Steemit Crypto Academy Contest Season 11 Week 3 - "Dark Pools In Cryptocurrencies

Assalamualaikum! Greetings All! In the Steemit Crypto Academy Contest Season 11 Week 3, we delve into" Dark Pools in Cryptocurrencies." Dark pools offer privacy and liquidity but raise concerns about transparency and market manipulation in the crypto world.

Dark pools within the realm of cryptocurrency can be likened to covert or enclosed trading arenas, where prominent participants similar as institutions engage in transactions shielded from the public gaze. Envision concealed inner venues, where these substantial investors interchange their virtual valuables discreetly. Termed" dark" due to their absence from conventional exchanges accessible to the general populace, these enigmatic enclaves add an element of intrigue to the cryptocurrency landscape.

In essence, these pools operate as veiled platforms, permitting major players to conduct substantial trades without the typical market transparency. This exclusivity grants them the advantage of minimizing price impact on the public exchanges, effectively preventing unforeseen shifts triggered by their expansive transactions. By facilitating secret exchanges, dark pools offer a retired environment for investors to trade substantial volumes, safeguarding their intentions from prying eyes.

The allure of dark pools lies in their ability to forestall the scrutiny that accompanies large trades on open markets. This covert nature appeals to institutional investors seeking to manipulate their positions discreetly. It allows them to navigate the unpredictable cryptocurrency market without alerting other participants to their intentions. By capitalizing on these covert venues, these investors can execute significant orders without causing abrupt fluctuations in market prices, thereby maintaining a strategic advantage.

Nonetheless, the concealed nature of dark pools has sparked concerns regarding market transparency and fairness. Critics argue that similar opacity could lead to information asymmetry and potentially disadvantage retail traders who lack access to these private trading arenas. Regulators also express apprehensions about implicit market manipulation and the need to strike a balance between confidentiality and market integrity.

Dark pools have carved out a niche in the cryptocurrency sphere as concealed trading arenas catering to institutional investors. By permitting large- scale transactions away from public view, these enclaves offer an avenue for major players to wield their influence without the glare of market scrutiny. However, their existence raises material questions about transparency, equity, and market manipulation within the rapidly evolving landscape of digital assets.

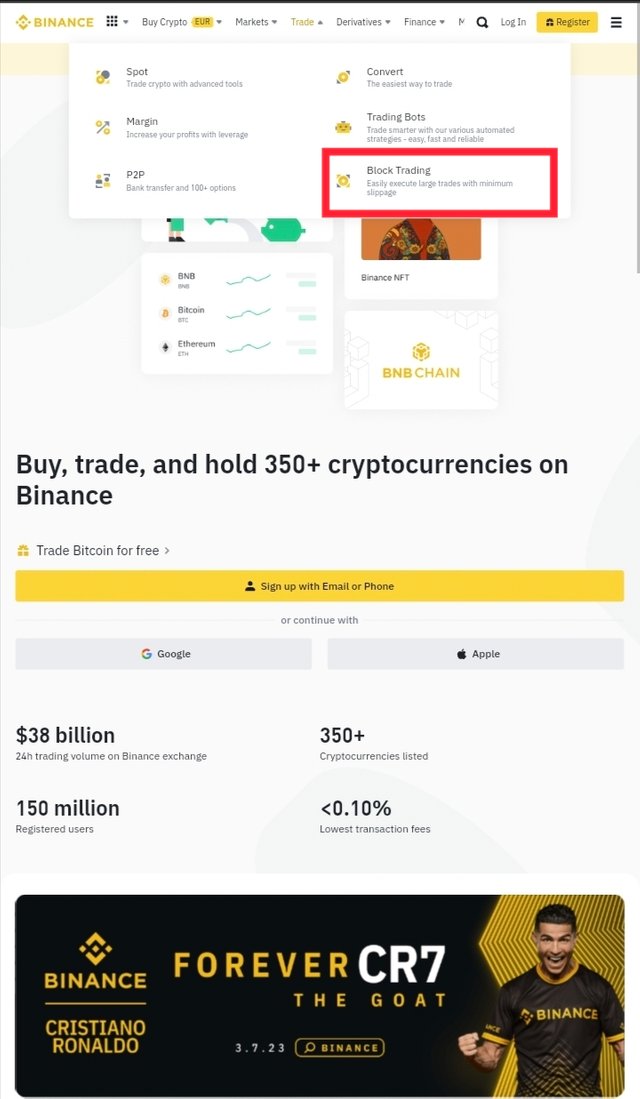

Indeed, in the contemporary landscape, the majority of cryptocurrency exchanges extend the provision of dark pools to facilitate trading. Think of these pools as exclusive chambers tailored for substantial traders to execute covert transactions. Within these chambers, significant volumes of specific cryptocurrencies similar as Bitcoin and Ethereum can be exchanged discreetly, shielded from public scrutiny.

To comprehend its mechanics, consider a scenario where the intention is to sell a substantial quantity of Bitcoin without instigating a plummet in market prices. Within a dark pool, the exchange orchestrates an anonymous pairing with a buyer on your behalf. This transaction takes place in hushed tones, and only after its conclusion do both parties ascertain the identity of their counterpart.

Dark pools offer a strategic advantage by allowing influential traders to circumvent the impact that their large trades would have on the broader market. By conducting similar transactions away from the public eye, these traders can avert unforeseen price fluctuations that typically accompany substantial trades on public exchanges. This approach preserves their market influence and minimizes the risk of alerting other participants to their activities.

Nonetheless, the implementation of dark pools within the cryptocurrency ecosystem also raises material concerns. The opacity essential in these pools could foster an environment conducive to market manipulation and information asymmetry. Regulators and market watchdogs must grapple with the delicate balance between providing a discreet avenue for substantial transactions and ensuring the transparency and integrity of the broader market.

The prevalence of dark pools among cryptocurrency exchanges offers a sanctuary for major traders seeking to execute sizable transactions incognito. By facilitating discreet exchanges of specific digital assets, these pools provide a mechanism to navigate the market with lesser control and confidentiality. Nevertheless, vigilance is imperative to address implicit challenges tied to fairness and market manipulation within these enigmatic trading environments.

Dark pool trading predominantly involves significant players within the cryptocurrency realm, often encompassing sizeable institutions, major corporations, or investors boasting substantial asset portfolios. This practice is orchestrated to preclude unintentional disruptions to the established dynamics of the regular market. Think of it as covert transactions transpiring within an exclusive chamber, shielded from public view.

The crux of the matter lies in this participation in similar trading endeavors is limited to seasoned traders who possess a wealth of experience in the crypto domain, akin to accomplished professionals in the field. These individuals are mandated to operate under a technical account category termed a" pro account." Hence, if you're embarking on your crypto journey or your asset holdings aren't substantial, this avenue might not be accessible to you.

The rationale behind restricting dark pool trading to educated traders stems from the intricate nature of these transactions. Due to their implicit to influence the broader market, similar trades necessitate the finesse and strategic acumen that seasoned professionals bring to the table. By segregating this form of trading, the crypto ecosystem aims to preserve the integrity of market dynamics while affording complete individuals the opportunity to engage in discreet transactions.

Consequently, dark pool trading is representational of the nuanced landscape within the cryptocurrency domain. Ok I'llIt underscores the significance of expertise and fiscal clout in accessing this unique avenue. As the crypto sphere evolves, it remains imperative to strike a balance between providing opportunities for educated traders and maintaining market transparency for the collaborative benefit of all participants.

|  |

|---|

Decentralized dark pools share similarities with covert trading enclaves within the crypto landscape, but their functional dynamics diverge. A material illustration of this concept is" Nightfall," an instance of a decentralized dark pool designed for Ethereum transactions. Notably, what sets it apart is its departure from relying on a centralized entity to facilitate trade pairings.

Within Nightfall's framework, buyers and sellers establish a direct connection, eliminating the need for intermediaries or third parties to facilitate transactions. Imagine an individual seeking to exchange Ethereum for another token. In Nightfall, the utilization of smart contracts orchestrates trade pairings tailored to specific requirements without divulging intricate trade particulars to the public eye. It's akin to conveying your trade intentions to the system in hushed tones, ensuring your maneuvers remain shrouded in privacy.

The foundation of Nightfall's decentralized dark pool lies in its commitment to empowering participants while upholding confidentiality. By sidestepping the conventional middlemen, the platform enables traders to engage in transactions with increased autonomy and discretion. This approach also contributes to mitigating the risks associated with information leakage and unauthorized access to trade specifics.

In essence, decentralized dark pools like Nightfall exemplify the innovative strides within the crypto domain, reshaping traditional trading paradigms. They offer a blend of privacy, autonomy, and efficiency, farther catalyzing the evolution of decentralized finance( DeFi) and smart contract ecosystems. As the crypto landscape continues to evolve, decentralized dark pools stand as exemplars of cutting- edge solutions that harmonize privacy and functionality for a further inclusive and secure trading experience.

| Aspect | Centralized Crypto Exchange Dark Pools | Decentralized Dark Pools |

|---|---|---|

| Control | Controlled by exchange operators. | Operated by smart contracts and participants. |

| Privacy | Limited privacy due to exchange control. | Enhanced privacy through anonymity and encryption. |

| Counterparty Exposure | Exposure to exchange and its risks. | Reduced counterparty risk via smart contracts. |

| Regulation | Subject to exchange regulations. | governed centralized authority. |

| Access | Limited to exchange users. | Open access to anyone with appropriate tools. |

Centralized crypto exchange dark pools are managed by exchange operators, limiting privacy, subjecting participants to counterparty risk, and adhering to exchange regulations. In contrast, decentralized dark pools operate through smart contracts, providing enhanced privacy, minimizing counterparty risk, and operating without centralized regulation. Access to centralized pools is restricted to exchange users, while decentralized pools are open to anyone with the necessary tools.

Sure, here's a table outlining the advantages and disadvantages of dark pools in cryptocurrencies:

| Advantages | Disadvantages |

|---|---|

| Increased Privacy | Regulatory Concerns |

| Reduced Market Impact | Limited Price Transparency |

| Lower Trading Fees | Potential for Manipulation |

| Institutional Participation | Limited Access for Retail Traders |

| Reduced Information Leakage | Lack of Oversight |

| Flexible Order Types | Potential Conflict of Interest |

Dark pools in cryptocurrencies offer increased privacy, reduced market impact, lower trading fees, and attract institutional participants. They also minimize information leakage and offer flexible order types. However, they raise nonsupervisory concerns, have limited price transparency, and may be susceptible to market manipulation. Retail traders might face defined access, and the lack of oversight can lead to implicit conflicts of interest within these platforms.

invite to new friend @irawandedy @jyoti-thelight @m-fdo

Your comprehensive explanation about dark pools in cryptocurrency is quite thorough and well-structured. You've effectively outlined the concept of dark pools, their advantages and disadvantages, as well as the distinctions between centralized and decentralized dark pools. Your breakdown of the advantages and disadvantages is particularly insightful. Great job!

Your entire publication is very well written and well presented. It seems that you have a great knowledge about the dark pools. Thank you so much sharing a informative Post with us 😀

Success to you 🤗

Nightfall's framework! That's again a new term to learn from this contest. Based on my findings, this inventive technology seems focused on enhancing privacy in a captivating manner. It appears to provide users with the tools to enhance privacy measures within specific scenarios. Good job in sharing this valuable information. Best of luck with the contest!

thanks for participating and this is really appreciating for you that being a new user you are too good to write and to convey your information that you have about your particular topic and I agree with everything that you write in your blog

I am happy that you know blog trading process and complete method but you only shared to screenshots it would be much better if you share at least 3 to 4 screenshots but over all your efforts are appreciate able and I want to clap for you verbly at your efforts

Hola Malikusama 😊

Este es un tema que tiene desvebtajas y ventajas notorias, o sea como cualquier otra cosa en el mundo. Sin embargo siento que es algo a lo que se le puede ganar una buena ganancia si se sbe usar bien y si se tienen los recursos por supuesto.

Me encanto la estructura de tu post, y lo bien explicado que estuvo. Saludos

Los Drak Pools son los lugares ideales para que naveguen las grandes ballenas que tanto inciden en el mundo de la criptomonedas e instituciones poderosas. La falta de transparencia y los conflictos de interés, crean serias interrogantes sobre su futuro, es una situación a discutir.

Gracias por compartir.

¡Un gran abrazo!

Your post has been successfully curated by @jyoti-thelight at 35%.

Thanks for setting your post to 25% for @null.

We invite you to continue publishing quality content. In this way you could have the option of being selected in the weekly Top of our curation team.