Steemit Crypto Academy Contest / S11W01 - The Cycle of Market Emotions

Pump and Dump, Going to the Moon, HODL, REKT, Bagholder, Cryptosis, ICO- these crypto- related slogans capture the essence of the dynamic and academic nature of the cryptocurrency market, reflecting the emotions, strategies, and challenges faced by investors and traders.

1. Pump and Dump A controversial tactic employed in the crypto world," Pump and Dump" refers to artificially inflating the price of a cryptocurrency through coordinated efforts to create hype and attract investors. Once the price reaches a desirable level, the instigators sell off their holdings at a profit, causing the value to plummet and leaving unknowing buyers with significant losses. Regulators often warn against participating in pump and dump schemes due to their inherently fraudulent nature.

2. Going to the Moon This slogan captures the auspicious and academic nature of crypto enthusiasts. When someone says a cryptocurrency is" going to the moon," they mean the price is expected to surge to unknown heights. The phrase originates from the idea that reaching the moon is a distant and seemingly insolvable goal, symbolizing the belief that a cryptocurrency's value will soar to unconceivable levels.

3. HODL Originating from a typo of the word" hold," HODL has become a popular meme and mantra within the crypto community. It encourages investors to hold onto their cryptocurrencies even during periods of market volatility and price drops, rather than succumbing to panic selling. The philosophy behind HODL is that, in the long run, the value of cryptocurrencies will appreciate, leading to potentially significant gains for loyal investors.

4. REKT This term is a sportful way of saying" wrecked," indicating significant losses incurred during trading or investing in cryptocurrencies. Traders often use it to describe the unfortunate outcome of a poorly timed or ill- informed investment decision. It underscores the parlous and academic nature of the crypto market, reminding participants to exercise caution and conduct thorough research.

5. Bagholder A bagholder refers to an investor who holds onto a cryptocurrency that has lost significant value and is doubtful to recover. They're left" holding the bag," meaning they're wedged with a depreciating asset that may have once held promise but has since lost its value. Bagholders often face emotional turmoil and fiscal setbacks due to their unwillingness to sell at a loss.

6. Cryptosis This term humorously blends" cryptocurrency" and" diagnosis" to describe the phenomenon of individuals becoming hung up with crypto trading and investment. It's a tongue- in- cheek way of highlighting how some people may develop an addiction- suchlike fascination with the fast- paced and unpredictable world of cryptocurrencies, dedicating inordinate time and energy to monitoring the markets.

7. ICO( original Coin Offering) ICO is a fundraising method used by startups to raise capital by issuing their own cryptocurrency or tokens to early investors. It's analogous to an original public offering( IPO) in the traditional stock market. Investors buy these tokens in the stopgap that the project will succeed, and the tokens will increase in value once the platform or product is developed. However, ICOs have faced nonsupervisory scrutiny, as some projects turned out to be scams, and others lacked proper transparency or feasibility.

In the dynamic and evolving world of cryptocurrencies, these slogans and terms offer insight into the emotions, strategies, and challenges faced by investors and traders. As the market continues to grow and change, new slogans and expressions are sure to emerge, reflecting the ever- shifting landscape of the crypto sphere.

FOMO( Fear of Missing Out) FOMO is a important cerebral phenomenon that's current in the crypto community. It refers to the fear and anxiety that individuals experience when they believe others are benefiting from an investment opportunity, and they might miss out on implicit gains. This fear often leads people to make impulsive and emotionally- driven decisions, similar as buying into a cryptocurrency at its peak price without conducting proper research or analysis.

FOMO can be triggered by colorful factors, including unforeseen price surges, news about a particular cryptocurrency's rapid-fire growth, or social media posts from others boasting about their profitable investments. It can cloud rational judgment and push individuals to take gratuitous risks, leading to significant fiscal losses.

Managing FOMO is pivotal for crypto investors. It involves staying informed, setting clear investment goals, and avoiding hasty decisions. By maintaining a disciplined approach and focusing on long- term strategies, investors can reduce the influence of FOMO and make further informed decisions based on sound analysis and risk management.

Crypto FOMO( Fear of Missing Out) typically occurs during the bull phase of the cryptocurrency market cycle, when prices are rapidly increasing and media attention is high. This can lead to illogical buying decisions based on fear rather than careful analysis.

To deal with crypto FOMO, it's important to have a clear investment strategy. This includes setting fiscal goals, understanding the risks involved, and not investing further than you can afford to lose. It's also pivotal to do thorough research on any cryptocurrency before investing, rather than just following the hype. Lastly, maintaining a long- term perspective and not getting swept up in short- term price fluctuations can help manage FOMO. Remember, investing in cryptocurrencies should be a advised decision, not an emotional reaction.

FOMO, or the Fear of Missing Out, is a cerebral phenomenon driven by the fear of not being included or experiencing something desirable that others are. It's primarily fueled by social media, where people constantly showcase their instigative activities and achievements, creating a sense of inadequacy in others.

To prevent FOMO, it's pivotal to cultivate a healthy mindset and adopt certain strategies. Firstly, rehearsing tone- awareness is essential. Recognize that social media often presents a malformed reality and that comparing oneself to others is ineffective. Secondly, prioritize your own values and goals. By fastening on what truly matters to you, you can reduce the influence of external validation. Additionally, limit social media usage and create boundaries to avoid constant exposure to curated highlights. Engaging in activities that bring you joy and fulfillment, building meaningful relationships, and practicing gratitude can also help combat FOMO by fostering contentment and a sense of purpose.

FUD( Fear, Uncertainty, and Doubt) FUD is a tactic commonly used in the crypto world and other fiscal markets to spread negative information or false rumors about a particular cryptocurrency or project. The goal of FUD is to create fear, uncertainty, and doubt among investors and traders, leading them to sell their holdings or avoid investing in the targeted asset.

FUD can take colorful forms, including spreading deceiving news, exaggerating risks, or highlighting implicit flaws in a project without proper evidence. It's often employed by individuals or groups with vested interests in seeing the value of a cryptocurrency decrease.

Crypto participants should be conservative of FUD and conduct their own research to verify information before making investment decisions. Being apprehensive of FUD helps investors stay rational and avoid falling victim to manipulative tactics in the highly volatile and academic crypto market.

The cause of FUD in the crypto world can stem from colorful sources, including competing projects or individuals seeking to manipulate prices for particular gain. Sometimes, misinformation or misconstructions can also inadvertently contribute to FUD. Additionally, nonsupervisory uncertainties, security breaches, and market fluctuations can amplify existing fears and doubts.

Preventing FUD requires a combination of awareness, critical thinking, and responsible communication. Participants in the crypto community should remain watchful and verify information from believable sources before accepting and spreading rumors. Conducting thorough research and due diligence before making investment decisions can help individuals make informed choices based on facts rather than emotions.

Crypto projects and leaders can combat FUD by maintaining transparency, promptly addressing concerns, and providing accurate information to their community. Building trust through open communication and delivering on promises helps in mitigating the impact of FUD. Overall, a well- informed and flexible community is better equipped to resist and fight the effects of fear, uncertainty, and doubt in the crypto space.

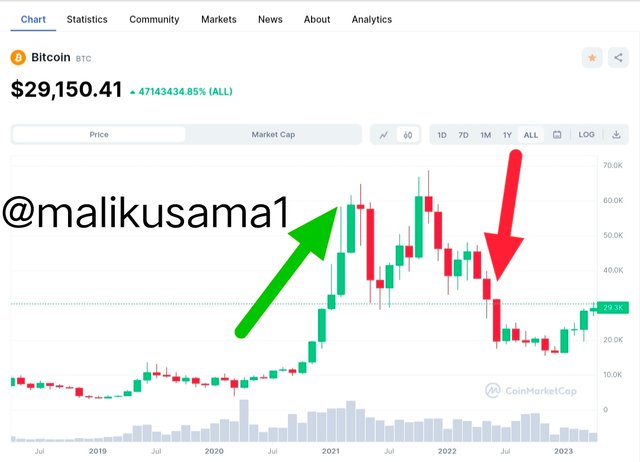

To identify FOMO phases, look for significant price surges in BTC accompanied by a surge in trading volume and a strong positive sentiment across social media and news platforms. FOMO often occurs when BTC is breaking through crucial resistance levels or reaching all- time highs.

On the other hand, to recognize FUD phases, observe moments when BTC experiences sharp price declines or negative news events that create uncertainty and doubt among investors. FUD can lead to panic selling and increased volatility in the market.

Screen shot by coinmarketcap

By analyzing literal price charts, trading volumes, and applicable news events, you can identify the periods when FOMO and FUD were prominent in the BTC market. Understanding these cycles can help you make further informed decisions and navigate the crypto market more effectively.

invite to new friend @irawandedy @jyoti-thelight @m-fdo

I'm glad to read your very welcome presented publication about the crypto market slogans. It is true that a brief knowledge about these slogans is very important before entering in the crypto market or investing in it. So you have provide us a brief knowledge about these slogans. Thanks for your valuable thoughts

Success to you 🤗

Thank you for your kind words! I'm glad you found the publication helpful for gaining insights into crypto market slogans. Success to you too! 🤗

La volatilidad del mercado de criptomonedas se debe muchas veces a la sensibilidad por noticias negativas que generan las falsas expectativas o el pánico ante la posibilidad de perderlo todo.

Espero que tenga mucha suerte y te deseo un día lleno de felicidad.

The crypto market can be volatile due to negative news reactions and false expectations, but I wish you luck and happiness. 🍀😊

Great explanation of the crypto-related slogans and the concept of FOMO and FUD! It's important for investors to understand these terms and the emotions they represent in the cryptocurrency market. By being aware of FOMO and FUD, investors can make more informed decisions and avoid falling victim to manipulative tactics. Keep up the good work!

Thank you for your positive feedback! Understanding FOMO and FUD is crucial for informed cryptocurrency investing. I appreciate your support!

You're welcome! Knowing FOMO and FUD helps in smart crypto investing. Grateful for your encouragement! 🙏😊

Good sir best of luck brother

This post has been upvoted through steemcurator08. We support quality posts anywhere and with any tags. Curated by: @yonaikerurso