Crypto Academy / Season 3 / Week 5 - Homework Post for @wahyunahrul

It was a great lecture and i am glad to participate in this homework post, I am @kelechisamuel and this is my homework post for week 5

Explain in your personal opinion whether IDO needs to be done on cryptocurrencies.

Considering 1DOs, I think they should, be done on Crypto currencies since they help well in crowd funding and input of more abilities in the crypto market and not just it, they tend to tackle issues of other crowd funding offerings just like we see in the ICO where several projects are trying to use it making it very prone to hacking and theft. More so, the IDO, establishes, the crypto market purpose, by having a decentralized nature and project entrepreneurs, can unleash crypto products that are safeguarded from malicious intermediary effects with their assets stored in their private keys /wallets. Their lesser transactionary cost seems to be another great consideration for users who would want to crowdfund which is relatively better compared to others.

They should also be done on Crypto currencies since they give everyone chances to participate in it and not just basically private investors

Can IDO have a significant impact on the cryptocurrency world.

Getting to explain the question if IDOs can have a significant impact in the Cryptocurrency world?

My answer would be yes !

Firstly we see the Initial DEX Offerings to be succeeding the ICOs, IEOs etc as they tend to correct their several failures and even make their own features better like in the following ways :

Firstly we understand that in normal coin offerings (mostly centralized) personal investors get to buy huge volumes of the tokens and then re-sell at their choice and price hereby exploiting other users but with the IDOs, everyone can buy without waiting for start orders from anyone

Another considerable fact about the IDO is that they can be traded easily, fast and could easily be turned to liquidity that is the project's token, can be turned to cash especially when the tokens appreciate in value like we see in the case of the UMA IDO, where the token's price appreciated from about one quarter of a dollar to two dollars

Mention one example of a token that has been IDO but failed / rugpull.

In the midst of crypto assets thriving and making waves from the IDO, there are some, who failed the expectation of crowdfunders and users relatively like the question says, pulled the rug.

One of them we would be seeing is the TurtleDEX Protocol.

The turtle DEX protocol initially posed itself to be a decentralized software designated for storage of tokens /files for users on the protocol hereby making the DEX Offering bring up a huge amount of 2.5milluon dollars worth of Binance Tokens.

The confirmation of this IDO crypto asset as a rug pull was the fact that after a confirmation that this was a scam, the value of the native token was almost equal to zero and medias serving as a page or basis to them, we're deleted

This TurtleDEX Protocol is a very good,, example of a crypto asset that used the IDO, that pulled the rug

Make a detailed fundamental analysis of 2 tokens that have done IDO, and compare the two tokens. Then give your opinion on the results of your analysis.

Here we will be considering two tokens that have done the IDO and showing the results of our analysis and they include : the Raven Protocol, the UMA, BZX etc.. but we would be considering, the Raven Protocol and UMA

The Raven Protocol :

The raven protocol could be seen as a decentralized and spread shallow learning and educating protocol that gives cost efficient and speedy working of deep networks by utilizing the calculate resources on the software.

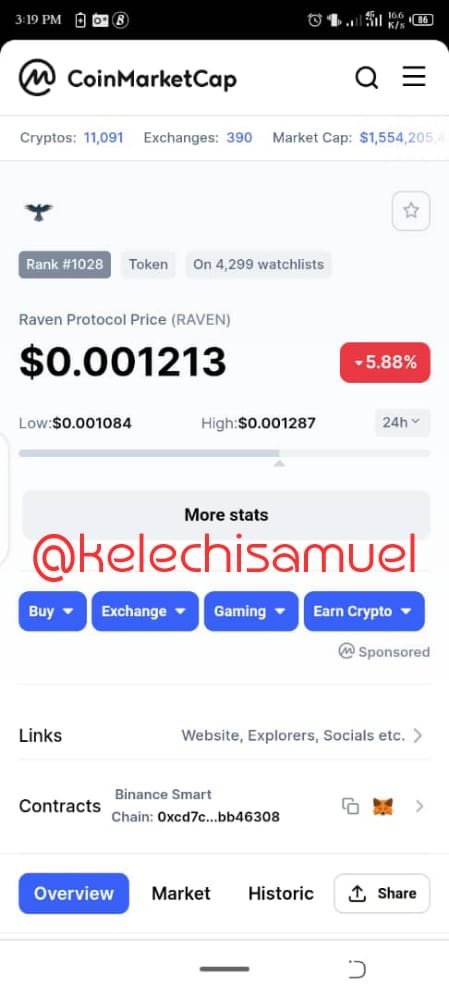

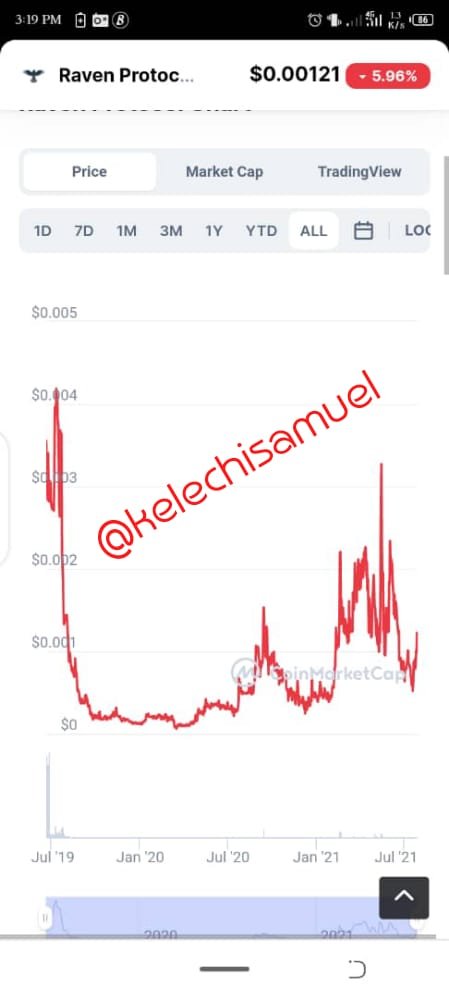

The Raven protocol could be seen as the first product to undergo the IDO crowdfunding with its present value today as 0.001206 USD with its daily volume as $1,024 and market cap of 5,389,202USD and is down by 6.38% in the last 24 hours

The UMA :Universal Market Access

On the other hand, the UMA could be seen as a protocol meant for development, giving out, and settling of the derivative for underneath assets structure on the Ethereum blockchain

A major understandable fact about this UMA is its nature of being one of cryptoassets that underwent the IDO.

We see the UMA to be the official token of the Universal Market Protocol showing the right of its users to vote on changes in the Protocol's system.

The analysis of the UMA shows its value placed at 8.76 dollars with its trading volume as 29.872, 186 dollars and up by 1.74 in the last 24 hours

We see the coin's chart and price movement in the chart shown below including its market cap and volume

In comparing these two Crypto assets that underwent the IDO we see that :

The My comparison and opinion :

RAVEN Protocol had it's basis on the Raven Protocol while the UMA has its on the Ethereum blockchain and also, the Raven Protocol has its aim at rendering , cost effective and speedy solutions that help out in transforming the several blockchain sectors while, the UMA has maximum consideration for cheap and no-price financial contracts and lessens utmost network security issues and scalable problems that trouble and are major issues in the Defi

Secondly we now understand that the IDO doesn't influence the prices of these tokens directly as we can see in the UMA case even though that Raven Protocol had it's origin before it, the UMA has a higher value and raised cap.

Look for 1 token that is doing IDO and explain the steps to be able to participate in the IDO token.

Here we are going to be considering one token that is currently IDO and steps involved in its participation and here we would be considering the $RAGE :

The $RAGE could be originally seen as a second DEX Offering initiated by the Zeroswap assist in the spreading of this tokens and yield farming of their tokens too.

This token is seen to be based on the ERC-20 token protocol and seen to be a means of reducing every stress involved in transactionary processes and is more based on users /crowdfunders staking their tokens in a liquidity pool.

The steps involved in this participation include three simple steps as follows :

As I explained earlier, this IDO is based on a liquidity pool locking kind of staking and crowdfunders are expected to stake $ZEE tokens on the Zeroswap staking platform like we seen in the picture below outside the fact that I don't have tokens and can't continue the process

After that, we send our evidence of partaking to the ZeeDo platform and get our tickets ready and waiting for the drops like the picture below entails showing the options of the ZeeDo platform

The final part, is following on media accounts , to claim your tokens as having Ethereum in your accounts goes a long way too

Conclusion :

The lesson propounds the concept of IDOs and we see them as advanced offerings that tackle failures of previous ones like ICOs and IEOs and in the same vein making users enjoy efficiency and scalability better

We also see the history and different, kinds of this IDOs, including what we think of it and potential movements of this offering.

Finally, we see the IDO as an utmost good pattern in support of projects and understand it to be a bigger system in the future.

Best regards

@wahyunahrul

Hi @kelechisamuel, Thanks for taking my class.

Based on the homework that you have made, here are the details of the assessment you get:

My Reviews and Suggestions:

You have completed the given task.

Get in the habit of putting screenshots of every piece of information you make as valid evidence.

Don't put a watermark with your username on the pictures you take on the internet, because the pictures are not yours.

In the explanation of the steps for following the IDO, you should show it with a screenshot to make it easier for people to understand and follow the steps.

Thank You!

Ok thanks for the correction sir