Steemit Crypto Academy Season 5 Week 3 [Beginner's Course] - Understanding Trends II

Designed from Powerpoint

Designed from Powerpoint

1a. Explain your Understanding of Trend Reversal. What is the benefit of identifying reversal patterns in the Market?

A trend reversal transpires when the direction that of a stock (or any monetary trading instrument) transformations and moves backing the opposite path of which might result to the movement of trends moving from up to down or vice versa. An example of such will be disscused below:

Bullish/Bearish Trend Reversal

An uptrend is optimistic worth action continues to create ordered higher highs and better lows. When a market chart displays lower lows along with higher highs it signifies the presence of a trend reversal and eventually changes the trend direction. Every bounce try gets sold forming the lower high and every previous low gets sold to create lower lows. Once the worth stops creating lower lows and establish a better low and continue to rise with higher highs and better lows, it's fashioned a pessimistic trend reversal.

Trends Reversals on Different Time Frames

When measuring the high and lows, they will vary reckoning on which era frame chart is getting used. A lower high associated with lower low series downtrend is also established on the 60-minute chart however the 5-minute chart is also showing an uptrend with higher highs and better low candle holder closes. In general, longer timeframes indicate the final lasting trends however the shorter time frames will type countertrend moves back to the longer time frame resistance-associated either revert go into reverse or still bounce for an early trend reversal try. it's vital to outline the particular timeframe you're mercantilism and conjointly perceive whether or not it's aligned with a wider timeframe trend.

Benefit of Identifying Trend Reversal.

It helps merchants to recognize when to exit present-day trends. Trend reversal identification performs a necessary position in the market due to the fact it helps to determine the stop of a modern-day fashion and this will assist merchants to recognize when precisely to depart the market.

It assists traders to protect profit. A Trader that does not know or have an idea of trend reversal might think the rate is retracing when the price is giving rise to a reversal of the current trend and as such he may lose the profit he has already created as an outcome of a lack of knowledge of the trend reversal. So understanding the reversal pattern will boost traders to secure profit in the market.

1b. How can a fake reversal signal be avoided in the market? (Screenshot needed)

There are several means by which fake reversal could be avoided in the market so i will explain them below:

- Confirmation with Indicators

Confirmation with an indicator is a good way to avoid fake reversal in the market today by using it to confirm it. Like for example now in the chat, I uploaded you will see the price is making a procession of higher highs and higher lows as well but at some points, there was an initial break of structure though this was a fake reversal as the price later proceeded in a bullish trend. Immediately one should have realized with the use of indicator that the reversal is an imaginary one and my reason is that if there should be a real reversal when prices earn a higher formation that means a lower low is expected from the indicator but as noticed in the left demonstration in the screenshot I uploaded both price and the indicator created the similar arrangement.

Presently see the second demonstration with a blue line which is at the right side in the image. In the process, there was a break of structure and price as well which was made higher high formation that implies an actual trend reversal. The market took off in a bearish direction, hence with the use of indicators in conjunction with trend reversal one could resist fake reversal signals.

- Double confirmation Method

Another way one can avoid fake reversal signals is the use of the double confirmation method. Normally traders do procrastinate for the last low to be violated in the case of a bullish market to identify a trend reversal but sometimes it is not always the case because we might have the last low violated and still, a market might not reverse rather it will continue as a bullish trend. Like for example now a chart of DOT/USD uploaded below is making a series of higher highs and higher lows as well but at a point, the price makes a high as indicated by [m], and afterward, it made a low [b] The next high made could not break the last high [m]. then the low [b] was broken downward for a period but it was surprising that the price later proceed with the upward trend even though there was an infraction of low [b].

SHIB -TRADINDVIEW

SHIB -TRADINDVIEWThe uploaded screenshot was a fake reversal. So how do we make use of the double confirmation procedure to know if a reversal is fake or not fake? The double confirmation method is waiting for the low of the last high to break before entering the market. For example now to make use of the double confirmation method for the illustration below we have to wait for the break of [k] that is going to be obvious for a trend reversal. Though there would have been a break of the structure before gives a double confirmation.

2. Give a detailed explanation on the following Trend reversal identification and back up your explanation using the original chart. Do this for both bullish and bearish trends (Screenshots required). (a) Break of market structure. (b) Break of the Trend line. (c) Divergence (d) Double top and Double bottom

BREAK OF MARKET STRUCTURE

If the market is trending in an upward direction or downward direction, there is a constant retracement. For a trend continuation in a bullish direction, the new high must be higher than the earlier high and the recent low must go beyond the earlier low. In case of a bearish trend, the new low must be lower than the previous low and the new high must not go beyond the earlier high.

Anytime the rule recorded above fails, in the trial of a bullish market, this simply means the buyers couldn't continue to subjugate the market and that the force of sellers outstrips that of the buyer and then, there is going to be a break of market configuration, and in this trial, the price will reversal of the trend from bullish trend to the opposite side. But the downfall of the criteria for a bearish trend will cause a break of the bearish market structure to the upside. Let's consider the violation of this criterion mentioned above for both bullish and bearish trends:

SHIB -TRADINDVIEW

SHIB -TRADINDVIEWThis chart uploaded is a chart of ETH/BTC on a 4h Timeframe. If u notice, the price was developing a series of higher highs and higher lows which implied that the market was in an uptrend. But at a point, the price went wrong to create a new high higher than the previous high. At this juncture, the buyers could not drag the price up beyond this level and this indicates the weakness in the forces of buyers in the market at that specific period.

In outstanding time, the seller controlled the market and dragged the price down to cause a break of the last low and this affected a break of the structure of the current trend. This, therefore, tells that the sellers have taken control of the market. After a break of structure, the price drops heavily to the downside.

SHIB -TRADINDVIEW

SHIB -TRADINDVIEWThe chart I uploaded is the chart of ETH/USD on a 4hours Time frame. Price was developing a series of lower lows and lower highs as noticed in the screenshot. meaning that this asset was on a bearish trend at that duration. But at a point, the sellers' forces have begun to be decreasing and the price couldn't make a new low that goes beyond the previous low.

After this a break of structure and caused a violation of trend continuation to the downside. This indicates that buyers have hijacked the market from the sellers. Traders at this point that know the market structure would have secured profit and vacate a sell order to look for an alternative to take a buy order. Later the break of structure, the price traded in an uptrend.

Break of Trendline

A trendline is very valuable used to recognize trend reversal in the market. This is a line that is pulled to connect at least two lows for a bullish trend and at portable two highs for a bearish trend. When the price enters the trendline, it always turns outback and continues in its trend. The offense of this tells that the structure has been shattered. That is if the price gets to the trendline and does not oppose from there, there is going to be a break of trendline, and this implies trend reversal in the market.

SHIB -TRADINDVIEW

SHIB -TRADINDVIEWTaking look at the chart uploaded above, we see we will see how price maintains making a series of higher highs and higher lows. It kept on bouncing back at the trendline which is pulled to function as a dynamic support. And as the price kept on touching the trendline, it keeps repudiating the dynamic support line, and this method proceeds for a while and At point, the price approaches the trendline but it could not deny it as it formerly did, but rather, breaks the trendline. After the break of this trendline, vendors took payment from buyers and there was an enormous sell to the downside.

SHIB -TRADINDVIEW

SHIB -TRADINDVIEWThe chart which I uploaded above indicates a bearish break of the trendline. If you observe in the chart, the price kept on making a series of lower highs and lower lows and the price keeps opposing the trendline as every retracement reaches the trendline. So after some time, the trendline that performs a dynamic resistance was broken to the upside. It indicates a trend setback from a bearish trend to a bullish trend. The price was then exchanged in a bullish direction. A trader with a knowledge of how to use trendline to observe trend reversal would have accepted the advantage of that.

Divergence

Divergence seems to be another outstanding way traders make use to detect trend reversal in the market. This method is the mixture of indicator and price activity at the same time. Divergence constantly occurs when an indicator is doing the negative of what the price activity on the chart is accomplishing. For example, during a bullish trend, if the price makes higher highs and the indicator makes a lower low, this might imply trend reversal. This tells that the indicator is signaling a trend reversal. Traders who know this, will close their position on the current trend and posture themselves for a sell order. The two kinds of divergence we have in trading are bullish and bearish divergence.

Bearish Divergence

A bearish divergence happens when the price makes higher highs and the indicator makes a lower low. This implies weakness in the bullish trend which has been shown by early indication from the indicator. Bearish divergence indicates a reversal to the downside. Traders with this understanding will use it to run out all the current buy orders while placing themselves for a sell order.

SHIB -TRADINDVIEW

SHIB -TRADINDVIEWThe snapshot uploaded above is a chart of ETH/USD on a 2H timeframe. As seen in is the price was making higher highs and higher lows. But at a point, the price makes a higher high point but the RSI indicator makes the lower low point. After the arrangement of this, we discover how prices reversed from bullish trend to bearish trend. Bearish divergence permits traders to exit a buy order and to posture themselves to do a sell order.

Double top and Double Bottom

Double tops are another means to detect trend reversal in the market. Double tops happen during a bullish market. It forms after a new high retest the previous high without breaking the previous high. This indicates weakness in the forces of buyers and as such, they couldn't raise the price above the earlier high.

For double tops to ensue, the criteria will be met, the close price of the recent high shouldn't be higher than the previous high. The price shouldn't go beyond the previous high. The screenshot uploaded below exhibits an illustration of double tops on a chart.

ETHU -TRADINDVIEW

ETHU -TRADINDVIEWDouble Bottoms

Double bottoms are the immediate negative of double tops. While double ends happen during a bullish trend, double bottoms occur during a bearish trend. In double bottoms, the price goes wrong to build a new low that is lower than the previous low. Which tells that the previous low is retested. This chart pattern symbolizes a trend reversal from a bearish trend to a bullish trend.

For the double bottom to be reasonable, this is following circumstances will be met.

The closing price of the recent bottom shouldn't be lower than the earlier low.

new low must not go beyond the previous low.

I will be uploading a chart that shows an example of a double bottom here below.

BTC -TRADINDVIEW

BTC -TRADINDVIEW

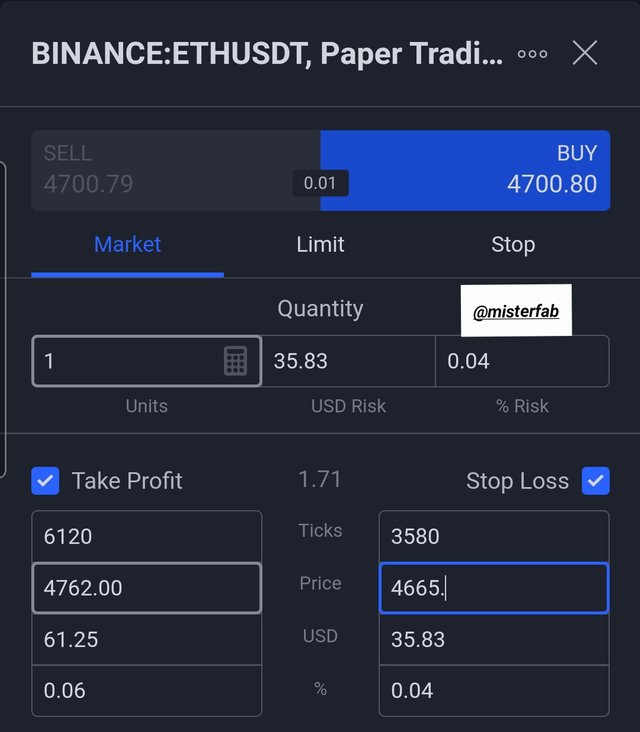

3. Place a demo trade using any crypto trading platform and enter a buy or sell position using any of the above-mentioned trend reversal/continuation patterns

In this question above I am going to be placing a demo trade and to that effect, am going to be making use of ETHUSDT to conduct a buy position making use of Double bottom to analyze the market. This Screenshot I uploaded below is the percentage of ETHUSDT I used to trade. I make use of 1 ETHUSDT to buy. Then later on I set my take profit and stop loss and I click to buy ETHUSDT.

TRADINDVIEW

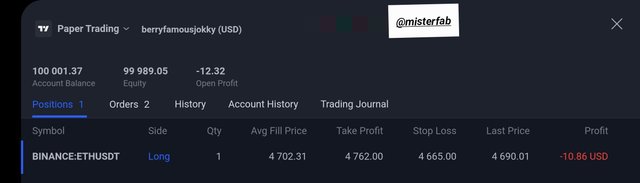

TRADINDVIEWI will be using the chart of ETHUSDT. From the chart, bearish period existed in the market but after, was followed by the double bottom indication and like I stated earlier that when a double bottom occurs, it signals that there will be a bullish trow, after a double bottom occurs the market started publishing. I started by making an entry at 4702.31 of which i set the take profit at 4762.00 and set the stop loss of 4665.00 and as you can see on the chart below, I have even started making maximum profit already. See the screenshot I did below.

ETHU -TRADINDVIEW

ETHU -TRADINDVIEW ETHU -TRADINDVIEW

ETHU -TRADINDVIEW

CONCLUSION

All these trend reversal patterns communicated here are very good reversal patterns that are going to help a trader make a reasonable decision. Moreover, we all should know that they do take some time to form, thus, one has to be calm and patient and don't rush into trading to avoid losing.

Hello @misterfab , I’m glad you participated in the 3rd week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.