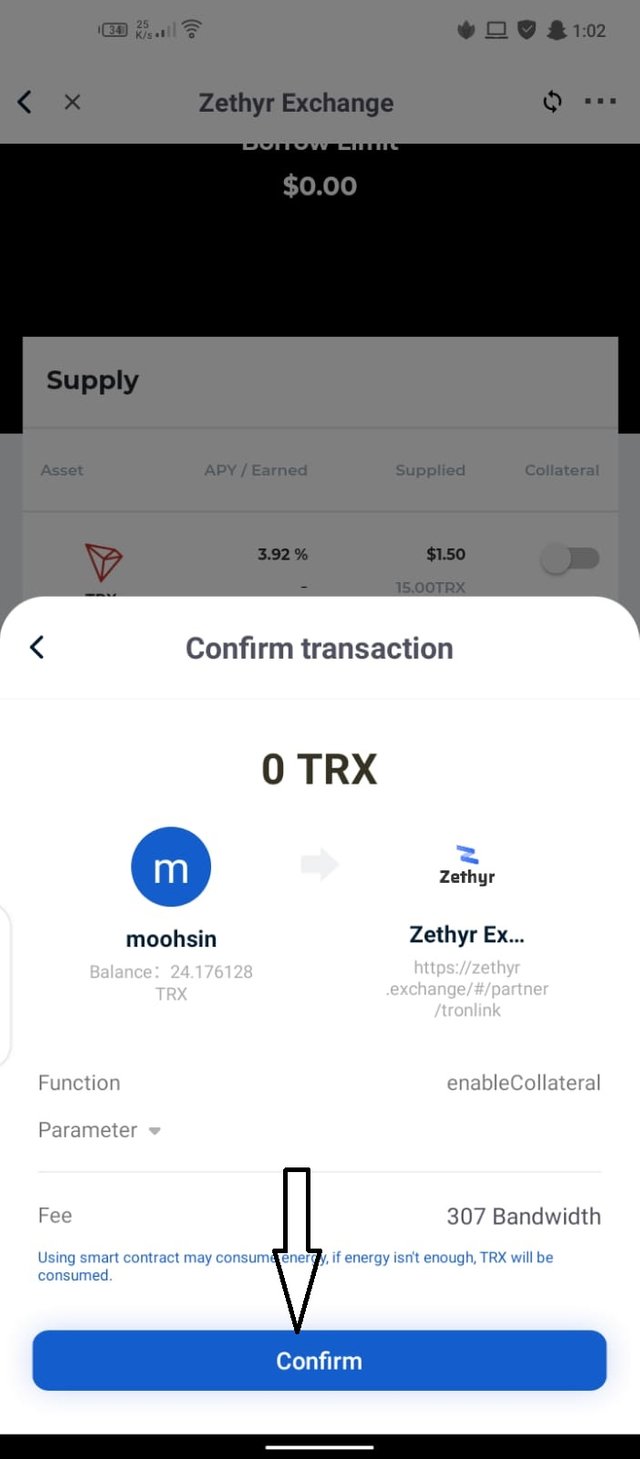

Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

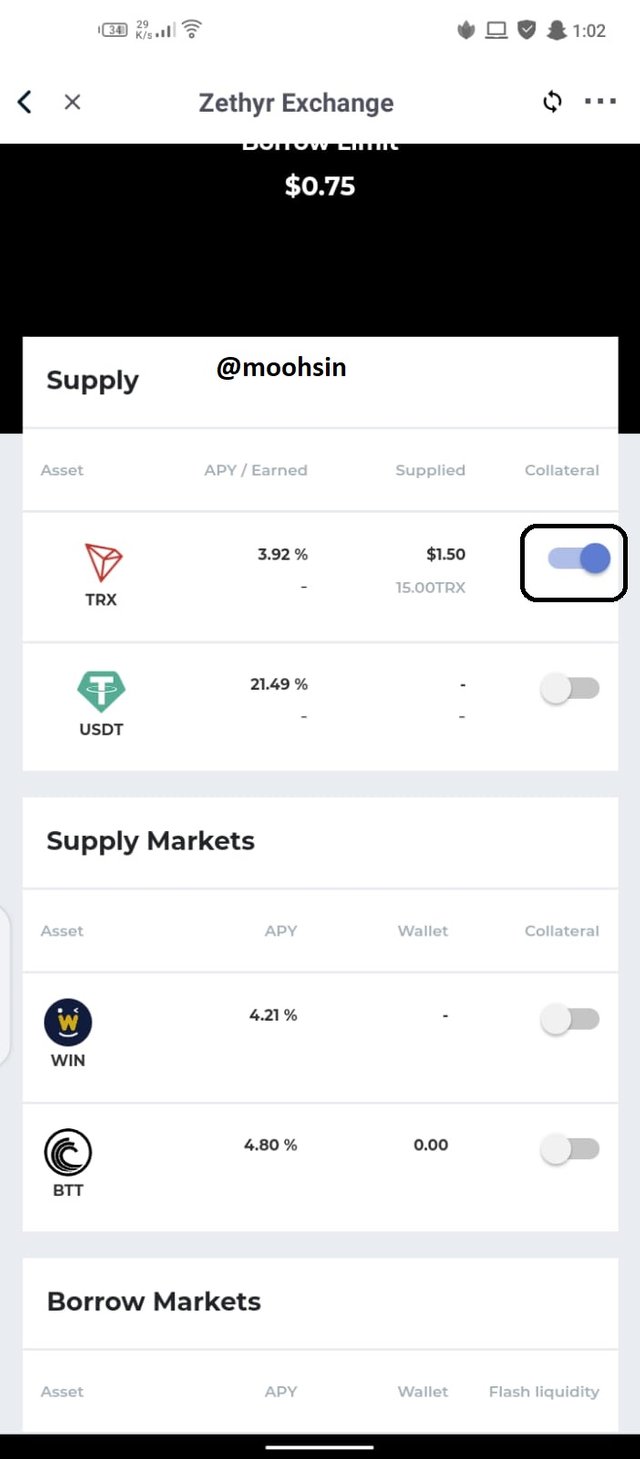

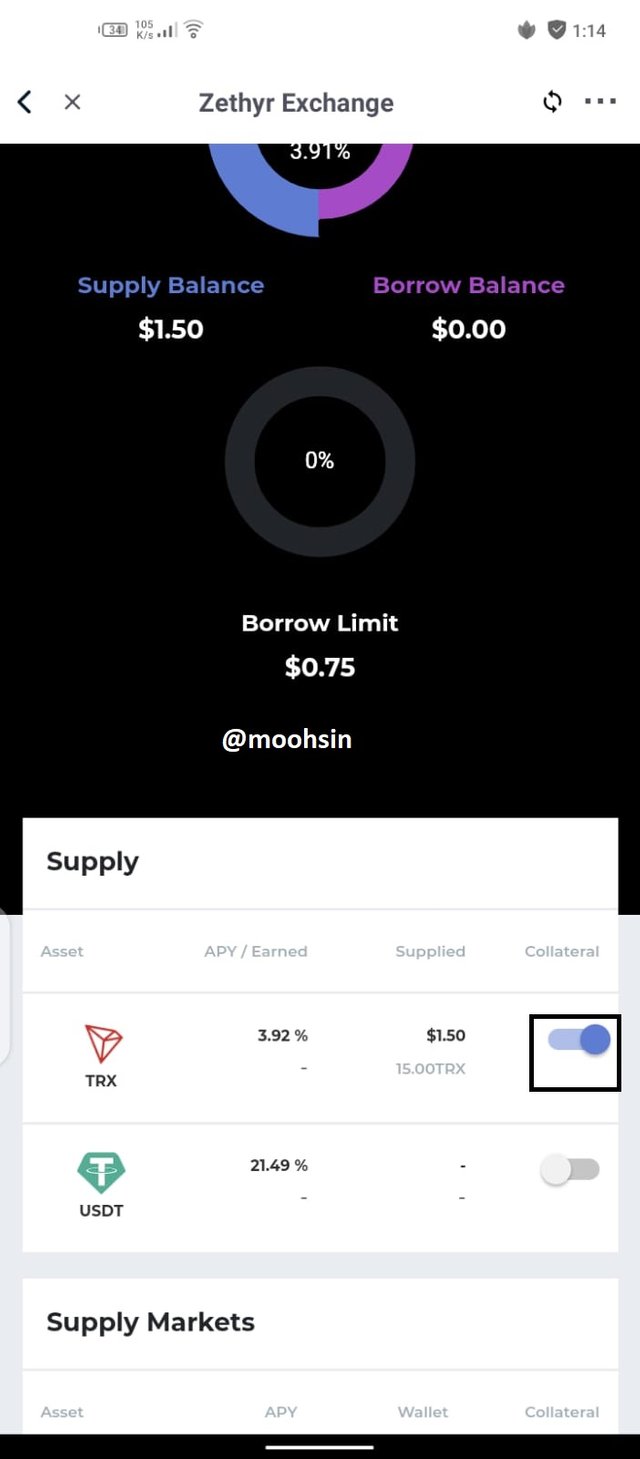

Collateralizing on my Asset

- From the supply options click on the asset already supplied by sliding the arrow key from left to right.

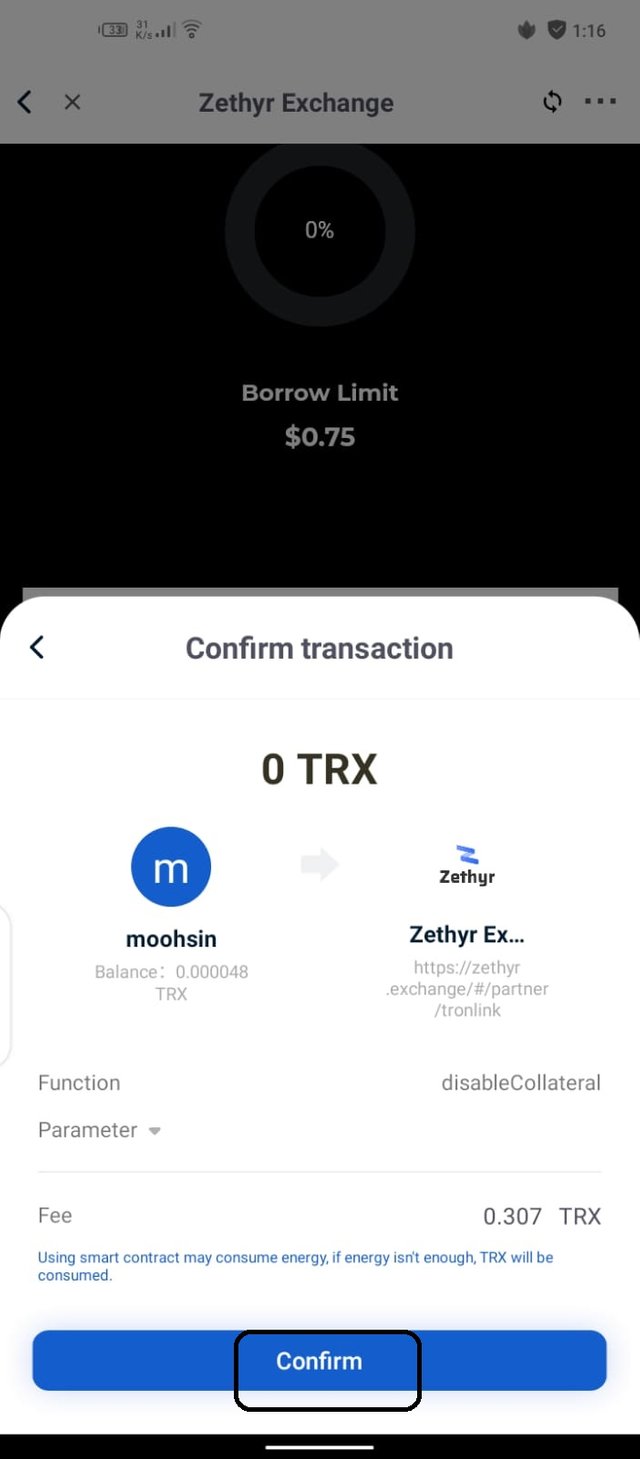

- from the pop-up message click on "USE TRX AS COLLATERAL".

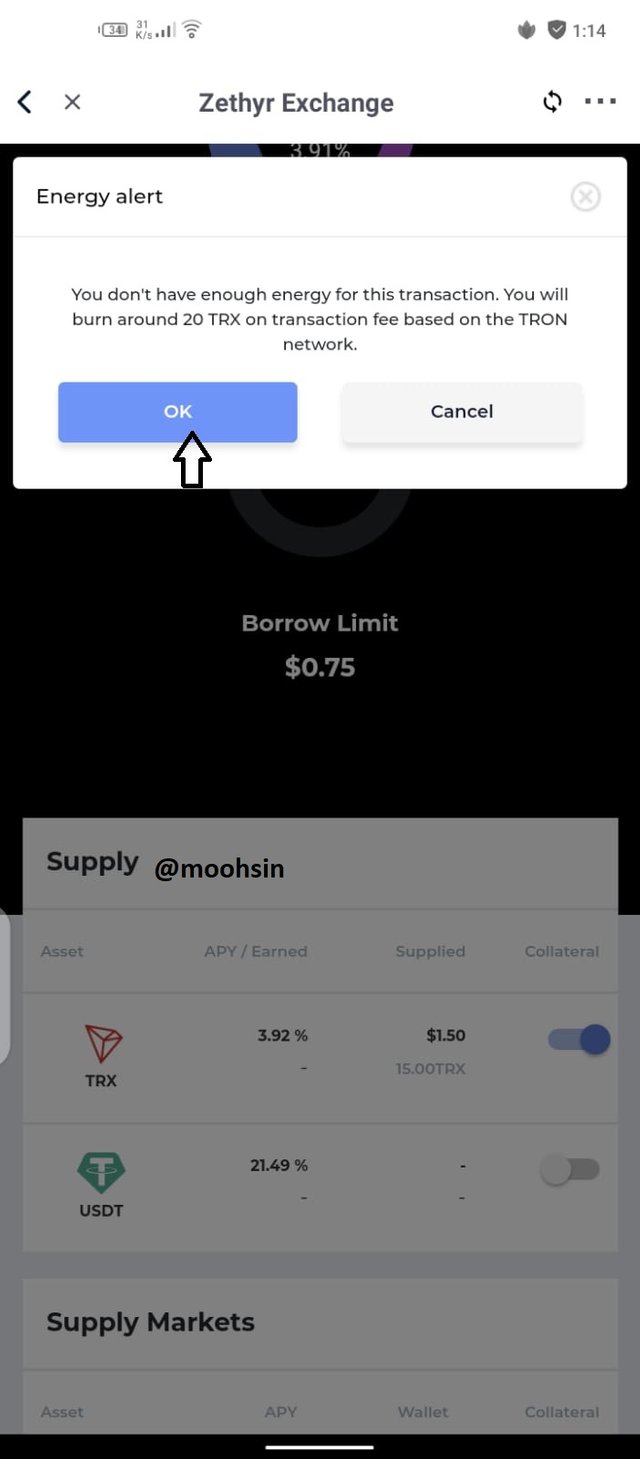

- Click on ok from the 20 TRX energy requirement for the transaction.

- Click on confirm button (with 307 bandwidth fee requirement).

- Enter the password to sign the transaction.

- This gets the button activated immediately.

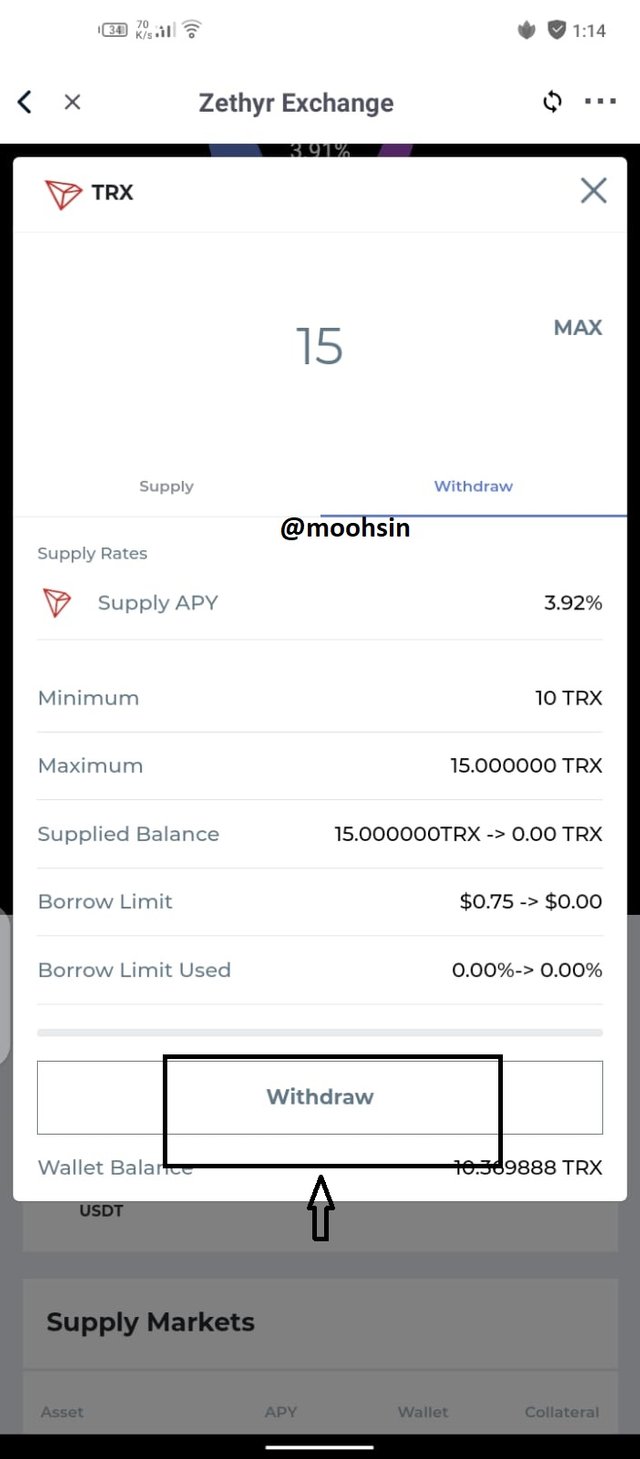

Withdrawing My Asset from the Supply Pool

- go-to the supply asset option

- Click on the asset already supplied

- switch to withdraw option

*click on SAFE MAX and then withdraw - then click on confirm and sign the transaction

What do you think of Zethyr Finance? Is it great or not? State your reasons.

Zethyr finance is providing their user a place where they can make investments and could make profit from them by supplying or borrowing other assets.

It has a low trading fee as compared to others.

Started as an exchange now a fully decentralized swap which easily changes ERC-20 token into TRC-20.

Here we get equivalent zTokens for collateral needs. Its value is begged into a 1:1 ratio. This feature helps to avoid some contract issues, and flash loan attacks. It protects overall users' liquidity.

Another great feature is the safe max feature which ensures the trading liquidity and avoids future liquidation risk.

Cross-chain functionality is another good feature and having fix transaction fee is another great plus point for heavy traders.

Overall Zethyr Finance is One of the great Dapp in Tron Blockchain. But it needs more development, more social activities, need to spread its features to all users.

While performing this task I nearly burn 120 TRX most of them in wrong transactions so keep in check that what you are doing so that you will not waste your assets.

Conclusion

Zethyr Finance is one of the great Dapp in Tron Blockchain. It's Dex aggregator is one of its key features along with stable swap. With Zethyr Finance, Tron coins can now be swapped to any coin of our choice as listed in the protocol. The TRC-20 standard token for USDT can now be exchanged for the ERC-20 standard token for the same USDT. Also it enables its user to lend and borrow assets which can be useful for any user for a short period of time but due to compund interest this might not be beneficial for everyone but for the big investors it is a plus point.

Thanks to professor @fredquantum for this amazing lecture and @cryptoacademy for this series of knowledgeable

courses.