[REPOST] BTC/USDT [SELL ISM10X] - Crypto Academy / S6T2- Team Trading Contest Post for Reminane

LINK TO THE ORIGINAL POST

Over the past few days, the crypto market has seen a not-so-easy period where one moment it was falling below major support levels and the other, it bounces in the opposite direction. After the news of Russia's invasion of Ukraine in Eastern Europe, prices went South but soon as sanctions began to fly and the impact began to be felt, the market corrected.

During this period, BTC was at the heart of the turpsy-turvy. Infact, only pro knife catchers dared venture into the market and left with profits. I was once, but not so fortunate at the second attempt. This post is about a trade that went against the script 😔

AN OVERVIEW OF BITCOIN

Bitcoin is a peer-to-peer electronic digital cash payment system founded by the pseudonymous Satoshi Nakamoto. It is worth noting that the anonymity of the founder helped cement the idea of Peer-to-Peer and decentralization which is the basis of the bitcoin doctrine. Bitcoin is manned by a community of people who participate in the Bitcoin network.

Bitcoin was created and till today still remains a payment system. Thus, the use of this token is strictly leaning towards that corner. Bitcoin today is seen by many as a store of value, a hedge against inflation and a digital form of gold. In other words, this cryptocurrency has evolved into a very precious asset and is currently worth several hundred billion $$.

THE BITCOIN TEAM

The founder(s) of bitcoin are unknown but the community manny the network are not. Anyone who has the capacity and wishes to can acquire the necessary equipments and join in the network. With about 51% of the computing power, decisions could be made and implemented.

MY PRICE EXPECTATION ON BITCOIN

I'm bullish in the long run when it comes to bitcoin. In the short term however, there are uncertainties as situations around the world are keeping investors on their toes. Bank of America recently debunked predictions of a crypto winter and shortly after, prices went up.

In the long run, I'm bullish on bitcoin.

WHERE TO BUY BITCOIN

Bitcoin can be gotten from all centralized and almost all decentralized exchanges. There are several hundreds of markets for Bitcoin, meaning it can be acquired with a wide range of other crypto assets. There are also markets that sell bitcoins for fiat.

MY BTC/USDT TRADE

FUNDAMENTALS/TECHNICALS

Bitcoin price slumped upon the invasion of Ukraine by Russia. The act of war raised deep concerns in various markets including crypto. Oil, wheat and natural gas were exceptions as they rose appreciably.

After sanctions, prices began to correct and things went up for sometime. Uncertainties surrounding the Russia-Ukraine situation rippled into the markets and volatility was noticed. Also, the scare of China repeating Russia on Taiwan added more concerns.

For this trade, I used technical indicators to try to cautiously approach the market and used a tight stoploss. Bad news is my stoploss was hit but good news is losses were very minimal.

For my entry, I considered the following:

The bearish crossover of the 12 TEMA below the 26 TEMA.

The bearish crossover of the 12 EMA below the 26 EMA on the MACD.

The fact that the MACD lay above the zero line.

MY TRADING STRATEGY

From the chart, we see the bearish crossover of the 12 TEMA below the 26 TEMA indicating that price was supposed to be headed downwards. This was confirmed by the MACD. The MACD showed a bearish crossover with the 12 EMA crossing below the 26 EMA. Also, the MACD bearish crossover happened above the zero line giving the signal more strength.

MY TRADING SETUP EXPLAINED

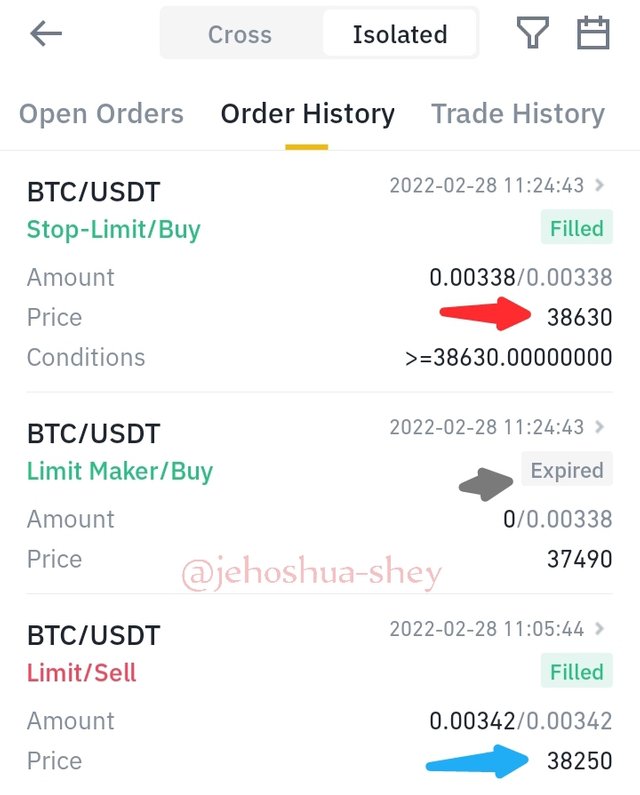

I used the TEMA bearish crossover trading strategy. I placed my entry at $38,250.00 and put my stoploss around the last resistance level on the trading timeframe at $38,630.00. My take profit was set in a 2:1 ratio with my stoploss at $37,490.00.

Screenshot taken from Tradingview

It was an isolated margin trade on Binance with 10x leverage.

Screenshot taken from Tradingview

After some hours, my trade hit my stoploss 🛑. Below is a screenshot of the how the price progressed on the chart after my entry.

Screenshot taken from Tradingview

PROOF OF TRADE

Screenshot taken from Tradingview

From the screenshot above, you can see that I sold 0.00342 BTC but was only able to buy back 0.00338 BTC. I lost about 0.00004 BTC.

From the price movement after my stoploss was hit, you can see that if I hadn't used a stoploss, I would have been liquidated and lost all my money but thanks to proper risk management, I only lost about 0.00004 BTC.

Initially I used 0.000342 BTC to enter this margin trade. 10x leverage made it 0.00342 BTC.

My loss of 0.00004 was about 11.7%. This would have been about 1.17% without leverage but then, I used 10x leverage.

MY RECOMMENDATIONS

It is advised that a trader does extensive research and strictly adheres to technical indicators while trading. Also applying the right strategies and proper risk management when making any trade entry will increase the chance of success and or least minimize loss.

It's not good for a trader to be too greedy, instead ladder your trade. I failed to do this for this trade but will do so next time.

Thanks for reading

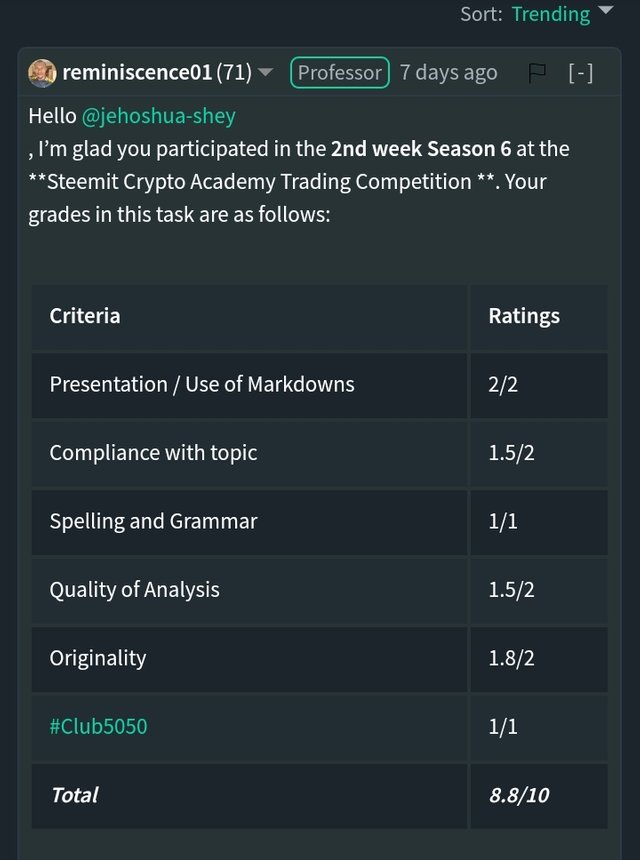

Hello @jehoshua-shey, I hope you are doing okay. Kindly consider supporting @Campusconnectng with any amount of steempower delegation.

Campus connect is a growing community of college students around the world. We are focused on promoting steemit on campus and creating a community space for students. We are seriously interested in building our community curation power to at least 100kSP, we appreciate steem power delegations and would offer 0.5Steem/1KSP daily on curation rewards.

This way you will be able to maximize your steempower delegation. I would also love to reach you on discord, that is if you find it appropriate.

We kindly request your support.

CC @whitestallion

You said 0.5 steem/1K sp daily? @whitestallion?

Yeah, that is 3.5 Steem weekly for 1k Steem power. You can delegate as many as you can.