What are indicators?

Indicators are used by traders to give indications on how the market is going to go. They can be used to show price behavior patterns. Strategies can then be devised to exploit these patterns. They are also used to keep abreast of any news or movements in other markets that may affect the price.

What are the best indicators for technical analysis?

Technical analysis is a method of forecasting the direction of an asset price based on past market price and volume of the asset. To maximize your chances of being successful, some very useful technical analysis indicators can be utilized.

Some of the best technical indicators for trading include Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), Bollinger Bands, and On Balance Volume (OBV), which we’ll look at in this article.

MACD

The MACD formula is used to indicate trend-following momentum. This is how you calculate it:

26 period EMA (Exponential Moving Average) – 12 period EMA (at closing prices)

If the MACD is positive, this correspondingly indicates upside momentum. When the MACD slopes upward towards crossing the signal line (as seen below), it is known as a bullish cross and can be interpreted as a good time to buy. If the MACD is negative, this indicates downside negative momentum. When the MACD slopes downward and crosses the signal line and heads below it, it is known as a bearish cross and this can be interpreted as a good time to sell.

MACD

RSI

RSI is used to indicate the weakness or strength of an asset through recent changes in its price, from which it can be evaluated if an asset has been overbought or oversold. This is how you calculate it:

RSI = 100 – 100 / (1 + RS)

RS = Average of periods which close up in price / Average of periods which go down in price

Normally the number of periods used is 14, but it is entirely up to the trader how many to use.

Generally, if the value is under 30, it indicates the asset has been oversold. On the flip side, if the value is over 70, it indicates the asset has been overbought.

RSI

Bollinger Bands

The Bollinger Bands is an indicator that is used to determine the movement of an asset’s price within a band by allowing the width of the upper and lower bands to move together with price fluctuation. If you see the price of an asset move out of the upper and lower bands, then a price reversal may be imminent. It can be interpreted as follows:

Middle Band – Simple Moving Average over 20 days (SMA)

Upper Band – SMA over 20 days + (Standard deviation of price over 20 days x 2)

Lower Band – SMA over 20 days – (Standard deviation of price over 20 days x 2)

Bollinger Bands

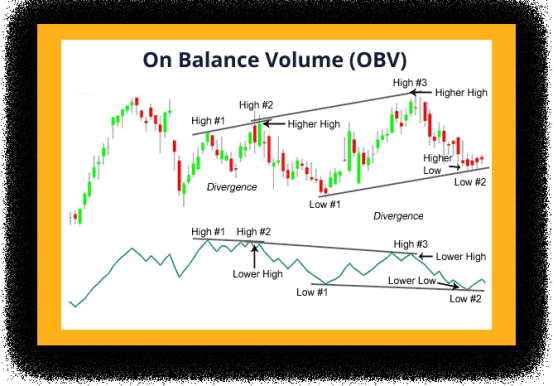

OBV

OBV is an indicator that uses the volume flow of an asset to predict price changes and to determine how strong signals are to buy or sell an asset. It is used as a cumulative indicator, meaning that:

If an asset’s price closes up, the volume for that day is added to the OBV’s total.

If an asset’s price closes down, however, the volume for that day is taken away from the OBV’s total.

If it is the same, no calculations are made.

The concept is really quite simple – if there is a higher high (unless there is a resistance zone), this means there is positive volume pressure, and there is a good chance that the price will increase. And the opposite is true with a lower high, unless it (hits a support zone). This means there is negative volume pressure, and there is a good chance that the price of an asset will decrease.

OBV

Final thoughts

There are just some of the best technical analysis indicators on offer, and there are many more. What works best for one trader may not be the same for others, so it’s always a good idea to try out as many as possible initially to see which ones work best for you.

As such, it should be not be seen as trading and financial advice, it is merely an opinion. Trading is done at your own risk.