Crypto Academy Week 2 Homework Post for [@gbenga] (100% powered up)

Hello Steemians, After two days of hard work, I have found the time to write this article in response to Professor @gbenga's second homework regarding our preferences between exchange platforms and wallets as safe storage and reliability of our crypto-currencies which has become a major issue as the number of hacks continues to increase.

Introduction:

Storing crypto-currencies is an essential step to ensure the security of your electronic currencies. Whether for Bitcoin, Ethereum or any other cryptocurrency, it is essential to have a good storage wallet so as not to take any risk on your e-currency capital. Indeed, a hack can lead to the outright loss of all its nest egg and this, in an irreversible way. A wallet for storing crypto-currencies is therefore even more sensitive than a traditional bank account, and the latter must therefore be selected carefully to avoid running any risk on your capital.

Why is it important not to leave your cryptos on an exchange platform?

When buying cryptocurrency, it is strongly recommended that you do not leave your belongings on an exchange!

Why ? Simply because currencies purchased on an exchange from you don't really belong to you. To be the true owner of a currency, a transaction must be written on the blockchain (which you can think of as a decentralized ledger), with a quantity, and a private key. Whoever has access to this key can do whatever he wants with this currency; transfer or sell it, for example. The private key therefore represents the owner.

When a platform “sells” you a currency, it keeps the private key. It just recognizes you a right of ownership on this currency by a contract which exists between this platform and you. The analogy with a traditional bank can help you understand. If you keep cash at home, it is yours. If you give it to the bank, the bank takes physical possession of your notes, and recognizes that it owes you a debt equal to the value of that cash, but your notes are no longer in your possession. If the bank disappears overnight, so does your money!

It's the same with cryptos. A platform recognizes that it manages currencies on your behalf, but in the event of problems such as maintenance, breakdown, hacking or bankruptcy, you run the risk of losing access to your currencies, temporarily or permanently.

It is therefore essential to secure your currencies in a personal wallet and to leave on an exchange only what is used for your daily transactions. When you take your cryptos out of an exchange, you transfer them from the platform's private key to yours, making you their full owner.

Small additional bonus, repatriating your cryptos to personal wallets allows you to take full advantage of the currencies offered during Forks and Airdrops .

There are 3 main methods to store your coins: Physical wallets, which look like USB keys, software wallets, to be installed on a computer or a phone, and paper wallets, to be simply printed.

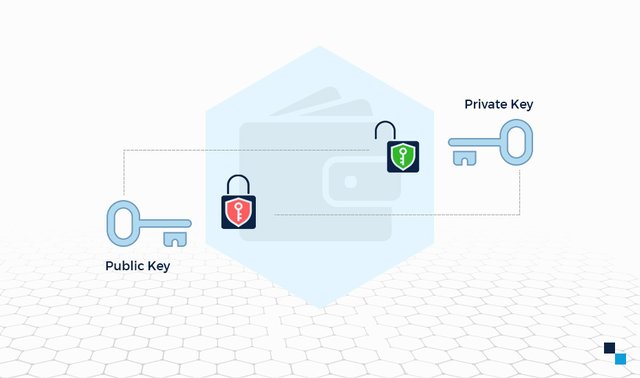

Your private key you will protect

Whatever method is chosen, it aims to secure your private key. This key identifies you as the owner of the currency in question. It is made up of a long series of upper and lower case characters. You must not communicate it to anyone, and protect it! It's a bit like the password to access your crypto vault! When you create a crypto wallet, you receive a private key, your “password” which allows you to access your funds, and to validate transfers to the outside, and one or more public keys, which allow you to receive transfers to your account. It is obviously important not to confuse the two, as one is secret, and the other is public.

Where it gets complicated is that there is no wallet that can handle all currencies. Cryptocurrencies were created by genius nerds who obviously went out of their way to complicate matters and make the system as opaque as possible for ordinary people.

No problem with major currencies, like Bitcoin, Litecoin, and Ethereum. Most physical or software wallets support them without a problem. But it's more complicated for less common currencies.

If you are interested in cryptocurrency, you probably know that the term cryptocurrency is a misnomer, and that you have to distinguish between coins and tokens. Tokens are always associated with a coin, whose protocol they use to operate. Ethereum is a corner, and many tokens like OmiseGO or Vechain use Ethereum as their platform. To make an analogy, think of the coin as a programming language, and the token as software that uses that language! This kinship between coins, like Ethereum, and some tokens means that this small family will be compatible with the same wallets. An Ethereum wallet will therefore also be able to store tokens that are based on Ethereum. You follow me ?

- Physical wallets

These wallets are small devices resembling USB keys that are ultra-secure and allow you to store your coins. Two models are currently competing for the market, the Ledger Nano S, and the Trezor.

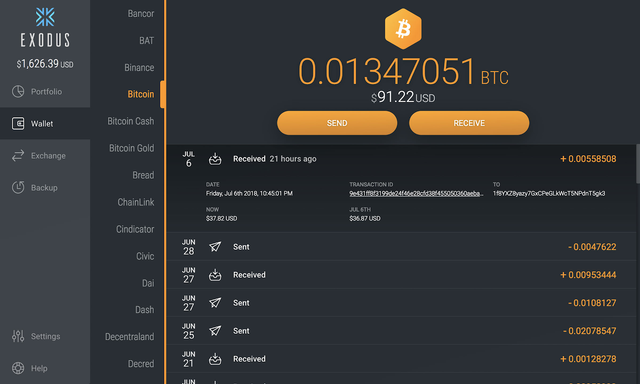

- Software wallets

On the official website of each currency, it is possible to download the wallet specific to that currency. To make sure you get to the official site, and don't land on a pirate site, I recommend that you always go to the Coinmarketcap site, select the currency in question, and click on “Website”. Usually a desktop version and a mobile version are available. Of course, if you have multiple currencies all of those wallets can get really bulky!

The other option is therefore to find a software wallet that can manage multiple currencies. These portfolios are produced by private companies. It is therefore important to choose companies with an irreproachable reputation.

- Paper wallets

Physical or software wallets don't actually store your currencies, since electronic currencies are by definition non-physical. You only own an amount of currencies after entering a transaction associated with your key in this blockchain ledger. These software are just tools for accessing that ledger, listing your possessions, and making transfers. They use your private key for this.

Conclusion:

Regardless of the method used, there are backup systems that can recover your information if your physical wallet, your computer, or your phone breaks down. Usually, when you create your wallet, you are given a list of words to note which will constitute a code to retrieve your information. Write this list down in a safe place, or memorize it!

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

@gbenga

Twitter link

I must confess that this is impressive, properly written, explained, and organized. Explaining why to use both exchanges and wallet why stating clear your choice.