Steemit Crypto Academy | Summary On Homework Task Week1-Season6

February 12th, 2022 was the deadline for Week 1 of Season 6 to accept your homework, I want to thank the 55 students who tried and worked hard this week submitting their essays to complete the assignment and get the best grades.

This week we introduced the Zig Zag indicator that eliminates price changes below the value set by this parameter. Therefore, the Zig Zag indicator only highlights significant price changes.

It is also best to know that the Zig Zag indicator may be useless for sideways trends, as it clearly shows large price swings. Moreover, it is not predictive but only photographs the past or real time.

The Zig Zag indicator is also included in one of the most popular trading platforms.

Help determine the highs and lows of the crypto market. And it is part of the family of trend indicators.

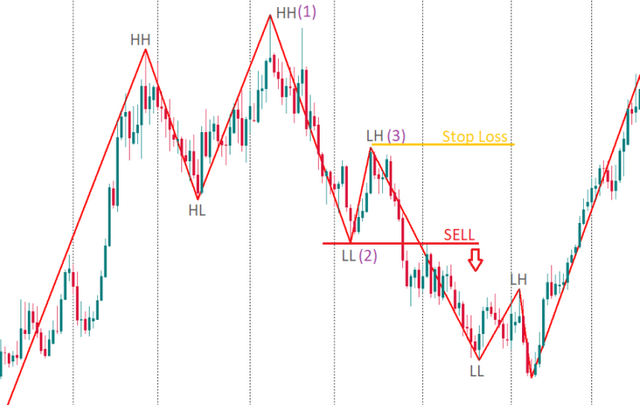

It claims that a series of higher and higher peaks, followed by higher and higher troughs, underscores an upward trend."

Conversely, "A series of lower and lower lows followed by lower and lower peaks underscores a downtrend."

I hope all users who have researched this week will benefit from the set of information and analysis provided to determine how much of an asset that typically moves in a given time period to set profit goals and decide whether or not to try to negotiate.

We always affirm that the main goal of our Steemit Crypto Academy community is to ensure knowledge and promote quality, fair and inclusive learning opportunities in the field of cryptocurrency for all.

Then I asked the students a few questions to gauge how well they understood the topic and to assess the cognitive gains they had made from reading the lesson.

The questions to be answered are:

1. Show your understanding of the Zig Zag as a trading indicator and how it is calculated?

2. What are the main parameters of the Zig Zag indicator and How to configure them and is it advisable to change its default settings? (Screenshot required)

3. Based on the use of the Zig Zag indicator, how can one predict whether the trend will be bullish or bearish and determinate the buy/sell points (screenshot required)

4. Explain how the Zig Zag indicator is also used to understand support/resistance levels, by analyzing its different movements.(screenshot required)

5. How can we determine different points using Zig Zag and CCI indicators in Intraday Trading Strategy? Explain this based on a clear examples. (Screenshot required))

6. Is there a need to pair another indicator to make this indicator work better as a filter and help get rid of false signals? Give more than one example (indicator) to support your answer. (screenshot required)

7. List the advantages and disadvantages of the Zig Zag indicator:

8. Conclusion:

What are the main parameters of the Zig Zag indicator and How to configure them and is it advisable to change its default settings? (Screenshot required)

The Zig Zag indicator plots and connects the highest and lowest points on the chart. The distances are equal to or greater than the percentage specified for the price range.

You will then need to define a percentage of the price movements. So, assuming the default value for a gap between two ZigZags is 5, a setting of 10 would end up showing only price moves of 10% or more on the chart.

This eliminates variations that are too small, so that the analyst can have a more global view of the asset in question.

By default, closing candle prices are used. While the imaginary points are positioned on the selected chart in which the price trend eventually reverses by the set percentage.

The points will be connected to each other by straight lines, which will appear to you in red by default. By bringing up the ZigZag trend indicator.

Here is the legend of the default settings:

Depth: corresponds to the minimum number of bars that does not exceed a maximum or minimum variation defined in relation to the initial bar

Deviation: This is the number of pips or points (depending on the market) after the formation of the previous minimum or maximum.

Parameters should be adjusted according to different markets. The risk is that we end up using specific parameters according to the different markets or assets that are linked to each other.

The parameters of the same market can also be modified. Or assets in the event that market conditions change and volatility changes accordingly.

Based on the use of the Zig Zag indicator, how can one predict whether the trend will be bullish or bearish and determinate the buy/sell points (screenshot required)

As we have already mentioned, the use of the Zig Zag makes it possible to identify the main trend of any financial asset, understood as a succession of significant movements on maximums and minimums at a given moment in the market.

The use of the zigzag indicator does not exclude the possibility of using additional trend identification tools, since it can be used alone or combined with other operational filters at will.

It is also very useful for identifying classic patterns of technical analysis, such as double top or double bottom, head and shoulders patterns or the very famous 1-2-3 high/low patterns of Joe Ross.

Is there a need to pair another indicator to make this indicator work better as a filter and help get rid of false signals? Give more than one example (indicator) to support your answer. (screenshot required)

Several traders use the ZigZag indicator to identify Fibonacci levels.

When taking into consideration the wave structure of the Fibonacci levels, it is considered that, given the number of waves formed by the ZigZag, it is therefore probable that the Fibonacci levels are respected.

However, these two tools complement each other. You can also use Fibonacci levels with ZigZag waves by applying them to a single candle or a natural reversal. Obtaining excellent results.

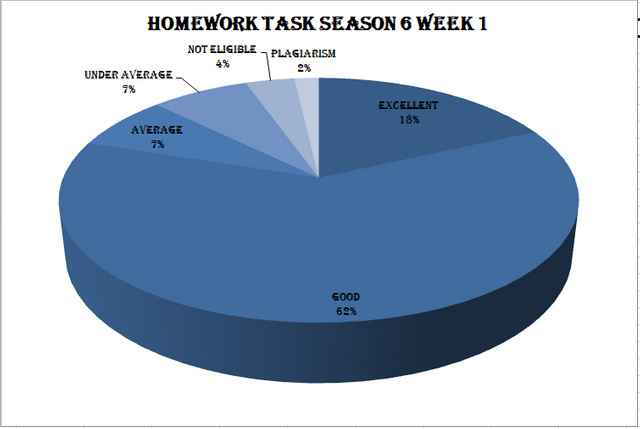

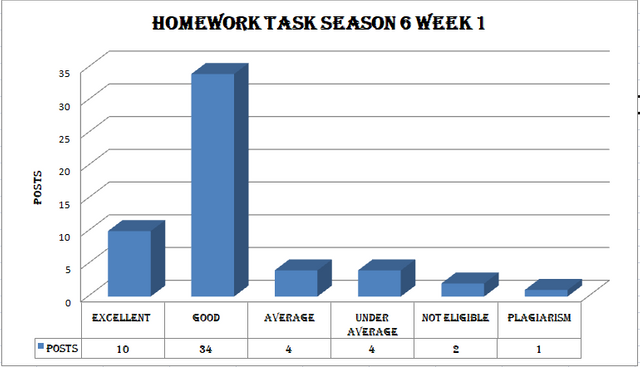

The first week of Season 6, which took place from February 5 to February 12, 2021, saw a respectable number of entries with the terms of this season changed to urge users to raise their reputation and influence for the benefit of the platform and users alike.

We note the availability of articles with excellent content, which represents 18% of the total writing, with a high percentage of articles with good content reaching 62%, as well as articles with medium content at 7%.

Thus the percentage of successful homework with a positive overall vote exceeded 87% versus 7% who failed to score above average, and if that is anything to be said, the seriousness with which students get what they are asked and how eager they are to learn and make Do their best to get the highest score and best results.

We also see 2% of plagiarism posts which we always look to combat and it remains our great hope that students will continue to write articles without these practices which remain the first and most important enemy towards improving their level and developing their knowledge.

4% were classified out of the competition due to non-compliance with the conditions of participation, and it must be remembered that the conditions of participation require a reputation of 60 and 250 SP with adherence to the expiration time and the fulfillment of the conditions for participation in the #club5050 event, so we invite participants to abide by these conditions so that the preparation effort is not lost without getting evaluation and upvote.

We would like to first thank all the participants for their challenges and inspiring achievements, and we hope that the spirit of this competition will continue for as long as possible, and we hope that the culture of challenge and facing obstacles will spread in all communities.

We are pleased to announce the names of the three winners of the 1st week of the 6th season competition :

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

Saludos profesor. Mi tarea no fue calificada

https://steemit.com/hive-108451/@ahumadaliliana29/crypto-trading-using-zig-zag-indicator-crypto-academy-s6w1-homework-post-for-kouba01

i like your post. I learned a lot from your posts

Thank you for this mention Professor @kouba01, without a doubt, it is worth every effort and teaching that you transmit to us. Regards

Hola profesor como estas espero que este bien líder le escribo por la razón si me puede ayudar sobre lo que me paso en la academia ya que usted es el encargado de dirigir a los excelente profesores que hacen vida en la academia ya que fue un error mío que pude corregir rápidamente si tiene la bondad de visitar mi usuario muchas gracias líder y disculpe la molestia bendiciones para usted y su familia espero pronta respuesta gracias