Yield Farming - Yearn Finance - Crypto Academy S5W3 - Homework Post for @imagen

Describe the differences between Staking and Yield Farming.

Another popular topic at present is Yield farming. I want to say something about yield farming and staking before giving the difference of them.

Yield Farming is one kind of way to make rewards by lending funds and it is a decentralized financial system. Actually, we all know to make rewards by staking funds but yield farming is another way to make rewards by lending assets. In another way, we can say yield farming is one kind of liquidity mining. Let's look at the process of yield farming. FIRST of all, liquidity providers provide some funds to the liquidity pool to yield farming. Yield farming platforms distribute the fund for business purposes. Through this, they get some amount of interest and distribute some of that interest among the liquidity providers. As a result liquidity providers are awarded after a certain period.

Staking is another way to mine cryptocurrency but the strategy is different from yield farming. Yield farming earns interest by lending assets on the other hand staking provider earn rewards by supporting the decentralization mechanism. For example, Bitcoin mining is a process that is completed by proof of consensus algorithm where need heavy hardware. But staking uses the strategy of PoS proof of stake consensus mechanism where no need for a combination of heavy hardware.

Let's see the difference between staking and Yield Farming

| Yield Farming | Staking |

|---|---|

| It is one kind of lending strategy by which providers earn crypto assets as reward | There is no lending system but staking helps the mechanism of blockchain transections |

| There has collateralization system | There is no collateralization system |

| A liquidity provider can earn the highest 100% | The reward may fluctuate 5% to 15%. |

(2.) Login to Yearn Finance. Fully explore the platform and indicate its functions. Describe the process for trading on the platform (wallet connection, funds transfer, available options). Show screenshots.

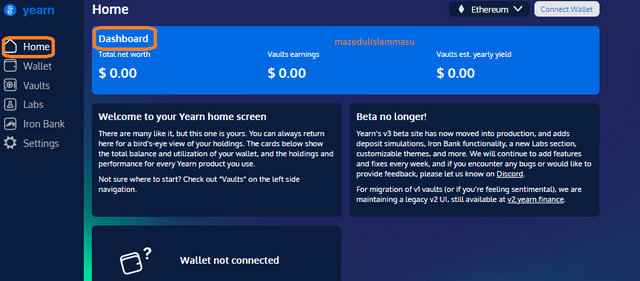

First of all let's visit the Yearn Finance website to explore all options.

- Home or dashboard contains some menu (total net worth, vaults earning,vaults est yearly yield etc

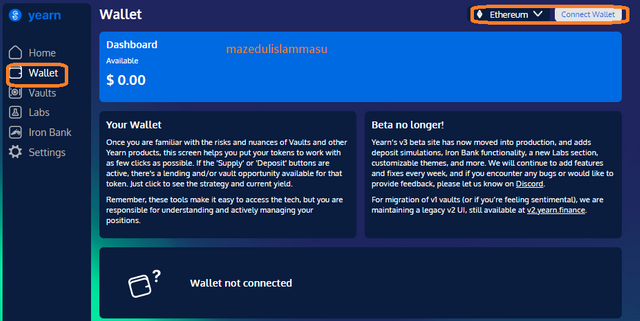

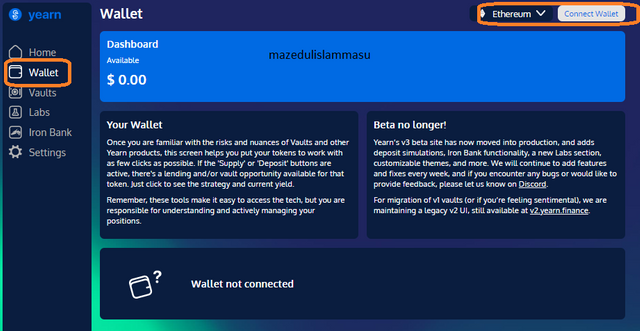

- Wallet Where we can connect wallet.

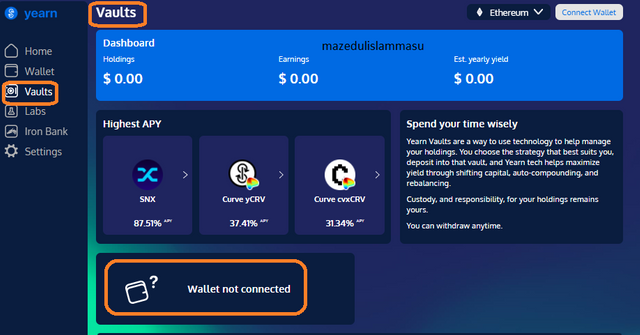

- Vault contains some options ( holding, earning, est yearly)

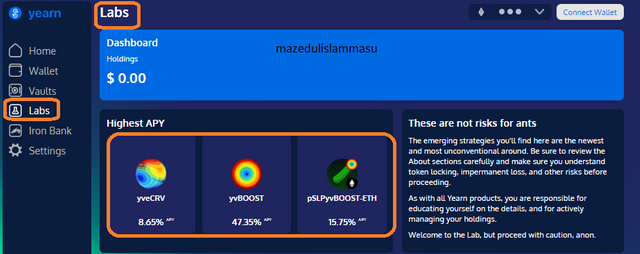

- Lab has holding and High APY optioins.

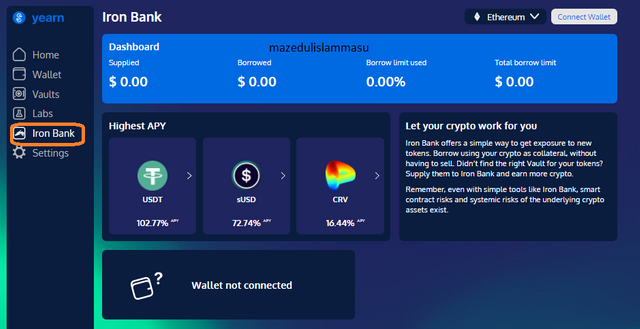

- Iron Bank has some options such as Borrowed, Borrowed Limit,Borrowed Limit Used.

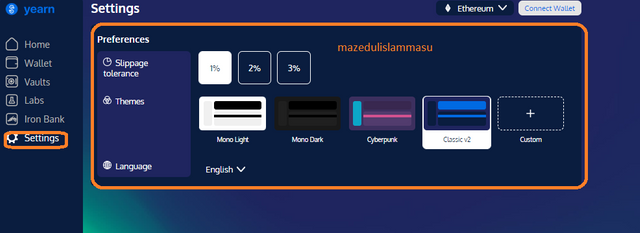

- Setting we can change the theme, language etc.

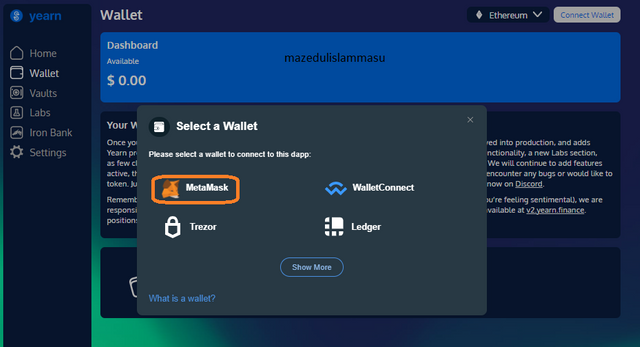

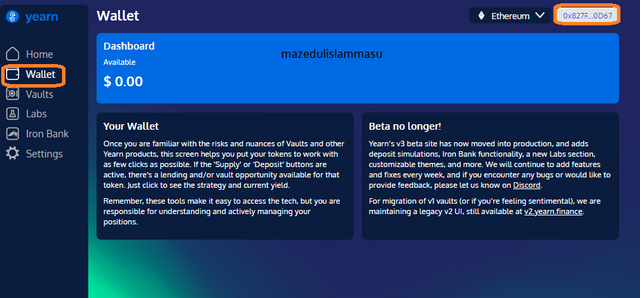

- Wallet Connection

Step-1

Step-2

Step-3

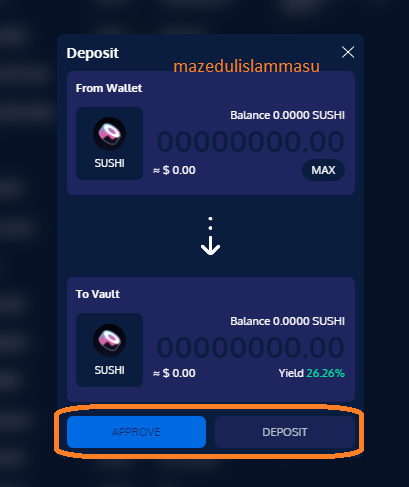

- Deposit

Step-1

Screenshot from Yearn Finance

Step-2

(3.) What is collateralization in Yield Farming? What is functions?

I have described earlier Yield Farming. Yield farming and staking are little bit different. Collateralization is totally different feature from staking. Yield farming is one kind of system where we can borrow assets as well as anyone can lend crypto assets and any other one can take the fund as borrow.

But in this case, there is a condition. Let me clear the condition. Usually, we take loans of different amounts from the conventional banking system. When we take a loan of a big amount, they give us a conditional loan. The condition is that we have to deposit with them something equal to or more than the value of the loan we want to take, it can be gold or anything. Exactly the same system is in yield farming which is called collateralization. If I want to take the loan from Defi it needs to deposit assets in my own Defi account. In another way, we can say collateralization provides security when you want to borrow in yield farming.

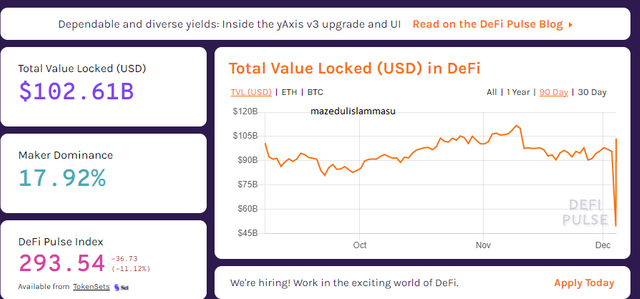

(4.) At the time of writing your assignment, what is the TVL of the DeFi ecosystem? What is the TVL of the Yearn Finance protocol? What is the Market Cap / TVL ratio of the YFI token? Show screenshots.

To answer the question I have taken some screenshots. Now (TLV) Total value of Locked in (USD) of the DeFi is $ 107.85 Billion.

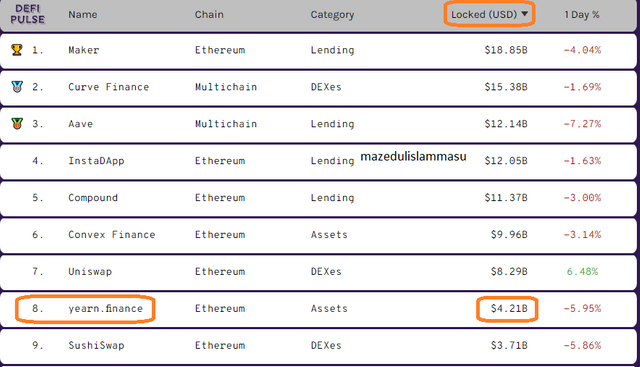

TLV of Yearn Finance

TLV Of yearn finance is $4.46B

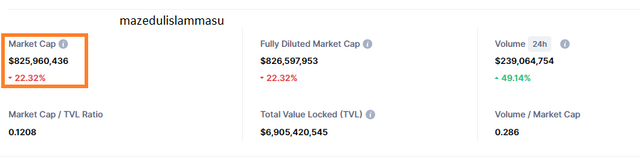

Now total market capitalization of YFI token is $825960436.

Let's calculate Market Cap / TVL ratio of the YFI token.

Market Cap / TVL = $825,960,436 / $4,210,000,000

= 0.1961901273159

(4.1.) The YFI token, is it overvalued or undervalued? State the reasons.

In the question, I am going to say my own opinion that the YFI token is undervalued. If we look the marketcap of the coin and the price of the coin. According to the market cap, the value of this token is much lower than it should have been. That is why I told the token is undervalued.

(5.) If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment in the actuality? Explain the reasons.

Bitcoin price

August-01-2021,

Bitcoin closing price= $ 39,839.90,

My investnent $500

I will get = 0.0125BTC

Today Bitcoin price = $ 53,620.60

I will get

0.0125 bitcoin = $ 670.25

The price at which I bought the bitcoin in August has now risen the price.

Total profit (670.25-500)= 170.25

Now For YFI

01-August- 2021

The price was $31780.

My investment $500.

I will get 0.015733

Now the price of YFI = $28510.80

Present value of 0.015733 YFI = $448.56

Total return from the investment = ($500-$448.56) = -$52.44

Let's summation the return, of Bitcoin and YFI.

Total= {$170.25+(-52.44)} = ($170.25-$52.44) = $117.81.

The price of Bitcoin, which was in August, has now risen. So we invested $500 and got a good amount of profit from there. But in the case of YFI, its price is currently lower than in August. So we've lost some dollars here. But we have made a profit by combining the profits of two investments in one place.

(6.) In your personal opinion, what are the risks of Yield Farming? Give reasons for your answer.

In the question, I will say it contains some risk. Some reasons are given below for my opinion.

- Liquadation Risk I think this is the risk that can happen when the price of collateral drops below to price of the loan. In this scenario, collateral can not be appropriate for the loan.

- System losses Generally Decentralized financial mechanism created by coding. If there is a mistake in coding then hackers easily take that opportunity. Which can be a big loss for small traders.

- Price Fluctuation risk is another cause. The Crypto market is not stable. Any time here can happen big fluctuation as a result trader suffers losses.

Conclusions

It is as important to know about Yield Farming as it is to know about staking. Yield farming is a easiest way to mine cryptocurrency. Though staking and yield farming are similar but the strategy of earning rewards comparatively different. By the lesson I have learnt about yield farming and yearn financial which is very helpful for me. I want to thank professor @imagen for his wonderful educative lesson.