Trading Cryptocurrencies- Crypto Academy / S4W6- Homework Post for @reminiscence01

Hello great steemians, it's another week in the steemit crypto academy with another interesting and inciting course by professor @reminiscence01 on cryptocurrency trading, I will go ahead with answering the questions below... Happy reading!

Explain the following stating its advantages and disadvantages:

-Spot trading

-Margin trading

-Futures trading

I will start with the definition of what spot trading is and how it works before stating its advantages and disadvantages, this would help in understanding the concepts of spot trading in full.

The Spot trading is a basic trading site or option for most if not all beginners in cryptocurrency. This trading type deals with the immediate buying or selling of foreign currency or cryptocurrency.

The spot trading gives an avenue for traders to hold their asset even if the asset is in loss without losing the asset but the price value, and can be held till whenever the value of the asset comes up again to profit. In spot trading is assets are bought and sold directly.

The Spot trading option helps and serves swing traders and long time asset holders in the fact that the more the increase in value of an asset, the more profit the holder/trader makes. Cryptocurrency traders transact and exchange their assets on spot trading at price known as the spot price.

This also applies to when the price value of the asset depreciates, there is no liquidity call by the exchange for spot traders, rather the asset would still be in hold despite loosing price value, but as the crypto market saying goes “In every bearish trend/season, there must come bullish trend/season as well”, so this is of great advantage to long term holders and swing traders.

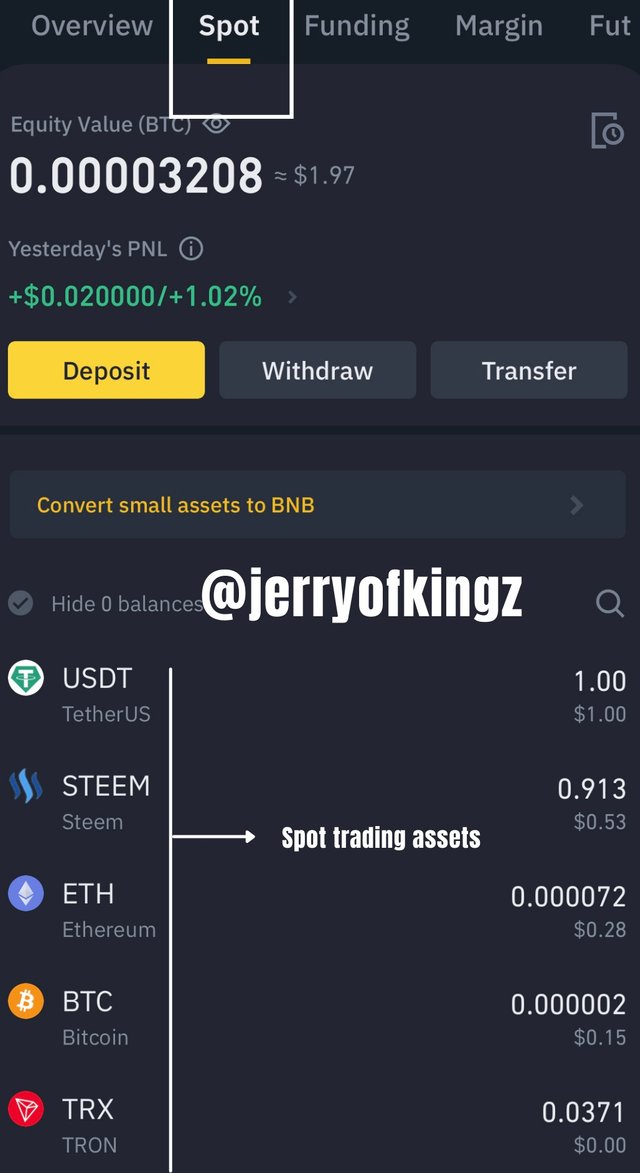

Screenshot gotten from my Binance app

The spot trading gives a full ownership and authentication to traders over their asset, that even in loss, the asset belongs to them to hold for as long as the want until the see due or fit to sell. And it’s till the asset is been sold of that the right to ownership of that particular asset is terminated.

Fully understanding the nature of Spot trading and it’s functionality, I would be advancing into the advantages and disadvantages of spot trading

1 -RIGHT OVER ASSET

Traders have the right and full ownership to the asset bought and also can hold and exchange their asset to a different asset of interest at will.

2 -SPEED

The speed and rate of delivery in trade and exchange in spot trading is very fast and it appears and delivers with its actual price after the completion of trade.

3 -MINIMUM CAPITAL

There are no minimum investment capital which might serve as a barrier to small scale investors. Any amount of capital in the spot trading option is allowed to give small scale investors a chance of making profit from the cryptocurrency trade market.

4 -LIQUIDATION FREE

In spot trading there is no form of liquidation call from exchange sites or brokers. No matter how price value of an asset depreciates, there is no liquidation call for investors in the spot trade, and this gives room to investors to make profit from the asset when it appreciates back.

1 - VOLATILITY

Trading assets which has high volatility rate could be a big risk to newbie investors in spot trading due to there inexperience in trading which could lead them into buying an asset at inflated prices

2 -LACK OF STRATEGY

In spot trading, there is no or less strategy compared to futures and margin trading. Here, counterparts has no settlement to delivery at future date.

3 -LESS BENEFITS

As we all know the cryptocurrency market to be of two ways, either it goes to a bullish trend direction or bearish trend. And for spot traders, there is no benefit or profit in the bearish trend of an asset, rather a decrease in price value of asset purchased.

This would lead the investor into selling the asset at a loss price at bearish season of period, or hold the asset until it’s price appreciated.

The margin trading option being almost the same with the future trading has a slight different which is the ability of a trader to acquire a high purchasing power to borrow funds from a third-party counterpart.

This counterparts could be a fellow trader or the exchange site/app itself , and this gives room for traders and investors to trade on there assets with greater capital more than the initial asset capital owned giving traders advantage over the market.

Just like the future trading option, the margin trade gives leverages to traders in other to double there staking power increasing there chances of making more profits. This is also directly proportional to when in losses, Traders tend to loose in proportional amount to the leverage given.

For instance a trader entering a trade in the margin trade With $20, using a leverage of 100X gives the trader (20 * 100) which is equal to $2000, and this increases the gain/profit rate of the investor in the market. This also leaves the trader vulnerable to loss if trade goes otherwise to the initial plan.

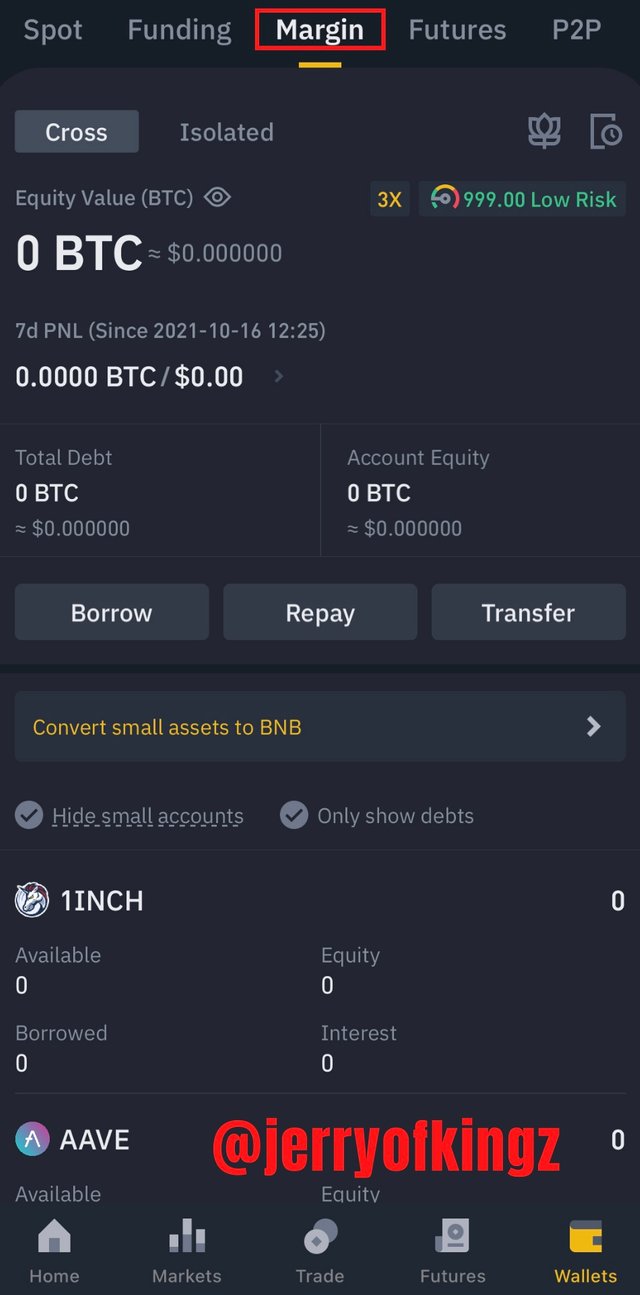

Screenshot gotten from my Binance app

Just like other trading, the margin trade involves a dual pair of currency for example TRX/USDT. The margin trade has a unique ability of investing multiple assets for leverage as collateral, for instance a trader can set their BTC, USDT, and other valuable assets as collateral.

1 -FLEXIBILITY IN TRADE

The margin trading is of big advantage to traders whereby traders have the ability to invest more while with limited cash. This gives room to traders over timely market opportunities.

2-DIVERSIFICATION

By the use of margin buying power traders can diversify there portfolios into different forms by holding a potent stock/currency direction.

The margin buying power is the cumulative amount held by a trader in a brokerage account with the normal maximum margin that would be given to the trader. This margin buying power of an investor at first-time is usually double of the equity given.

3 - TRADING CAPITAL

An investor who has little trading capital has much advantage to trading as much as gaining using margin trading. Traders can make much more profit in as much as how little their capital could be.

A risky but huge advantage in this system of trading in margin trade if the trade goes the right as planned by the trader due to leverage.

1 -RISK LEVEL

The level of risk in margin trade is high for borrowers in the exchange. The act of borrowing money in other to trade a high volatile currency is a very risky thing to do, no matter how interesting it looks there is always a high tendency of the market going against the trend places by the investor.

This would lead to the trader being in debt in as much as losing the initial capital used in entering the trade.

2-INTEREST

In every borrowing made in the margin trade, there is an interest fee to pay, and with the risk in trading cryptocurrencies the trader would be at higher risk if trading should go wrong.

3 -MAINTENANCE

Brokers who offer margins in margin trading have their controlled rules and regulations depending on the deal with the investor/trader. Here, maintenance charges affect the investors in a way due to the inability of not getting complete trading profits.

A margin broker may tend to charge for maintenance to a trader up to 25%, when what the trader might have used in opening the account is with a 50% margin-right.

The future trading is an advanced trading option form whereby traders Take advantage of fluctuation in market prices. Future trading Is a risky trading due to the involvement of leverage by brokers in the crypto/stock market. In the futures trade, you can borrow money from the exchange of traders as well as brokers.

Futures trading is mostly done by more experienced traders, and it is a no no for newbies in trading. As a newbie trading with futures, there are lot of complicated agreements and settings which a trader needs to agree to or adjust in other not to lose assets.

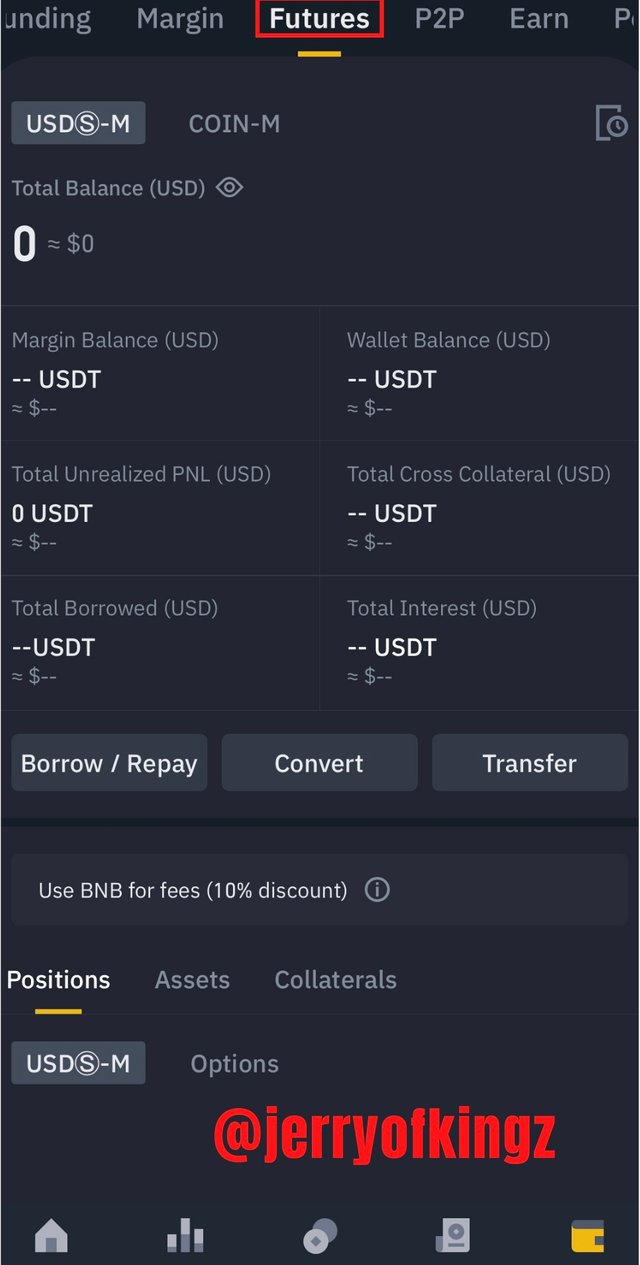

Screenshot gotten from my Binance app

Traders can either go long (buy) or short (sell) while in anticipation for price trend movement either in an uptrend or downtrend movement respectively. And this is only done in futures trading. The futures have more unique features which could also be a hard bounce-back on traders if by chance goes otherwise.

The futures have the following leverages which is given to traders, and these leverages are in an X indicator such as; 4X, 6X, 10X, 24X, 20X, 100X.

These Leverages given in the futures trade aids traders in multiplying their percentage gain and as well their loss rate. So it's a 50:50 chance deal, which can either go in the favour of the trader or against the trader.

1 -LEVERAGE

The futures trade offers leverage to traders in other to boost the rate percentage of gaining profit. These leverages are of great advantage to traders if the market trend of an asset goes as the trader's wishes, that is to say in the direction of the trend placed by the trader.

Traders can make 100X the capital invested with due to leverage of 100X given by the futures trade.

for instance In a future trading, a trader opens a trade with $10 worth of assets and a 100X leverage given, the trader is automatically investing with (10*100) profit rate which is equivalent to $1000, and with this leverage percentage given, the amount of profit expected out of this trade is gone right would be a large sum of profit.

2 -HEDGING

Here, traders/investors had the ability to hedge in the market. Hedging in the sense that a trader can open two same but opposing trend movements trade in other to avoid much potential lose of capital/profits.

Hedging protects the traders capital/investments even when the trend is against the trader's Forecast, for instance, a trader opens a trade buy going long TRX/USD and also opens another trade going short on the same currency pair. This is what we call hedging in a cryptocurrency trade and this protects the investor's assets from liquidation.

3 -FLEXIBILITY

The nature of flexibility is an attractive attribute to traders, due to the ability of a trader to open a trade as much as willed. Due to the nature of crypto In the movement of trend either in an uptrend or downtrend, traders using the futures trade are liable to also generate income not only from buying asset but also from selling.

1-DANGER IN LEVERAGE REVERSAL

In as much as leverages give aids in maximizing traders asset, it could also be a terrible rebounce on the trader, and this is dependent to the level of leverage used. The level of maximum gain by the leverage given is proportional to the level of loss in return if the trend goes against the trader's intuition.

2 -NON-USER-FRIENDLY

Futures trading is a non-user-friendly system of trade, due to its complicated nature. And this can lead to misinterpretation of agreements and data which would cost the trader roughly.

It's data the base format is for those who have full knowledge of the terms and agreements of the future trade, so since it's not user-friendly traders tend to avoid trading on futures, mostly newbies in trading & cryptocurrency.

Explain the different types of orders in trading

There are two main kinds of orders in the cryptocurrency trading exchange, traders can easily set and select any kind of order suitable to their trading. This orders are as follows;

market order

pending orders

The market order deals with instant execution of trade.Market Orders are trades which are been placed with the initial and assigned price. In the market order, assets are been bought at the actual price without been debated or altered by traders.

For instance, let's take the price of TRX/USD to be $0.09, traders who trade using market order would buy at that exact amount it is been placed for without debating or adjusting the price.

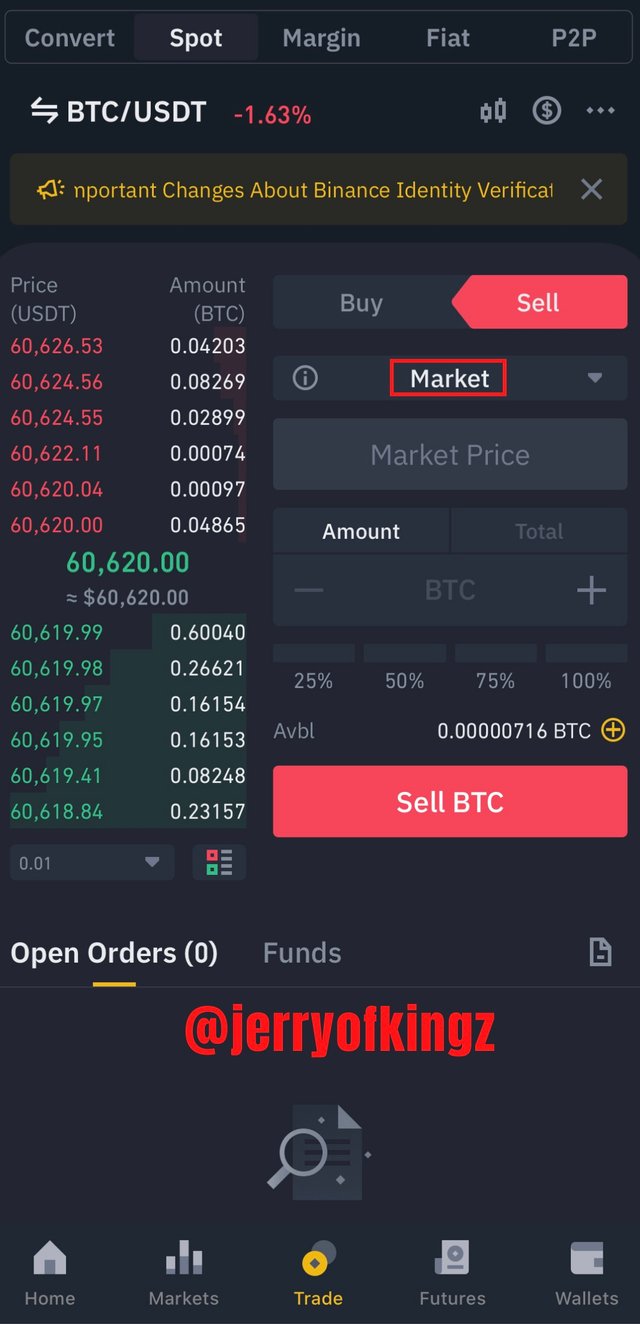

Screenshot gotten from my binance app

The market order as you can see above have no room or space for editing or bargaining of price in the place labelled market price, this is to show that prices using this order is fixed according to price of an asset per time.

They pending order is a free will type of order, where traders are not restricted to a fixed price of assets per time but rather the have the ability and right to bargain and fix any amount of price the would want to trade or exchange the asset to.

This types of trading orders Are categorised as follows;

Limit order

Stop order

OCO order

The limit order is one of the types of pending order in cryptocurrency whereby a trade intended to be placed or placed by a trader is executed when the trend of the asset gets to a certain price amount.

This trade isn't placed with the initial price stated by the market, that is to say that the price tag of an asset in the trade at that moment is not what the trader would use in entering the market, rather the trader would have a fixed price which would be convenient for the trader in carrying out the trade.

Let's take for instance, the value of price of BTC is $60,639 and an investor/trader tends to buy the asset BTC maybe against USD. The trader using the limit order would adjust the price of the asset to a suitable price, maybe at $58,700. This is how limit order works.

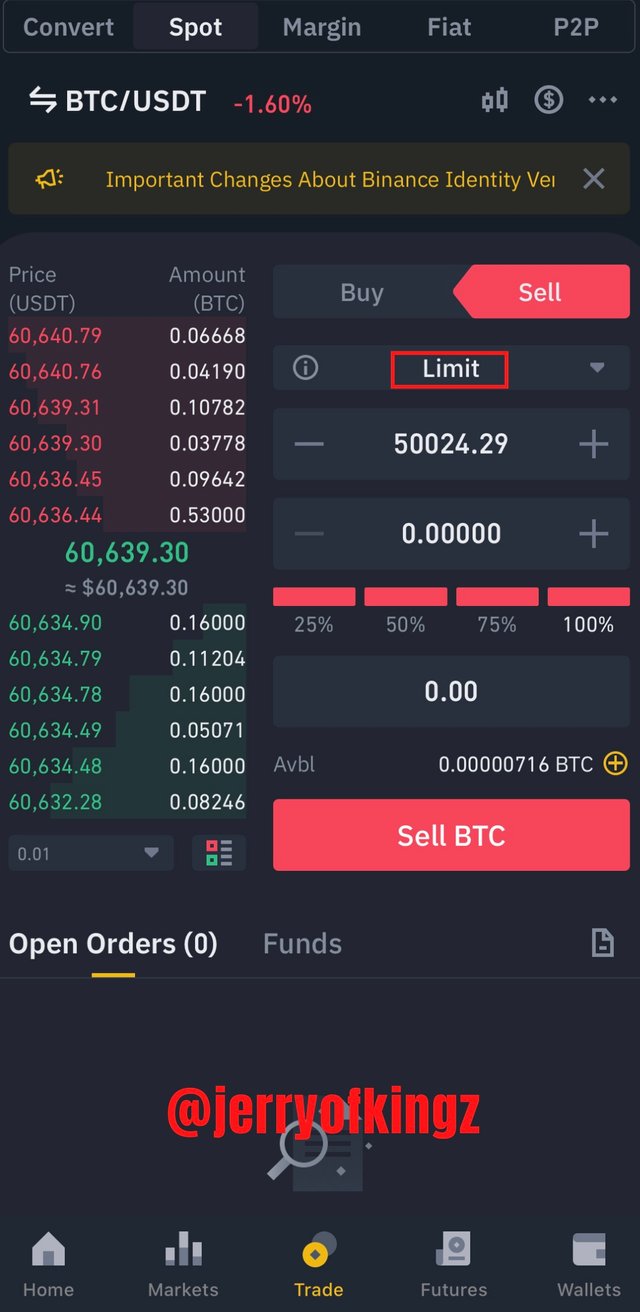

Screenshot gotten from my binance app

Looking at the image above you would notice that the price of BTC is $60,639 but a limit order is placed in other to buy when the price gets to $50,024.

The stop-limit order serves as a triggering signal that triggers either the buy or sell limit. The stop-limit orders is been placed on a trade in order to avoid loss and as well as loss due to retracement. This are two different things in the pending order, where one triggers and executes the other.

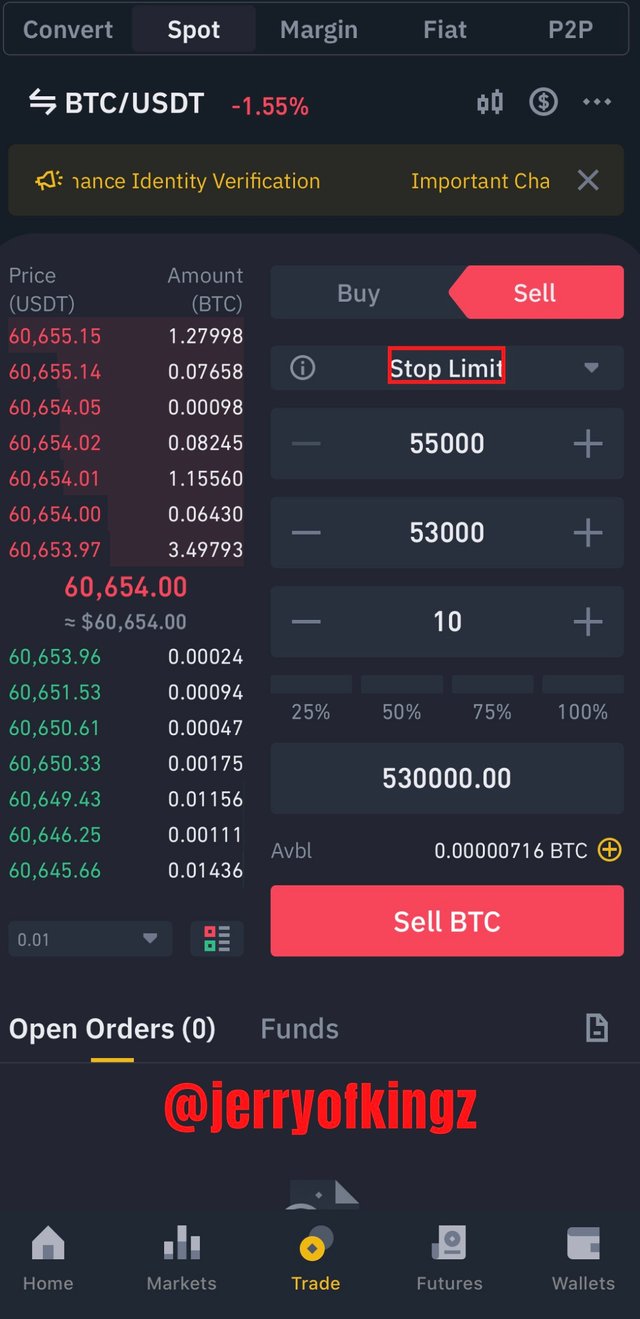

Screenshot gotten from my binance app

Following the image above, with the current price of BTC at $61,000, I placed a stop limit at $55,000 to trigger the selling of BTC at $53,000 whenever the price value of BTC drops to $55,000.

The OCO is a type of pending order which comprises two different orders and the execution of two different orders as well.

This order for instance is the type of order carried out by traders mostly at the resistance and support level of an asset. This is because of the two conditions which are likely to occur, either the asset price crosses it's resistance point or it retraces, this is vice versa to the support level of the asset.

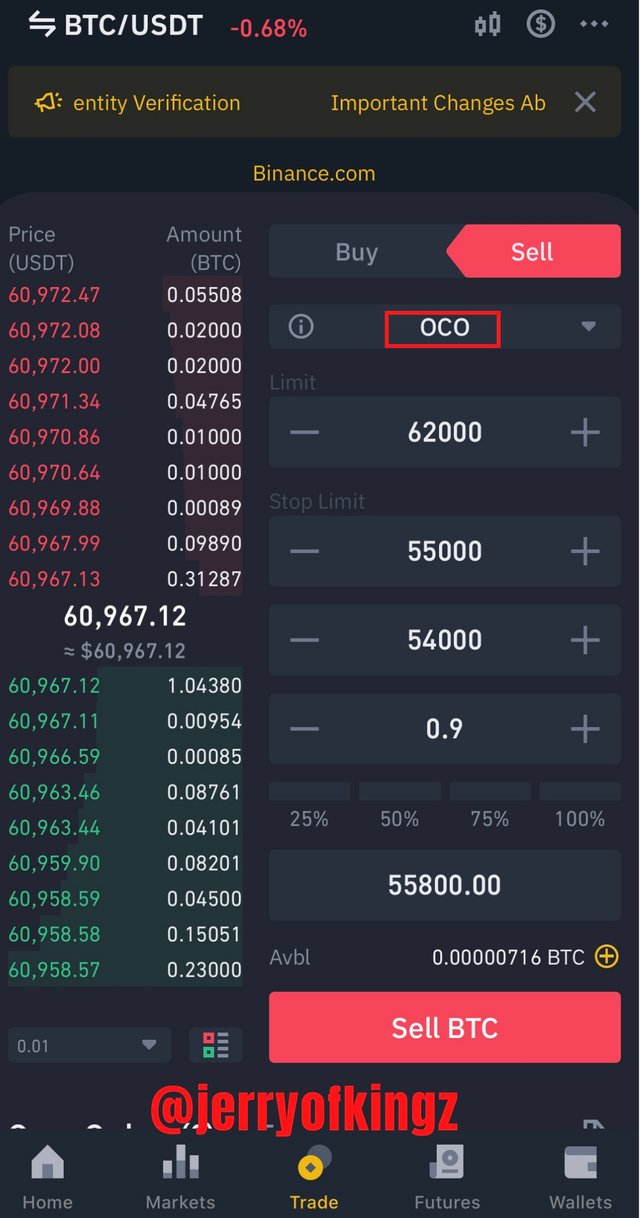

Screenshot gotten from my binance app

Following the screenshot above, you would notice that there are different figures been placed in the boxes, this is because of the ability of the order to carry out two different orders at the same time, which comprises of the stop-limit order and the limit order.

OCO means “One cancel the other”, meaning that as a trade is been placed out of the two different order placed the other order is been canceled, vice verse.

So in the screenshot above I placed a sell order at $62,000 in case BTC crosses it's resistance level but couldn't break further and also placed a sell stop-limit order at $55,000 in case of retracement of price trend to trigger the sell limit of BTC at $54,000.

This is of good advantage to traders in order to avoid lose in trading.

The exit orders as the name implies are orders made in other to exit or end a trade. The exit orders are of two types which are;

Take profit (TP)

Stop loss (SL)

The take profit is a kind of exit order whereby a trade ends at a particular price point fixed by the trader in profit. The take profit as the name implies means that the trend has come to an end in profit. Here, investors make gain and profits from the initial amount placed.

This kind of order helps traders in saving there capital from lose and also lose of profit gained.

This is been placed due to retracement of price to the opposite direction leaving the trade vulnerable

To loss.

The stop-loss order is placed directly under the asset if the trader bought the asset, this is in order to avoid retracement of asset leading to loss of capital. And also this order is placed above an asset if the asset is being sold, this is to avoid retracement of asset price that would lead to loss of capital.

The stop-loss automatically ends the trade, but in or at loss. This means that once the trade is been ending and at its stop-loss, that means that the trade didn't end well and that the trader lost some capital.

How can a trader manage risk using an OCO order? (technical example needed)

The OCO which is known as “one cancel the other” is a pending order which comprises two different orders in other to prevent traders from loss due to high volatility of asset prices.

In the OCO order, once one out of the two different orders is placed the other order is been terminated, vice versa.

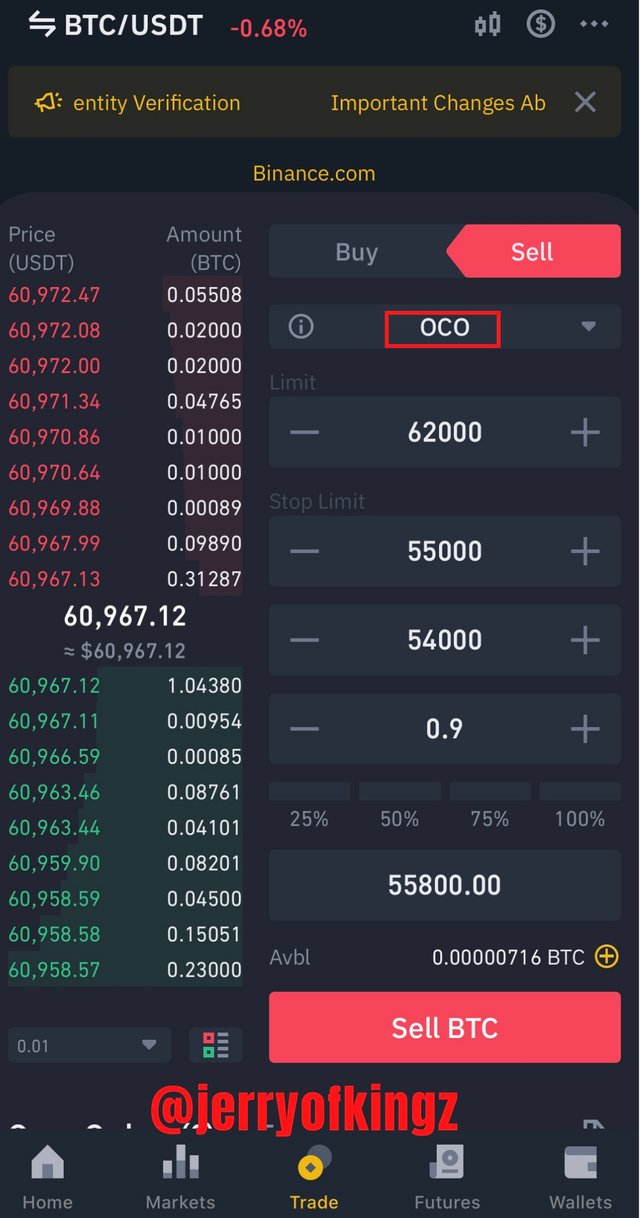

Screenshot gotten from my binance app

As I said earlier on my reasons and methods of placing a trade using the OCO order,

So in the screenshot above I placed a sell order at $62,000 in case BTC crosses it's resistance level but couldn't break further and also placed a sell stop-limit order at $55,000 in case of retracement of price trend to trigger the sell limit of BTC at $54,000.

This format now is just like a two way format, whereby if the trade doesn't go well in this format, it's better to stay not in profit than to stay at a loss, because the more the losses the more the loss of capital.

Once the order to sell BTC at $62,000 is been placed, the other order which is the stop limit which I placed at $55,00 would be terminated.

This is as a result of trading at the resistance level, which has a two-way tendency with anything g being possible in the world of cryptocurrency.

Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

I logged into my binance app

screenshot gotten from iPhone x hompage

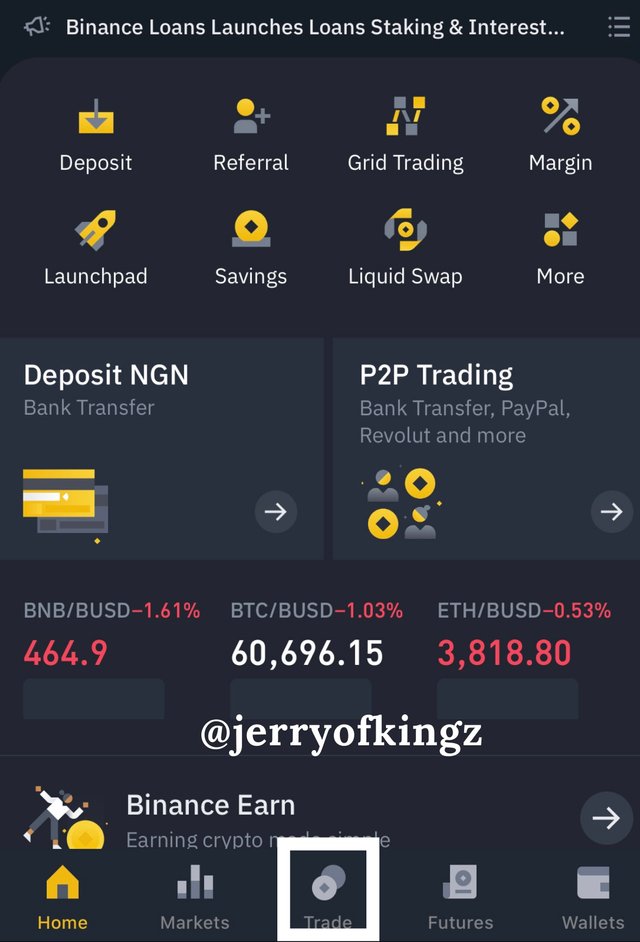

Click on trade in other to select the currency pair of your choice.

Screenshot gotten from my binance app

Select any currency pair of your choice at the in dictates place showed at the image below, here I chose to trade on BTC/USDT.

Screenshot gotten from my binance app

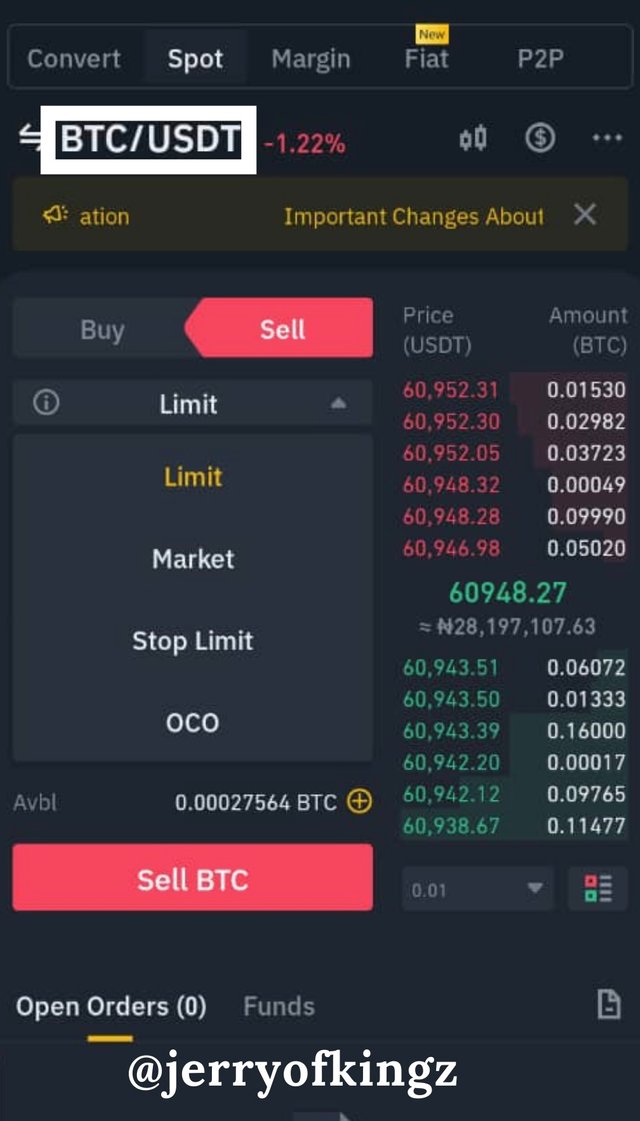

Select the order in which you desire to trade with, here I would be trading using the limit order

Entering the trade by buying $16.52 worth of BTC

Screenshot gotten from my binance app

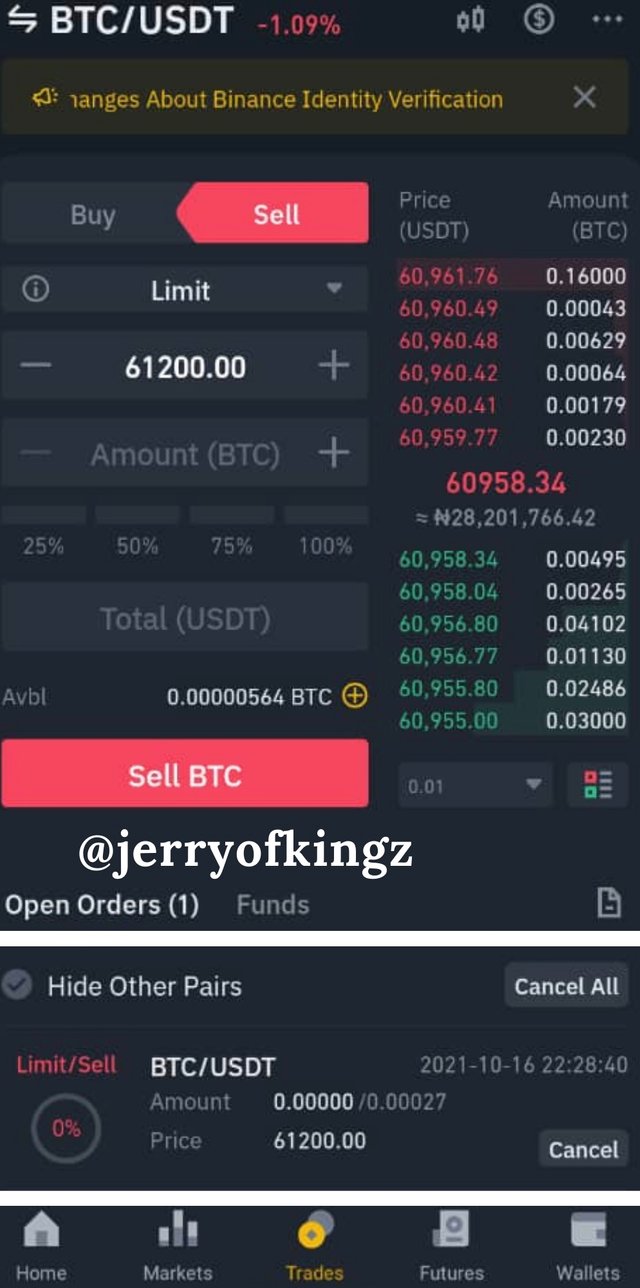

The order had been placed and stored at the order book where the trade would be executed once the asset trend fits in with the agreements made with the limit order

Screenshot gotten from my binance app

NB: That the limit order once staked can as well be canceled if the trade is yet to be executed.

Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected.

i)Why you chose the crypto asset

ii)Why you chose the indicator and how it suits your trading style.

iii)Indicate the exit orders. (Screenshots required).

In carrying out my trade, I used my Tradingview app in trading CARDONA/USDT with the following indicator;

- Bollinger band

- stochastic (RSI)

BUY ORDER

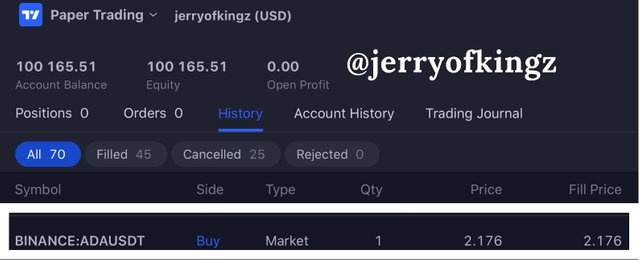

I bought ADA at $2.176 and placed my stop-loss at $2.170, and my take-profit to be at $2.185

Screenshot gotten from my Tradingview app

Screenshot gotten from my Tradingview app

The above images are for the “buy order” and the profit made was $0.002

SELL ORDER

I traded on ALGORAND/USDT in my trading view demo app, which I entered the market at $1.8093, placing my stop-loss and profit at

$1.8115 and $1.800 respectively.

Screenshot gotten from my Tradingview app

Screenshot gotten from my Tradingview app

Made a profit of $0.005 after the end of my trade.

They reason why I choose ADA/USDT is because of the trend signal by CARDONA, which showed that prices of the asset is at the oversold region, and this was indicated and depicted by the two signals I used which are the Bollinger band and the Stoch. So the prove being at the oversold region signaled the “purchasing period”.

Looking interesting to study more on the chart also with the use of price action, I found trading ADA/USDT interesting and profiting.

This was also the same reason for the “selling signal” depicted by the Bollinger band and stock that asset price is at the oversold region.

So I found it interesting to trade on ALGORAND/USDT because of its trend qualities which I studied also with price action analysis.

I choose this two set of momentum indicators together with price action analysis due to the fact that the stoch being a leading indicator, shows and predict price trend movements with the Bollinger band also, which shows the overbought and oversold region together with the stoch indicator.

Choosing these two indicators and backing it up with price actions is very easy and understandable to read by me, whereby I have the time to guess the next price trend following my leading indicators trend.

Following my previous question where I traded CARDON/USDT for my buy order and ALGORAND/USDT for my sell order, I would be showing the exit points I made in the image below;

Screenshot gotten from my Tradingview app

Following the buy order image above between CARDONA/USDT, I placed my stop-loss at $2.170 and my take profit at $2.185. This are my two exit points in the buy order.

Screenshot gotten from my Tradingview app

Following the sell order image above between ALGORAND/USDT, I place my stop-loss at $1.8115 and my take profit at $1.800. This are my two exit points in the sell order.

Trading cryptocurrencies are complicated and nonuser friendly to starters, and this is as a result of complicated data analysis and fluctuations of assets which is caused by asset volatility affected by the fear and greed nature of traders and investors.

Trading with technical indicators as a back up is a good tactics to efficient trading in crypto currencies, thereby having a higher chance of making profits to loss.

The different orders initiated by traders in carrying out trade is dependent on their trading styles which is best suitable for them, and it is of good skills to learn and understand your trading style together with technical indicators which serves as backup for you while trading. So a trader is meant to understand and be able to read the functions of any technical indicator of choice.

Thanks to professor @reminiscence01 for this intriguing and inciting course.

Hello @jerryofkingz, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observation

I particularly liked your take in question 1 as it was well detailed, good job.

In question 3 you placed a sell limit order and kept mentioning buy. Proof reading of your post will prevent this.

Recommendation / Feedback:

Thank you for participating in this homework task.

You are a blessing professor, thanks a lot 🙏