News-Based Trading: Strategies for Steem/USDT

Hello everyone! I hope you will be good. Today I am here to participate in the contest of Steemit Crypto Academy about the News-Based Trading: Strategies for Steem/USDT. It is really an interesting and knowledgeable contest. There is a lot to explore. If you want to join then:

Question 1: Understanding News-Based Trading

Explain the concept of trading the news and its significance in the cryptocurrency market. Highlight its advantages and risks with examples related to Steem/USDT.

Crypto market is always unpredictable but sometimes it becomes predictable just because of the news related to the crypto. According to my experience in the crypto market I have seen many events where the market reacts vigorously and these events are just because of the solid news foundation related to the crypto market. Sometimes we see general news for the cryptocurrency market and sometimes we see some token or platform specific news which impacts just the specific token.

In the news based trading we analyze the events which can drive the market. We use these events to make the trading decisions. These events can be the economic announcements or the regulatory updates with respect to crypto. They also include the developments of the crypto projects which can impact the price of the associated tokens. In the history of the crypto whenever it has been regulated in the countries the adoption of the crypto has increased and it impacted the price in the positive direction. Cryptocurrencies have been regulated in many countries and this news is really helpful for the positive moves in the prices.

We know that cryptocurrency market is a volatile market and in this volatile market the the news serves as the catalyst for the movement of the price. It also serves as an opportunity to gain the trading benefits.

We all remember that when the war of the Israel and Gaza started then the prices were declined and when Iran involved in this war and after the attack on Israel this news led the prices to go down greatly. So it is how the news impact the prices to go down.

After this an other major event was of Trump selection as the prime minister. He is the lover of crypto and supporter of crypto and he fired Garry Gansler who was not favourable in crypto regulation and recruited new one. This led the prices to go in the upward direction greatly. Moreover the USA Government mentioned DOGE in one of their report and it was the greatest supportive news for DOGE coin and people got this as the positive news and it jumped from around $0.15 to $0.40 so it is how the news impact and we use the concept of the news for the trading.

Recent fire in Los Angeles has played a great role in pushing the prices downward. We know that before the start of the fire the crypto was performing well but right after the fire news the people became very curious and it was a bad and sad news for everyone and in the hype of the fire the people started selling their assets which drove the prices to move significantly downward.

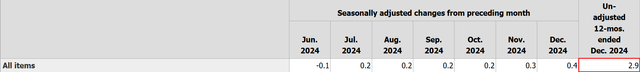

I want to quote here the general news which comes each month related to the crypto. I am talking about the CPI (United States Consumer Price Index) report which impacts the movement of the crypto market greatly. Each month when the CPI report is near then the traders carefully hear this report and then take decisions accordingly.

If I talk about the recent report of CPI then I can guide you easily that how the news impact the price of the cryptocurrency. The labour department released their CPI report data on Wednesday 15 of December month and it was positive as expected. And we can notice that CPI report was positive and the price of teh BTC went up and crossed 100K again.

There are a number of examples which can be given when the news drove the price significantly. I want to quote a recent example of the news based trading. It is about Elon Musk who changed his Twitter Profile picture to Pepe elements on 31 December, 2024 with the name Kekius Maximus. It was the symbol to promote a meme coin Kekius Maximus and after this hype of the news of change of the profile picture and the profile name to specific name led to a major increase in the price.

Here is the tradingview chart of this coin which git a lot of hype due to Elon Musk. any people took advantage of this news and they made a lot of profit but these news are not for the long term and currently this coin is trading at the around $ 0.04 but after the news it was at the highest price of $ 0.43

Similarly if we talk about the Steem news then we can conclude that if new listings of the Steem are announced by the major exchanges such as kraken and coinbase where the investors can put their investment in it then the price of the Steem will also move higher because of its increased demand in the market.

On the other hand if any celebrity like Elon Musk quote about Steem in his tweet, profile name or profile picture then the price of stem will go parabolic because many investors will suddenly buy this and it will ultimately lead the prices to go in the upward direction.

Similarly if we get any bad news with respect to any cryptocurrency such as crypto regulations rules updation which can impact Steem then it will cause the price to go down. So the news related to the cryptocurrency are very significant for the movement of the price.

Advantages News-Based Trading

Here are some advantages of the news based trading:

In the news based trading there is a high potential of the profit. As it can be seen that when the Elon Musk quoted Kekius Maximus then its price went parabolic and it earned a good profit to the traders. We can contribute this scenario on the Steem trading as well.

If Steem announces a new partnership or technology upgrade then it is a positive news and if it is favourable for the traders then the traders can buy this token and ultimately due to increased demand its price will increase.

Sometimes scheduled events of the news drive the price and it serves as the predictable catalyst. If central bank schedules an important announcement for the Steem then the price will go higher at that schedule.

As an example if Steem is going to launch a new roadmap milestone then the traders can keep an eye on this news and they can take fill their bags before the launch to take advantage of this news.

The traders can stay active and involved in the news based trading. They always hunt news and related to coin and then they drive that news in their trading strategy. Being a steemian I also keep an eye on the exciting news from the Steemit team which is positive and can drive the price to move in the upward direction.

Risks of News-Based Trading

Each picture has two sides one is bright and other is the dark side. Similarly news based trading is significant and has advantages as well as risks. Here are some risks where we can understand how the news based trading is risky.

In the news based trading there is high volatility. The prices are not predictable and have very low precision. One time the price is moving at the bottom the next time it can go at the top and vice versa. It happens when the market reacts differently as expected.

If the Steem gives an update to the community regarding it next development and changes in the rewards system and they expect it as a good news for the investors and the content creators but it goes unexpected due to not getting interest of the investors and other stakeholders then it will cause to drop the price.

Sometimes in market there are rumours and misinformation about the coins and these rumors can lead to poor trading decisions. The positive rumours still can drive the price in the upward direction for short term and similarly bad rumours drive the price downward.

If a rumor spreads in the community that Steem is going to be delisted from major exchanges where the volume of the Steem is huge then it can cause frustration and it will lead the price to move in the downward direction.

There are execution challenges and risks because the market reacts the news suddenly without giving time to act on the news or information. Delays in the news can lead to missed opportunities. It cause bad entries.

If we get the news that Steem is going to be listed on Crypto.com and Coinbase then the market will act suddenly and the price will go higher and we do not get time to act on the news timely and ultimately we get entry in the running train and it can hurt us.

So the news based trading brings many opportunities but it needs a sharp eye and the traders need to be very active to keep an eye on the events happening in the surroundings which can impact the crypto market. It is always necessary to keep an eye on the news based trading opportunities to make unexpected profit.

Question 2: Analyzing the Impact of News Events

Choose a past event (e.g., a major exchange listing, regulatory update, or macroeconomic announcement) and analyze its impact on the Steem/USDT market. Discuss the price action and market sentiment surrounding the event.

Steem blockchain is very old and it has covered a long distance and many milestones in the crypto market with its native tokens. There are several events when the Steem blockchain adopted new things and its native token got listed. Steem has different markets on different exchanges. It is listed on poloniex, htx, upbit, and Binance.

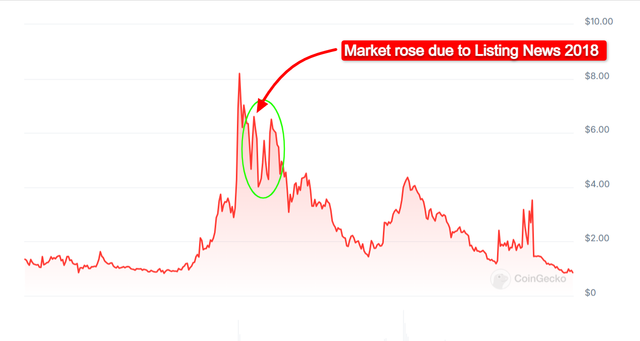

Indeed before the listing on these platforms there was a news about the listing of this token on the exchanges and it is sure thing that each need of listing drove the price in the upward direction.

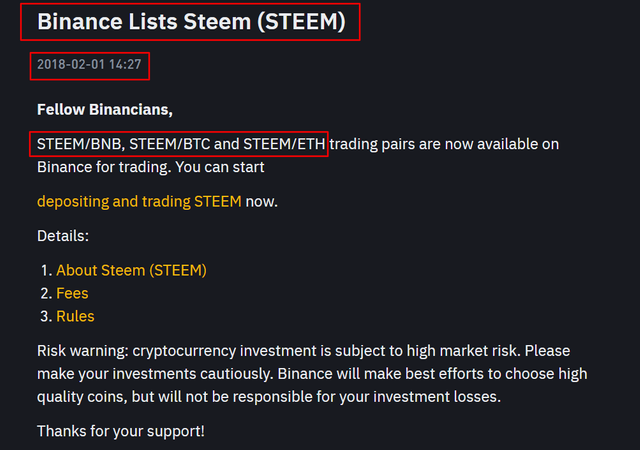

So from the listing events of all the exchanges I am going to select it's listing on Binance as one of the widely used exchange in the whole world and then I will analyse the impact of this listing news of steem.

https://www.binance.com/en/support/announcement/binance-lists-steem-steem-360000492012

On 2018/02/01 one of the largest cryptocurrency exchanges Binance announced the listing of the Steem token. This listing was global it means in the whole world whee the services of Binance are available. It was a big gateway for Steem towards the investors.

Generally if we see then the listings of the tokens on the major exchanges lead them to boom. It increases the visibility and accessibility of that token to wider audience. It leads to increase in the trading of the token as well as liquidity of the token.

So now let us talk about the impact and hype of the Steem token when it's listing in Binance was announced. As soon as the listing date was announced by Binance the price of Steem surged around 25% within the 24 hours. It shows its demand increased and speculative interest.

Due to this news the trading volume of Steem was also increased. This news caused a great hype for Steem and the traders took the opportunity to accumulate Steem as much as they could to get more profits in future.

This news proved to be a positive market sentiment. This news approved the validation and credibility of Steem token. It attracted many new investors world wide where Binance was in operation. Due to this the price moved from $4.67 to $6.60.

On the other hand due to this news there was a FOMO in the market. It is the fear of missing out in the crypto market. Due to FOMO the traders rushed to buy Steem. It further pushed the price in the towards direction. In this way Steem got more exposure.

Volatility is the part of each news whether it is positive or negative. As this news was a great news so due to large trading volume of Steem token caused volatility in the market for short term. Right after the listing the correction happened because the early investors and other smart investors drained out profits at time before the hype of this news ended.

After the listing of Steem in Binance the price remained very volatile for around one week because of buying and selling in large quantity. So the price be and stable after one week but it still remained higher than the pre listing level. It showed the interest of the traders and investors in this project.

If we talk about the reasons why this happened means the increase in the price of Steem and interest of traders in it worldwide. It happened just because of it's increased accessibility on the whole world. Listing on Binance increased demand for Steem.

Moreover the listing of Steem on Binance created an optimism about the future growth of token. It led to the speculative buying which further pushed the price to rise and increased its volume.

If we conclude that what the traders get from the news of the listing of the tokens on the major exchanges then here are some important points:

The news of the tokens listing on the major exchanges can help the traders to generate handsome profits.

The traders should buy the tokens as soon as the exchange announces listing and they should sell in the initial stage right after the listing to get god profits.

This also comes with the risks especially for those traders who fail to buy them at the most initial stage and they dive into the trade when the coin has already pumped and due to the selling pressure it dumps. So the risk management is very important.

The Binance listing of Steem showed the profound impact of exchange related news on the Steem/USDT market. Traders who understood the dynamics of such events and they acted on time they were able to capitalize on the opportunity. This news also highlighted the importance of managing risks in the face of volatility.

Similarly in March 2020 Hive became a separate decentralized platform after the hard fork from the Steem. This news impacted the price of the Steem a lot because the investors got the opportunity of the high price of the STEEM and they sold it immediately to lock their profits and to buy Hive. In this way STEEM saw a downtime due to this negative news.

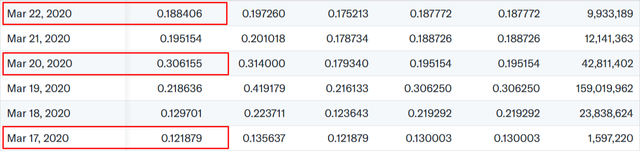

I have taken price crash chart from Cointelegraph because on TradingView data is limited and only available up to 2022. In the chart it can be seen that the price dropped quickly at great extent from $0.44 to $0.20. So it it is how negative news can drive the price to move in the downward direction.

This is the historical data of Steem obtained by finace,yaho. It clearly shows that when the news was announced to the hard fork then the investors rushed towards STEEM to take their last ride. And the price increased up to $0.30 rising from $0.12. And soon the news was published that hard fork is successful so right after this news Steem was crashed from the top price of $0.30 to $0.1884.

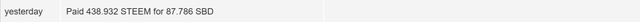

Here I did news based trading within the Steemit wallet. 6 days before when Upbit confirmed the delisting of SBD I got this news as an opportunity and I decided to sell my SBD and to buy Steems with them. I reacted as soon as I got the information. I sold my SBD holding to Steems right after the announcement and I got 636.378 STEEM for 97.302 SBD.

Here when the price became stable I converted my STEEM tokens to SBD again. Here you can see that I sold my 1 SBD for around 6.54 STEEM and then I rebuy SBD at 5 STEEM per SBD. In this way I got benefit from this news based trading.

Question 3: Designing a News-Based Trading Strategy

Propose a strategy for trading the news in the Steem/USDT market. Include:

- Criteria for selecting impactful news.

- Tools for monitoring and analyzing news events.

- Entry, exit, and risk management rules tailored to news-driven volatility.

News based trading strategy needs a lot of care because if the news is not correct and authentic then we can loose our money in the rumours and we can face a lot of downtime.

Criteria for selecting impactful news.

As we are going to design a trading strategy based on the news so we need to be careful while choosing the news so that our trading strategy can be successful and reliable and likely to be risk free.

We should focus on the events which have high influence in the market. We should focus on those market news which can influence the sentiments of the market. Here are some examples of the news which should be selected as an impactful news:

Exchange Announcements: Exchanges are the most trusted sources of the news. The news announced by the exchanges is very reliable and it impacts the price of the token a lot. We should focus on the listing, delisting or changes in the trading pair announced by the exchanges.

Regulatory Updates: If there is any news which is about regulation of the crypto then it can also impact the price a lot. We should always be focused on the cryptocurrency policies in major regions such as United States and Europe.

Inflation Rate: Inflation is the key component which drives the crypto market vigorously. If the inflation rate increases then the prices fall. So whenever there is a news which is of increased inflation then take this news seriously to save and lock your profits. Moreover if the inflation decreases then the prices increases.

Steem Updates: While designing a trading strategy we should be very careful and vigilant about the updates in the Steem ecosystem. We should focus on the updates, partnerships, roadmap milestones and the technological upgrades.

After listening to these types of news we need to filter then further by thinking that if the news directly involve steem or its ecosystem. We should filter the timing of the execution of the news. Then we need to understand the expected impact of that news about the project.

Tools for Monitoring and Analyzing News Events

There are different tools which helps to monitor the news and analyse them. We can use combination of those tools for the correct analysis of the news and to justify if the news is correct. Here are some tools:

News Platform: There are different crypto related websites which deliver latest and correct news about the crypto events in the market. These websites are CoinTelegraph, CryptoSlate, and CryptoPanic. But mostly CoinTelegraph is used for the most trusted news source.

Social Media: In the news based strategy and to monitor and analyse the news social media is one of the best tool because there are many events which breakthrough from the social media announcements. As we are developing strategy for Steem so in order to get latest updates we need to follow social media accounts of steem at Steemit, X, Facebook and telegram. Because any announcement regarding the Steem will be published first from these social media accounts as a trusted source.

Crypto Exchange: We need to follow the news and updates about Steem from the trusted crypto exchanges to monitor and analysis the latest and reliable news. So to analyse and monitor properly Steem based news we should follow the news from major exchanges for the trading updates or new trading pairs.

Market Sentiment Tools: There are different tools which are used for the sentiment analysis for the proper news confirmation because if the sentiment analysis of the steem are positive then we can take long entry and if the sentiment analysis are negative then the trading strategy for the short entry. Some sentiment analysis tools are LunarCrush and Santiment.

Indicator: We can use some trading analysis platforms to set some levels of the price to be notified and then we can analyse the price at that moment and monitor the news event which led to crash the price or led to rise the price. TradingView is the best news and price analysis tool which offers a number of indicators and alert tools.

Trading Strategy Framework

So after analysing the effective news and monitoring the news it is the time for the trading strategy framework where we will define the entry exit and risk management techniques for the news based strategy.

Entry:

In the news based trading strategy entry really matters a lot if we are able take entry at the exact time of the arrival of the news then we can gain a lot of profit by following the news hype. We should enter the market within the minutes of high impact of the news announcement.

For the confirmation of the entry we need to wait for the breakout patterns on short term charts such as 5 to 15 minutes chart.

We should use technical indicator to confirm the breakout. We should use indicators such as RSI or Moving Averages to avoid the false breakouts.

We should take entry positions before the schedule of the news event so that we can take entry before others to avoid volatility. We should see if the positive sentiment is expected by seeing the roadmap or macroeconomic data.

We should identify the key support and resistance levels to take entry at the support where it is likely to go in the upward direction.

Exit:

In the news based strategy exit of the trade at the exact time is really very important because when the news fades then the prices can go against the expectations.

We should set primary target for the profit at 5 - 10% gain during the volatile periods of the market. And news based trading is always very volatile.

We should use trailing stops to lock the profits and still leaving to the market to absorb the volatility. Trailing stops are really beneficial in the volatile market.

We should place stop-loss orders to manage the risk. The stop loss orders should be 2 - 3% below the netry price to limit the losses if the market goes against the expectations and the news hype.

We should use time based exit strategy. We should set some specific time for the trade if in the set time the price does not react correctly then the entry should be exited to avoid losses.

Risk Management:

Risk management is very important in the crypto trading whether it is a news based trading strategy or simple. We should look for the position sizing to manage the risk. We should only allocate 1 - 2% of the total trading capital per trade. It helps to limit the losses.

We should use volatility indicators such as Average True Range (ATR) to determine the stop loss and take profit level. It is very simple to use and we can calculate the stop loss and take profit based on the value of the ATR. It helps us to manage the risk based on the recent market volatility.

In the risk management Diversification is really very helpful. We should not allocate all the trading fund to one trade but instead we should use our trading fund in multiple trades. We should not use all the funds to concentrate on a single news event but we should allocate small portion for one news event.

Practical Example

I am going to give you a hypothetical practical example of the news based trading strategy. Let us suppose that a major exchange like coinbase announces the listing of the Steem token. SO it is how we should react to this news to do trading:

Entry: We should enter in the trade within the 15 minutes of the announcement after confirming the action and movement of the price. We should focus on the volume and if the 5 minutes candle shows a breakout above the resistance then we should take entry.

Exit: We should set the profit target at 10% gain from the entry price. And on the other hand to avoid loss we should set our stop loss at around 3% below from the entry price. Moreover we should use trailing stops technique to allow the trade to move within the fixed level and to lock the profit as the market moves.

Risk Management: Risk management is the key factor to avoid loss. So we should use only a small size of our portfolio. We should limit our position size to 2 - 3% of our portfolio. And we should hold some funds to manage the and average the entry price if the market gives a chance with good news.

This news based trading strategy for the Steem/USDT market helps to balance the quick decision making with the proper risk management. So by monitoring the key events and by using the technical tools we can make exact entry and exit rules. It helps the traders to make goof profit from Steem based on the news.

Question 4: Managing Risks in News-Based Trading

Discusses the risks associated with news-based trading, such as slippage, overreactions, or misinformation. Suggests practical steps to mitigate these risks and improve decision making during periods of high volatility.

News based trading strategy comes with some specific challenges and risk. Indeed news based trading strategy provides a number of benefits and opportunities for the profit gains. It comes with the risks due to the volatility and unpredictable nature of the market during the major events. Here are some key risks associated with the news based strategy and some steps to reduce and overcome these risks:

Slippage:

Slippage is the condition in the market when there is a difference between the expected trade price and the actual executed price during the high volatility of the market. It happens when the market is very volatile. It can also happen when the liquidity is very low and the prices can move rapidly between the order placement and the execution.

Example:

I want to explain this risk with the help of the example let suppose a trader places a buy order for the Steem at the price of $0.18 by following a a positive news but the price suddenly goes up to $0.20 and the order does not execute and if we select current market price for the order to be executed then the order will execute but at the higher price than the expected price.

Overreactions:

Market can overreact to the news. It can lead to the unexpected movement of the price. It happens because of the sharp reversals. Actually by seeing the news the participants react excessively to the news. This thing drive the prices to move insanely in the direction of the news sentiment.

The traders overestimate the impact of the news and in this way the market faces the flood of the buy or sell order based on the sentiment of the news.

Example:

Let us suppose that there is a rumour about the listing of the Steem on a new exchange. This causes to surge the price by 20% in an hour as the traders buy intensely. And when the traders know that the rumour was false then again they react excessively and the price drops to an unexpected level in a a few time. And this thing causes losses for those people who buys based on the hype of the news at the top of the price thinking that the price will further go in the upward direction.

Misinformation and Rumours:

In the news based trading sometimes it happens that we get rumours and misinformation about the certain events. But we consider those rumours as the real news and we act according to those rumours which put us to face loss because misinformation leads the market to move against the expectations. We should not believe social media blindly because it is often seen that a word of mouth often cause poor trading decisions.

It happens when we react vigorously on the false and unverified news. By just seeing the rumour and unverified news the market participants react quickly and they fall prey to the loss because of misinformation and rumours.

Example:

Let us suppose that someone tweets that Steem is partnering with another big blockchain project such as Binance Smart Chain. The traders buy aggressively which pushes the price to move in the upward direction. But when the officials of Steem sees this rumour and they correct the people that this a false news then the prices drops suddenly leading to the potential losses.

Lack of Liquidity:

Liquidity is also a problem and risk in the news based trading. This lack of liquidity during the news events can cause price slippage, delayed execution or partial order fills. When the order book has a few buy or sell orders then the large trades can significantly impact the market price.

Example:

If a trader tries to sell a large quantity of Steem during the news based even but in low liquidity then the order cannot be executed completely and ultimately it will lead to sell the Steem in the progressively at the low prices.

Emotional Decision Making:

News based events often causes emotional trading decisions which is also a great risk. By seeing the hype of the news sometimes the traders fail to manage their risk and take a good decision regarding the trade entry. It happens because of FOMO as it has discussed earlier where the traders think that they are missing something and they dive into the trade. Moreover if the news is negative then sudden and panic selling can also occur.

Example:

During the price rally of Steem because of the positive news a trader buys at the peak due to the fear of missing out and it expects a further gains. When the price drops then they sell and in this way they face a loss.

Practical Steps to Mitigate Risks

Here are some practical steps which can help to mitigate risks:

Addressing Slippage:

In order to address the slippage in the news based trading we should use limit orders instead of the current market price orders to control the execution of the price.

We should avoid sudden trading right after the news breaks to avoid setting orders in the volatile market.

Managing Overreactions:

In order to manage the overreactions of the market in the news based trading strategy we should use technical analysis tools. They help us to identify the support and resistance levels. They help us to avoid chasing the extreme prices.

Moreover for the better management of the risk we should use time based trading strategy. It helps to delay the entry until the market stablizes.

Addressing Misinformation:

- In order to address the misinformation of the news we need to verify the news from the reliable resources such as from the official accounts and from the crypto exchanges.

Addressing Liquidity Issues:

- We should trade during the periods when the market is highly active so that our orders can be filled easily because when the market is active at that time there are several traders who do different buying and selling orders.

Addressing Emotional Trading:

In order to avoid emotional trading and decision making we should set predefined entry and exit points to reduce the impulsive actions.

We should use automated tools like the trading bots. We can also use alerts or notifications to stay updated from the movement of the market.

So in order to manage the risk in the trading of Steem based on the news we should first verify the news from the official sources and then we should wait for the breakout by using the technical indicators. Then after the confirmation we should use a small portion of our trading balance for the trade. And then we should set the profit and loss levels to avoid the risks and major losses.

Question 5: Leveraging technology for news-driven trading

Explore how tools such as sentiment analysis algorithms, trading bots or real-time news aggregators can improve the effectiveness of news-based trading strategies. Provide examples of tools or platforms relevant to the cryptocurrency market.

Technology is driving the events in the market as well as in the whole world. Due to the change in the technology we can see that every field has become easy to manage and monitor. Similarly we can use technology for the news based trading.

Technology plays an important role to enhance the effectiveness of the news based trading strategy. Here is the detailed information how the tools like the sentiment analysis algorithms, trading bots and real time aggregators can help the traders in the news based trading strategy:

Sentiment Analysis Algorithms

Sentiment analysis involves the usage of the natural language processing techniques. It uses the machine learning techniques as well. Actually in the sentiment analysis a model is designed and then the model is trained based on the historical data and then it helps to provide analysis based on the training. They can analyse the news articles and social media posts. They determine whether the sentiment is positive or negative.

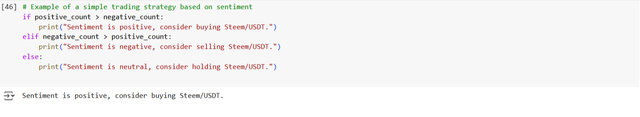

In the previous post AI and Machine Learning in Cryptocurrency Trading: A Steem/USDT Perspective I designed a sentiment analyser which accepts the text based data and then analyse the text as positive, negative and neutral after this it give a final thought about the market.

I have taken this picture from previous research you can see here this sentiment analyser accepted the text based data and then it analysed and answered that the sentiment is positive and you can consider buying Steem at this point.

We can detect the market trends earlier by analyzing the large volumes of the data. The pre-defined conditions and algorithms can identify the the reversals and the trends in the price before the change in the price. If we assign numerical scores to the sentiment tools then they can help the traders to assess the intensity of the market reactions.

Tools and Platforms:

We can create our own tools for the detection and sentiment analysis as I developed to analyse the sentiments of news and runours.

Here is a already built tool which is TIE. It provides cryptocurrency specific sentiment data and analytics for the better trading decisions.

LunarCrush as mentioned earlier is also a sentiment analysis tool. It tracks the social media activity and the sentiments of the cryptocurrencies. It also provide sentiment analysis of Steem.

Trading Bots

The trading bots are the automated tools which help to execute the trades automatically based on the pre-defined conditions. We can set certain market conditions in the bots and they save them in their memory and when the specific criteria meets then they execute the trades. We can use technical indicators or the sentiment data in the bots for the confirmation of the trends.

These trading bots work like this. Here you can see I designed this automated trading bot. I trained this bot by using the historical price data of Steem. And then I run this trading bot and it suggested that it is the time to see your assets. But in the automated trading bot when these conditions are met then the bot automatically sell the assets and on the other hand if according to the trained model if the price gives a chance to be bought then the trading bot executes buy order. It is how the trading bots work.

Here are some benefits and advantages of using trading bots:

- The trading bots have a great speed and efficiency in the execution of the trades than the humans.

- Bot trading does not involve emotions. So this trading is also emotion free and it leads to more consistent decisionmaking.

Tools and Platforms:

Commas is a widely used trading bot platform which offers customizeable trading bot for the cryptocurrencies.

HaasOnline provides advanced trading bots for the cryptocurrencies. It provides advanced configurations including the news based triggers and the sentiment integration.

Real-Time News Aggregators

News aggregators collect and organize news from the multiple sources in the real time. They deliver the most relevant and authentic updates about the cryptocurrencies such as Stem to the traders. The news aggregators play important role by providing solid foundation for the trading for the news based events. It is how the news aggregators help in the news based trading:

The news based aggregators provide quick access towards the news. They centralize the market events. They ensure that the trader do not miss critical updates.

They filter the noise about the specific cryptocurrencies. The customizeable alerts allow the traders to focus on the relevant news such as Steem related events or macroeconomics.

Example:

Let suppose that a trader receives an instant notification from a news aggregator about the regulatory news impacting trading. It allows for the timely decisions. If the trader does not get information about the regulatory updates then the trader can face significant loss.

Tools and Platforms:

CryptoPanic is a crypto news aggregator that provides updates from the multiple resources. It provides sentiment analysis.

NewsNow offers a real-time feeds about the cryptocurrency such as information about Steem.

So by using technology like the sentiment analysis tools, trading bots and real-time news aggregators the traders can make informed decision. These tools enhance the efficiency of the news based trading strategy.