Crypto Academy Season 2 - Week 14 - For @Kouba01

What is MACD INDICATOR?

MACD is an acronym that stands for the moving average convergence or divergence indicator is an impetus oscillator primarily used to sell and buy trends.

Though it is an oscillator, it is not classically used to recognize over bought or oversold conditions. It is shown on the chart as two lines which oscillates without limits. The verge of the two lines gives trading signs comparable to a two moving equal system.

How does the indicator works

MACD intersection above zero is considered hulking, while crossing below zero is bearish. Secondly, when MACD goes up from below zero it is considered hulking. If it goes below after above zero it is considered bearish.

When the MACD line passes from below to above the signal line, the indicator is said to be hulking. The more the line gets below zero the stronger the signal.

Also if MACD line passes from above to beneath the signal line, indicator is known as bearish. During trading sorts the MACD will whipsaw, with the fast line crossing from side to side across the signal line.

Users of the MACD usually avoid trading in this circumstances or close positions to reduce instability within the range.

Deviation amongst the MACD and the price action is a stronger signal when it settles over to the boundary signals.

Calculating MACD

To get an estimation, MACD can be calculated by deducting the worth of a 26 period Exponential Moving Regular (EMA) from a 12 period EMA. The smaller EMA is repetitively meeting toward, and separating away from, the longer EMA. This causes MACD to oscillate about the zero level. A signal line is formed with a 9 period EMA of the MACD line.

Note: The illustrated calculation above is the default. You can decide to adjust the parameters based upon your own conditions.

Is the MACD indicator good for trading crypto-currency?

Yes, the MACD indicator is good means for trading crypto-currency, in such a way that the trend follows and make use of moving averages (regulars) to determine the amount of momentum of a stock, crypto-currency or another tradable assets.

Which is better, MACD or RSI?

both the MACD and the RSI are vast momentum indicators that shows the connection of two moving average stock. The MACD and RSI are both commonly used by both beginner and expert traders.

The good thing about the RSI is that it can be joined and connected with a number of indicators and can support different trading methods and schemes.

We must realize that the RSI is a leading oscillator which means it shows the likely future changes in the amount of stock index. The MACD proves to be the most effective and efficient in the vast fluctuating market whereas the RSI tops out beyond 70 level and bottom out beneath 30.

It usually forms these tops and bottoms before causal price chart. The MACD can easily be interpreted thereby making trading easier for a day one or novice trader.

How to add the MACD indicator to a the chart and what are the settings

The regular settings for MACD is the change between the 12 and 26 period EMAs. Chartist looking for more subtle may try a smaller short-range moving average and an extended long-range moving average. MACD (5, 35, 5) is more subtle than MACD (12, 26, 9) and might be well suited for weekly chart

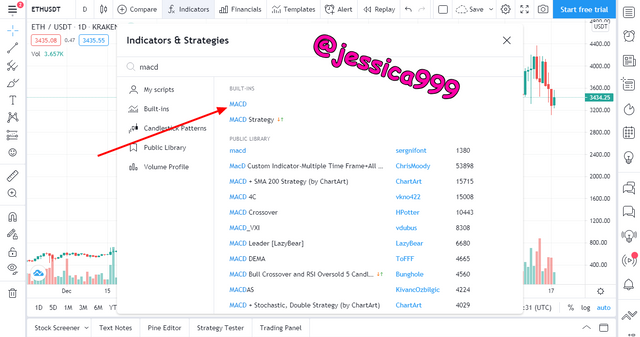

Open the chart for the coin you want to add MACD indicator to

Click on indicator at the top, then type MACD in the search bar provided, after typing select MACD to add the indicator

USING MACD WITH CROSSING MACD LINE AND SIGNAL LINE

With most crossover approaches, a buy signal comes when the shorter-term, more responsive line in the case of the MACD line crosses above the slower line the signal line. Equally, when the MACD line passes beneath the signal line it delivers a bearish sell signal.

As the crossover approach is lagging, it is based on coming up for a movement to happen before opening a position. The key problem faced by the MACD in feebler market trends, is that by the time a signal is made, the price may be getting to a reverse point. Then it will be called a false signal.

It is means noting that approaches which exploit price action for the confirming of a signal are most times seen as more dependable.

HOW TO USE MACD WITH CROSSING OF ZERO LINE

Zero cross approach is centered on either of the EMAs passing the zero line. If the MACD passes the zero line from beneath, a different uptrend may be arising, while the MACD crossing from top is a signal that a different downtrend may start.

This is frequently seen as the slowest signal of the three, so you will typically see lesser signals, but also less false reversals.

HOW TO FILTER OUT FALSE SIGNALS AND DETECT A TREND

In these case, use normal MACD factors (12, 26, and 9) and add a 50 simple moving average (50MA). If worth is above the MA simply take buy signals. If beneath, simply take sell signals. This will filter out various corrupt signals and assist to detect likely trend market reversals.

HOW CAN MACD INDICATOR USED TO EXTRACT POINTS AND SUPPORT FROM A CHART

The plan is to buy or close a little position when the MACD passes beyond the zero line, and sell or close an extended position when the MACD passes beneath the zero line.

This approach should be cautiously used, as the late nature means that fast, choppy markets mostly see the signals delivered late. Though, as a means for providing reversal signals of long sweeping moves, this can be very handy. If you use zero cross strategy, it is crucial to know where to exit the market, or place a stop.

CHART ANALYSIS OF ETHEREUM

Looking at the chart above, the red candlestick indicates that the price is going up, while the green candlestick indicates that the price is dropping.

Unfortunately @jessica999/, your article contains plagiarized content

Rating 0/10

Source-https://www.fidelity.com/learning-center/trading-investing/technical-analysis/technical-indicator-guide/macd

The Steemit Crypto Academy community does not allow these practices. On the contrary, our goal is to encourage you to publish writing based on your own experience (or as per the mission requirements). Any spam/plagiarism/spun action reduces PoB's idea of rewarding good content.

Thank you.

Cc: -@endingplagiarism @sapwood

I am sorry professors. It was a mistake when i was doing research to attempt the assignment, i promise it would not repeat itself again

@endingplagiarism @sapwood @steemcurator02 @kouba01

Once again i apologise, please pardon me