Stability in Digital Currencies- Steemit Crypto Academy- S4W5- Homework Post for @awesononso

Hello Everyone, welcome to this post where I discuss the homework tasks that were given by Prof. @awesononso at the end of the lesson.

Today, there are over 12,500 cryptocurrencies. After the birth of Bitcoin, many digital currencies trooped in. The cryptocurrency that came after bitcoin are known as Altcoins. These coins are also known as alternative coins since they are alternative coins to Bitcoin.

Bitcoin and all other Altcoins have become popular over the years because of the obstacles they came to solve. Digital Currencies were invented to serve as alternative ways to Fiat currencies which will be used in a transaction. There is no go-between in the use of digital currency and that is not the case with Fiat money. Unlike Fiat currencies that the government has control over, digital currency is decentralized. The users of digital coins have control over their assets. Also, blockchain technology has been one of the fast and growing technologies that came to be as a result of the invention of Bitcoin.

Though bitcoin and other Altcoins are used for transactions, one of the major problems associated with them is the fluctuation in price. If you make a payment to buy/sell a product or service with 1BTC now, in a few moments. The same product's price may have increased to say 1.2BTC. In reality, some Altcoins and Bitcoin are not steady in price. They are very volatile; the price can increase and decrease at any time.

With the issue of this price variation, stable coins are introduced to join the recess/gap. It is therefore pertinent to know that, there are coins that are called stable coins. They are stable coins because their price doesn't change. There are quite many of these digital assets whose values are constant. Examples are, USDT, TrueUSD, Binance USD.

Stability in digital currency is important. Its importance can never be overemphasized. There's what is called store value. People believe that some cryptocurrencies cannot be store value because of the fluctuation in price. This is true because any asset that is store value must maintain its purchasing power. Traders should be able to be exchanged in future without losing their value. Unstable coins, therefore, can not be utilised for store value. Therefore, stability is necessary for store value.

Furthermore, stability in digital currencies is key as it enables to have a reservation. When you make a profit on your purchase and want to preserve part of your profits, you will acknowledge saving it to where it can not depreciate. There are times of lack or need when you may want to use the money for something. If the fund is not saved to where the purchasing power will be maintained, you may likely not be able to use the money at a particular time.

Stability in digital currencies makes traders or Investors keep their profits. If there are no stable coins which traders can use to save their profits earned from trading unstable coins, they may not be able to save their profit, and then they may incur a loss at the end of the day. In essence, stability in digital currencies helps traders to claim they have an "asset or reservoir". The point of stability can nevermore be over-emphasized.

It's also pertinent to know that stability in digital currencies help us or withdraw or sell without having any loss. You can easily withdraw your asset in stable coins without having to worry about losing. This is one of the values of having assets that are stable coins. Also, with the use of stable coins, one can make a quick position when trading.

CBDCs is Central Bank Digital Currencies and they are digital currencies which are the representation of the a given nation's currency. The value of a CBDC is an equal to the currency value of the nation. For example, 2 naira will be equal to 1CBDC of Nigeria.

Since CBDC is a digital currency issued by the central bank of the nation, it will be centralized. This means that the government will be in control of that digital currency. Although CBDCs have not been fully implemented, the governments are beginning to create digital coins which will have the same value as the currency of the nation.

Now, let's look at the pros and cons of this digital currency.

• It is legalized.

currency issued by the central bank of the nation and supported by the government, then it will be backed by the law and government policies. Therefore, it will be accepted in the country where it's issued.

• Security

There's no need to take along huge funds when you want to purchase goods worth millions of dollars. One can do the transaction with the tip of a finger from his wallet. Thus, stealing or robbery will significantly decrease. You will only be robbed when another person has access to your private keys or password to your digital wallet.

• No need to have accounts with Bank

You will not need to have an account with any commercial bank with the use of CBDC. All you need is to create an account online and have your wallet. With this, the unbanked will be added to it.

• It may lead to the adoption of cryptocurrency

If citizens enjoy the use of CBDC and see the little enjoyment it presents, they may end up adopting cryptocurrency where they will have total control over their assets.

• Its centralized system

One of the major disadvantages of this is that, it's controlled by the government of the nation. This means the citizens don't have control over their assets

• Government Policies

Government policies may lead to paying more transactions fee, especially if you want to send a large amount of money and since they are the ones controlling it, you don't have a choice than to pay.

• It may be difficult for uneducated people to be adopted

Citizens who don't have skills in using digital devices may not adopt the use of CBDC. Because they may not know how to operate the wallet, confirm a transaction or send money.

Now, if we weigh the merits and demerits of CBDC, I can say it can be beneficial in the future. Some of the advantages are more significant as compared to the disadvantages. Let me try to explain properly. The legalization of CBDC will make all citizens adopt it and use it as a medium of exchange.

Recall I said one of the disadvantages is that illiterate citizens. These are people who are not skilled in using digital devices, hence finding it hard to adopt them. However, they can be educated on how to use it. Also, one of the pros is that there will be secured with the use of CBDC. Citizens will not have to move with money when going and purchase goods or products.

Although CBDC may be centralized, its centralization may be used to monitor all forms of malicious behaviour and dubious activities on the network. Also, its adoption may lead to the adoption of cryptocurrencies by the citizens. Thus, when they are using CBDC, they will still be using their country's digital currency.

Another important factor why CBDC will be good in the future is that using it will bring about the fast transaction. Unlike the use of fiat money where you will be collecting receipts and papers when you make a payment, you only need to view transaction history on your wallet. Then, you can make transactions anytime on your phone at any time.

With these and many others, I suppose CBDC can be good in future.

Rebase token is a kind of token in which the circulating supply varies due to the variation in its price. It is also known as an elastic supply token as a result of the variation of the price. This, therefore, makes the circulating supply to continue changing itself automatically.

Rebase tokens like stable coins are similar because both have are always targeting a price. However, rebase token is different from stable coins in that, the supply in rebase token is elastic in nature. The supply keeps adjusting itself as the price adjusts based on the law of supply and demand.

**Now how does rebase token work? **

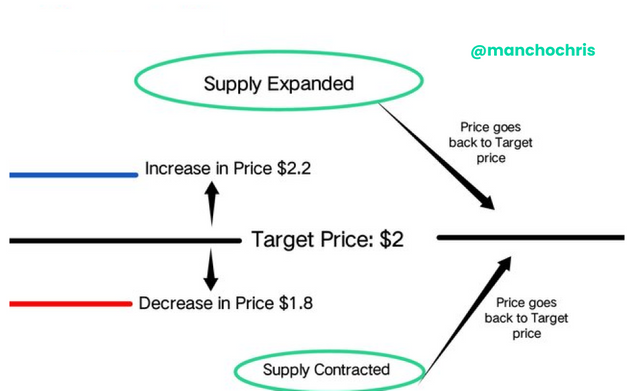

Rebase token, as I said earlier, has a Target price, just as stable tokens do. To understand how it works, we will look at supply and demand with the price. From the fundamental simple economics, we know that when demand rises, the price will skyrocket, that's to say the price of the commodity will increase. And also, when the producers of a commodity increase the supply of a given commodity, its price will drop.

For rebase tokens, a price increase will increase the supply. It is the increase in supply that will cause the price of the token to go back to the target price or very close to the target price. Remember the law of supply says that, as the supply increases, the price will fall. Therefore, the instant rise in price will go back to the target price due to the rule of supply.

Likewise, when the demand declines, the price will also drop. Then rebase tokens adjust the supply by decreasing the number of tokens in circulation that will make the price get back to the target price. As we now know, the rule of supply is, reduction in supply will increase the price.

Now, to understand this better. For instance, assume the target price of a rebase token is $2. If the price rises to say $2.2. Then rebase token will automatically adjust itself by increasing the circulating supply (An increase in supply decreases the price) to bring back the price to the intended target price of $2. Also, if the value drops to say $1.8. The rebase token will contract the supply (Decrease in supply increases the price) to bring the price back to the Target price of $2.

See the screenshot below.

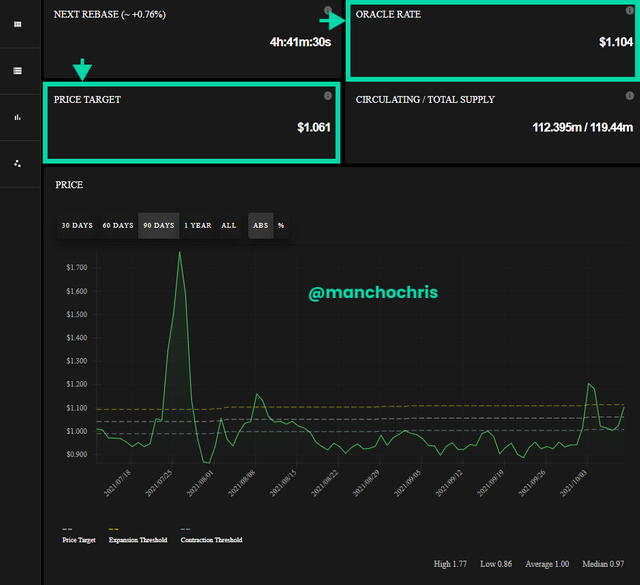

In this part of the question, I am going to enter ampleforth.org and check for the parameters needed to calculate the rebase percentage. By clicking on the link in the question, you will be taken to the homepage of Ampleforth. Now, from the screenshot, you can observe the oracle rate, price target, circulating/total supply and next rebase.

Oracle rate = $1.104

Price target = $1.061

Next rebase is 4h:41m:30s

Circulating /total supply is 112.395M / 119.44M

Now let's calculate the rebase %.

The formula for computing the rebase percentage is stated below:

Rebase percentage = (((Oracle Rate - Price Target) / Price Target) x 100) / 10

Rebase % = (((1.104 - 1.061) / 1.061] x 100} / 10

Rebase % = ((0.043 / 1.061) x 100) / 10

Rebase % = ( 0.04053× 100) / 10

Rebase % = (4.05278) / 10

Rebase % = 0.4053 %

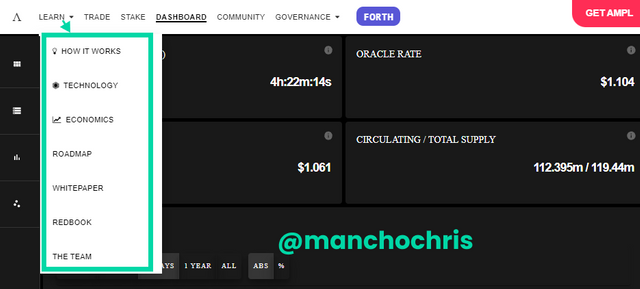

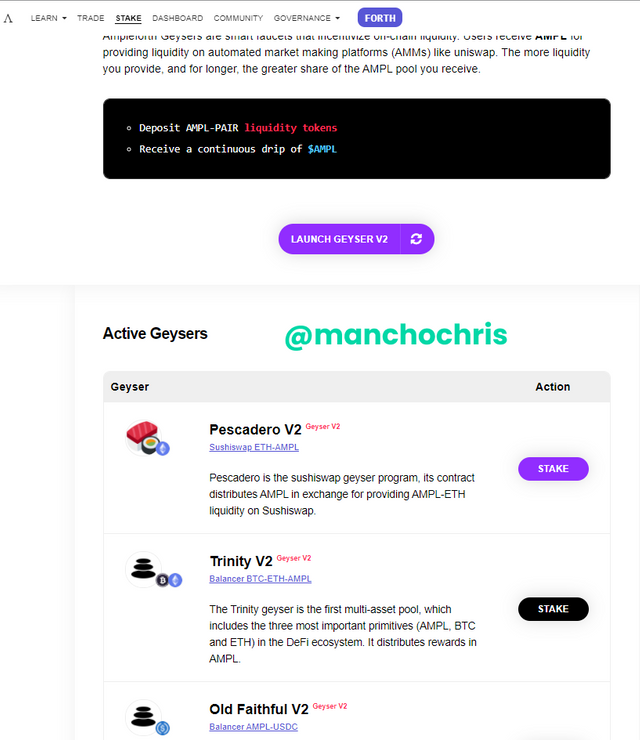

Now if you notice well, you would realize that I picked the parameters from one of the features of the website, which is the dashboard. There are other features at the top of the page. Features such as learn, trade, stake, community and governance

When you click on the Learn section on the top left side of the website, a drop-down of other features will unfold. Features such as how it works, road map, Technology and so many others. These features will inform you on how to go about the Ampleforth website and also provide you with more information about Ampleforth.

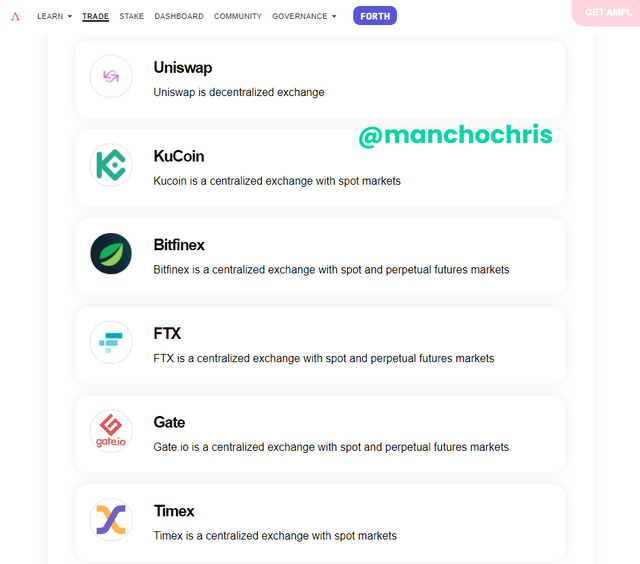

In the trade section part of the website. There are kinds of supporting exchanges such as uniswap, kucoin, FTX, gate and others. See the screenshot below.

Ampleforth has a stake section as one of the features.

Also, the community section. This is a feature where the participants can talk to one another.

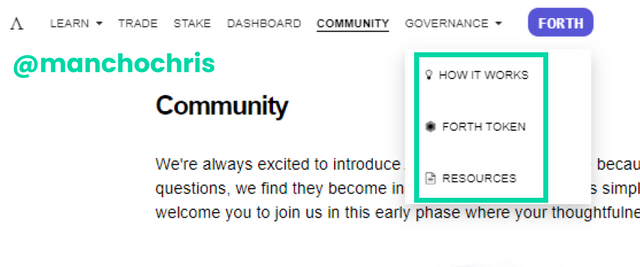

The governance section is where you see how it works, the fourth token and resources.

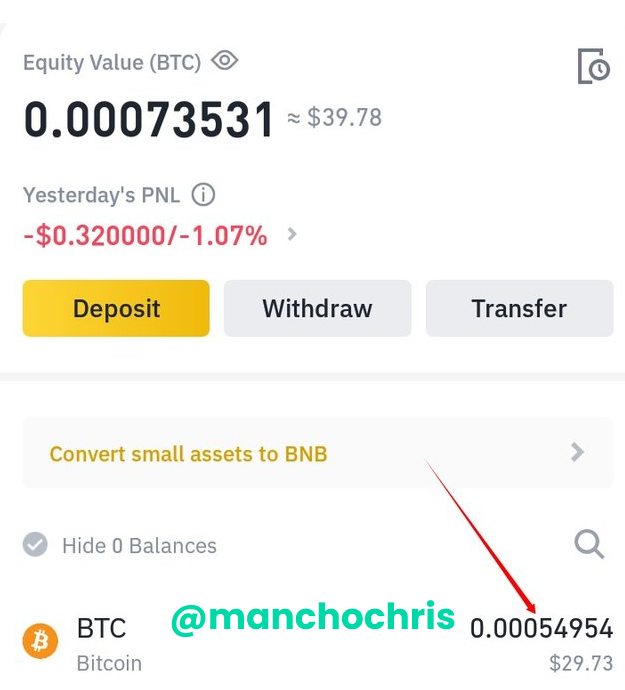

In this question, I'm going to buy USDT from binance. I will be buying USDT with my bitcoin asset. the screenshot below shows my BTC asset in my wallet on finance.

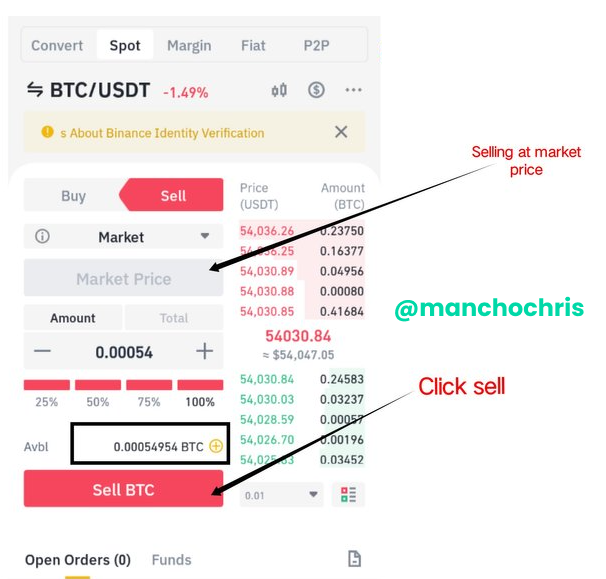

Now, the next thing to do is to go to the trade section under spot. On getting to the trade section, I am going to search for BTCUSDT, since I want to buy USDT with my BTC. I have $29.73 worth of BTC and I am going to use it all to purchase USDT. I am choosing this market because I want to buy at the prevailing price in the market. After filling in all the details, I clicked on sell.

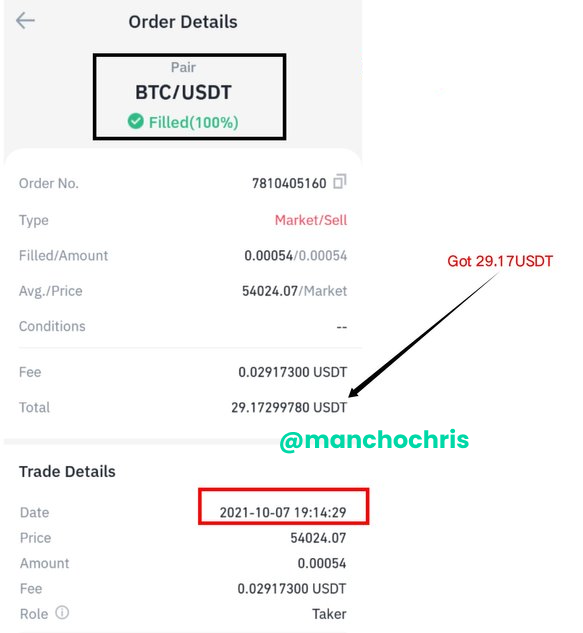

On clicking on sell, the order is filled immediately as it was bought at market price. The order details of the transaction are shown in the screenshot below.

From the screenshot above, one can tell that I have successfully purchased USDT. I got 29.17 USDT. Roughly 0.6USDT was deducted as transaction fees.

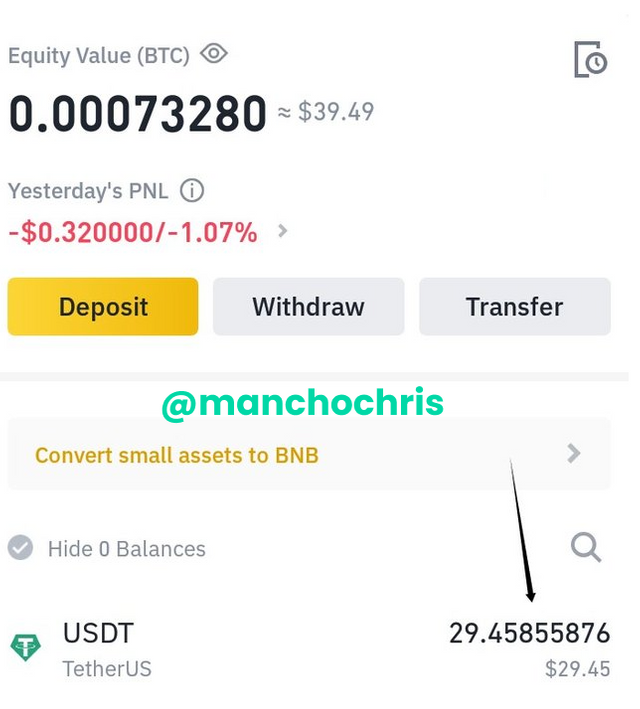

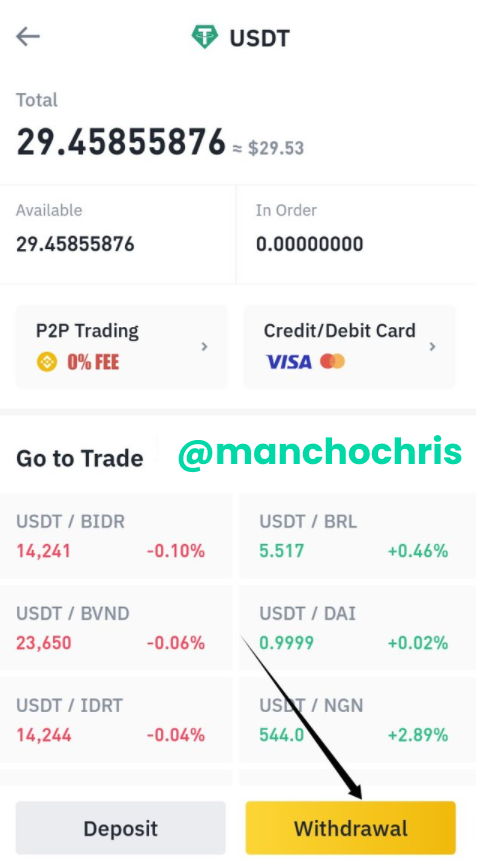

Let us start by transferring my USDT asset from my binance wallet to my Kucoin wallet. I have 29.45USDT in my binance wallet. See the screenshot below.

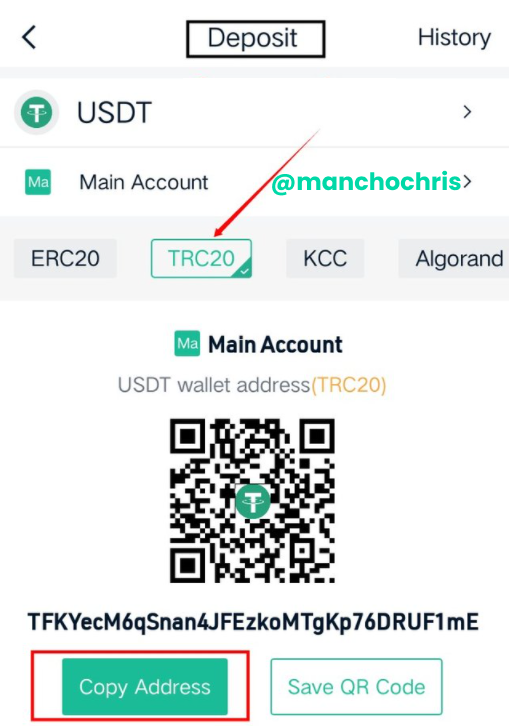

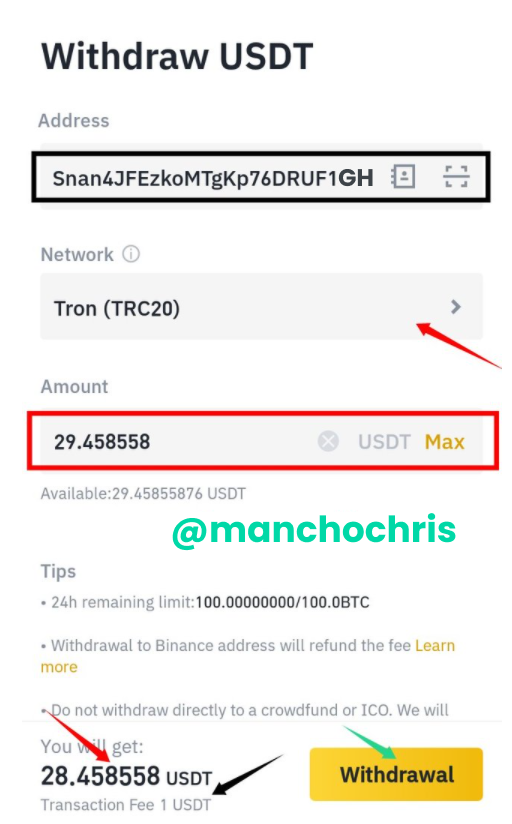

Now, since I want to transfer this USDT to Kucoin, I will need to go and copy the USDT Tron network wallet from Kucoin first. In your, Kucoin App navigate to the wallet section and click on deposit. And since it requested that I use the Tron network, I will click on the Tron network and copy the wallet address

After copying the wallet from the Kucoin app, I will have to navigate back to my binance app. While in there, access the wallet section and tap on USDT asset, then tap on the withdraw button.

After you have clicked the withdraw button, you will be redirected to a different page. Paste the address copied from the Kucoin app. Now write the amount you would wish to transfer and selected the Tron network. I'm withdrawing all my 29.4588 USDT. The gas fee is 1USDT. This implies that I will be getting 28.4588USDT into my Kucoin wallet.

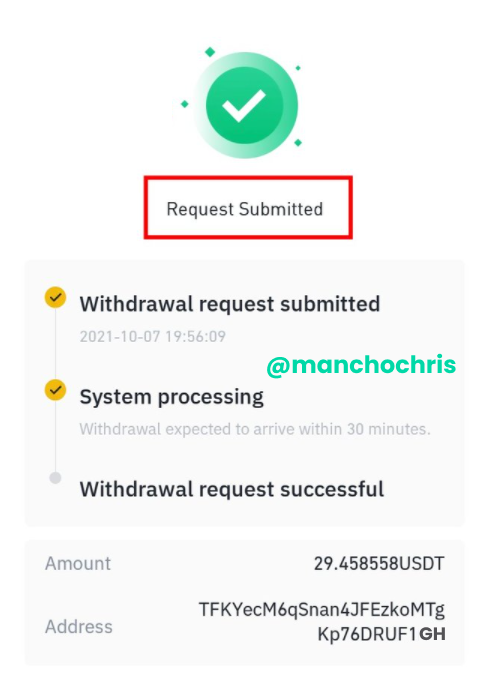

Then, filling in all the details, I clicked withdraw. A dialogue box will be displayed indicating that the request has been submitted successfully.

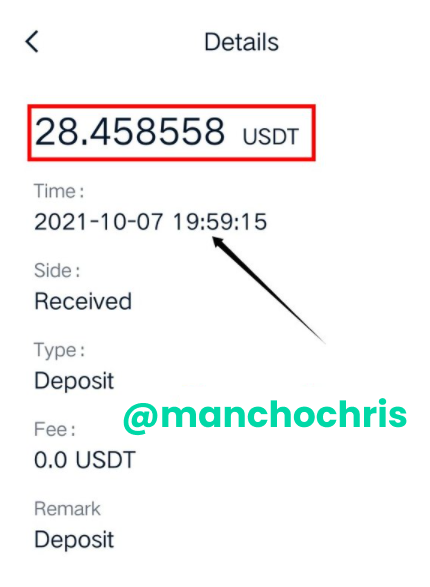

After some time, the deposit of 28.588 USDT is received in my Kucoin wallet. See the screenshot below.

• It is easy and fast

We can see from the process of transaction of USDT (stablecoins), it is easy. All you needed is to copy the wallet address of where you wanted to transfer to and send it there. If you were to do it, you would realize that in just 1 or 2 minutes the transaction would be entered into the wallet I sent it to.

• Stablecoins are not under the control of the government.

Since stablecoins are not under the control of the government, this means you can withdraw or transfer any amount you wish to transact at a given time.

• Stablecoins have a Target price

The price of the USDT that I transferred from binance is the same as what I receive in my Kucoin wallet, only that the transactional fee was deducted.

• The transaction is very secure in stablecoins

There's always no trace of the sender of the money. In essence, the sender is kept hidden.

Many traders use stablecoins to save the profits they make from trading volatile coins. In essence, stablecoins are used as store value as they don't look at their purchasing power. It is therefore pertinent that traders have these coins on their portfolio, so they may withdraw or transfer at any time they need their fund without having to sell at a loss.

Thank you for your time.