Why SBD Rewards Are Back? Understanding debt-ownership ratio

Introduction

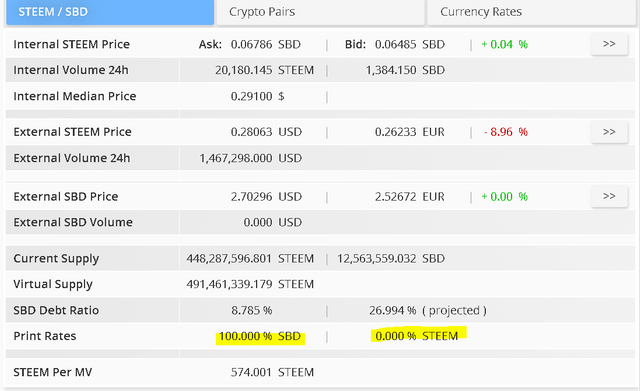

Due to the recent surge in prices impacting both STEEM and SBD, there has been a shift in consensus regarding the SBD printing rate. As of the current moment, SBD is being traded at $4.34, closely approaching its peg. Consequently, the printing rate has been adjusted from 0% to 100%. This increase in the printing rate aims to boost the supply, theoretically acting as a measure to prevent excessive price surges. This adjustment reflects the operational mechanics enforcing the pegging mechanism of SBD.

Background

The Debt-Ownership ratio is a pivotal metric that serves as a financial compass for the Steemit ecosystem. It not only provides insights into the financing structure but also serves as a strategic guide for decision-makers within the community. The effort to maintain a Debt-Ownership ratio below 10% underscores the community's commitment to fiscal responsibility and sustainability.

In essence, a lower debt ratio indicates a lesser reliance on borrowed funds, showcasing financial prudence. This becomes particularly important in times of economic downturn or reduced commercial activity. By minimizing the amount of STEEM allocated via SBD conversions when the debt level nears the 10% threshold, the Steemit ecosystem aims to shield itself from potential financial strains and ensure the resilience of its reward mechanisms.

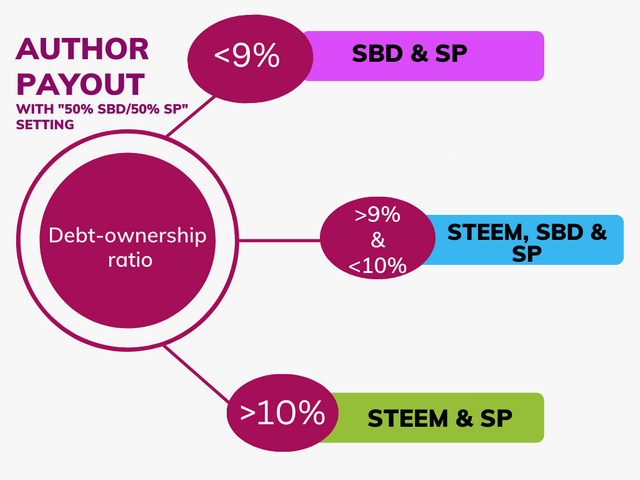

The Debt-Ownership ratio's direct impact on the reward system is significant. Users who opt for the "50% SBD / 50% SP" parameter in their payment preferences may find their default payout method shifting between SBD and SP based on the prevailing debt ratio. This dynamic adjustment aligns with the community's commitment to maintaining a healthy financial position.

What is Debt-Ownership Ratio ?

This ratio fluctuates with market conditions. In bullish markets, the ratio tends to be low due to the high value of STEEM, requiring fewer tokens to support 1 SBD. Conversely, in bearish markets, the ratio increases as more STEEM tokens are needed to support 1 SBD. The blockchain system prints SBDs to reward content creators, but it halts this process if the debt ratio surpasses 10%, redirecting payouts to STEEM.

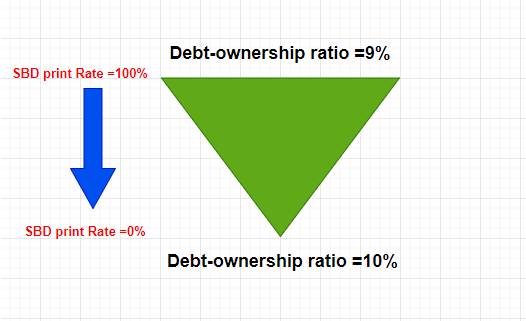

The SBD print rate is calculated using the formula: SBD print rate = 100% * (10 - debt ratio). For instance, at a 9.5% debt ratio, the SBD print rate is 50%, meaning half the reward is in SBD and the rest in STEEM.

As the debt ratio rises, the percentage of the cash reward paid in SBD decreases. Once the debt ratio hits 10%, no SBD bonus is issued, and rewards are entirely in STEEM. The debt-to-ownership ratio is defined as the ratio of SBD market capitalization to STEEM market capitalization.

The formula for the SBD print rate is expressed as follows: SBD print rate = 100% * (10 - debt ratio).

To illustrate this, consider a scenario where the debt ratio is 9.5%. Substituting this into the formula, we get SBD print rate = 100% * (10 - 9.5) = 50%. In practical terms, this means that 50% of the cash reward will be allocated in SBD, while the remaining 50% will be disbursed in STEEM, with the customary fortified reward in SP.

Continuing with another example, let's assume the debt ratio is 9.7%. Applying the formula, we find the SBD print rate to be 100% * (10 - 9.7) = 70%. Consequently, 30% of the cash reward will be designated in SBD, and the remaining 70% will be distributed in STEEM, alongside the standard fortified reward in SP.

It's crucial to note that once the debt ratio surpasses 10%, no SBD bonus will be granted.

The debt-to-ownership ratio is formally defined as the ratio of SBD market capitalization to STEEM market capitalization:

Debt-to-ownership ratio = STEEM market capitalization/SBD market capitalization

The STEEM market capitalization accounts for the entire virtual supply, encompassing the tokens necessary to support SBD. This is calculated as follows:

STEEM Market cap = Virtual STEEM supply×STEEM current value

The SBD market capitalization considers the total supply of SBD:

SBD Market cap = Total SBD supply × 1S

Why 1$ and not SBD price?

The blockchain's debt is determined by the internal conversion rate, and the system consistently maintains SBDs at or below $1, irrespective of external market fluctuations. As a consequence, the current debt ratio is estimated to be around 12%.

However, the situation becomes more intricate due to a peculiar phenomenon: when the debt ratio reaches 10%, the conversion rate intentionally drops below $1. This strategic adjustment ensures that, technically, the debt ratio never surpasses the 10% threshold.

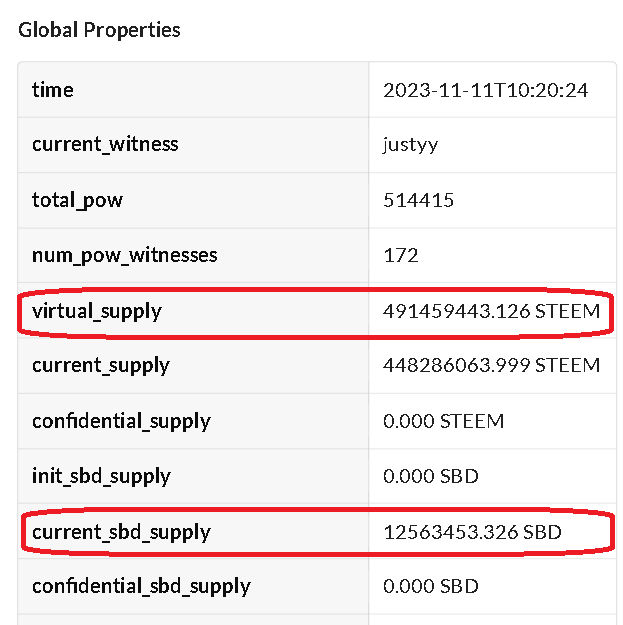

Both the total SBD supply and virtual STEEM supply can be obtained from Steemdb.io.

STEEM Market cap= 481504305,655 * $0,2788 $ = 134 243 400,416

SBD Market cap= 12138911,123 * 1 $ = 12138911,123

Current Debt-to-ownership ratio = 12138911,123 / 34243400,416 =0.09

According to this calculation, the debt-to-equity ratio is now 9%, which means that the printing rate for SBD is 100%.

Thus, now 100% of the cash reward is paid in SBD and 0% is paid in STEEM. That's why you can now see author payments in a combination of STEEM + SP.

Notes :

A noticeable trend is that the debt-to-equity ratio experiences a decline with an increase in the market capitalization of STEEM. Once it reaches the 9% threshold, the Steemit Blockchain initiates a 100% SBD printing, leading to authors receiving payments in both SBD and SP.

Furthermore, authors on the Steem Blockchain can contribute to maintaining a stable environment by setting their yield to "Power Up 100%." This strategic move aids in controlling the daily money supply, subsequently influencing the supply/demand ratio to favor STEEM. This, in turn, contributes to enhanced performance in the market. A rise in the price of STEEM leads to an increase in market value, effectively causing a reduction in the debt ratio.

Conclusion :

In summary, understanding and actively managing the debt-ownership ratio is crucial for the Steemit ecosystem's stability and sustained growth, and the encouragement of strategic choices.

Best Regards,

@kouba01

Hey kouba01 Awesome breakdown of the recent changes in SBD printing and the Debt Ownership ratio on Steemit! Your explanation make these financial aspect much more understandable

I appreciate the Examples you provided With percentages especially how you showed the impact on reward At different debt ratios it helps users like Me grasp the dynamics better

The $1 fixed value for SBD is smart move to maintain stability amidst market fluctuations and your insight into the intentional adjustment When The debt ratio hits 10% add an interesting layer to the platform financial strategy

I also like how you emphasize the role of authors in maintaining a stable environment by setting their yield to " Power Up 100% " Its a practical tip that connect individual actions to the Overall performance of STEEM in the market

Your post provide valuable insights into the financial mechanics of Steemit and its clear you put effort into making it accessible thanks for sharing this knowledge! Looking Forward to More informative content from you

This comment has been supported through the account Steemcurator06 for containing good quality content and comments.

Curated by : @sduttaskitchen

Thank you ao much

Good

This is absolutely phenomenal again. You have a better understanding of this whole thing making your explanation more and more understanding. I strongly hope and believe that the price will become better and better.

Thanks for sharing your knowledge.

This is very timely sir and am glad I could learn much from this post..

Thank you for the explanation

This is very important, nice for me to learn more about it.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

That's true.

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

TEAM 1

Congratulations! This post has been upvoted through steemcurator04. We support quality posts , good comments anywhere and any tags.