{Steemit Crypto Academy - Season 2, Week 4} Don't get lost in the fuzz || @mojubare submitting the asignment

Going through this class thought me a lot about the cryptocurrency trading market. The market isn't a place to get into without a proper entry and exit plan. After reading @fendit lecture, I will be answering the homework questions.

As people who trade, there are a lot of mistakes they make over the period of trading. Mistakes such as, Over trading, Revenge trading, FOMO (Fear Of Missing Out), and so on. These mistakes had led lot of people to lose millions and billions to the market.

Question 1

A) Place yourself in the following situation:

You bought BTC a couple of days ago at a price of USDT 62K. Suddenly, you see that this situation is going on:

What would you have done before reading this class? What would you do now? Explain in detail if there's something you would do differently.

Answer

Something I just learned from this class is stopping loss. Before reading through this class, I will follow the school of thought that says hold the coin even when it is crashing down on you. Since I believe it is an investment worth it, I would have held it even when if it had dumped below $30k from $62k.

After going through this class, if there is to be a scenario of a Bitcoin crash or break down, then I would have set a stop loss at a level where I am going to be able to manage my loss and manage my risk and Stop- Loss can be the way to getting out of a loss in value of token or from becoming a bag holder.

Explain in detail if there's something you would do differently.

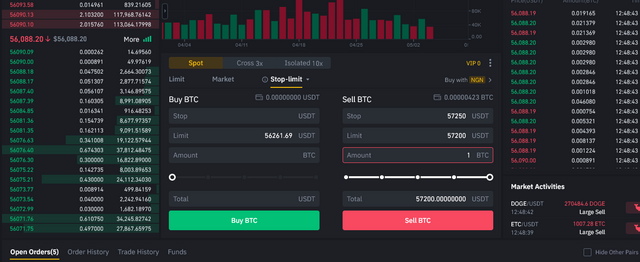

If I had a bought Bitcoin a couple of days ago at $62k and I hope that it increases in price but then I hope to manage my loss should incase the price drops, I would be using the Stop-Loss to mitigate my losses to the barest minimum should in-case there is a bear market. I will be using the Stop-limit in this case.

To use the Stop-Limit, you set a price you believe will be the next support or the price you feel is safer in the stop column and then you set the price that you want the action to be taken on the limit column. Ensure that the Stop price is higher than the Limit price, so when the price reaches the stop level, it automatically sets the limit order for sale.

Question 2

B) Share your own experience when it comes to making mistakes in trading:

What mistakes have you done when trading and what did you learn from them? If you have little experience when it comes to trading, tell if you got to know about someone else's experience.

Answer

Revenge Trading

I was used to doing this in the past, my believes were, since the market could be cruel to take my money from me, I will buy again at that point and make the market pay for it. I did this during the bear market of 2018 and I got bitten biterly as the price kept going down as I tried to take my revenge on the market. I didn't know anything about studying the market, so I just did it with guts that I was going to get the market to pay for the damage it caused me but i was getting hurt at almost everytime.

I got to understand I was hurting myself more when a friend who traded very often told me I cannot win against the market, I had to understand the market and let the market play into my hands.

Which of the strategies discussed in this class you find the most useful for you? Why?

Do not let your emotions control you

If you are on telegram, then you would agree that there are a lot of coins which are believed to shoot up to 10X in like the next week and they will be painted to be the next Big thing after the Bitcoin. With this, a lot of people will go in and buy these coins/tokens so they do ot miss out on the next big thing but then, they end up regretting their actions.

Trade with a plan and not with the noice from the public, never be in a hurry to get a piece of cake from the cake available in the market as you will end up losing your capital.

Trade what you can lose in the market

Never trade all your funds into the market as you can lose part or all of your investment in one trade. As a result be willing to trade with a fraction of your total investment or capital. Do not trade with borrowed money, or with leverage you can't handle.

Question 3

C) Place yourself in the following situation:

You're browsing Twitter and you see this:

You see that whenever this kind of things happen, BTC prices rush. What would you have done before reading this class? What would you do now? Explain in detail if there's something you would do differently.

Answer

Before the class, I would have bought the coin without thinking twice and there was a time it got me. When Elon tweeted about Doge and I bought it only because he tweeted about it and immediately I expected the price to skyrocket but it didn't. I ended up selling my coins low (actually, if I had waited, a little longer I would have gotten a good result).

After the class, I will take my time to study the changes in price and be sure that the price is going as expected, after which I will trade with a very little amount which I can lose and then set a stop-loss to help reduce the risk of losing all of my funds in the process.

Conclusion

After this class, I gained a lot and it has made me do a little more reseach on trading. I have learnt never to go with the noice of the market which could cause FOMO. Thanks a lot for the class, I am happy to be a part of it.

Thank you for being part of my lecture and completing the task!

My comments:

Nicely done!!

You explained all tasks really good and clear, which is no easy task.

As a suggestion for next time, focus on markdowns as you can improve your work a lot more!!

Overall score:

6/10

Thanks a lot for the rating,

When you mean focusing on markdown, what do you mean... I used the right markdown for my post, quoting the questions because they aren't my words and using the subtopics and topic, as well as the bold marks properly.