Steem Blockchain: STU, Reputation, Author/Curator Ratio, etc.- Steemit Crypto Academy- S4W7- Homework Post for @sapwood

Q.1. What is STU? What is the break-up of STU? Take a real example to indicate the STU and calculate the different rewards that Author and Curators generated from your last Post Payout? (Screenshot required)

The term STU did not initially exist in the protocol's glossary but it was invented by some developers who wanted to refer to a post's payouts with one word or term.

STU stands for Steem Token Unit and it represents the tokens that are received from a post's payout on the steem blockchain. The post payout includes SBD, Steem, and SP. Depending on SBD print rate and/or Debt ratio, Steem may or may not be paid out. These three are referred to as Steem Token Unit.

Example of STU

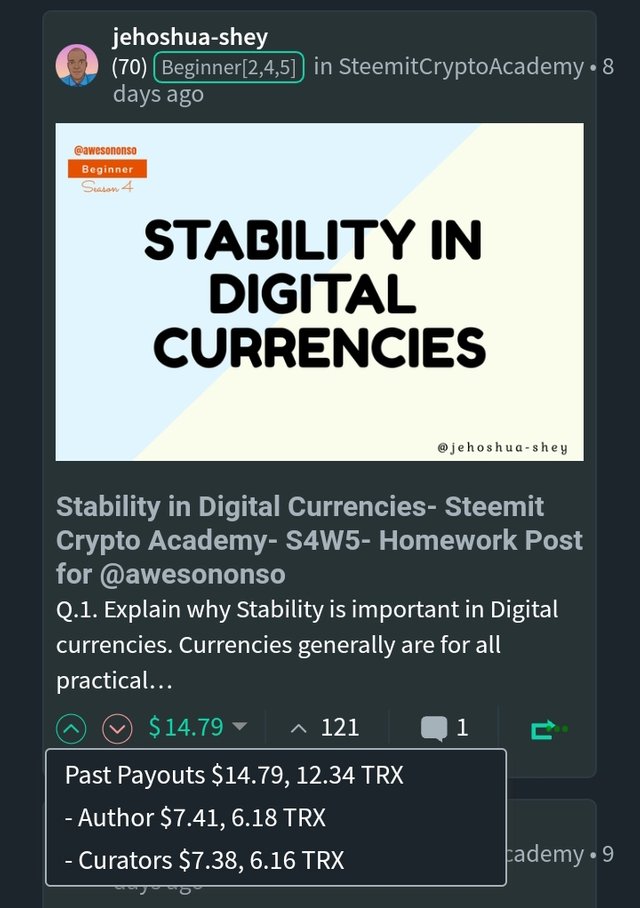

From my last payout, there's a breakdown of rewards among the author (me) and the curators (those who upvotes my post) in this manner

Author: $7.41

Curators: $7.38

Total payout: $14.79

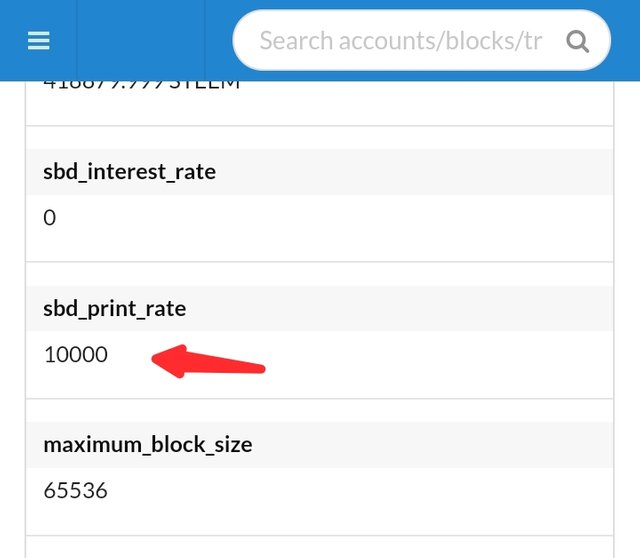

For this post, I chose 50%SBD/50%SP settings and since SBD print rate is 100% from the data obtained from the global parameters section on steemdb.io, we know that payout will only be SBD+SP.

The STU in this case is SBD and SP. That said, let's calculate the payout for author and curators.

Author payout:$7.41

Note that on the Steem blockchain, 1 SBD = 1 USD but outside the blockchain, the price of SBD could vary significantly either higher or lower than 1 USD.

The author will receive 50% of this payout as SBD.

i.e Author SBD reward = 7.41/2 = 3.705 SBD

The other 50% of the author's payout is the USD equivalent of the SP paid out.

i.e Author SP reward = 3.705 USD worth of SP.

To know the SP paid out from the USD value, we need to know the feed price.

The price feed at the time of payout was 0.6017.

We can get the feed price from Steemscan

The SP earned by the Author from the post was

3.705/0.6017 = 6.158 SP.

Let's check the Author rewards from Steemworld.org

Curators payout: $7.38

The curators payout is 100% SP so to get the amount of SP paid out, we divide by the price feed.

Curators SP reward = 7.38/0.6017 = 12.265 SP.

Q.2. Indicate the Raw reputation score of your Steem Account and calculate your Reputation? Cross-check it with the Reputation score displayed in Steemworld.org?

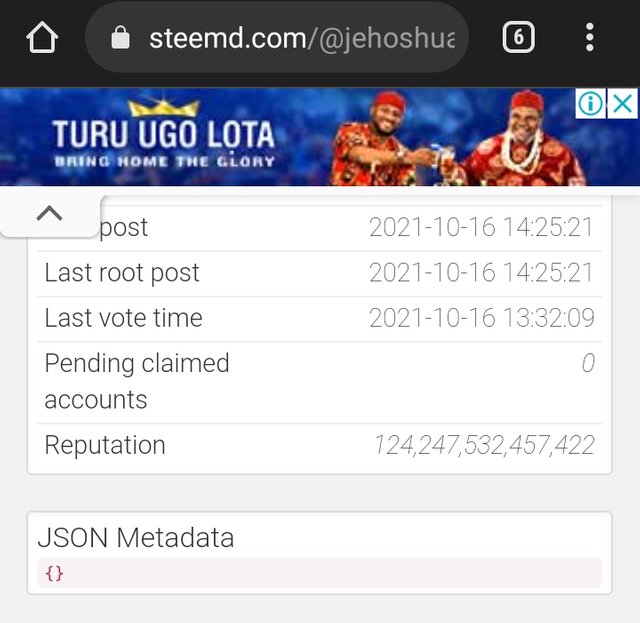

According to steemd.com, my raw reputation score is 124,247,532,457,422

From the reputation calculation formula

Reputation = Log10(Raw Reputation Score)-9)*9)+25

My reputation score will be

Reputation = ((Log10(124,247,532,457,422) - 9) x 9) + 25

= ((14.0942877724 - 9) x 9) + 25

= (5.0942877724 x 9) + 25

= 45.848589952 + 25

= 70.848589952.

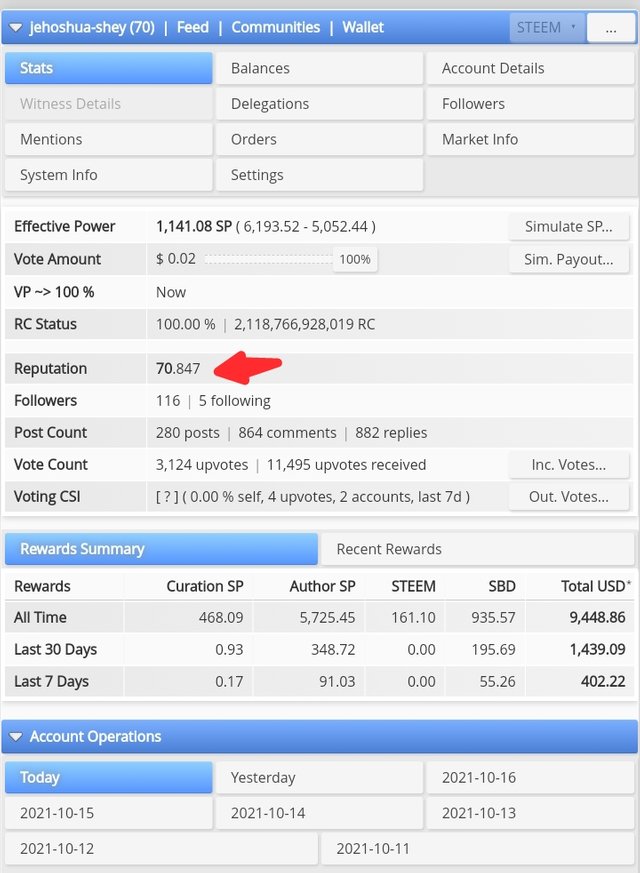

Approximated to 3 decimal places, my reputation score is 70.849

My reputation score on steemworld.org reads 70.847

Q.3. What percentage(of the Post Payout) was generated as liquid rewards(SBD) from your last Post in terms of USD equivalent? Explain how the rise of SBD has shifted the supply dynamics? As per your last post payout calculate the ratio of Author:Curator Reward in terms of USD equivalent?

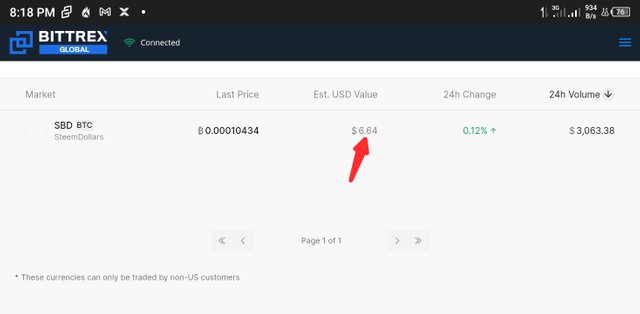

Since I didn't take note of the prices at the exact time of payout, I'll use the price at the time of writing, where 1 SBD sells for roughly $6.64

From the previous example involving payout calculations of my last post,

The total payout was $14.79.

The author got $7.41 which was to be shared in half between SBD and USD worth of SP (i.e 3.705 SBD and $3.705 worth of SP).

While the curators got $7.38 worth of SP.

USD Worth of SBD = 3.705 x 6.64 = $24.601

USD Worth of SP = 7.38 + 3.705 = $11.085

Total rewards in USD = $24.601 + $11.085 = $35.686

SBD% = (24.601 / 35.686) x 100 = 68.94%

Since SBD was the only liquid rewards, percentage of liquid rewards from my last post was 68.94%

The staked rewards (SP) constitute the rest of the percentage.

SP% = (11.085 / 35.686) x 100 = 31.06%

This percentages occasioned by the rise of SBD indicate an anomaly in the supply dynamics on the steem blockchain. This is discussed next.

HOW THE RISE OF SBD HAS SHIFTED SUPPLY DYNAMICS

On the Steem blockchain, PoB makes up 65% of the reward pool. 50% of this PoB reward goes to content creators or authors and the rest 50% goes to curators.

Whenever a post payout is set to 50%SBD/50%SP, 50% of the payout is allocated to the author, and 50% of the author rewards will payout in liquid rewards (SBD) while the rest 50% in staked rewards (SP). The curators rewards which forms the rest 50% of the post payout is totally staked rewards (SP).

This implies that liquid rewards forms 50% of author rewards which forms 50% of payout. Therefore, liquid rewards forms 25% of the entire post's payout. This is the blockchain's supply dynamics.

Considering the payout of my last post

| Units | Post | Author | Curator | Total |

|---|---|---|---|---|

| STU ($) | 14.79 | 7.41 | 7.38 | |

| SBD | 3.705 | |||

| SP | 6.158 | 12.265 | ||

| SBD ($) | 24.601 | |||

| SP($) | 3.705 | 7.38 | ||

| Total ($) | 28.306 | 7.38 | 35.686 |

On the Steem blockchain, PoB shares rewards among authors and curators in a 50/50 format and this holds true if 1 SBD = 1 USD. However, since SBD is trading above $6, we see that the sharing format of the rewards between the authors and curators have been distorted.

For a post payout equivalent to 35.686 USD, the authors now have 28.306 USD or 79.32% while the curators now have 7.38 USD or 20.68%. Thus the reward is shared in a 79.32%/20.68% format rather than the original 50/50.

So if SBD in external markets trades above the blockchain pegged price of 1 USD, the author who sets payout to 50%/50% earns more rewards than the curators. Conversely, if SBD trades below 1 USD, the author will need to set their payout to '100% powered up' to earn more than the curators.

From our latest example, we see the result of SBD selling above the pegged price of 1 USD. The rewards are no longer shared 50/50 between author and curators but they're shared 79/21 with the author getting the lion share.

Aside from the author getting the lion share, the blockchain protocol stipulated 50% of PoB going to authors and 50% going to curators. Of the 50% allotted to authors, 50% is liquid rewards (SBD and Steem) while the rest 50% is staked rewards. This means liquid rewards forms 25% of PoB reward should all authors set their payouts to 50%SBD/50%SP.

With the price of SBD above 1 USD, we see that of the total payout of 35.686 USD, 24.601 USD is paid in SBD (liquid rewards). This forms about 68.94% and is due to the fact that the price of the 3.705 SBD that paid out was far above 3.705 USD that should have been its equivalent per the blockchain's price.

This significantly huge liquid payout alters the original supply dynamics of the blockchain which allotted 25% PoB rewards to be paid as liquid rewards. Rather than this, 69% of the PoB rewards is being paid as liquid rewards.

Thus, the supply dynamics is shifted from 25% to 69%. This brings about excessive supply of liquid rewards, which is an anomaly going by the blockchain's original protocol.

AUTHOR:CURATOR FROM LAST PAYOUT

From the previous calculations from my last payout, USD equivalent of the total payout is 35.686 USD. Of this figure, the author gets 28.306 while the curators get 7.38.

By percentage, the author has

(28.306/35.686) x 100 = 79.32%

While the curators have

(7.38/35.686) x 100 = 20.68%

By ratio authors/curators rewards becomes

28.306/7.38 or 3.836/1 or 79/21

i.e 28.306 : 7.38 or 3.836 : 1 or 79 : 21

Q.4. Explain how & why an initiative like #club5050 can shift the demand/supply dynamics in favor of STEEM?

The rise of SBD has shifted the supply dynamics of the STEEM blockchain as it has led to a very significant increase in the supply of liquid rewards from 25% to about 69% from my last post. This means there's an unusual supply of liquid rewards to the author through post payout.

Let's look at the numbers again with these 3 tables below

| USD equivalent of Total post payout | $35.686 |

|---|---|

| USD equivalent of SBD | $24.601 |

| USD equivalent of Total SP | $11.085 |

Since feed price as at payout was $0.6017,

| Total STEEM equivalent of payout | 59.309 STEEM |

|---|---|

| STEEM equivalent of SBD | 40.886 STEEM |

| STEEM equivalent of Total SP | 18.423 STEEM |

The percentage composition of rewards is as follows

| STEEM% in Liquid Rewards | 68.94% |

|---|---|

| STEEM% in Staked Rewards | 31.06% |

From the data above, we see that 40.886 STEEM of the total 59.309 steem (68.94%) was paid out as liquid rewards. This results in an unusual supply of STEEM and shifts the demand/supply dynamics of STEEM.

Recall that from the blockchain's protocol only 26% of payout should be in form of liquid rewards. For this post under study, 25% would be

(25/100) x 59.309 STEEM = 14.827 STEEM.

Thus, the usual supply of STEEM from a payout of 59.309 STEEM should have been 14.827 STEEM rather than the enormous 40.886 STEEM.

This is the current state of distorted demand/supply dynamics of STEEM.

WHAT IS THE #CLUB5050 INITIATIVE

The Steemit team has proven over time to be a team to watch whenever one is short of innovative ideas. You could find a long list of exceptional concepts that performed exactly as scripted in their history, one of the best being this crypto academy.

Just to deviate a little, I noticed CMC and CZ have begun running learn and earn schemes on their platforms - CoinmarketCap and Binance respectively. It's a pity @steemitblog didn't patent it, they should have been referenced there.

So back at the office, someone from our dear innovative Steemit team felt disturbed about this unprecedented supply of liquid rewards and wished for the good old days when almost every post had the STEEM logo beside it. They thought of getting people build up their Steemit influence aka SP and because powering up post would be a loss of rewards to authors, they decided to form a club.

The Club5050 is a commitment to power up 50% of liquid author rewards payout. You can get the memo from this post from the Steemit team.

It's not a one of thing, it's a commitment to constantly power up at least half of the liquid rewards accruing to the author. So, for every amount of STEEM or SBD transfered out of a wallet, an equal or greater amount should be powered up.

This Initiative is exactly the panacea STEEM needs to address its distorted demand/supply dynamics.

Let's see how.

HOW #CLUB5050 READJUSTS THE DEMAND/SUPPLY DYNAMICS IN FAVOUR OF STEEM

Basically, #club5050 says "thou shalt power up 50% of your liquid rewards, for in doing that, thous shalt obtained membership of the prestigious Steemit club"

Fine. Let's return to the numbers behind the distorted demand/supply dynamics of STEEM.

Recall this table

| Total STEEM equivalent of payout | 59.309 STEEM |

|---|---|

| STEEM equivalent of SBD | 40.886 STEEM |

| STEEM equivalent of Total SP | 18.423 STEEM |

Now, with #club5050, 50% of liquid rewards is powered up. This means the STEEM equivalent of SBD (liquid rewards) reduces and that of Total SP increases.

Precisely, 50% of 40.886 STEEM = 20.443 STEEM.

This amount goes out of liquid and enters staked rewards. Our table then modifies to this:

| Total STEEM equivalent of payout | 59.309 STEEM |

|---|---|

| STEEM equivalent of SBD | 20.336 STEEM |

| STEEM equivalent of Total SP | 38.759 STEEM |

Let's look at the percentage composition table and see how it modified

| STEEM% in Liquid Rewards | 34.29% |

|---|---|

| STEEM% in Staked Rewards | 65.71% |

Bravo! Supply has adjusted remarkably. Liquid rewards have reduced from 68.94% to 34.29% and Staked rewards have increased from 31.06% to 65.71%.

If this is not a panacea for STEEM's distorted demand/supply dynamics, I don't what is.

So then, it is clearly shown how a commitment to power up 50% of liquid rewards READJUSTS the demand/supply dynamics in favour of STEEM.

PRO TIP: If you're committed to this 50% power up of liquid rewards, you're entitled to use the hashtag #club5050 in your post to get more votes from @steemcurator01 and @steemcurator02.

To state it clearly, #club5050 readjusts the demand/supply dynamics in favour of STEEM by reducing the Liquid rewards and increasing the Staked rewards.

BENEFITS OF THE #CLUB5050 INITIATIVE

Some of the major benefits of #club5050 include:

Readjusted Dynamics: The initiative helps to readjust the demand/supply dynamics in favour of STEEM by reducing the amount of liquid rewards and increasing the amount of staked rewards in a payout for which it is applied.

Increased Influence on Steemit: One reason I like this initiative is because it increases the influence of whoever participates on Steemit, just like '100% powered up posts' helped me get +6k SP over the last one year. This initiative sees the user add to their SP 50% of their liquid rewards and this is currently the fastest way to do this.

Extra Votes: Not that you're doing the Steemit team a favor, because the powered up liquid rewards is still yours to keep, but this angel 👼 investors will still encourage you with extra votes when they come around.

Q.5. Consider a user having a reputation lower than you, upvotes your Post-- Does it affect the Payout and increase the Rep? If the same user goes for a downvote, does that affect your Payout and Reputation both? Explain Why & How; with Examples?

Upvotes is an act of distributing rewards from the PoB reward pool to a post ideally based on quality of content. The upvotes amount depends on the size of the Upvoter's SP and the Vote Weight. It is independent of the Upvoter's reputation.

A user with a lower reputation will affect my post's payout with their upvotes depending on the vote weight and their SP.

Here's a good example:

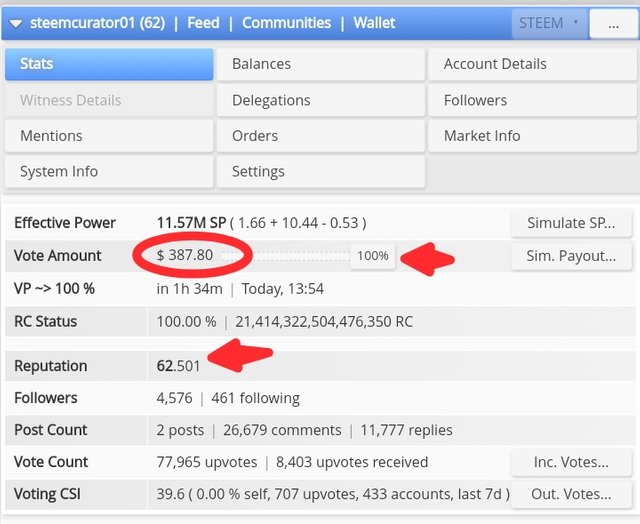

I have a reputation of 70.847 but @steemcurator01 has a reputation of 62.501.

From the image above, a screenshot from Steemworld, we see that 100% upvotes from @steemcurator01 will attract a payout of $387.

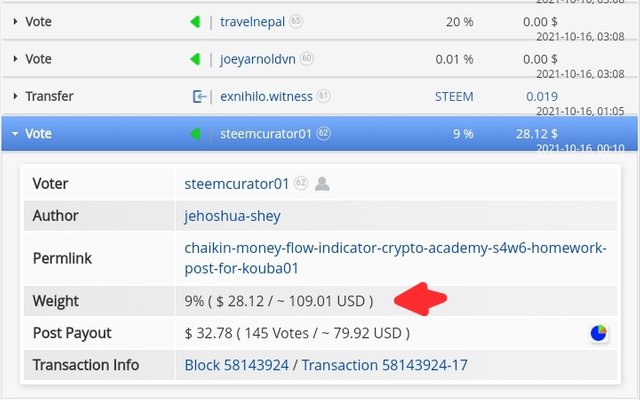

Also, the last time I was voted by this account, here is what happened to my post payout:

A vote weight of 9% earned me $28.12 irrespective of the fact that I have a greater reputation than the account.

Upvote values are typically a function of the vote weight and the SP of the Upvoter's account.

Reputation increases as well. My reputation increases whenever I received upvotes from accounts with huge amounts of SP and significant vote weight.

DOWNVOTES

I literally can't remember/find the last time I was downvoted so I don't have a personal example to show currently.

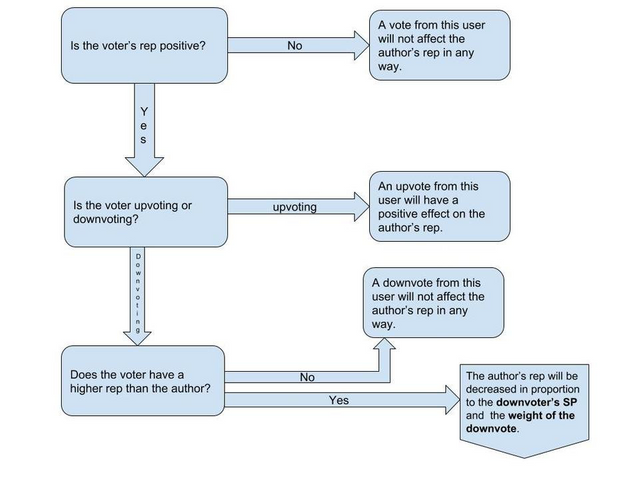

However, when a user gets downvoted by a user with lesser reputation, the only thing that happens is that the rewards are redistributed according to the downvote weight and SP while the reputation remains unscathed.

It only takes a user with a higher reputation to reduce the reputation of another user through a downvote.

A user with a negative reputation can not have an effect on another user's reputation whether they're upvoting or downvoting.

Here's a diagram that pretty much summarizes how upvotes and downvotes affect reputation.

Source

CONCLUSION

The rise in the price of SBD has created an unusual supply of liquid rewards via post payouts. Rather than the intended 25% as per the blockchain's protocol, a user gets up to 69% of the payouts in liquid rewards. This is even more than the 50% they should be getting as authors because PoB shares post payout 50/50 among authors and curators.

Initiatives like the #club5050 is one way to curb this unusual supply of liquid rewards and it also builds the influence of its practitioners on the Steemit platform. The little matter of extra upvotes has also be added as a stimulus to make the initiative more appealing.

Finally on upvotes, whether it's a user with a higher or lower reputation, the rewards distributed to the post as well as the reputation increases. But for downvotes, a user with a lower reputation will only redistribute the rewards and won't affect the reputation.

Thanks for reading.

Cc:

@sapwood