Stability in Digital Currencies- Steemit Crypto Academy- S4W5- Homework Post for @awesononso

Hi. @awesononso thanks for lecturing us on Stability in Digital Currencies. It was fully understood and below is my submission to your assignment

Explain why Stability is important in Digital currencies.

The merits of stability can not be talked about without knowing what Stability.

Stability can be understood as a situation where the price of a digital asset is considered to be stable in respect to its value. The mother of all cryptocurrencies was born to combat the flaws of the central banking system and give the average person a chance to have control over their assets and not be controlled by the central banking system as it is based on the principle of centralization.

This was achieved by giving the passageway of bitcoin to be implemented. In no time, this idea of decentralization was beginning to make sense and there was the birth of altcoins. Mind you, all these cryptocurrencies’ assets are volatile, which means that the price value of these assets is not stable.

Due to the volatile nature of these cryptocurrencies, the crypto space needed a mechanism that could solve the issue of stability as these cryptocurrencies are unstable and highly risky for the faint-hearted investors who can’t withstand the risky nature of these assets.

The idea of stable coins was conceived, meaning that the implementation of a cryptocurrency asset that could be a medium of storage of value and its stable purged against a common fiat currency (dollar) irrespective of the market trend. This was achieved by purging these stablecoins against a common fiat currency, in this case, the Dollar, which is widely used across the length and breadth of the globe as a well-accepted medium of exchange in the sense that the price of 1 stablecoin would be equal to $1, thereby achieving stability.

Importance of Stability in the Cryptocurrency Market.

Store of Value:

Because of the volatile nature of cryptocurrency assets, they are unable to achieve stability in the sense that the prices of these assets fluctuate at any given time, and the quantity of these assets you hold fluctuates as well, thus violating the principle of store of value say I own a position in a crypto asset which is worth a million dollars, and within a specific time period the market is in a downward trend and the assets I hold have depreciated to say half a million dollars. In this instance, the store of value hasn’t been achieved. But if I own 1 million dollars worth of USDT for a year, irrespective of the market movement, I am still worth 1 million dollars. Why? Because stablecoins serve as a store of value.

Avoidance of Loss of Funds:

Stability always tries to avoid loss of funds for investors. Why? Because whatever amount you own in stablecoins does not depreciate nor appreciate in value. For example, say I own $500 of a crypto asset, not a stablecoin, and per the market antics, bears are in control and the asset I own is now worth $100. This is to say that I have lost about $400, which is not the case with stablecoin. Whatever you own in stablecoin remains the same, therefore loss of funds is avoided.

Do you think CBDCs would be good in the future? Weigh the pros and cons in your own understanding and state your position.

The world we live in is changing, and so as to live in accordance with its change, we must also embrace changes. I believe Central Banking Digital Currencies (CBDGs) should be embraced by every country, as it will in a way help the economies of these countries, and I strongly believe CBDCs are the future. Below are the pros and cons of CBDCs;

Cash Free System: The free flow of cash in a country’s economy always has an adverse effect on the economy as this cash is not controlled. When CBDCs are properly implemented, all transactions will be based on digital, which doesn’t need any third party involvement and also averts the risky nature of holding voluminous cash in hand.

Improved Transaction Fees: CBDCs are usually less costly in transaction fees as compared to the fees charged by banking systems of countries.

All Inclusive Economy: When CBDCs are implemented, people from afar who do not have access to banking systems within their vicinity could reply on CBDCs for faster and quicker transactions as they wouldn’t be left out.

Legally Backed: When CBDCs are implemented, they would be considered as legal tender and therefore controlled by the Central Bank of any country, so they would be widely accepted without any side issues.

CONS

- Dormant Financial Institution: As financial institutions depend on customers for survival and operation, when CBDCs are implemented, these institutions will lose a chunk of their customers as they have found a reliable and fast way of doing transactions in the comfort of their homes. These institutions will be out of business and of no use to their customers, thereby forcing these financial institutions to collapse.

- Centralized Nature: As cryptocurrencies are based on the principles of decentralization, CBDCs would operate on the opposite principle, meaning that they would be subject to control by the central government and all their information would be made available to the central body and could be frozen at any time in case of malpractices.

Explain in your own words how Rebase Tokens work. Give an illustration.

As already learnt in class, Rebase Tokens can also be referred to as Elastic Supply Tokens which is propounded based on the theory of Supply, Demand, and Price, in that the total circulating supply is adamant to change due to the changes in the price of the token in question. In that regard, the tokens that you hold can increase and decrease beyond their par value, but the price will still remain static.

Illustration

In this regard, let’s use the base token as an example, I hold 10 pieces of the base token worth $5. If for any reason, due to the volatility of the crypto market, the supply of the tokens increases in the market and my token is increased by 20 pieces, creating an excess supply of tokens, my price holdings will still be the same at $5 despite the increase in supply. On the other hand, if volatility causes the token price to drop, its circulating supply is reduced, and my holdings drop to 5 pieces, thereby limiting supply and creating high demand, my token's worth will still be $5.

Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the rebase %. What else can you find on the page?

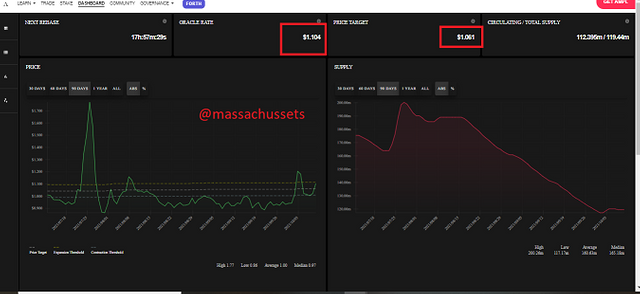

Calculation of Rebase on Amplerforth

Formular

Rebase % = {[(Oracle Rate - Price Target) / Price Target] x 100} / 10

Parameters

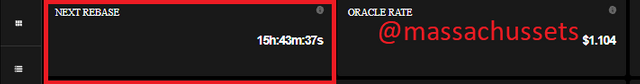

Oracle Rate = $1.104

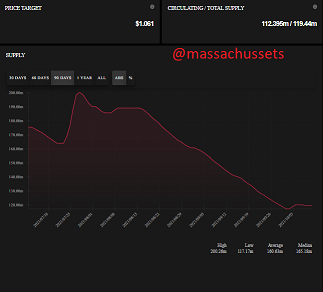

Price Target = $1.061

Rebase % = {[(1.104 - 1.061)/1.061] * 100}/10

Rebase % = {[(0.043)/1.061] * 100}/10

Rebase % = {[ 0.0405] * 100}/10

Rebase % = {4.05}/10

Rebase % = 0.405%

What else Can you find on the page?

Apart from the Oracle Rate and the Target Price, we can as well find;

Next Rebase: Which literally gives us the time frame within which the next Rebase will take place.

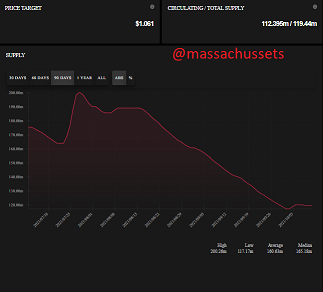

Circulating/Total Supply: This also tells us the circulating and total supplies, which are 112.395m and 193.44m, respectively.

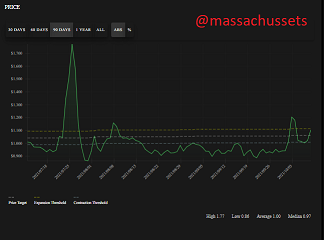

Price: we can also find a price chart which gives the price history.

Supply Chart: The supply chart too was not left out and it also gives us the supply chart history.

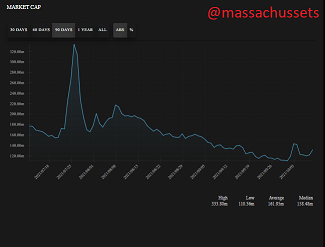

Market Cap: The market cap is also represented by a chart.

Trade some tokens for at least $15 worth of USDT on Binance and explain your steps. (Give necessary Screenshots of the transaction).

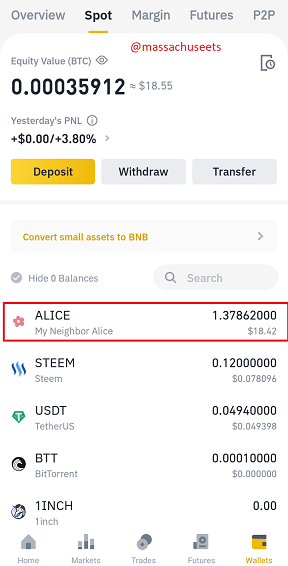

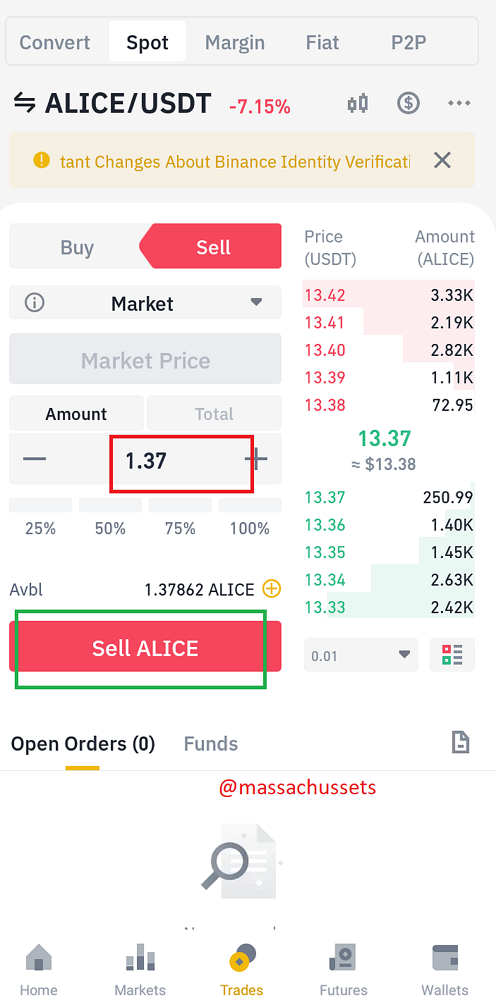

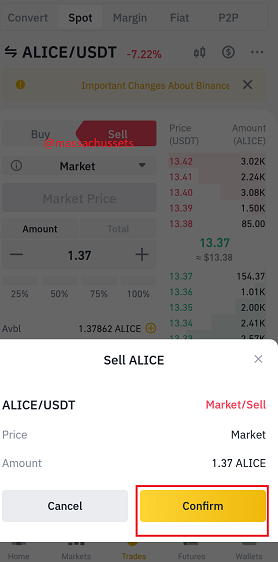

For this task, I will be trading Alice token for USDT.

To be able to do that, first of all, I have to login into my binance exchange.

- From my wallet, I will click on Alice.

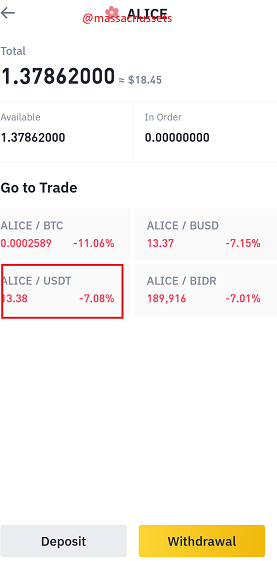

- Select the ALICE/USDT pair

- Click on theSell and key in the amount you wish to sell, ie 1.37 Alice and click on the sell Alice.

- Click on Confirm for the order to be filled.

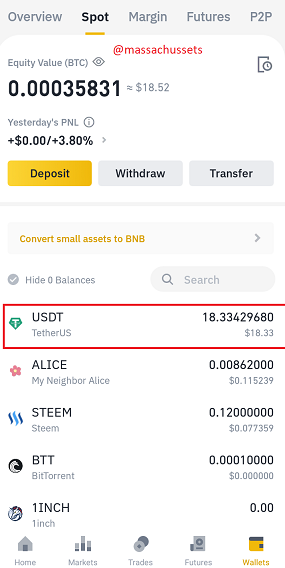

successful trade

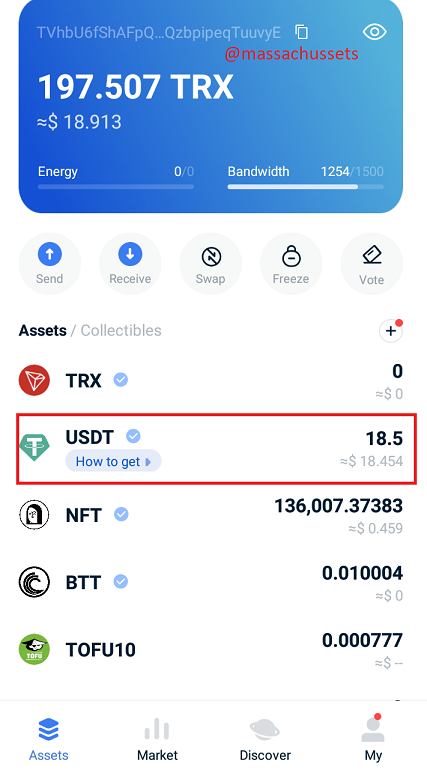

Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of the stablecoin over fiat money transactions? (Give Screenshot of the transaction).

For this task, I will be transferring from Tronwallet to the Binance exchange using the TRC20 address from Binance.

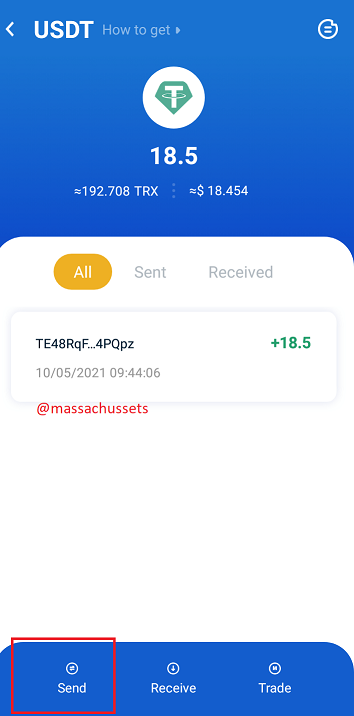

- From my Tronwallet I click on usdt.

- Click on send

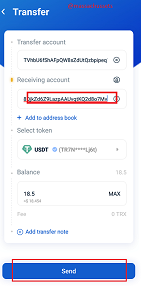

- Key in the receiving address and the amount and click on send.

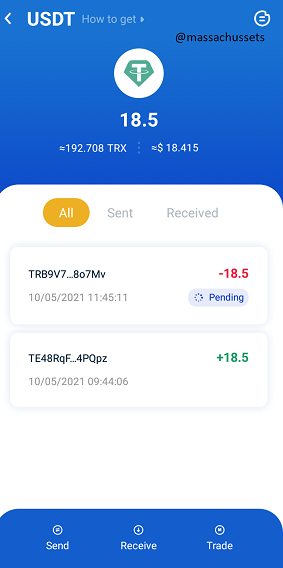

processing transfer

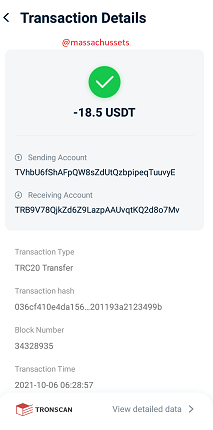

confirmed transaction

Pros of stablecoin over fiat money

Low Transaction Fees: One of the advantages stablecoin transactions have over fiat money is the low transaction fees they have when compared to fiat money. The transaction fees people pay overseas in order to get money to their loved ones are very alarming.

Speed: Stablecoin transactions, especially on the Tron network, are the fastest. Transactions are processed in less than a minute, which always tends to outplay the fiat money transfers that normally take hours, days, or weeks to reflect.

CONCLUSION

To conclude, this lecture has been a top-notch presentation by prof @awesononso. Stablecoins have been a lifesaver for traders and investors, as they can store their funds in stablecoins and worry no more as their funds will still be intact. On the other hand, I can’t wait for all countries to embrace CBDCs in the near future, as it would speed up transactions and be accessible by anyone anywhere at anytime.

Hello @massachussets,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You should improve on your arrangement and markdown use.

Your answer in question 3 needs to be improved.

I noticed some parts paraphrased from other sources. Always be as original as possible.

Thanks again as we anticipate your participation in the next class.