Crypto Academy / Season 3 / Week 2 - Homework Post for @asaj by: @juanjo09 / Market Psychology & Trading Psychology

Greetings to all and a big welcome to the new crypto teacher @asaj who has been introduced to the academy to share his knowledge. On this occasion, the teacher @asaj proposes a topic that borders us all at some point. This is how psychology becomes so imposing in the market and trading, therefore, we will know some concepts already given by his conference (see here) and we will see how they are applied to a practical and real environment, this taking as a help his story and real market graphs.

This post, therefore, is aimed at answering the questions posed by the professor in his lecture mentioned above and not at defining and / or reiterating concepts already outlined above. @asaj gives us two parts to carry out in this activity, a part "A" oriented to analyze the case given in his example, and a part "B" oriented to practice and how psychology helps to orient oneself in the graph. Without more to say, let's get started.

Part A: Case Study Jane

1. The case study given is an example of what type of psychology? Explain the reason for your answer.

Undoubtedly, in Trading Psychology, at every moment of the story we see how Jane is influenced by a group of "signals" (trading suggestions in a telegram group) and she bets emotionally on this, letting us see how Jane is dependent on her emotions and not from a set of techniques or analysis, therefore in the first instance we deduce that Jane has no other cognitive support other than an emotional hope that the price will take its desired orientation. We note, then:

I don't analyze a project.

He did not assess the risks.

He did not analyze the situation and prices.

He did not make a strategy.

I personally identify with this anecdote, well, in my first moments trading cryptocurrencies, ignorance left me alone at the emotional mercy and I was a victim of the same biases as Jane, but what bias are we talking about, which ones affected Jane's decisions? Well, let's answer the following question.

2. Using the case study above, list and explain at least 5 biases that influenced Jane's trading behaviour with examples of how it affected her behaviour?

In Jane's case you can see many biases that can provide information about her actions, I will list and describe how each one manifested in Jane's case.

Herd Mentality Bias: or as I know "the carry-over effect", we know that this is described as a "tendency to do or believe something because most believe it and do it" this manifests in Jane as in the group where he extracted the information, he got carried away, perhaps because many did; This prompted her, due to a cognitive bias, to invest in this asset, although at first it did not go wrong, she was the same victim of this bias.

Emotional Bias: Once Jane had already invested in the asset, she was carried away by desire, her greed, as she continued with the asset, eager for it to go even higher, this perhaps, accompanied by a fallacy. of the player, as he thought in "if he has gone up all these days, he will go up even more", which is wrong, then, seeing the price change, he retires out of fear.

Representative Bias: we can also see how this bias manifests itself in Jane's decision, when making a decision based on scarce information.

Loss aversion bias: Jane was unable to rate her emotions and is anxious to avoid risks, becomes impatient and out of emotional impulse leaves her post, this again without assessing a big picture

Result Bias: To conclude, Jane is a victim of this bias, because she underestimates the result of the decision rather than the process, the decision itself was bad from the beginning for not evaluating her position well, for investing without investigating . , removing it without analyzing.

Among these, other biases such as "confirmation bias", "anchoring bias", among others, can also be analyzed ... however, for me, the most influential were those described.

List and explain how each bias you have mentioned can be avoided?

Let's learn how to avoid each of the aforementioned biases.

To avoid the "drag bias", the ideal would be to think in a position totally opposite to that devised by a majority, this could be a good activity since you could better imagine the opposite cases, therefore, the best option would be to stick to a strategy already planned.

To avoid "emotional biases", the ideal, even if it is repeated, is to have a plan. This bias is often manifested by irrational uncertainty towards a stock, so the best strategy would be to stick with a well-studied strategy to minimize risk. uncertainty of the decision made.

To avoid the "representative bias", the key would be to educate yourself, inform yourself and fill yourself with all the possible knowledge, in trading we must be aware that currencies and prices are constantly fluctuating and that there is enough time to investigate and meditate. in the best decision.

To avoid "loss aversion bias", the only way to avoid this is to change the perspective of how we see losses, we must accept that we are not perfect, we make mistakes and that losses in trading are part of trading.

To avoid "result bias", we must focus more on the process than on the result, on how it was developed, a good exercise is to analyze and study our process, our reasoning and strategies, from there it would be key to overcome this bias. .

Part B : Research & Analysis

What type of analysis can be used to monitor market psychology and trading psychology, and why? Identify the differences between trading psychology and market psychology.

I consider that the analysis that could be given to monitor market psychology and commercial psychology is technical analysis, since the price graph and the indicators are the only ones that provide us with a numerical and statistical connection of the purchase and sale.

We notice then an important difference, market psychology is not the same as trading psychology. Where trading psychology can be described as one that affects the individual and their decisions in trading, on the other hand, market psychology, is one that frames all trading in general.

We can analyze the following, one is inherent to the other, therefore, we can infer a trading psychology from a market psychology, so that we use the same analysis tools to stipulate behaviors.

How can you measure market psychology using a crypto chart? Select 5 trading biases and explain with screenshots of any cryptocurrency chart how the biases can cause a coin to be oversold and overbought. (Add watermark of your username)

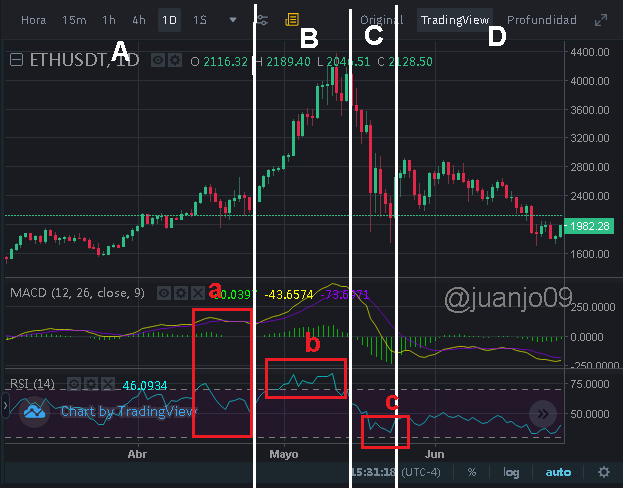

Let's do an analysis of the market psychology, with the help of a graph and some indicators let's see, I chose the ETH / USDT pair.

Here I want to distinguish four very notorious sections, let's call it "A", "B", "C", "D".

And I also want to distinguish some sections of the MACD and RSI markers, these will be distinguished with the letters "a", "b" and "c".

We can distinguish in section "A" a low volatility, which we could interpret as a neutral and healthy state of the market, however, we can see a slight upward trend, since the minimum and maximum peaks are increasingly higher, this could generate in many the first bias, a drag bias, traders buy responsibly with the certainty that each peak will be greater than the previous one.

Finally in stage "A" we can see that in the technical indicators MACD and RSI (square "a") first an overbought, shown in the RSI then a retracement to enter stage "B" notice that the histogram hardly shows trend signal here we can interpret a drag bias, more people follow the "herd"

In stage "B" we see the high volatility in an uptrend, here we can be in the presence that many traders may be the victim of an emotional bias and perhaps a "representativeness bias" where many only see that the price and greed or desire they buy in large volumes.

Then we can see how the RSI indicator already marches the overbought (box "b") at this point and many can withdraw to liquidate their long position (sell) in the first sales the price drops sharply here we could imagine another scenario, a anchor bias those who bought in stage "A" are selling at the peak of stage "B" here some traders who entered late are anchored to the idea that the price will not go down even though the RSI is already over signal sale, this perhaps due to player's fallacy and confirmation bias where in the "a" box it already marked over sale but the price continued to rise.

At point "C" we can see how the emotional bias is manifested again by people selling out of fear and FOMO and others by Aversion bias we can see how the RSI almost marks a point of overselling (squared " c ").

Finally in stage "D" there is again a process of low volatility showing that fear and traders who are victims of these biases do not participate in the market for a while.

In your own words, define the term efficient market hypothesis (emh). List and explain the advantages and disadvantages of efficient market hypothesis (emh).

The efficient market hypothesis is an approach that describes that the optimal situation to profit from prices is only extracted from them, their movements, whether with indicators or not, therefore, news or information about a future event that will affect the price and what open affected.

In my opinion, the focal point here is the information, as it travels and reaches the desired places first, I am not antithetizing the EMH but completing it, since there would be no benefit in this type of information.

Among this hypothesis, if it is analyzed well, some advantages and disadvantages can be extracted among them.

Advantage

It could avoid psychological biases when trading.

It is healthier when acting on a trading strategy.

It could reduce your losses.

Disadvantages

If the decision to invest in a crypto asset is made so random it could increase investment risks.

The information will always be ambiguous and difficult to interpret efficiently.

conclusion

Market and trading psychology is a tool not only to analyze the market, but also to the trader and ourselves, which could give us not only monetary benefits but also health, since trading is very psychological and for many it is usually exhausting mentally, so part of solving a problem, such as the biases shown, is knowing the root of it.

Many times our worst enemy is ourselves and there is nothing more difficult than changing habits, but it is not impossible. This task has taught me a lot about how to read to myself and others, I hope it has helped reading this as much as my writing it, greetings.