Dynamic Risk Management In Crypto Trading

Hello everyone! I hope you will be good. Today I am here to participate in the contest of Steemit Crypto Academy about the Dynamic Risk Management In Crypto Trading. It is really an interesting and knowledgeable contest. There is a lot to explore. If you want to join then:

.png)

Question 1: Foundations of Risk Management

Explain the principles of risk management in cryptocurrency trading. Discuss key practices such as position sizing, stop-loss placement, and diversification, with examples relevant to the Steem/USDT market.

Each market comes with the risks whether it is the traditional market, crypto market or stock market. And the wise trader always manage its risk irrespective of the type of the market. Moreover if we see crypto market is not too much mature and it is very volatile. And this volatility is the major reason for the risk involved in the crypto trading. All the crypto traders must understand their risk management before trading for the success of trading otherwise they will loose their assets and courage as well.

If a trader does not know about the risk management factor in the cryptocurrency trading then the trader can loose money. Actually without knowing about the risk management is like giving your hand in the mouth of the lion who is very cruel and does not have any mercy. Similarly cryptocurrency trading does not have any mercy and it is like a cruel lion out of the cage. So you have to manage your risk to avoid losses. There are a number of examples where people became unable to manage their risk and they loss a lot.

The success in the crypto market depends upon the effective risk management. In the cryptocurrency market disciplined strategies are very necessary. These disciplined strategies limit the potential losses. This effective risk management by using the disciplined strategies preserve the capital and on the other hand it boosts the profits in the cryptocurrency trading.

Here is a comprehensive discussion of the important principles of risk management in cryptocurrency trading along with the examples of the STEEM/USDT trading pair.

1. Position Sizing

In the cryptocurrency trading position size matters a lot for the risk management. Position sizing means the amount of the assets allocated for the specific trade from our portfolio. We need to be very careful while setting the position size. The position size which we set remains in the specific trade and that amount of our portfolio is in the trade and risk.

So we should always allocate precise amount of our portfolio for each trade. We should avoid large positions to save our portfolio from the large amounts of money.

Example

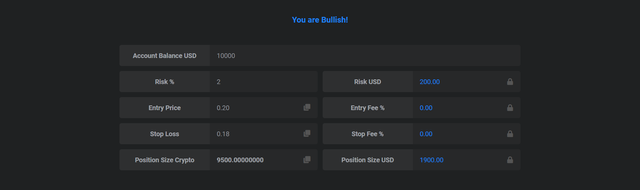

We can understand position sizing with the help of the example easily. Let us suppose we have a total portfolio of $10000. And from this portfolio we are willing to risk 2% per trade. And this becomes $200 according to the total worth of our portfolio.

Now while adding example of STEEM/USDT I will continue the example. Let say that STEEM is trading at the price of $0.20 we can calculate that how many tokens we can buy on the basis of the stop loss that limits our loss to $0.02 per token.

- Maximum risk = $200

- Stop loss = $0.02

- Position size = $200 ÷ $0.02 = 10000 tokens.

So after this calculation we can say that my position size is 10000 tokens. This approach prevents excessive losses even if the market moves against our perspective.

2. Stop-Loss Placement

Stop loss placement is another important factor in the risk management. Stop loss order protects the traders from the big losses. It limits the loss to a specific limit which we set. It is a great way to protect the capital automatically by exiting the trade when the price hits the stop loss level.

Stop loss placements comes into action when the market moves against our perceptions. It often happens that we are thinking about some coin that it will pump and we take a long entry but it starts decreasing. In this situation if we do not have put stop loss level then our trade will be liquidated. It is where we know the importance of the stop loss placement. If we put stop loss as well for that trade then our trade will be exited automatically after hitting the stop loss placement level. So it is how stop loss placement helps us to manage the risk in an effective way.

Example

We should place stop-losses at the logical levels. We should place it just below some key support level or a percentage from the entry price.

Let us suppose we are entering Steem at $0.20 and we have your target at $0.25. We are putting our stop-loss at $0.18 so that our loss will be limited to $0.02 per token that is 10% of the entry price. But on the other hand if we do not use stop-loss placement then our loss can be unlimited up to the position size.

The strategic placement reduces the losses. Moreover it gives room to the trade for the fluctuation within the market movements.

3. Diversification

Diversification is the most widely used concept in the cryptocurrency trading and the smart investors use this trading strategy to manage the risk and reduce their losses while increasing their gains in the market.

Diversification means the spread of our investment in different assets not just in single asset. It can be good understood by this idiom:

Don't put all your eggs in one basket

According to the idiom if we put all of our eggs in one baskets and it slips down then all the eggs will be affected but on the other hand if we use different baskets for the eggs then if our one basket slips then it will only cause limited and bearable loss and the other will remain safe.

Same thing is applied in the cryptocurrency trading that do not put the complete portfolio in the single assets because if it goes down then your all money will be at risk. Just diversify your portfolio in different coins to reduce the potential losses but to increase your gains.

Example

Let us suppose we have a total portfolio of $10000. Now by using the diversification technique instead of allocating our entire $10,000 to BTC/USDT we should diversify our investment by investing $4,000 in Steem/USDT, $3,000 in BTC/USDT and $3,000 in ETH/USDT.

It is a golden rule in the cryptocurrency that always invest your money in the different assets not in single coin. This approach reduces vulnerability to adverse price movements in a single market while capitalizing on broader opportunities.

Personally I was not aware of this strategy in the beginning of trading and I used to put all of my money in the one coin but after facing challenges and losses I always use the technique of diversification. And in my portfolio there are some assets which move down but the other move insanely up by giving good profits.

Except these fundamental principles for the risk management I will suggest to only use the amount of money which you are vulnerable to lose in the trading. Because the market is always unpredictable and never put your hard earned money blindly in the cryptocurrency trading if your not aware of the consequences. Always use that amount which does not impact your life if your loose that amount.

Here is the complete example in which I have tried to integrate all these principles for the risk management:

- Portfolio: $10,000 capital.

- Position Size: Risking 2% per trade ($200).

- Trade Entry: Buy 1,000 Steem at $0.20.

- Stop-Loss: Placed at $0.18 (loss of $0.02 per token).

- Target Price: $0.25 (gain of $0.05 per token).

According to this trading strategy the trade stops trading when the price hits $0.18 to exit the trade. Therefore loss does not exceed $200. And if it reached $0.25 it means profit is $500. This way it indicates disciplined risk management with defined borders.

By following risk management principles such as position sizing, stop-loss placement, diversification and maintaining favourable risk reward ratios a trader can navigate the volatile cryptocurrency market effectively. These practices safeguard our capital and enhance the probability of consistent long term profitability even in unpredictable markets.

Question 2: Calculating Risk-Reward Ratios

Using historical Steem/USDT data, demonstrate how to calculate the risk-reward ratio for a trade. Provide a practical example, including entry and exit points, to highlight how this metric guides decision-making.

Risk to reward ratio is another important tool used in the cryptocurrency trading and it helps in the risk management. Risk to reward ratio helps the traders to understand whether the potential reward of the trade justifies the risk involved in the trade or not. It is really very helpful in maintaining the disciplined decision making to optimize the profits. It is especially useful in the volatile market where the risk is high involved.

The risk to reward ratio compares the amount of the capital at risk to the potential profit from the trade. The formula for the risk to reward ratio is given below:

According to this formula if the RRR is 1 : 2 then it means that we are risking $1 to get the profit of $2. And it is considered favourable. It means that we can take risk $1 to get the potential gain of $2. Typically the traders tries to get RRRs of 1 : 2 or higher.

Steps to Calculate the Risk-Reward Ratio

Determine Entry Price

First of all we need to determine the entry price where we have bought or sold the assets. I will consider it for the STEEM/USDT trading pair.

Set Stop-Loss

This is the level at which the position is automatically exited to limit losses.

Define Take-Profit:

Then we need to define target price at which the trade will be closed to secure profits.

After getting all these values we will calculate the potential loss and potential gain which will be used in the risk-reward ratio calculation.

Calculate Potential Loss:

Calculate Potential Gain:

Determination of RRR:

Now after determining the potential loss and gain we can simply calculate the risk reward ratio for the trade.

Example Using Historical Steem/USDT Data

After analyzing the historical STEEM/USDT data If we say that we took long entry in the STEEM/USDT trading pair at $0.20. And in order to manage our risk we put stop loss level at $0.18 to limit the loss up to $0.02 per token. And on the other hand we have set take profit level at $0.25 to target the profit of $0.05 per token. So after accumulating this data now we can calculate the potential loss, potential gain and ultimately risk reward ratio.

Entry Price: $0.20

Stop-Loss: $0.18

Take-Profit: $0.25

Calculations:

- Potential Loss (Risk): 0.20 − 0.18 = 0.02(per token)

- Potential Gain (Reward): 0.25 − 0.20 = 0.05(per token)

- Risk-Reward Ratio (RRR): 0.02/0.005 = 1 : 2.5

This calculation of risk reward ratio shows for every $1 we get risk we get the opportunity to gain $2.5. It is a highly favourable trade according to the risk reward ratio.

If the RRR ratio is less favourable such as 1:1 or further lower than this then we should avoid that trade. Moreover if we are ready to take high risk then we should make sure to implement stop-loss level as well as take-profit level. We can also use trailing stops.

On the whole risk-reward ratio not only quantifies the profitability of the trade but it also helps to take the decision about the trade. We can see of the reward is higher or lower than the risk.

Here I have used Risk Calculator to calculate the position size in the tokens as well as in the usd by giving information about the account balance, entry price, risk ratio and stop loss level. After this data it has calculated the risk size in usd which is $200 and the position size is $1900 and in the tokens the position size is 9500 STEEMS for the entry price of STEEM at $0.20, stop loss level of $0.18 and risk ratio of 2%.

Question 3: Leveraging Volatility Indicators

Analyze how volatility indicators like Bollinger Bands or Average True Range (ATR) can be used to manage risks in volatile markets. Use a chart to illustrate how these tools inform stop-loss adjustments and position sizing.

Volatility is the part if the crypto market. Sometimes it is more volatile than normal and in the volatile market trading is not an easy job. It requires a lot of care while trading the volatile market. So there are some indicators and tools which help us in the volatile market.

We can use Bollinger Bands and Average True Range (ATR). They help the traders to assess the dynamics in the market. They enable us to manage the risk by the stop loss adjustments as well as position sizing. These trading tools quantify the volatility of the market and they help in the identification of the appropriate trade entry, exit as well as risk thresholds.

Here is the detail for each indicator helpful in the volatile market:

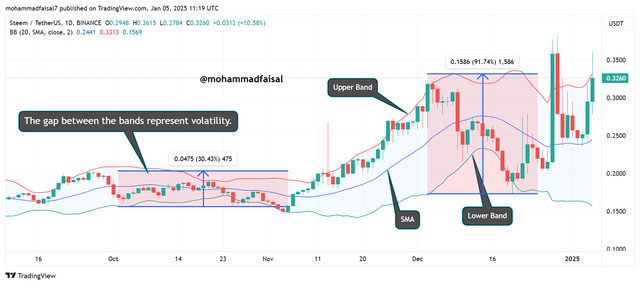

1. Bollinger Bands

Bollinger bands are the technical analysis tool. This is used to measure market volatility. It is used to identify the overbought and oversold conditions in the market. It has three main components.

- Upper Band

- Lower Band

- SMA

Simple Moving Average (SMA)

The SMA is the central line of the Bollinger Bands. It is set to a 20-period average. It represents the average price over a specific time period. It shows the price fluctuations. Simple moving average allows the traders to see the trends more closely. It assess the price movements as compared to the overall trend.

Upper Band

This is another main component of Bollinger Bands. The upper band stays above the SMA. It stays away at a certain number of standard deviations. This upper band acts as a resistance level. It represents the upper limit of the price movement. When the prices approach or exceed the upper band then it gives the overbought signal. And this overbought signal represents the reversal in the price. At this point the market can also take correction. But if the price has a strong move with the upper band then it indicates the bullish momentum.

Lower Band

The lower band is always available below the SMA. It is also set at the specific standard deviation. This band serves as a support level. It indicates the lower limit of the normal price movement. When the price touch the lower band or fall below the lower band then it signals an oversold condition in the market. It indicates a buying opportunity. On the other hand if the price move along the lower band then it can cause bearish momentum.

Bollinger Bands help to understand volatility of the market. We can make god decisions based on the Bollinger bands.

Market Volatility

The distance between the upper and lower band suggests the volatility in the market. We can divide this distance between the bands and expansion in two ways to understand the market volatility easily. Because these bands contracts and expands based on the market volatility.

If the distance between the bands is wide then it suggests higher volatility in the price movements.

If the distance between the bands is less or the bands are narrow then it suggests lower volatility in the price movements.

Position Size

We can link the position size for the trade by seeing volatility in the market with the help of the bollinger bands. Where the volatility is low means the gap between the bands is less then we can use the large position size as it does not have high risk.

If the gap between the bands is large then it means higher volatility in the market which represents the higher risk in the trade because it is possible that the price can move within the bands. So when the volatility is higher then we should use small amount of our portfolio so that we can put small portion of our portfolio in the risky trade.

Stop Loss Adjustment

The upper band act as the dynamic resistance and the lower band acts as the dynamic support level. They changes with the move in the market.

According to the nature of the trade there are two scenarios for the stop-loss with the help of the Bollinger Bands.

If we are in the long position then we need to put our stop-loos near the lower band according to our entry. We know that lower band acts as the support level and if the market approaches the lower band and crosses below this band then it means the support level has destroyed and the price will further move down so to avoid loss we need to put stop-loss near the lower band.

On the other hand if we are in the short position then in order to avoid the potential loss of the position we need to put the stop-loss right after the upper band. If the price move above the upper band then we can face loss and our trade can be liquidated so that putting stop-loss after the upper band can protect us from the potential loss.

Setting stop-loss at the bands provide room to the trade to move within the bands easily and to avoid stop loss hunting. Moreover we can adjust our stop loss by using the trailing stops automatically as the market moves. And trailing stops should be near the SMA or middle line to lock the profit.

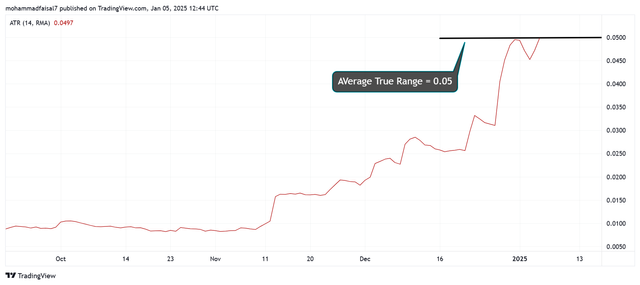

2. Average True Range (ATR)

Average true range is also a trading tool which helps us to measure the volatility of the market by the calculation of the average range. The average range is calculated by using the higher prices and well as lower prices within the specific time period.

The traders can use average true range for the position sizing as well as for the adjustment of the stop loss. We calculate stop-loss levels by adding or subtracting multiple of ATR such as 2x from the entry price in the market.

Similarly if the ATR value is higher then it means the trade has more risk. So when the value of the ATR is higher then we need to use small position size.

Here is the example by using ATR for STEEM/USDT to set stop-loss:

Here you can see that the Average True Range (ATR) for the STEEM/USDT chart at the current market price is around 0.05. And I am assuming that we eneter in the long postion fat the price of $0.30. So here we will calculate the average true range for this chart at the current price and ATR level:

So the stop loss price is $0.22. Moreover we can also calculate the risk per token with the difference between the entry price and stop-loss price and we can calculate as follows:

So the risk per token is $0.10.

By knowing the risk per token we can calculate the position size as follows:

The maximum risk is $200 because we are using only 2% from the total portfolio of $10000.

So after all the calculations by using the ATR the stop loss for the trade whose entry is at $0.32 is $0.22 and the position size for this trade is 2000 tokens. And if the price drops to $0.22 then the total loss will be $200 which is the maximum risk we are willing to take. So by using the ATR-based calculation the stop loss adapts the market volatility and the position size ensures the risk remains controlled.

Volatility indicators like Bollinger Bands and ATR are indispensable tools for managing risk in volatile markets like Steem/USDT. By leveraging these indicators traders can dynamically adjust stop-loss levels and position sizing. It ensures they protect capital while allowing for market fluctuations.

Question 4: Developing a Risk-Adjusted Strategy

Design a trading strategy for Steem/USDT that incorporates risk-adjusted principles. Explain how your approach adapts to different market conditions, such as sharp price swings or periods of consolidation.

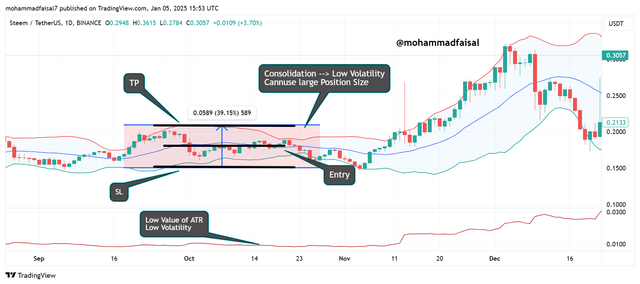

So in order to design a trading strategy for the Steem/USDT we will combine risk management principles as explained recently. These will adapt the market dynamically in the different market conditions such as in the sharp price swings or consolidation periods. This strategy will ensure increased profit while minimizing the the risk. We will use the following attributes in this strategy:

- Position size

- Stop-loss adjustments

- Volatility based rules

I will use the Bollinger Bands and Average True Range to detect the increased volatility in the chart before developing the strategy for long trade in the market.

Here we can see that the gap between the Bollinger bands (upper band and lower band) is very high. It means the volatility is high. And we need to be very careful in this volatile market for taking the entry as well as in position sizing. We can see the market is very volatile even the price has crossed above the upper band greatly and currently trading within the bands.

As the volatility is high so we will use small position size to limit our risk to a limited a small amount from our portfolio. It will ensure proper risk management to avoid huge loss if the market move against our perceptive.

Here I have integrated ATR along with the Bollinger Bands indicator. The value of the ATR is high which is around 0.05 and this high value also suggests the high volatility and sharp movements in the market of STEEM/USDT.

After seeing this data we need to use small position size to avoid the potential loss. And we need to set the take profit of the long trade near the upper band because the upper band is acting as the resistance level and after touching the resistance the price can retest and then we can again get the buying opportunity. And on the other hand we need to set the stop loss level right after the lower band because if the market breaks below the lower band then it means it break the support level and it can further go in the downward direction.

Here after seeing the volatility and the sharp price swings I have developed this trading strategy. I have set the take profit level at the upper band and the stop loss level is at the lower band.

If we see with the stop loss level according to the average true range it becomes:

Stop Loss:

And this stop loss level is also near the lower band and similarly if we see the take profit according to the ATR it also near the upper band. So we can combine Bollinger Bands and ATR to minimize the risk and to enhance the profit. Moreover the volatility is high so we have to use small amount of our portfolio means small position size. The entry point is at the SMA line because when the price crosses above the SMA line it means the trend has confirmed in the upward direction.

Risk to Reward Ratio TP:

My take profit level also follows the risk to reward ratio of 1:2 because the stop loss is at $0.165 and the take profit level is set at $0.32. It means we put $1 at the risk for the gain of the $2.

Position Size:

I have $10000 in my account and according to the 2% usage of my portfolio for this trade my position size becomes:

Here you can see the market is in the consolidation phase and the volatility is very low and in this scenario the risk is also minimum because the movement of the price is limited in between the small range of support and resistance.

We can use high position size in this phase where the risk is very minimum. We can see the volatility is very low because the gap between the upper and the lower band is very small. Moreover the concept for the take profit, stop loss and entry remains same. Here also we can set the stop loss at the lower band and take profit at the upper band. And the entry point is the middle line when the price is crossing above the SMA line.

It is the best opportunity for the conservative traders who does not like to enter in the risky trades. They can easily mange their risk in this low volatility zone. The ATR also suggests that the market is in the consolidation phase because the value of the ATR is very low.

This trading strategy adapts the changes in the market. It is how this strategy adapts the different market conditions:

When the gap between the Bollinger Bands is high as well as the value of the ATR is high it means that the volatility is huge at this time we need to use small position size from our portfolio to manage our risk for the potential loss of all the money. And we should use trailing stops to lock the profits in the volatile market while protecting ourselves from the loss.

When the value of the ATR is low and the gap between the bollinger bands is also minimum then it suggests low volatility in the market. In this phase we can use large position size because of the low risk factor. But still we need to use the proper stop levels as well as profit taking levels to ensure the risk management.

Question 5: Lessons from Real-Life Scenarios

Discuss a real-life or hypothetical scenario where poor risk management led to significant losses. Reflect on what could have been done differently and propose key takeaways for improving future strategies.

Case: The Fall of 2021 Cryptocurrencies

In May of 2021, the cryptocurrencies market plunged to a severe low in just about a month time. Bitcoin fell sharply by more than 50 percent from its value at its zenith, pulling almost all the alternative coins along as well. Majority of the sellers lost drastically especially because they held over-leveraged positions.

What Actually Went Wrong

Holding Over-leveraged Positions.

Many traders used extreme leverage to realize the highest possible returns. On the downside, leverage is also a multiple of losses; therefore, selling quickly during downtrends.

Example: A trader on a Steem/USDT position at $0.50, with 20x leverage, would be liquidated if the price dropped to $0.475, a decline of just 5%.No Stop-Loss Orders:

Businessmen who forgot to place stop-loss orders watched their longs completely erased as price began its plummeting descent. The very speed of the collapse meant that little room was left in which manual intervention might be useful.Lousy Diversification:

Compressing money in volatile altcoins like Steem made the portfolio more susceptible to liquidation. Alts have a much deeper correction compared to Bitcoin or Ethereum during downtrends.Overlooking Warning Signs of Volatility:

Despite the early warnings from volatility gauges such as ATR (Average True Range) or Bollinger Bands, most investors did not step back and adopt protective measures, such as scaling down their position sizes or widening stop-loss levels.Emotional Trading:

During bull runs, FOMO was the enemy, as the trades were placed without a clear plan. Panic selling amplified losses during the crash.

What Could Have Been Done Differently?

Use Stop-Loss Orders: One of the most essential risk management strategies is setting stop-loss orders.

Example: A trader entering Steem/USDT at $0.50 might set a stop-loss at $0.45, thereby limiting the loss to 10%.Adopt Proper Position Sizing: Position sizing must be in consonance with predetermined risk tolerance.

Example: For a $10,000 account risking 2% per trade, the maximum loss is $200. With a $0.05 stop-loss, the position size would be 4,000 tokens.Diversify Portfolio: Do not put everything into the unstable altcoins. Diversifying between large caps, stablecoins, and relatively less correlated decreases overall risk in total.

Monitor Volatility Indicators: Volatility tools like ATR and Bollinger Bands can guide risk adjustments:

- High Volatility: Reduce position sizes and widen stop-loss levels.

- Low Volatility: Use tighter stop losses and consider larger positions.

Limit Leverage: Use leverage conservatively, especially in times of high volatility. Trading without leverage during high-risk events can prevent catastrophic losses.

Develop a Trading Plan: Predefine all the entry, exit, and risk management rules while executing any trade to avoid emotional decision-making.

Key Takeaways for Future Strategies

Capital Protection is Paramount:

Trading success depends on surviving adverse market conditions. Risk only a small percentage of total capital per trade.Plan and Execute Trades Systematically:

Avoid impulsive decisions by adhering to a clear plan with predefined entry, exit, and risk parameters.Diversification is Essential :

Spreading investments reduces exposure to the steep corrections of individual assets.Adapt to Market Conditions:

- High Volatility: Lower position sizes and widen stop-losses to account for rapid price swings.

- Low Volatility: Take advantage of tighter price ranges with larger positions and closer stop-losses.

Learn from Mistakes:

Analyze past trading errors to improve future strategies. Avoid repeating the same mistakes by incorporating lessons into your plan.

The 2021 cryptocurrency crash showed how important risk management is. Those who didn't use stop-losses used too much leverage or ignored volatility indicators were severely affected. Proper risk controls such as stop-loss orders, position sizing and diversification protect the capital and enable traders to adjust to the conditions of the market to be successful in the long term.

This case points out that disciplined execution and a risk-first approach are the cornerstones of sustainable trading.