[Investment through Private and Public Sales] - Crypto Academy S4/W6 - Homework Post for professor @fredquantum

.jpg)

Hello friends. How are you doing this week? This post is my submission to Professor @fredquantum's class on Investment through Private and Public Sales. The assignment was given as below:

What can you say about Crypto Investment and how to properly utilize the investment tools available to make the right decisions?

Talk extensively about the following. Also, highlight the benefits and risks associated with each.

i. Private Sale in Cryptocurrency.

ii. Presale in Cryptocurrency.

iii. Public Sale in Cryptocurrency.What are the mediums used for Public/Pre/Public Sales in Cryptocurrency?

Research about any recent (2021) successful ICO or IEO and give detailed information about the project. (Note: BETA token is excluded).

Create an imaginary token. Write about the project including its use case. Develop an ICO which includes Private sales (3 stages) and Public sales (1). Note that: You are expected to explain what the funds are intended to be used for, your Private sale should have 3 stages, and specify the initial supply available, and the price you are issuing the token in each stage. Also, specify the price you are issuing the token at the Public sale phase (including the supply).

What are the criteria required for listing a token on CoinMarketCap. Is there a criteria for listing an asset on a Centralized Exchange? If Yes, use an exchange for your explanation in response to the question.

What can you say about Crypto Investment and how to properly utilize the investment tools available to make the right decisions?

The birth of Bitcoin paved way for thousands of other forms of cryptocurrency to make entry into the market. Regardless of the unique use cases of these assets, they hold monetary value whether they are fungible or not. These assets are also popular for their volatile nature as a cryptocurrency with very high worth can experience a huge price drop in a moment. The driving forces behind these price directions are primarily investors, who are in the market to make profits off their investments.

Since these cryptocurrency assets have financial values, they are no different from minerals like Gold. Individuals and corporations purchase these digital assets at lower price points and sell them at a higher price to secure their profits. This event is the common nature of marketing. Investment in the cryptocurrency space, however, is not always lucrative. The promising outcome of cryptocurrency investment can turn into nightmares for ignorant investment as fraudulent activities and losses are also commonplace.

The launch of cryptocurrency projects are similar, and this characteristic makes it easier for unscrupulous persons to mimic the procedure and scam investors of their resources. The emergence of cryptocurrencies has inadvertently created breeding grounds for scams. A permanent stop to such vice is not available; therefore, investors are always advised to be cautious of the projects they commit to. Thorough research about the project, its purpose, and the developers behind them are necessary to build trust.

Also, not all these digital assets experience massive growth from the start. It takes years for such projects to pick up along the way. This act translates to stalled profit for investors. Should inpatient investors decide to cash out early, they will only receive considerably less amount than they invested. Thus, they will lose some of their capital. It is, therefore, incumbent of investors to make judicious usage of the available cryptocurrency investment tools to perform deep research about a cryptocurrency asset’s performance on the market.

Every investor has a particular duration for the investment. Some investors prefer the long term, while others choose a short term duration. Also, some cryptocurrencies are more volatile than others, thereby presenting a more advantageous opportunity for investors to capitalize off the violent impulses. All such data about a cryptocurrency project can be accessed on cryptocurrency investment tools. These tools are of distinct types and forms.

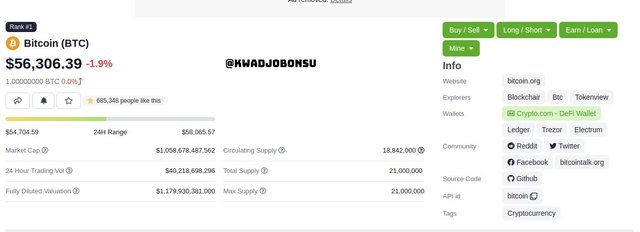

There are websites such as Coingecko, Coinbase, and Coinmarketcap that offer comprehensive data about the performance of such digital assets in real-time. They highlight information such as the current price of the asset, the market capitalization, circulating supply, rank, chart representation, and many others. Such investment tools also offer data on the available markets where the respective cryptocurrency asset can be purchased/sold. An instance of the data from Coingecko on Bitcoin is highlighted below.

In the above screenshot from Coingecko, the price of Bitcoin is shown as $56306 and a rank 1, at the time of writing. Its market capitalization was around 1.058 Trillion Dollars and a fully diluted market capitalization of 1.179 Trillion dollars. The maximum supply of BTC is indicated to be 21 million, with 18.942 Million in circulation.

The 24-hour trading volume and price range are also presented among the data above in the image. This information gives investors a fair metric of the current performance of the asset on the market.

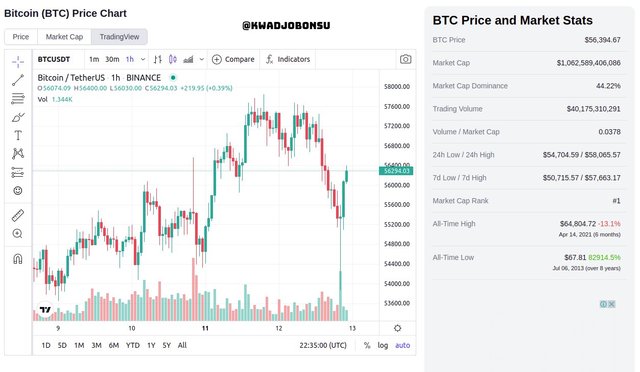

The Coingecko, as an investment tool, also presents a chart of the asset’s performance on the market. Users are permitted to add technical indicators, lines, and other trading tools on the chart to analyze the price action of the digital entity. Various timeframes can be selected to suit the trading styles of investors on the market.

Furthermore, other investment tools such as on-chain metric websites can also be a good additional assessment tool for the supported digital assets. All in all, cryptocurrency investment is highly risky and demands careful research and market decisions to secure profits on the market.

Talk extensively about the following. Also, highlight the benefits and risks associated with each. i. Private Sale in Cryptocurrency. ii. Presale in Cryptocurrency. iii. Public Sale in Cryptocurrency.

1. Private Sale in Cryptocurrency.

One of the stages during the initiation of a cryptocurrency coin offering is the Private Sale stage. During this period, the unannounced cryptocurrency asset is sold to a group of individuals and firms in a private manner. The primary aim of such an undertaking is to gather considerable funds for the development of the project through the financial commitment of the investors.

The cryptocurrency coins or tokens are then sold at economical prices to the investors, creating a space for huge financial gains once the tokens or coins are publicized. Meetings with the investors can be done in-person or online through video calls and even voice calls. The most important aspect is that the aim of the project and the financial outlook are in sync with the investor’s expectations.

Merits

Investors are offered the cryptocurrency coin or token at prices that are far cheaper than the price of the same asset once it becomes public and starts selling on exchanges.

Investors realize huge profits with every growth in the price point of the assets. This event makes their investment worthwhile as their ROI is usually massive.

Private Sales presents investors with the chance to secure more of the cryptocurrency assets in question. This confers power to individuals or firms with high holdings on the respective platform of the project.

Acquisition of a large number of tokens or coins with governance purposes confers considerable decision-making responsibilities to the investors. This helps them to contribute to the projects they have financially committed to.

Demerits

The lowest threshold, in terms of capital, required for investment is usually higher than the other stages during the coin offering process

In the event that the project disappoints, there is not a chance of receiving a refund of one's investment. Hence, investors incur losses.

Since the lowest capital conditions are higher, not all interested people are able to participate during this early stage.

Projects do not always experience catapulting growth after going public. This event translates to slow realized profits as it can take a considerable amount of time for liquidity to surge on the asset’s market.

2. Presale in Cryptocurrency.

The Presale stage happens before the public sales take place. The cryptocurrency tokens or coins during this period are offered to interested persons and firms for sale at a discount price that is lower than that of the public sales. During the presale stage, the project itself is usually in the development phase.

These sales are made by the developers of the project to secure additional funds that will be used towards any further advancement of the project, which includes the preparation for the public launch of the token. The risk involved in this stage is considerably lower than that of the private stage, although the price of the cryptocurrency asset in the Presale is relatively higher than that of the private sales.

Merits

The price of the cryptocurrency coins is cheaper than the price of the same coins or tokens when they are sold publicly on various platforms.

The lower price offers investors the chance to acquire more of these assets, which then can confer them more control in the respective ecosystem based on the function of the cryptocurrency coins or tokens.

The lower price points of the coins or tokens translate into profits once the public sale of the asset as well as the subsequent performance on the markets is successful.

Since not all projects carry out the public sales of the digital tokens or coins, participants of this stage are able to obtain the tokens or coins before the maximum supply pool is reached.

Demerits

Profit returns of the investment can be delayed due to the low liquidity of the asset on the market.

The number of coins or tokens made available for purchase during this period is considerably smaller than those of the private sales.

The price of the tokens is considerably exorbitant compared to the public sale price of the same assets.

Losses could be realized should the project turn out unsuccessful after its public debut.

3. Public Sale in Cryptocurrency.

The public sale is the ultimate stage. During this period, the cryptocurrency coins or tokens are sold on various platforms like exchanges and many others.

This stage, however, usually becomes a necessity when the targeted supply pool of the cryptocurrency assets was not fully purchased during the two former stages.

As a result, the available number of tokens on the market is significantly lowest among the three main stages. No bonuses or purchase discounts are offered to customers during this period as done in the former two stages.

Merits

There is low risk involved in this stage as the development of the project is usually completed by the time the public sales are executed.

The financial barrier for participation is the lowest of the three main stages; hence, more individuals and firms can participate in the sales and acquire more assets.

During this stage, the liquidity of the cryptocurrency tokens or coins is heightened due to the massive buying and selling of the assets by investors to secure profits.

Demerits

Private investors can sell their large acquisitions to secure profits; this event can lead to a huge decrement in the value of the tokens or coins.

This is stage is not always assured because it becomes a necessity when the targeted sales of the supply pool are not met.

Few tokens or coins are made available on the market for sale. Therefore, participants are unable to acquire a large number of the tokens, especially considering the huge prices at that point.

What are the mediums used for Public/Pre/Public Sales in Cryptocurrency?

During the sales of a token, developers utilize various platforms to gain the attention of potentials investors and also to execute the sales of the cryptocurrency coins or tokens. Instances of such media are as below:

i. The Website of the Project

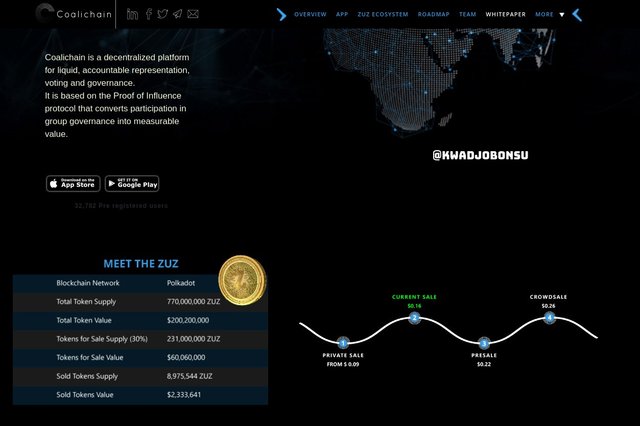

Cryptocurrency project developers often create an official website for the project, which highlights the goals and history of their projects. These websites are sometimes utilized for the announcement and sales of the respective cryptocurrency asset, being it a token or a coin. Usually, the Presale and public sale stages employ this method to bring the event to the awareness of people. Special discounts, as well as bonuses for the presale stage, are often highlighted on the platform to allure investors. KYC is also a common requirement for the presales on the website of the issuers.

In the image above, the website of the Coalichain project highlights tokenomics and the price of the ZUZ token at various stages. The token was sold to private investors at $0.09 but is currently selling at $0.16. Once the Presale stage is reached, the price of the ZUZ token will be $0.22.

ii. Launchpads

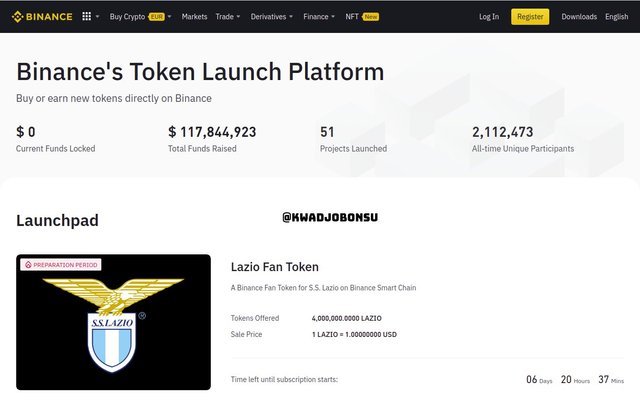

Launchpads are fundamentally platforms that provide project developers with a large group of users or potential investors and aid the developers in carrying out their coin offerings. This form of support is robust and effective in drawing great financial support for promising projects. Funds on launchpads are raised rapidly, the distribution of the tokens is also done in an efficient manner. The Binance Launchpad is one of the most popular cryptocurrency launchpads. Other examples include the Polkastarter, TrustSwap, DuckSTARTER, and many more.

The image above is a screenshot of the Binance Launchpad. As shown, the Lazio Fan token sales are offered at a price of $1. A total of 4 million Lazio tokens were offered, which translates to 4 million USD if all the tokens are sold.

iii. Social Media Platforms

The predominant social media platform that is employed in the sales of tokens or coins is the Telegram application. The Telegram and other social media platforms permit the utilization of bots to conduct sales. These automated bots make specific inquiries and use eligible responses for executing the sales. Hence, project developers create bots that ask for the participant’s data and also provide additional links for some other procedures or information.

iv. Private Meetings

This method is predominantly employed in the private sale stage. As mentioned earlier, the coins or tokens are unannounced, and the developers seek to acquire huge capital investment for the development of the project. As a result, the meeting is conducted privately through distinct but surreptitious means such as a private online video call and others. Other times too, a physical meeting with interested investors is carried out in a secure location such as offices.

Research about any recent (2021) successful ICO or IEO and give detailed information about the project.

The ALICE token which is possesses utility purposes in the My Neighbour Alice multiplayer game successfully executed its Initial Exchange Offering on the Binance Launchpad. The video game is a builder-based game where participants can purchase digital in-game items with the token. The token also has governance functions and is according employed in vote casting procedures.

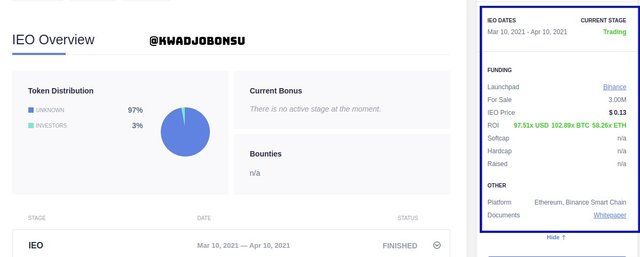

During the IEO on the Binance Launchpad, 3 Million tokens were available for a price of $0.13 each. The Initial Exchange Offering took place between 10th March 2021 and April 10, 2021. Three percent of the supply pool went to investors as 97 percent was distributed to an uncategorized group of participants.

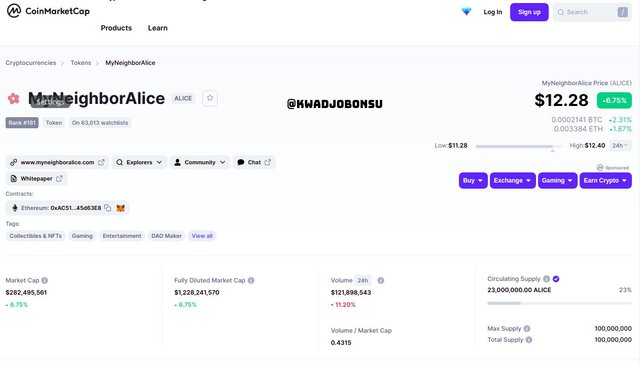

Currently, the token is selling at $12.28, according to the CoinMarketCap Website at the time of visit. The Market Capitalization of the token is around $282 Million, and its fully Diluted Market Cap is $1.2 Billion. The ALICE token has a maximum supply of 100 Million, and 23 Million tokens are currently in circulation. The 24 hours volume of the ALICE token is 121.8 Million Dollars.

According to the chart of the ALICE token on CoinMarketCap, the all-time high price of the token was $28.95, which happened on 15th March 2021 at 11:00:00 am GMT.

Create an imaginary token. Write about the project including its use case. Develop an ICO which includes Private sales (3 stages) and Public sales (1)

The Kejetia Run Token (KR Token)

The Kejetia Run is an endless running web-based video game that takes events in the Kejetia market surrounding Kumasi, Ghana. Players will have to maneuver their way over and under obstacles, while their characters run from security personnel characters for not wearing a nose mask. Players will be able to customize the character’s appearance including skin color, hairstyle, clothes, and many others. These customization objects can also be sold and purchase with the KR token.

The underlying framework of the game and its token is the Solana Blockchain, due to its high speed and low transaction fees. The high security of the Solana network ensures that the earnings of players will be secure from malicious manipulation on the blockchain. Also, the decentralized nature of Solana will ensure constant up-time of the video game market, even when one node is faulty.

The KR token will also have a governance purpose in the game's ecosystem. Players will be able to stake their tokens to participate in votes and polls concerning the further development and expansion of the game. Players who also agree with the technical updates from the developers will be rewarded exclusively.

The development of a video game is by no means cheap. Various professionals with different skill sets are needed for a successful venture. The team of the Kejetia Run game comprises marketing agents, game development agents, software engineering agents, public relations officers, and many others. A significant amount of funds are required to pay for their contribution towards the project. Hence, an ICO is conducted to acquire such financial aid for the development of the game.

The Kejetia Run is a favorite among many Africans and has approximately 2 Million players on daily basis. The maximum supply of the token will be capped at 100 Million. The estimated amount of money deemed necessary to keep the project running for five years before it's sold is about $17750000. Hence, the Initial Coin Offering will be carried out as below:

1st PrivateSale: A meeting with the Vodafone Ghana network will be held on 20th November 2021. 25 million KR tokens will be offered for $0.1 per token. The expected amount will be $2.5 Million for 25% of the maximum supply pool. Vodafone Ghana is planning on making the game free to play on its network to drive up the traffic for the game.

2nd PrivateSale: A meeting with Samsung Ghana will be held over Zoom on 12th December 2021. 15 Million KR tokens, which account for 15 percent of the maximum pool, will be sold at a price of $0.11. The expected amount will be $1.65 Million. Samsung plans on making the Kejetia Run game a default application on upcoming budget entry Samsung devices for the African continent.

3rd PrivateSale: An in-person meeting with a business guru on 28th December 2021 at his him. She is seeking to acquire 10 Million KR tokens. These tokens will be offered to her at a price of $0.11. The expected return will be $1.1 Million.

The gross income from the three private stages will be $5250000 for 50 Million KR tokens, which accounts for 50% of the supply cap. This leaves a net revenue of $1475000 to be sought for in the other stage.

Public Sale: The tokens will be publicized on 4th February 2022. The remaining 50 Million tokens will be sold at $0.25 each. These tokens will be listed on various platforms such as CoinMarketCap. If all are purchased, the gross returns from this stage will be $12.5 Million. The estimated amount needed to run the project will be met.

What are the criteria required for listing a token on CoinMarketCap. Is there a criteria for listing an asset on a Centralized Exchange? If Yes, use an exchange for your explanation in response to the question

1. Listing on CoinMarketCap

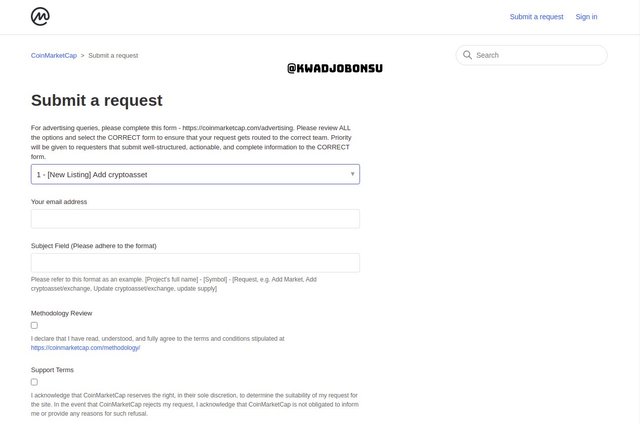

- To list a cryptocurrency token on CoinMarketCap, the participant must first submit a form here, providing the requested details about the project which will be used for evaluation by the CoinMarketCap team.

After evaluation, the token can be categorized as a tracked listing or an untracked one. This grouping depends if the project meets certain standards according to the Rules and regulations of the CoinMarketCap platform.

- For the tracked listing, there should be entities such as consensus algorithms, smart contracts, and many others integrated into the project. A block explorer or a website that functions similarly is a necessity. The token must also be publicly sold and bought. All these requirements help the CoinMarketCap team to track the performance of the asset on the market so that real-time data can be provided on the platform for users.

- When submitted projects do not meet certain requirements, as shown in the image above, they are regarded as untracked listings because the unavailability of certain data will make it cumbersome for the team to analyze the token from various angles.

- Additionally, there are also some fundamental CoinMarketCap rules and regulations that participants must adhere to. The image above highlights those rules.

2. Listing on Binance

Centralized Exchange platforms such as Binance have rigorous specifications that ought to be met before tokens can be listed on the exchange.

For Binance there are two distinct online applications that would have to be filled: Launchpad application, which is recommended for projects without issued coins, and A Direct Listing on the Binance Exchange, which is for projects whose coins or tokens are already moving around in the market.

.jpg)

The above image highlights some of the measures participants can observe to enhance the listing of their tokens on Binance.

Once the submitted form is accepted after the first review from the Binance team, the applicant will be contacted via a PGP signature verified email.

Conclusion

The commitment of financial resources to a cryptocurrency asset with aim of obtaining profits is primarily the central dogma behind cryptocurrency investment. The cryptocurrency market is diverse as each asset functions unique or similar to others. Investment tools such as Coingecko and CoinMarketCap cap can be used by investors to assess the performance of a cryptocurrency asset on the market. It is also important that investors diversify their investments to secure their capital from unfavorable violent swings in the market.

Coin sales in the cryptocurrency ecosystem can happen privately or publicly. Each has its merits and demerits as discussed in the article. It is therefore critical that investor perform thorough research on a project and their coin offerings before committing their financial capital.

I thank Professor @fredquantum for this amazing class.

Congratulations! Your post has been selected as a daily Steemit truffle! It is listed on rank 19 of all contributions awarded today. You can find the TOP DAILY TRUFFLE PICKS HERE.

I upvoted your contribution because to my mind your post is at least 6 SBD worth and should receive 40 votes. It's now up to the lovely Steemit community to make this come true.

I am

TrufflePig, an Artificial Intelligence Bot that helps minnows and content curators using Machine Learning. If you are curious how I select content, you can find an explanation here!Have a nice day and sincerely yours,

TrufflePig