Crypto Academy Contest / S9W3 - STEEM Inflation

Hello everyone, welcome to the third week of the SteemCryptoAcademy contest.

This week, we will be talking about Steem inflation and below in my entry.

Use your own words to explain the concept of inflation in general and does it affect cryptocurrencies?

Inflation is a very common monetary term which simply means the rate at which prices of goods increases over time or the rate at which the value of a currency decreases over a given period of time. It can also be referred to as the rate of increase in cost of living.

There are different causes of inflation and some of them includes;

- Cost push

Sometimes the prices of goods rise not because of currency devaluation but because the cost of production have increased.

- Increase money supply

This often leads to inflation as the currency tends to lose value as a result of increased supply.

- Devaluation

Devaluation occurs as a result of reduction of currency value in the foreign exchange market. This usually leads to inflation as the currency tend to be regarded as minor.

- Rising wages

This contributes a lot in the increased price of goods. When manufacturers are paid so much, the products they produce are often costly.

- Monetary policies, etc.

This deals with policies such as interest rate adjustments, bank reserves, etc. This regulations can either attract currency users or scare them away. In a situation whereby there are no much demand for a currency, the value tends to decrease.

Yes, inflation affects any form of currency with Cryptocurrency not being an exception. A simple way at which inflation affects cryptocurrency is through its increase in supply.

If you observe well, you agree with me that most cryptocurrencies with huge supply are often of lower values compared to the ones with small supply but this is not what we are talking about now as it doesn't define inflation. Inflation which deals with the rate at which the value of a currency decreases over time has a lot to do with cryptocurrencies because the value of cryptocurrencies are quite dependent on the rate of demand and supply.

When there's a high demand, the value increases and when there is a low demand the value decreases.

Several blockchain have a portion of their Blockchain token locked and this locked token are often been released either as a reward to the Blockchain users or it is partly unlocked over a given period of time. When these currencies are unlocked and are added to the circulating supply, it obviously increases the supply of the currency and thus causing a reduction in value unless an equal demand is met.

In a case where there is no increase in demand to meet the additional supply, the value of the cryptocurrency will most obviously drop and when this happens, the cost of living if users of the currency will most certainly increase and that's simply inflation.

- Inflationary cryptocurries

These are those type of cryptocurrencies whose supply are steadily increasing. This type of cryptocurrencies usually have a fixed number of maximum supply which when reached, there will be no more introduction of new coins into circulation.

In inflationary cryptocurrency, new coins are often introduced using various mechanism which includes;

-Proof-Of-Work

-Proof-Of-Stake

-Proof-Of-Brain

In Proof-Of-Work, miners are rewarded with new token thus releasing them into circulation untill there are no more coins to mine.

In Proof-Of-Stake, validators who stake their tokens on the Blockchain are rewarded with new tokens. This is a way of releasing the token into circulation untill a maximum supply is reached.

In Proof-Of-Brain, users of the blockchain platform are rewarded based on the intellectual Value they offer to the platform. This reward which can come in the form of voting, is a way of adding new coins into circulation.

- Deflationary cryptocurrencies

Just as the names says, deflationary cryptocurrencies deflate as time goes on. This is because unlike inflationary cryptocurrencies whose supply increases with time, the supply of deflationary cryptocurrencies decreases with time and this are often achieved using various means which includes;

-Token burn

-Transaction fees

Similar to inflationary cryptocurrencies, deflationary cryptocurrencies can have a fixed maximum supply but a fixed percentage of the supply is often been removed from circulation either annually or quarterly as the case may be.

Take for instance, a particular cryptocurrency might have an annual or quarterly deflation rate of 1%. This tells that 1% of the supply will be annually or qauterly removed thus making the cryptocurrency more scarce as time goes on.

With what we have explained regarding inflationary and deflationary cryptocurrencies, it is now safe to say that the Steem token is a inflationary cryptocurrency which means that the supply increases over time.

This increase is as a result of constant Steem reward on users who add intellectual value on the Blockchain platform. As more users emerge, more is being distributed thus increasing the supply.

This can cause an inflation in Steem price should the supply go way beyond the demand and that is why certain measures have been put in place to control the balance between Steem demand as it's ever increasing supply.

Some of these measures includes;

-Introduction of club status.

-Burning 25% to of earnings.

The club status is a way of making sure that most users and earners of Steem on the steemit platform do not withdraw all their earnings thus encouraging them to power up at least halve of whatever they earn on the platform. This power up increases the demand of Steem thus making the fight for demand and supply equilibrium much easier.

Also, the burnsteem25 initiative is a good one to help control the supply of Steem. In this initiative, a percentage of Steem mostly 25% is set to at null which is an unaccessible Steem wallet. This coins in the null wallet helps to hold the price of Steem by making sure that not all is accessible for withdrawal.

In other to calculate the current Steem inflation rate, will we be doing so using the below formula.

Inflation rate (t) = 978 - (headblock number/250000)/100

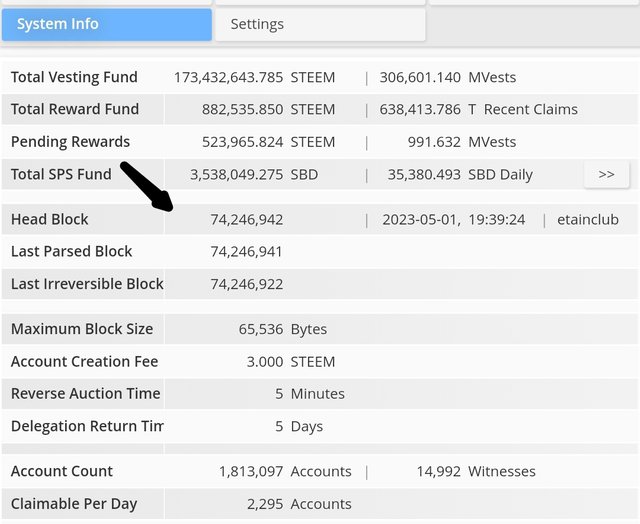

With all the values above, we will need to get the current value of the headblock using steemworld.org.

On Steemworld.org click on locate system info and under it you will find the headblock.

Now let's apply BODMAS in calculating the inflation rate.

According to BODMAS, we will solve the figures in brackets first, after which we substrate and then divide.

Inflation rate = 978 - (74,246,942/250000)/100

= 296.987

= 978 - 296.987 / 100

= 681/100

= 6.81%

In other to interpret how easy or difficult it will be to earn Steem in the coming years, we will have to calculate the current block reward using the below formula.

New Steem = (Virtual supply × Inflation rate) / Number of blocks per year.

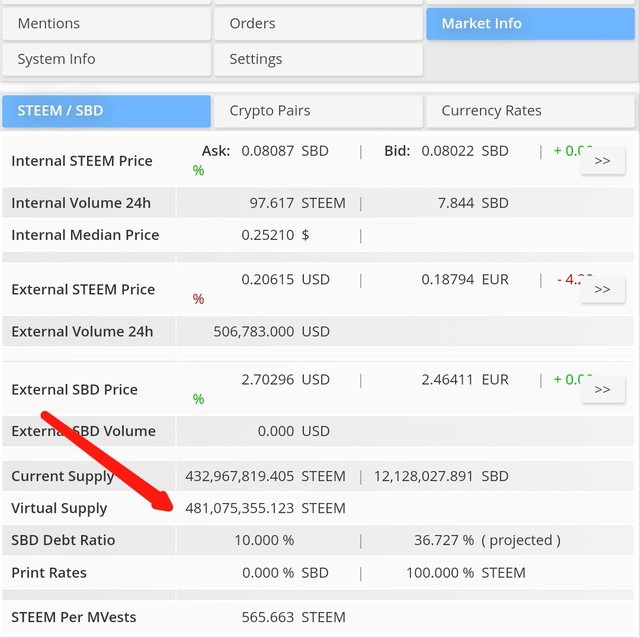

The virtual supply can be seen using the Steemworld.org

Virtual supply = 481,075,477

To get the number of block per year we will consider the time it takes to produce a block on Steem Blockchain and that is 3 seconds.

Therefore if 1 block is produced in 3 seconds, how many blocks will be produced in a year?

We will first check how many seconds are there in a year = 31536000 seconds.

3 seconds = 1 block

31536000 = X

X = 31536000/3

X = 10,512,000.

Now we have the values, we can proceed to calculate the current block reward using.

New Steem = (Virtual supply × Inflation rate) / Number of blocks per year>

New Steem = (481,075,477 × 6.81%) / 10,512,000

New Steem = 311/100

New Steem = 3.11

It's is believed that the inflation rate of Steem decreases by 0.01% after every 250,000 blocks and it will continue like this untill the inflation rate reaches 0.95%.

If it takes 3 seconds to mine 1 block

How long will it take to mine 250,000 blocks.

3 seconds = 1

X = 250,000

X = 750,000 seconds

Converting 750,000 seconds to days it will give us 8.6 days.

This means that the inflation rate of Steem decreases by 0.01% after every 8.6 days.

If the inflation rate decreases by 0.01% every 8.6 days, it will be decreased by 0.42% after 365 days which is one year.

8.6 = 0.01%

365 = X

X = (365 × 0.01)/8.6

X = 0.42%

If the inflation rate gets to 0.95%, the Steem block reward will be reduced to (481,075,477 × 0.95%) / 10,512,000

Steem BR = 442,589,438.84/ 10,512,000

Steem BR = 42.1

Steem BR = 42.1/100

STEEM BLOCK REWARD = 0.421 STEEM

Therefore when the inflation rate gets to 0.95%, the block reward of Steem will only be 0.421 Steem every 3 seconds. This is 7.3 times less than the reward we get now which is 3.11 Steem every 3 seconds.

3.11/0.421 = 7.3

In summary, if takes an average person 1 year to earn 1k Steem reward now, by the time Steem inflation drops to 0.95%, it will take 7.3 years for an average person to earn 1k Steem reward.

Now let's project what time we have remaining for this to happen.

According to our calculations, the current inflation rate is 6.81% and this inflation rate drops by 0.42% yearly. Which means that by this time next year the inflation rate of Steem will be;

Let's first get the value of 0.42% of 6.18%

= (6.81/100) × (0.42/100)

= 0.0681 × 0.0042

= 0.00028×100

= 0.0286

FR of Steem next year will be;

6.81 - 0.0286

= 6.78%

If it takes 1 year for the inflation rate to drop from 6.81% to 6.78%, how long will it take to drop from 6.81% to 0.95%?

Let's first take the difference;

6.81- 6.78 = 0.03

6.81 - 0.95 = 5.86

0.03 = 1

5.86 = X

X = 5.86/0.03

X = 195.3 years.

With all the calculations, we have seen that the Steem block reward keeps decreasing and it best for one to hoard Steem now for more better price appreciation in the future.

Personally, I will focus more on building my SP now because the reward is much more higher compared to what it will be in the coming years.

The Steem cryptocurrency is an inflationary cryptocurrency which means that there's a constant increase in Steem supply over time. In as much as there's a constant increase in Steem supply, the rate at which this supply is distributed is in a constant reduction and for that reason, it is best to take advantage and build Steem power now that the inflation rate is a bit high.

I invite @starrchris @sahmie and @patjewell to take part in this contest.

Okay, I am well aware of what inflation and deflation are but to read about it relate to crypto currencies and STEEM was very interesting.

It is the first time I have read an article about it.

Let's keep fingers cross that there will be only good times awaiting STEEM in the next couple of years.

Thank you for the invite!

I appreciate your nice comment on my entry. Indeed there's a brighter future for Steem but only the holders will win.

Once again, thanks for your comment

Pleasure!

Saludos amigo loverboy10, otra reto donde has cumplido con todo lo que se pide, me ha gustado tus respuestas y tus imagenes.

Te deseo mucha suerte.

Thank you my friend. I am glad you were able to go through my entry and have carefully observed the answers I provided. Thank you a lot

You have written very well on this. You gave a good insight on what inflation is. Yeah, steem is an inflationary cryptocurrency, there is a constant increase of its price over time.

I enjoyed reading your post.

Well done and I wish you the best of luck.

Thank you for your valuable comment and for taking your time out to go through my entry. I am glad you have agreed with me that Steem is an inflationary cryptocurrency. Thank you

Great post @loverboy10! Your explanation of Steem inflation and its effects on the Steemit ecosystem is well-written and informative . i appreciate the way you broke down the Different components of The inflation rate and how you compared it to other cryptocurrencies. Your analysis of the inflation rate's impact On the platform's growth and user incentives was insightful & thought-provoking . Its important for users to Understand how the platform's economics work & your post does An excellent Job of explaining That. Overall this Is A valuable resource for anyone looking to understand the Economics of Steemit. Keep up the great work!

Thank you very much for your encouraging comment. You have indeed motivated me to keep doing my best in writing beneficial contents. Good luck to you

Saludos

Es muy interesante esto, ya que nos enseña a Cómo sacar la inflación en el aspecto virtual de la criptomoneda, de nuestra criptomoneda STEEM, por otro lado, bueno estoy aprendiendo y veo que también has hecho un buen desempeño en esta semana y me contenta mucho saber que aprendemos nuevas cosas cada día.

Gracias por compartir en verdad hiciste un post bastante entendible.

Éxitos

Thank you for taking out your time to read through my content. You have indeed exrcourged me to do even more better. I'm glad you found my content very interesting and educative.

Thank you

TEAM 3

Congratulations! This post has been upvoted through steemcurator05. We support quality posts, good comments anywhere and any tags.Thanks for the support

Greetings Friend... Thank you for the invite.

Your understanding of what inflation is about, the causes of inflation, the types, and how it affects world economies is commendable. You also pointed out Inflation not only affects world economies but also in the Cryptocurrency world.

Your explanations of how inflation impacts the future of Steem are also very vivid to understand as you've pointed out it is for a greater as Steem has mechanisms such as Club statues and Token Burning to mitigate the effect of inflation also worth mentioning is the fact that Steem has a decreasing inflation rate of 0.42% annually.

You have also foretold the future of the Steem token to be bright for those who keep hold of the Steem for the future. So make hay while the sun is shining. All the best my friend.

Thank you so much for this valuable comment. I am glad you took time to read through my entry. Indeed, the Future of Steem is more than positive and all diamond hands will be rewarded. It's best for each and every one of us to focus on building their Steem power.

Thank you for honoring my invite.

Thank you for inviting me.

hi dear @loverboy10

you have shared a very informative post and it is good that you know basics of the inflation in general and also it's impacts on the cryptocurrency which can never be ignored

you have said that steem is an inflationary token because its supply is increasing day by day and hence steemit platform is using some steps like burning and staking to stop the high supply pressure

you have calculated the current inflation rate and it will decreases in the future so now we can invest our time to earn steem and the stake them to make good steem power to strengthen our future

success in contest

I'm glad to have you reading through my content. Thank you for your warm comment and I am glad I was able to explain most terms in a way that is easily understandable.

Good luck to you my friend

Greetings brother ,

Welcome to SEC , you have well-presented post on the concept of inflation and its impact on cryptocurrencies. Your explanation of the rise in demand and its effect on fiat currency and also crypto-currency was insightful. It's wonderful to see your understanding of deflationary

& inflationary cryptocurrencies, especially in regard to the Steem token's strategy in maintaining inflation levels is just wonderful .