Crypto Assets Diversification - Crypto Academy / S4W4 - Homework Post for @fredquantum

Hello! Steemians, I am @masumrbd. In Steemit Crypto Academy Season-4, Week-4 is running. Now, I am writing my homework task about "Crypto Assets Diversification" for professor @fredquantum. Let's get started:

1- Explain Crypto Assets Diversification.

Crypto Assets Diversification (CAD)

Crypto Assets Diversification (CAD) is an investment strategy in the cryptocurrency market. With this strategy, a trader successfully manages his portfolio and makes more profit and less loss. The main thing here is to invest all your capital separately without investing in one coin or project. The technical and fundamental analysis both are done in CAD so that the investment will be reliable and secure.

There is a saying in English, "Don't put all your eggs in one basket". We have to find various good coins and projects where investing is more likely to be profitable. If all the capital is divided and invested in different places, if there is a loss in any coin or project, it will be filled with the profit of other coins.

Crypto Assets Diversification (CAD) strategy gives us a lot more reliability and security. Cryptocurrency is a highly volatile marketplace, where price fluctuation is much higher. So anything can happen at any time.

If a trader has $100 to invest, he must invest according to the 1-4 rule. In this case, $ 100 will divide into four parts, $25 in each investment. In this case, instead of investing $100 in just one coin, you have to invest in 4 different coins, which are good by fundamental and technical analysis. So even if the price of one or two coins falls, it can be compensated with the profit of the rest. In this case, even if it is not a profit, the possibility of loss is very low. But if you invest $100 in just one coin, there is a possibility of profit and loss.

A real trader and investor invest his capital everywhere through diversification, such as commodities, stocks, gold, etc. But there are different coins for cryptocurrency diversification. You have to find and invest in good profitable coins. It is better to stay away from the signal taken from any telegram group or friends. You have to find and invest in profitable coins by doing fundamental and technical analysis by yourself.

2- What are the Benefits/effects of Diversifying one's assets?

Benefits of Diversifying one's assets

Increase chances of profit

One of the benefits of diversifying assets is the opportunity to make a profit. Because if you invest in a few coins, if one of them pumps well, then there is a possibility of getting much more profit from it. But if you only invest in one coin, it may not return that way.

Another benefit of asset diversification is that there is usually no chance of loss if the fundamental and technical analysis of the invested coins are done carefully. If for some reason the price of a coin drops for some reason, then its deficit can be compensated through the rest of the coins profit. However, in this case, the fundamental and technical analysis of the coins that will be invested should be done well.

Increase your presence in the market

In the cryptocurrency ecosystem there are many types of coins and projects. No one knows when the value of which will increase, but it can be predicted by fundamental and technical analysis. When our analysis is correct, then we make a profit by investing in that coin or project. In this case, if you can invest in more coins or projects, the presence in the market increases and there is a possibility of more profit.

Effects of Diversifying one's assets

Reduces return on investment

Diversify reduces the risk a lot, but in this case the amount of profit is less. Because if you can invest in 4 coins with $100, then each coin is bought with $25. In this case I think if the price of a coin is 40% up then the profit at $25 will be $10. But if $100 was invested in the coin, the profit would be at $40 with a 40% price increase. Which is three times more than the previous profit. So it can be said that even if the risk is reduced due to diversify, it also reduces the profit of the investment.

3- Construct Crypto Assets Diversification according to the 1 - 4 Rule - Choose 4 crypto asset (State the reasons for choosing them), discuss each of the assets, and perform a detailed fundamental/technical analysis on them. Invest a part of at least 15 USD into each of the assets based on the diversification constructed earlier, proper stop loss and take profit levels must be put into place. A real trade on a centralized exchange is expected here. (Graphics/Screenshots/Charts are required). Note that: You are expected to show your verified account screenshot, your reservoir and the steps involved while investing (For example, if you are investing a part of 15 USD at a time, then, the reservoir must have been 60 USD clearly shown, you can use Fiat or Stablecoin for construction). Kindly take note.

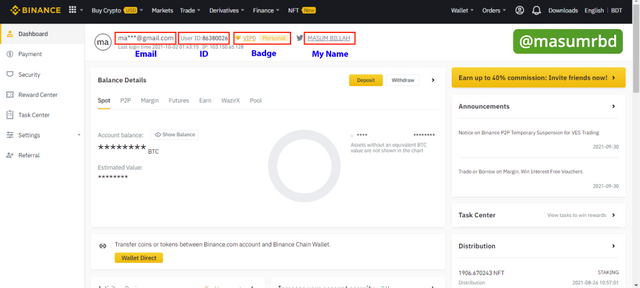

Now, I will diversification my asset $60, and I will buy Bitcoin (BTC), Cardano (ADA), Uniswap (UNI) and Solana (SOL). Let's see the overall procedure along with my fundamental and technical anlaysis-

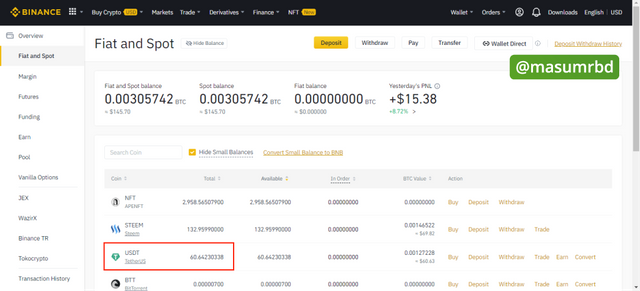

- I got $60 to invest in 4 coins per coin $15.

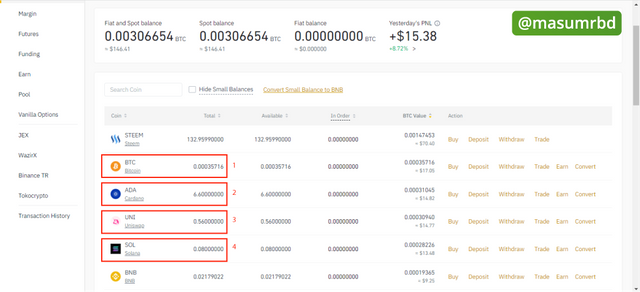

I buy Bitcoin (BTC), Cardano (ADA), Uniswap (UNI) and Solana (SOL) $15 each for my diversificaion investment as my professor said-

- My portfolio looks like this after diversification. Look at the screenshot, I invest in 4 coins $15 in each.

BITCOIN (BTC)

Fundamental analysis

Bitcoin (BTC) is the worlds fist cryptocurrency. The price of BTC is also highest among all other cryptocurrencies. The current price of BTC is $47750 now by the time I was writting this post. People trust this coin than any other coin in the market. A couple of months age the price of this coin crashed because of whales. Now the price is increasing. If you see the development of Bitcoin since 2009, It has huge potential. The increasing percentage is surprising, because people believe in it.

Besides this many companies try to use BTC as their payment method. Ths official currency of El Salvador country is BTC that means a lot. People are adapting BTC day by day and it is good to investment in Bitcoin.

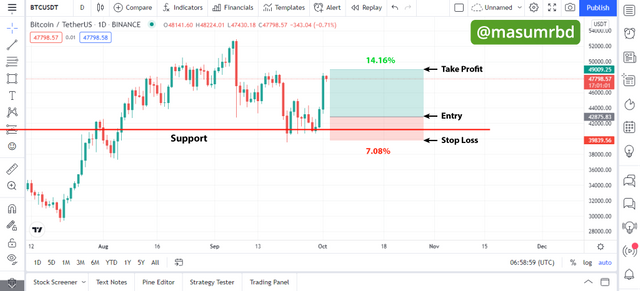

Technical analysis

According to my technical analysis, I draw a support line and there will be my entry point. I also indicate take profit and stop loss region as 1 : 2, risk/reward ratio. Hence the probability of profit it 14.16% and the probability of loss is 7.08% as you can see in the screenshot.

CARDANO (ADA)

Fundamental analysis

Some says that Cardano is the next bitcoin. Cardano is a Proof of Stake (PoS) consensus algorithm based blockchain. The native coin of this blockchain is ADA. Cardano team claimed that, Bitcoin’s scripting language is too rigid, whereas Ethereum’s Solidity language is far too complex. The team made it simple and developed Simon that is good for the blockchain. Cardano is famous for its unique value proposition. The adption of Cardane in happening many places like Ethiopia and industries can easily solve theirs problems.

Technical analysis

According to my technical analysis, I draw a support line and there will be my entry point. I also indicate take profit and stop loss region as 1 : 2, risk/reward ratio. Hence the probability of profit it 20.10% and the probability of loss is 10.05% as you can see in the screenshot.

UNISWAP (UNI)

Fundamental analysis

Uniswap is a decentralized exchange created by Hayden Adams who was an Ethereum developer in November 2018. This exchange is popular and facilitates Defi tokens. The native token of this exchange is UNI. UNI token is very popular now, because its the worlds top decentralized exchange sites native token. UNI is listed in various popular exchanges. One of the top centralized exchange Binance, Coinbase Pro also listed UNI that is a very good. Investment in UNI will be a very good choice in my opinion.

Technical analysis

According to my technical analysis, I draw a support line and there will be my entry point. I also indicate take profit and stop loss region as 1 : 2, risk/reward ratio. Hence the probability of profit it 23.6% and the probability of loss is 11.8% as you can see in the screenshot.

SOLANA (SOL)

Fundamental analysis

Solanas Proof-of-history (PoH) consensus algorithm helps it achieve high transaction and the block production time is faster. Solana has great develpment within last few months. It is assumed then Solana will be the competitor of Ethereum. Two organizations Solana Foundation and Solana Lab are working on the development of the blockchain. The blockchain is optimized for security, decentralization, and scalability. The blockchain trilemma problem solved very easily. The good thing is there are 900 validators on Solana and the number is still growing.

Technical analysis

According to my technical analysis, I draw a support line and there will be my entry point. I also indicate take profit and stop loss region as 1 : 2, risk/reward ratio. Hence the probability of profit it 35.4% and the probability of loss is 17.7% as you can see in the screenshot.

4- Explain Arbitrage Trading in Cryptocurrency and its benefits.

Arbitrage Trading

Arbitrage trading in cryptocurrency is a strategy of trading where profit is made by using the difference of price of the same coin in different exchanges. A coin is bought cheaply in one exchange and sold at a higher price in another exchange. In this case profit is small but strategy is very useful.

The price fluctuation in cryptocurrency is very high. Thats why the operation should done quickly otherwise you may end up with loss. The price differs slightly form exchnage to exchange due to the differences in the liquidity of the coins in the market.

Exchange sites withdrew withdrawals and trading fees. So looking at the price difference in a coin, you have to think in advance whether there will be profit apart from withdraw and trading fee. If not, many times you may face loss.

Benefits of Arbitrage Trading in Cryptocurrency

The biggest advantage of arbitrage trading is that it does not require any kind of fundamental and technical analysis. So anyone can make a profit by applying arbitrage trading strategy, in this case he just needs to know how to run different exchanges and be quick.

We know that fundamental and technical analysis requires a lot of time. Those who are new traders do not know these issues at the beginning and start the problem phase to trade. So they can make profit by spending less time on arbitrage trading.

Arbitrage trading can be done at any time. You can make profit by trading as many as you want every day. By trading in this way, the small profits come together to make a big profit.

Another advantage is that in arbitrage trading you don't have to worry about when the value of a coin will increase or decrease. Here we just have to wait when two different exchanges make the price difference of the same coin.

You can make more profit with lower denomination coins. So always look for low value coins.

5- Discuss with illustration how to take advantage of Exchange Arbitrage.

Now I will show you how to take advantage of Exchange Arbitrage. For this I have chosen two exchange Binance and Poloniex and ETH/USDT pari as coin pair.

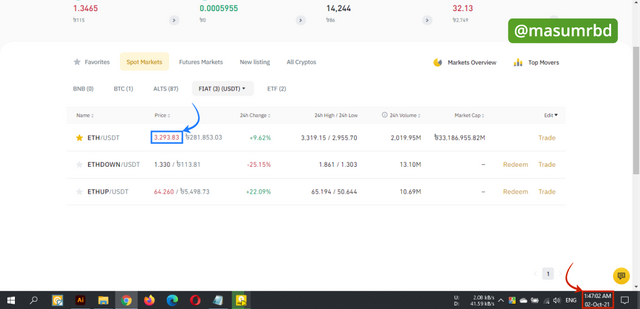

- You can see in the below screenshot, the price of ETH in Binance Exchange was 3293.83 at 1:47:02 AM, 02-Oct-21.

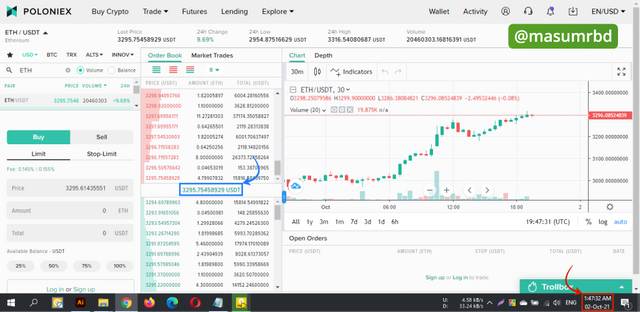

- You can also see in the below screenshot, the price of ETH in Poloniex Exchange was 3295.75 at 1:47:32 AM, 02-Oct-21.

The price is less in Binance Exchange, so we have to buy ETH in Binance and after sending it Poloniex exchnage we can sell it at higher and we will be able to make a profit of $1.92 considering trading fees. Which is very small about 0.05%, because we are investing $3293. So, from it 0.05% profit is less. If we want to profit more then we have to apply a simple trick, we have to trade low price coins. This will give us more profit compared to high price coins like ETH as I discussed here.

Now, I will show you how to take advantage of Exchange Arbitrage by TRX coin is a low price coin. Let's see-

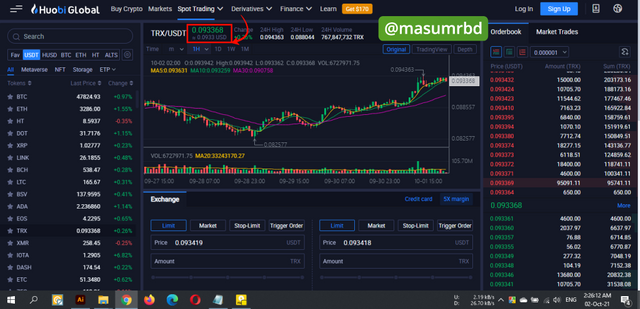

- You can see in the screenshot, the price of TRX in Huobi Exchange was 0.0933.

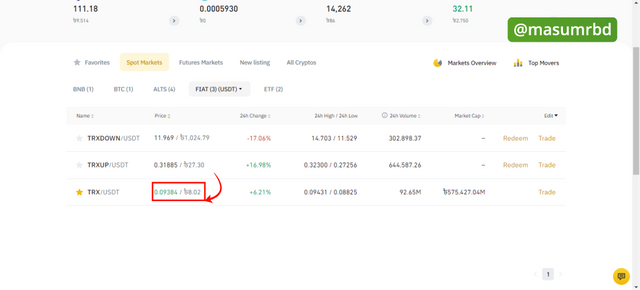

- You can see in the screenshot, the price of TRX in Binance Exchange was 0.0938.

The price is less in Houbi Exchange, so we have to buy TRX in Houbi and after sending it Binance exchnage we can sell it at higher and we will be able to make a profit of $0.0005 considering trading fees. Which is about 0.53%, if we invest we invest $100 we can easily made $0.53. So, from the previous in case of ETH the profit was lower compared to this investment. So, It is wise to use lower price coins for more profit.

6- Creatively discuss Triangular Arbitrage in Cryptocurrency. How to identify Triangular Arbitrage opportunities and the risks involved.

Triangular arbitrage in cryptocurrency is an exchange strategy where arbitrage traders take advantage because of the differences prices of crypto pairs. Usually three coins are exchanged between themselves and they become profit due to price difference. The trader takes advantage of the price difference of this crypto pair.

Example

Let's assume, three cryptocurrency coins A, B, and C. The ratio of crypto A/B pair is trading at 0.700, and the B/C pair is trading at 1.300 and the A/C pair is currently trading at 1.500.

For the above case, if I purchase $50000 worth of coin A after selling the coin B based on the A/B pair and its rate, I will get-

$50000 * 0.700

= $35000

∴ I will get $35000 worth of coin A.

Next, I will place a sell order of $35000 worth of coin A for coin C based on the A/C pair and its rate of 1.500 and I will get-

$35000 * 1.500

= $52500

∴ I will get $52000 worth of coin C.

Lastly, I will sell coin C for the base coin B at its rate of 1.300 and I will get-

$52500 * 1.300

= $68250 - $50000

∴ The net profit from this triangular arbitrage will be⇒ $68250 - $50000 = $18250.

By the following ways triangular arbitrage trading occurrs in cryptocurrency trading.

Conclusion

Asset diversification in cryptocurrency is very important. This strategy can be also be used in commodities, stocks, gold, etc besides cryptocuency. Crypto Assets Diversification (CAD) is an investment strategy in the cryptocurrency market. The technical and fundamental analysis both are done in CAD so that the investment will be reliable and secure.

For good portfolio management, diversification has to be done well. In this case, you have to do the fundamental and technical analysis yourself, you shouldn't listen to others.

Best Regards,

@masumrbd