SEC S17-W4 || Crypto Assets Diversification .

Hello Steemians, welcome to my post. I am excited to participate in this challenge which I have talked about "Crypto Assets Diversification".

What are the main reasons why crypto asset diversification is important in an investment portfolio?

.png) *canvas background

*canvas background

The main reason why crypto asset diversification is important in an investment portfolio is that it helps reduce risk and protect investors' portfolios.

There is a popular saying which states that "Don't put all your eggs in one basket". This statement means if you put all your eggs in one basket and something happens to the basket you will lose all the eggs in the basket, but if you split your eggs into other baskets and something happens to one of the baskets it will not affect the eggs that you have in other baskets.

This is the reason why crypto asset diversification is important in an investment portfolio, since having many digital assets in your portfolio would help you to avoid many losses, which means instead of focusing on one asset you will focus on many, and if one asset is decreasing another asset will cover your losses. Crypto asset diversification helps us to cover losses and amass huge profits.

Risk Mitigation:

Crypto asset diversification helps investors to reduce their exposure to the market of any special asset. If one cryptocurrency underperforms, in your portfolio another cryptocurrency will perform which will help you minimize your losses.

Lowering Volatility.

The crypto market is very volatile with sudden price changes, so an investor needs to diversify his or her portfolio to reduce the overall volatility of the crypto market.

New Opportunities for Capitalizing:

By diversifying your crypto asset you are been open to various investment opportunities for you to capitalise on.

Every crypto has its unique features and benefits for holding, and diversifying your crypto asset will help you take advantage of the opportunity offered by the crypto asset. For example, if you have BNB and your stake in the Binance launch you will be eligible to earn new cryptocurrency that Binance will launch.

Can you explain how you diversified your crypto assets in your portfolio? What strategies have you used to maximize diversification while minimizing risk?

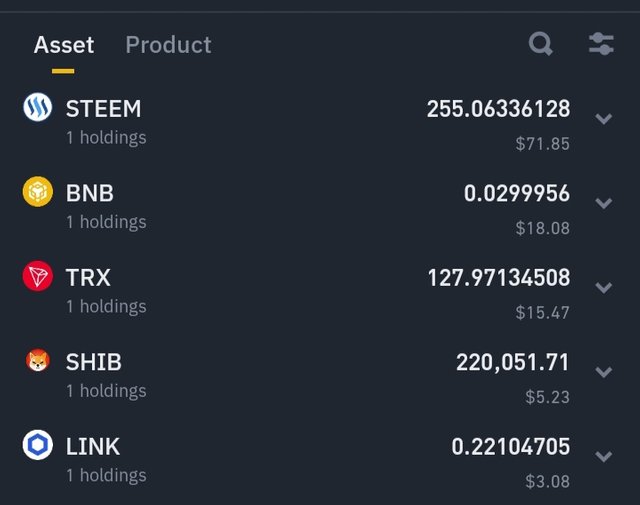

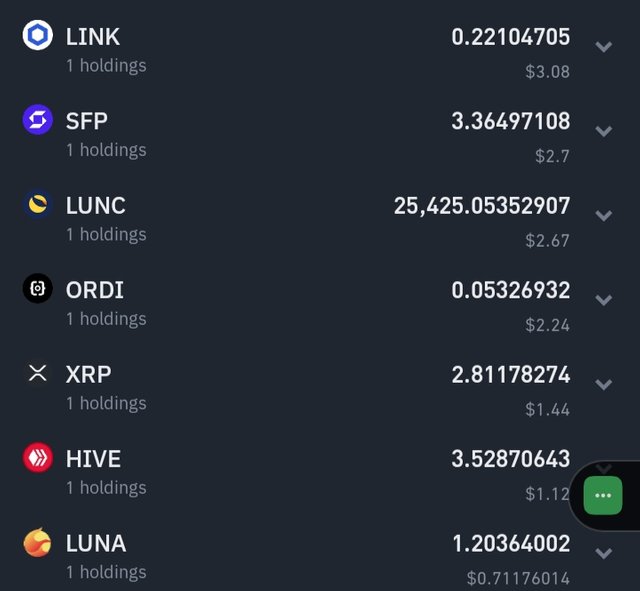

I am still growing my crypto portfolio in my Binance account as it is Binance that I am using for trading. In my Binance account, there are many assets that I hold which I have locked in Binance flexible staking in return for rewards.

|  |

|---|

From my Binance account

The strategies that I have used to maximize diversification while minimizing risk are the strategies of Dollar-cost Average (DCA), and Spot Limit Order.

Dollar-cost Average is one of the investment strategies that I have used and build my portfolio. In this strategy, I usually use 5% of my monthly income to buy cryptocurrency and USDT.

If I should buy USDT now I will use it and place an order with the crypto that I want to buy. I don't buy when the price is still high, I only buy when it is low and sell when it is high after selling I will rebuy back the asset and split the remaining USDT into other assets.

Staking is another strategy that I have used to maximize diversification while minimizing risk. I like staking all my assets via Binance which helps me to earn rewards which you can see from the screenshot image.

I have some value of BNB which I have locked in the BNB vault which has helped me to get new coins in my Binance. The interest that I received from staking my cryptocurrencies is helping me to reduce my risk.

How can diversifying crypto assets help mitigate market volatility? Can you give concrete examples of situations where diversification has had a positive impact on your portfolio?

Diversifying crypto assets can help mitigate market volatility when we invest in mixed assets. For example, if you're a lover of Altcoins, you can add Bitcoin (BTC) to your portfolio to help soften the blow should incase your smaller tokens and coins drop (fall) in value.

The crypto industry moves synchronously whereby if Bitcoin and Ethereum should fall by 5%, Altcoins will fall by more than 5% which is an advantage to adding Bitcoin which is for a store of value, and Ethereum which is for smart contracts to subside our portfolio from market volatility.

Diversifying crypto assets helps mitigate market volatility because when you diversify your portfolio with different crypto assets, you are spreading your investment across multiple classes of assets and sectors. If you diversify your portfolio across multiple asset classes, if there is any impact of market fluctuation or a single mishap your portfolio will be diluted.

By diversifying your crypto asset across multiple classes of assets you have prepared a stable and unpredictable return of investment in the future which can help you overcome negative involve during the period of bear market fluctuation.

How does the STEEM token fit into your crypto asset diversification strategy? What is its role in your portfolio and how did you select it among other assets?

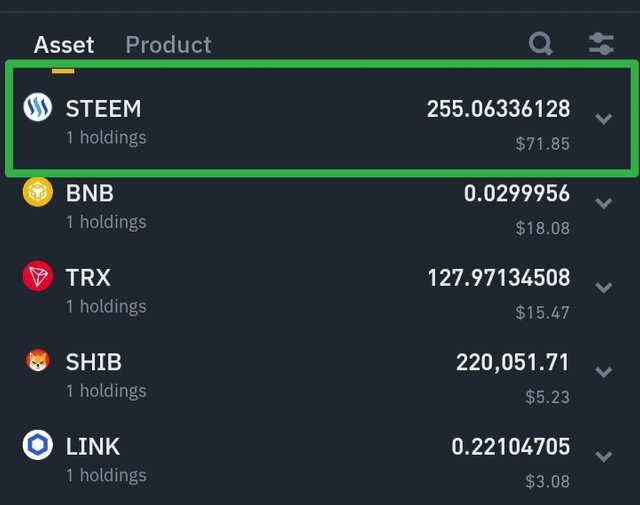

STEEM token is just like every other asset in my portfolio but it is one of the tokens that I cherish so much in my crypto asset diversification which is the reason why in my portfolio it is the token with the highest value.

From my Binance account

From my Binance account

STEEM token fits my crypto asset diversification because STEEM token has much more potential value than the other tokens in my portfolio. In my portfolio, I have staked my STEEM tokens which I am earning rewards from. I selected the STEEM token as the top token in my portfolio because it is the token with the highest value in my portfolio.

I earned the STEEM token by writing which I need to hold for a long period as the use case for the EM token is more than other tokens in my portfolio. With the use case of the STEEM token in my portfolio, the STEEM token can hit $1 and above which I want to continue holding.

Can you share a detailed analysis of your crypto assets, including their distribution, historical performance, and the criteria used to select these assets? How do these choices reflect your overall crypto asset diversification strategy?

From my Binance account

From my Binance account

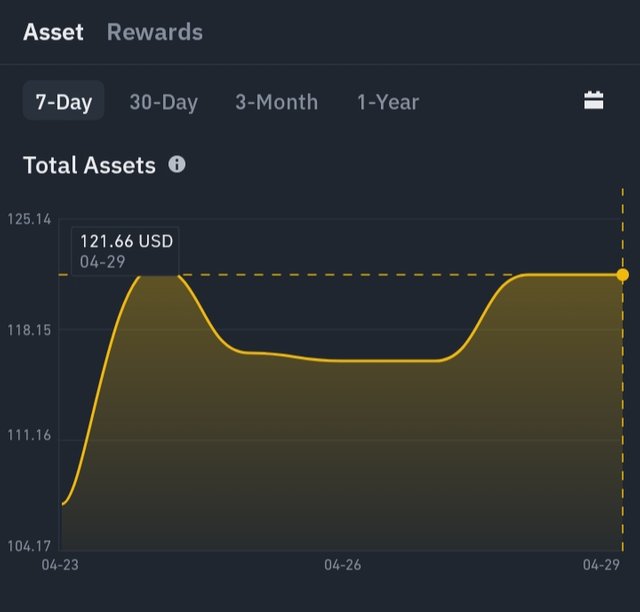

Early this year I grew my crypto portfolio from $10 with just Steem token and TRX which currently as of today I have used the strategies of Dollar Cost Average and spot limit order and grew my crypto asset portfolio to more than $122.15.

From my Binance account

From my Binance account

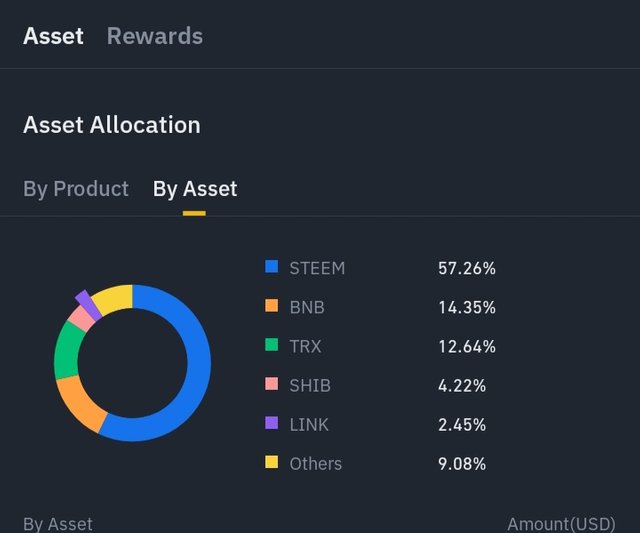

Also in my portfolio, I don't just hold but staked my asset which I am earning daily rewards of $0.003808 from my stake. In my portfolio STEEM token is the leading asset with **57.26%, followed by BNB 14%, TRX 12.64%, SHIB 4.22%, LINK 2.4%, and others 9.08% as shown in the screenshot below.

From my Binance account

From my Binance account

I am inviting: @simonnwigwe, @nancygbemi, @dave-hanny, and @woka-happiness

@jasminemary Your insights on Crypto Assets Diversification are spot-on! Diversifying our investments is like having backup plans for our backup plans especially in the unpredictable world of crypto. Your analogy of not putting all our eggs in one basket makes it easy to understand why spreading out our investments across different assets is so important.

I found your strategies for diversifying your portfolio like Dollar-cost Averaging and Staking very practical and smart. Its clear you've put a lot of thought into minimizing risks while maximizing potential gains.

Wishing you the best of luck in the contest

Thank you for responding to my post.

Congratulations! This comment has been upvoted through steemcurator04. We support quality posts, good comments anywhere, and any tags.

We support quality posts and good comments posted anywhere and with any tag.

Curated by : @artist1111

Hi @jasminemary,

my name is @ilnegro and I voted your post using steem-fanbase.com.

Come and visit Italy Community

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

This post has been upvoted by @italygame witness curation trail

If you like our work and want to support us, please consider to approve our witness

Come and visit Italy Community

You have presented a beautiful review here on the topic under consideration. Diversification means we should spread out our assets to other parts and not just concentrate on a single asset. You have shown us how you diversify your assets using the DCA method where you use 5% of your earnings to buy crypto and hold.

It is also amazing to see how you grew your portfolio from $10 to around $122. This is a very huge profit if you ask me, please I would like to learn more about this because the profit to me is so massive. You also stake your asset to mint new tokens or get returns which is a good investment strategy. I wish you success in this contest my friend.

Thank you, sir. Honestly, the achievement didn't come in just one day sir, but several days.

Hello friend greetings to you, hope you are doing well and good there.

You say diversification is important, because it protect investors' portfolios and helps reduce risk. This is true and I completely agree to you here. If you go for diversification option no matter how volatilite or dump the market is, you will be safe. Even you can get profit. Your screenshot from binance portfolio show us you are practically applying diversification mechanism to your portfolio.

You have mentioned some beautiful points how diversification can help us or facilitate us. It includes Risk Mitigation, Lowering Volatility and New Opportunities for Capitalizing. Yes these all are true, diversification facilities us in such ways. All the expert traders use this option to cope up with volatile market.

I wish you best of luck in the contest dear friend. Keep blessing.

It is very important to diversify our assets, sir. Thanks for reading.

You're absolutely right. Your thoughts on diversifying our investments in crypto assets are on point. It's like having backup plans for our backup plans, especially in the unpredictable world of cryptocurrencies. Imagine if we put all our money into just one cryptocurrency, and it suddenly crashes or doesn't perform well. We could lose everything. That's why it's important to spread out our investments across different assets, like not putting all our eggs in one basket. This way, even if one cryptocurrency doesn't do well, we still have other investments that might be doing great. It's a smart strategy to manage risk and increase our chances of success in the crypto market. Good luck in the contest friend.

Crypto portfolio diversification has help me to grow my crypto holding. Thank you sir for supporting me.