Exchange Coins - Crypto Academy S5W1 - Homework Post for @imagen

You Are Highly Welcome To My Homework Post That Was Given By Professor @imagen On The Topic: "Exchange Coins" Remain Bless As You Read Through...

1.) Perform a complete analysis of the currency of some exchange. Not allowed: BNB, KuCoin, Cake and Uniswap.

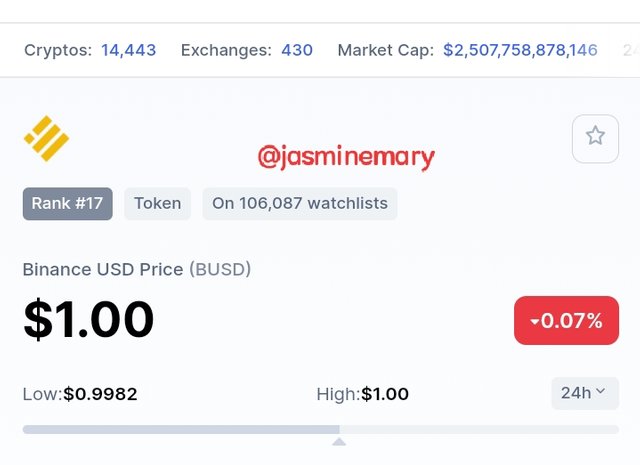

Here I will be giving analysis of BUSD. BUSD which is also regarded as Binance USD (BUSD) is a 1:1 fiat back stable coin that is pegged to the U.S dollar and issue by Binance in collaboration with Paxos, that is approved and regulated by New York State Department of Financial Service. BUSD was fully launched on September 5th 2019,the purpose of the cryptocurrency is to conflate the stability of the US dollar with blockchain technology in other to avoid devaluation.

Although the currency is built as an ERC-20 token and supports BEP-2 token.

Holders of the BUSD token can easily swap their tokens for fiat and other cryptocurrencies and their can also view a monthly audits report on Paxos. According to the information gotten from Coinmarketcap Binance USD (BUSD) is the 18th largest cryptocurrency that is trading in the world by market capitalization, valued at $12,990,851,298 USD. As at the time of writing this post, the current price of Binance USD (BUSD is $1, which is 0.205% higher than it previous price. In the last 24hrs the price of BUSD have flow between the range of $1.02 and $0.999786.

Screenshot gotten from Coinmarketcap

Screenshot gotten from Coinmarketcap

The Use Of Binance USD (BUSD)

Since there is always price stability in our local currency, Stablecoins play a very vital role on transactions, such as payments and settlement for goods and services and also in a Decentralized Finance. Although, below are some of the uses of BUSD.

I can use BUSD for payment of goods and services.

With BUSD I can earn interest rate when is been stake in an exchange.

I can use BUSD as a collateral for the loaning of other digital asset.

BUSD can be use and trade on different exchange just like other Stablecoins and Decentralized Exchange.

2.) Make a purchase equal to at least US $ 10 of the currency you explained above. You must make some movement with that currency within the exchange that created that currency. Show screenshots and explain in detail the steps to follow. Example: transfer of funds, Staking, participation in a Launchpad, trading in futures, etc. Indicate the reasons why you chose that option (operation) on that platform.

Basically there are two types of exchange that one can purchase BUSD: this are exchange are Binance and Paxos.

Here is a steps/details on how i purchased BUSD on Binance:

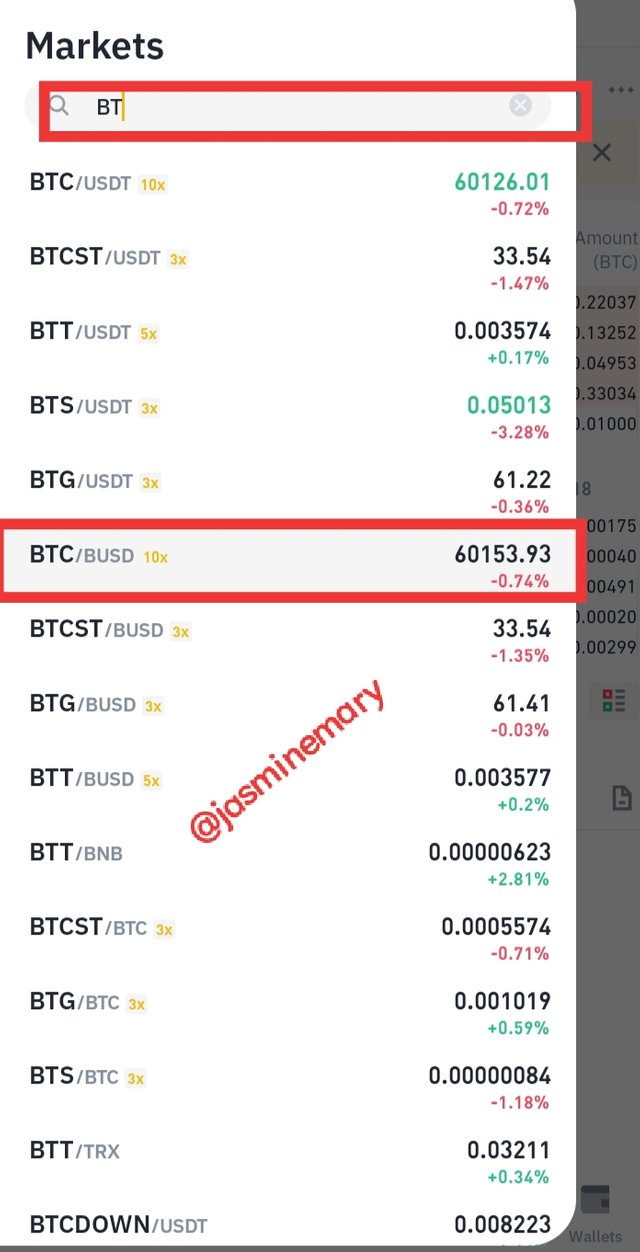

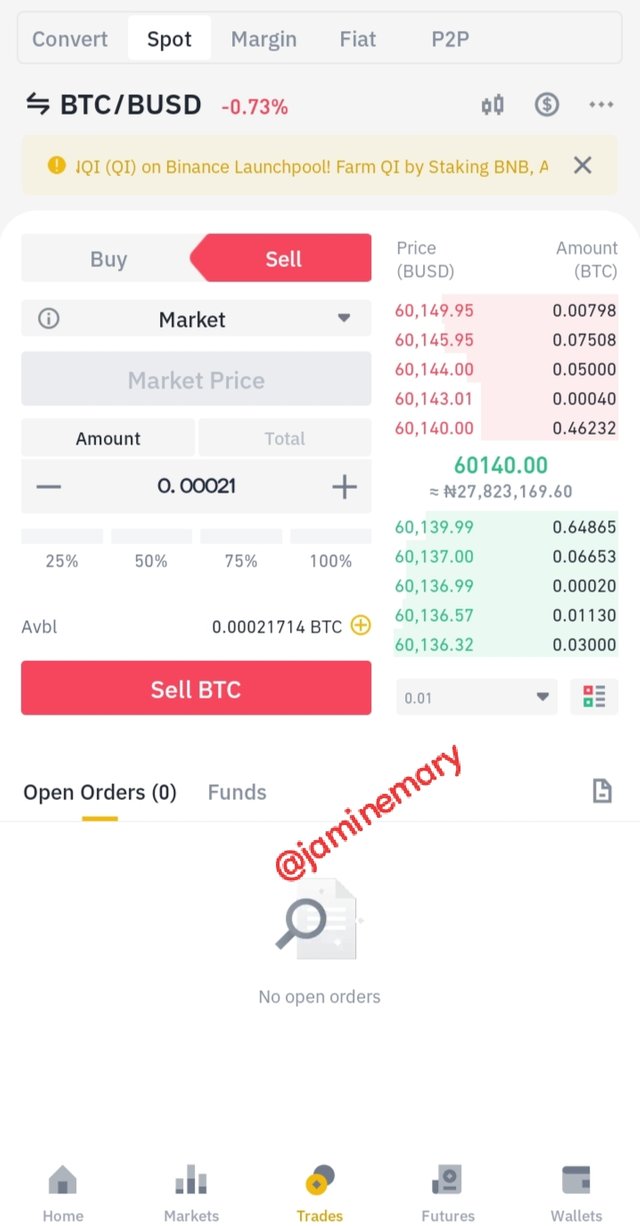

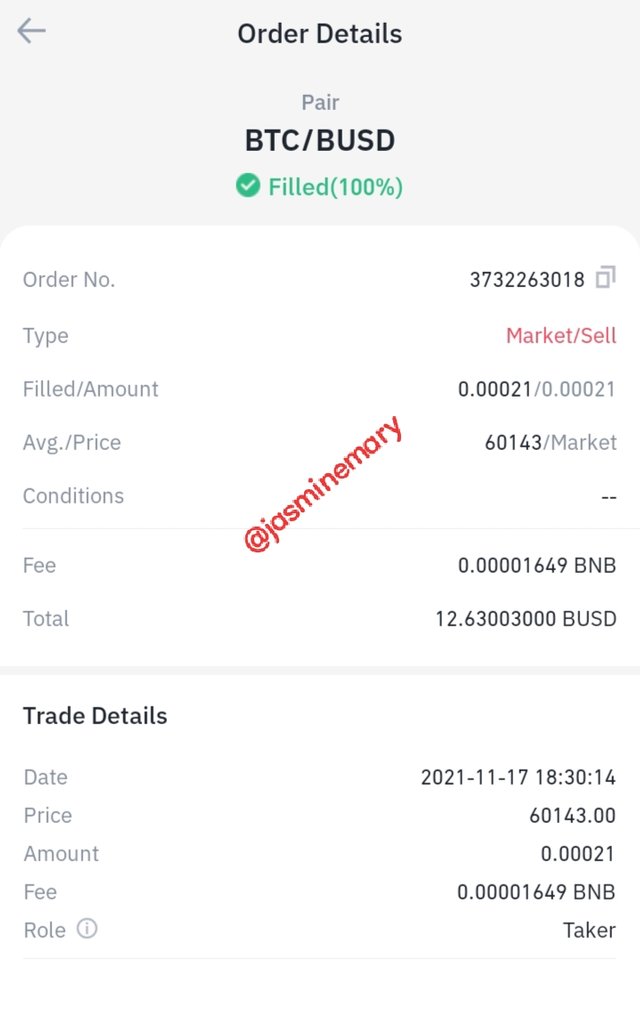

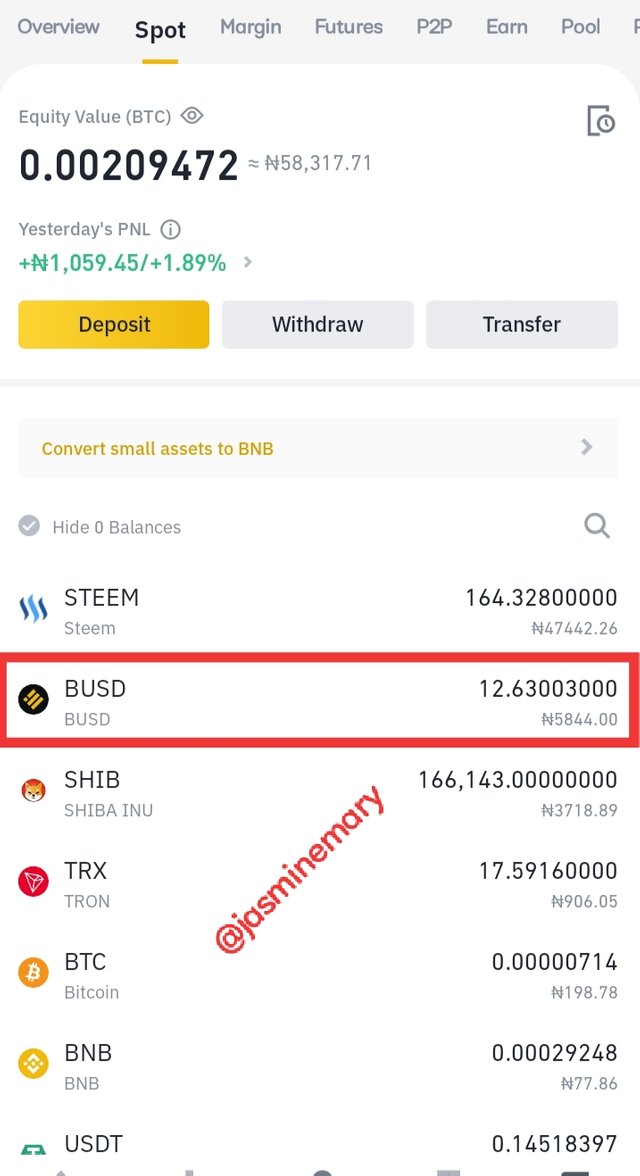

Step 1: I use my BTC to purchase 12.63 BUSDT.

Step 2: After I have purchased BTC on Binance exchange I then head to Trade and search for BUSD/BUSD pairs.

Step 3: After I have select the pair, I then open a market order an input the required details, like the order type and amount of BUSD before I then click on Buy BUSD.

Step 4: As soon as I click on Sell BTC the order was executed immediately because I make use of a market order.

|  |

|---|

|  |

|---|

How I Stake My Binance USD (BUSD)

At this point, I will be explaining in details the steps that I use in staking my BUSD. At first, after I have purchased BUSD I then use the steps below to staked it.

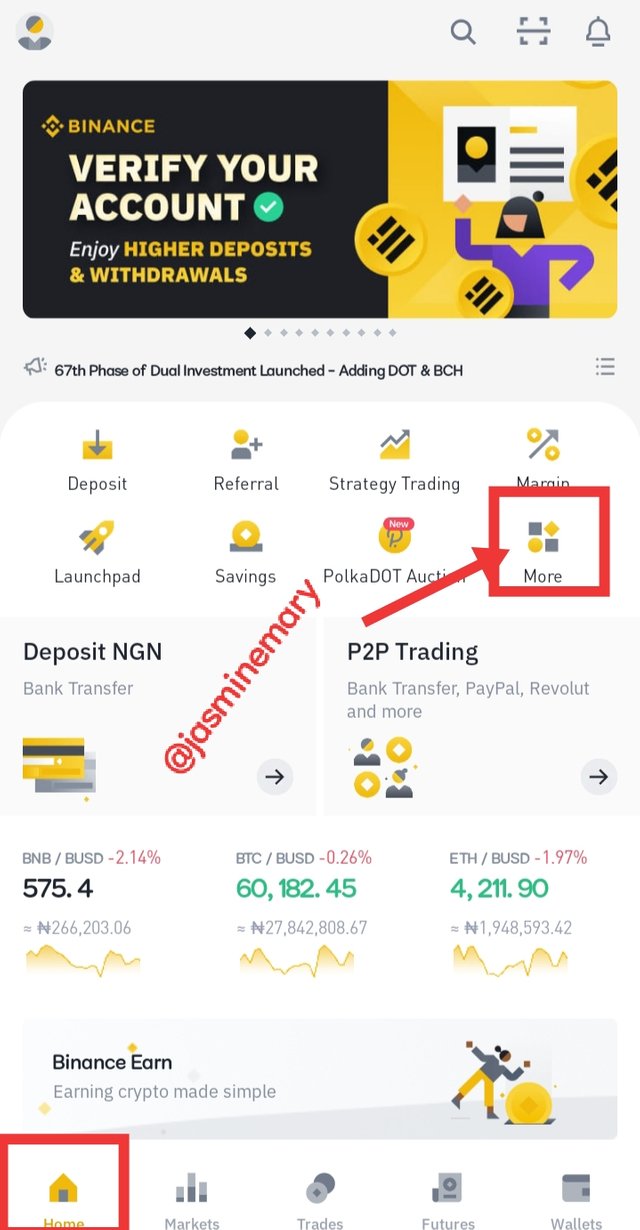

Step 1: I open my Binance click on More at the homepage as shown below.

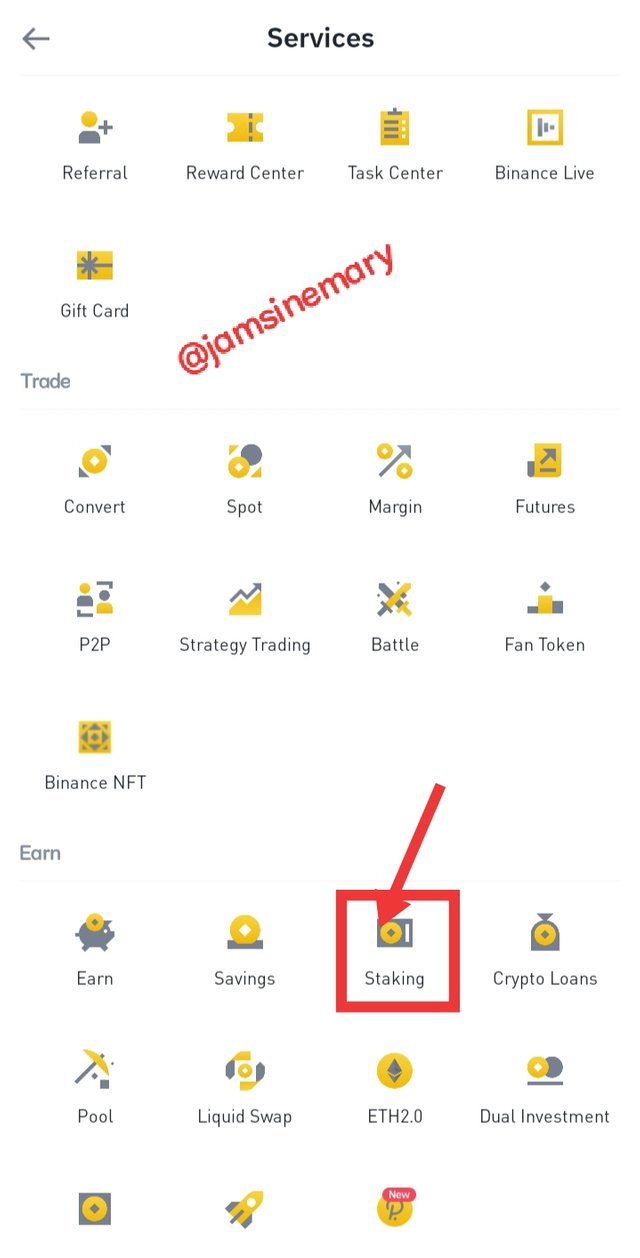

Step 2: After I have clicked more i was taking to Service then I scrolled down and clicked on Staking.

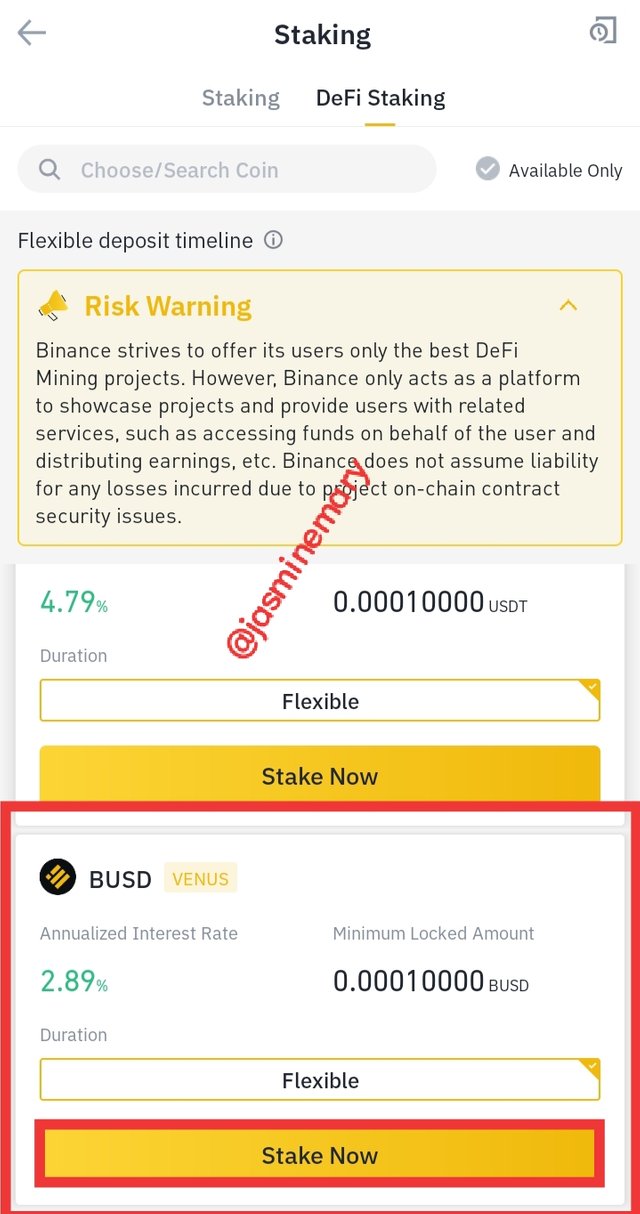

Step 3: At the staking page I select DeFi Staking.

|  |

|---|

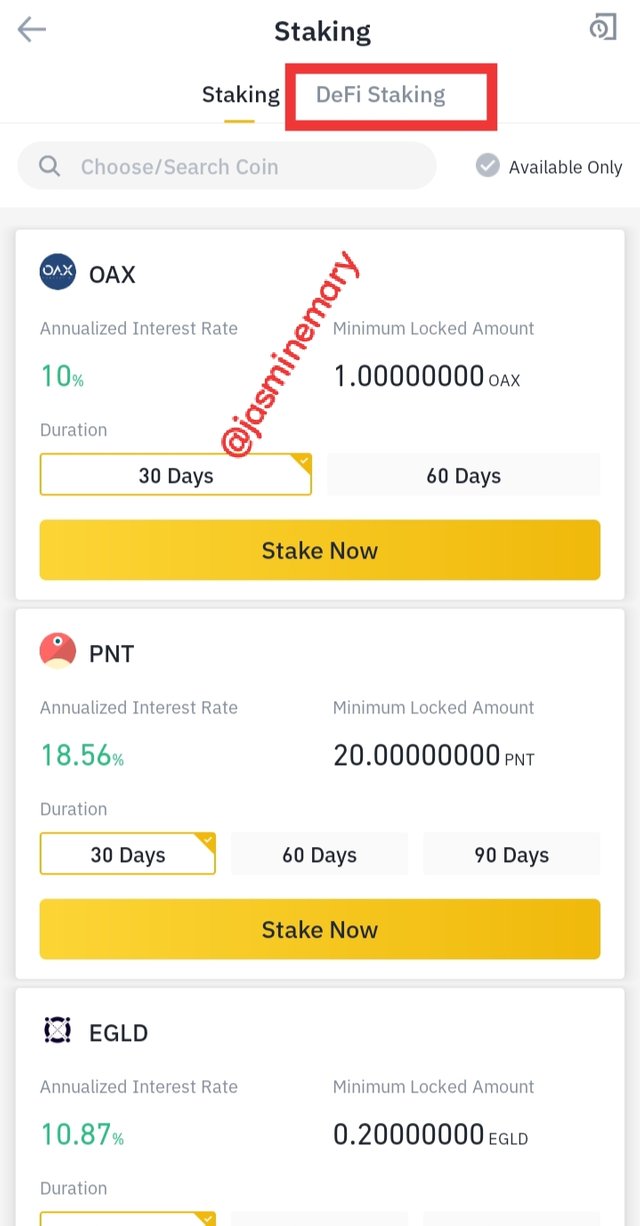

Step 4: I Scrolled down to BUSD, and then I clicked in Stake Now.

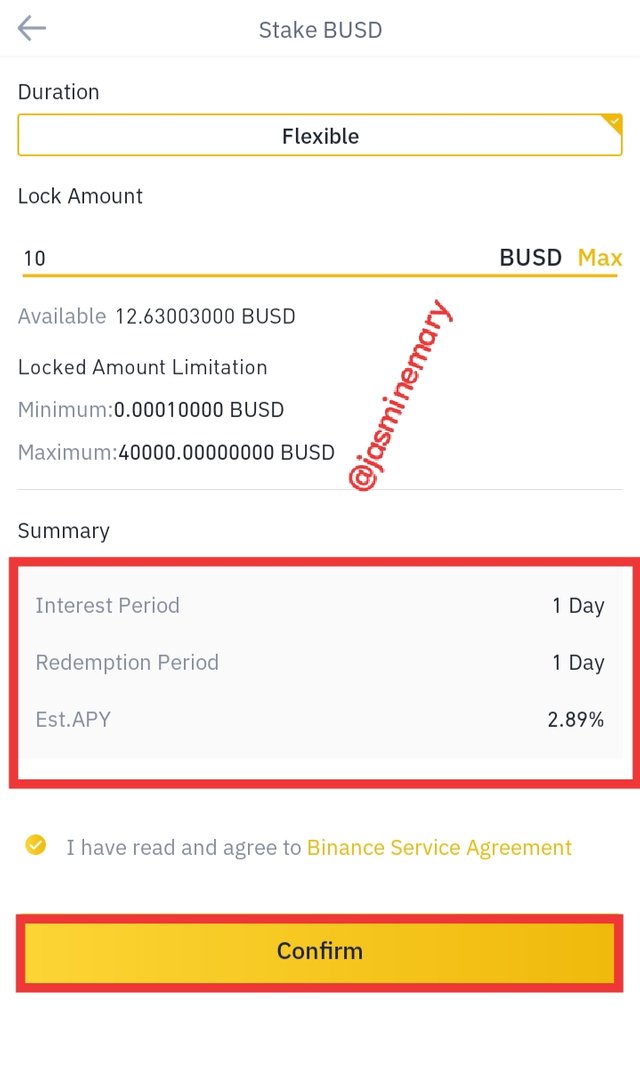

Step 5: I input the 10 BUSD as the amount l, before I then click on the box to accept BSA before I then click on Confirm.

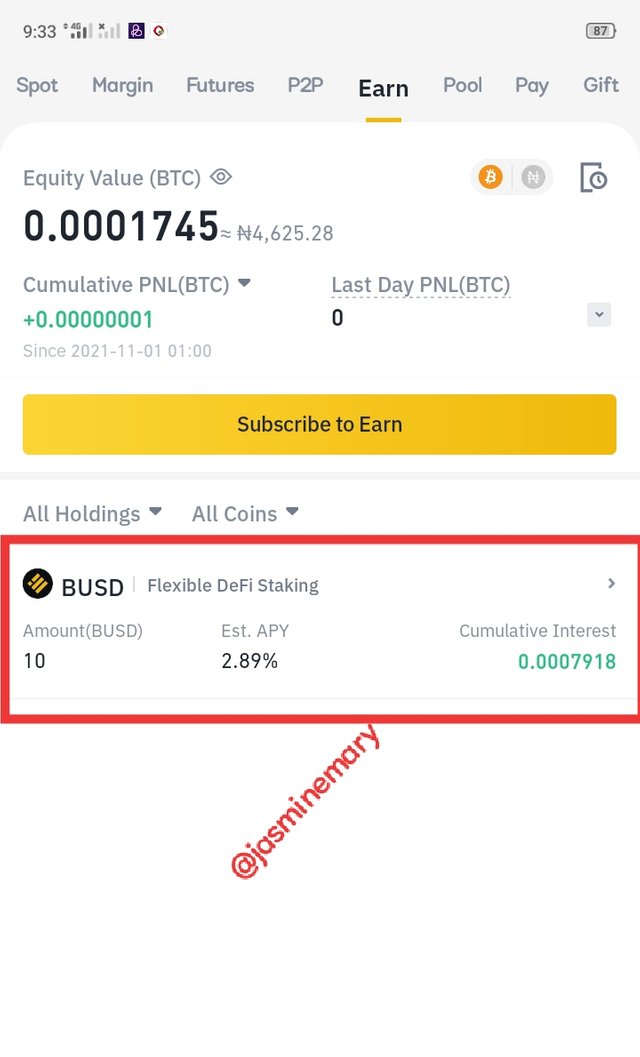

The summary of the staking is as follows;

Interest Period: 1 Day

Redemption Period : 1 Day

Est.APY : 2.89%

Indicate the reasons why you chose that option (operation) on that platform.

The reasons why I choose staking as an option is that Staking will earn me some rewards. Although, here is the main reasons to why I choose staking:

Staking is one of the simple ways to earn reward without any special skills.

Just like the money that is being save in our fixed deposit account earns us interest without doing anything, that is how the 10 BUSD will earn me some interest without me doing nothing expect relaxing while it accumulate BUSD for based on the interest rate.

Staking only required the purchase of cryptocurrency and then lock it up for APY return.

3.) Show the return on investment in time frames of 0, 24 and 48 hours from the moment you bought. Take screenshots where you can see the price of the asset and the date of capture.

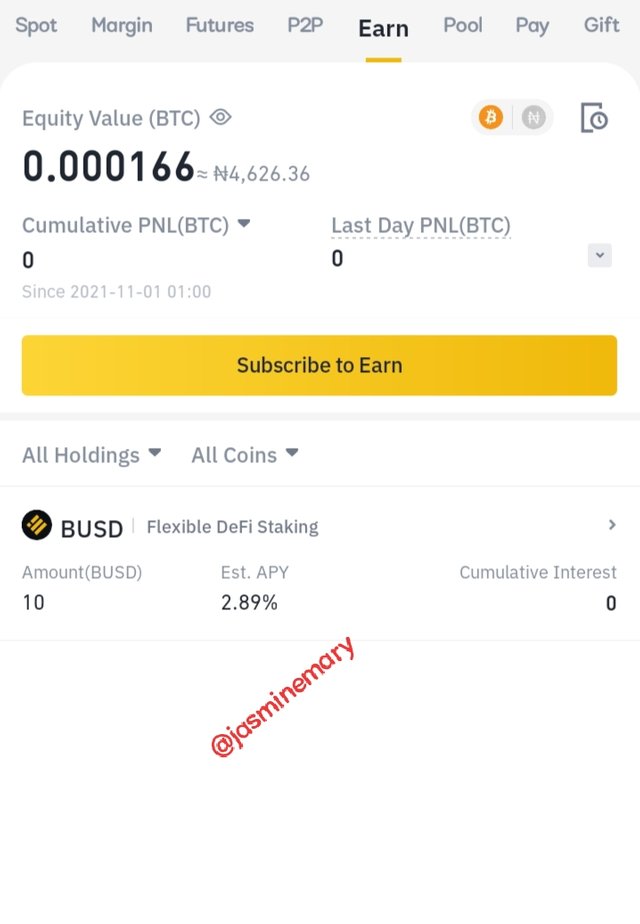

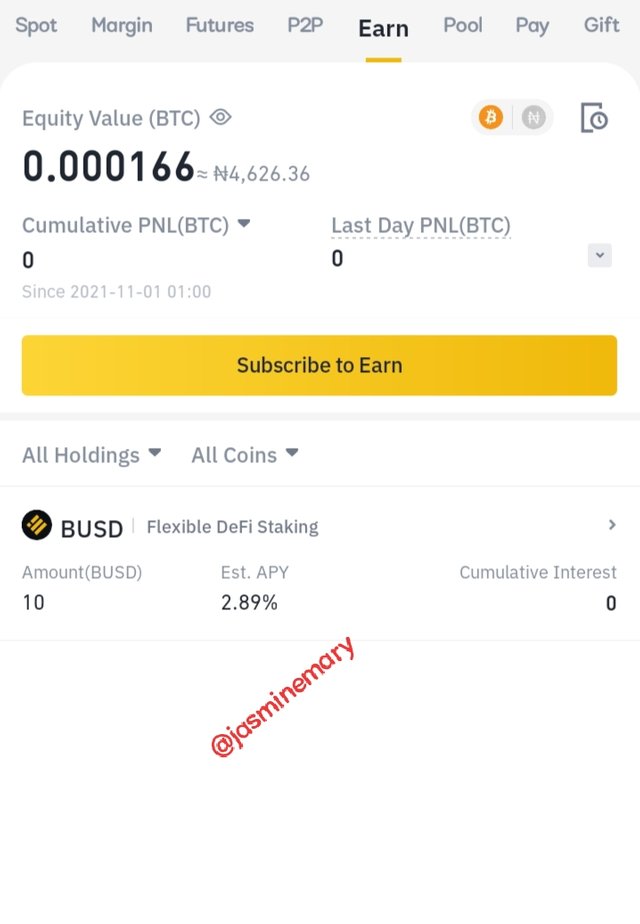

After I have purchased 12 BUSD I went to stake 10 BUSD in the staking pool and from the staking pool I discovered that the Interest Period: 1 Day Redemption Period : 1 Day Est.APY : 2.89%. This means that my return of investment for 24 hours time frame will be 0.0007918 BUSD.

|  |

|---|

3.1) Has the asset's price acted independently or does its price strictly follow the correlation with Bitcoin?

Honestly, the answer to this question is yes. The reasons to why the answer is yes is that Bitcoin is not just the first digital currency, but it is the father of all cryptocurrencies.

For the fact that Bitcoin is the father of all cryptocurrencies doesn't means other coins cannot follow suit. BUSD as we all know is a Stablecoin that is pedge to the US.dollar meaning that whenever the USD rise BUSD will equally rise vice versa.

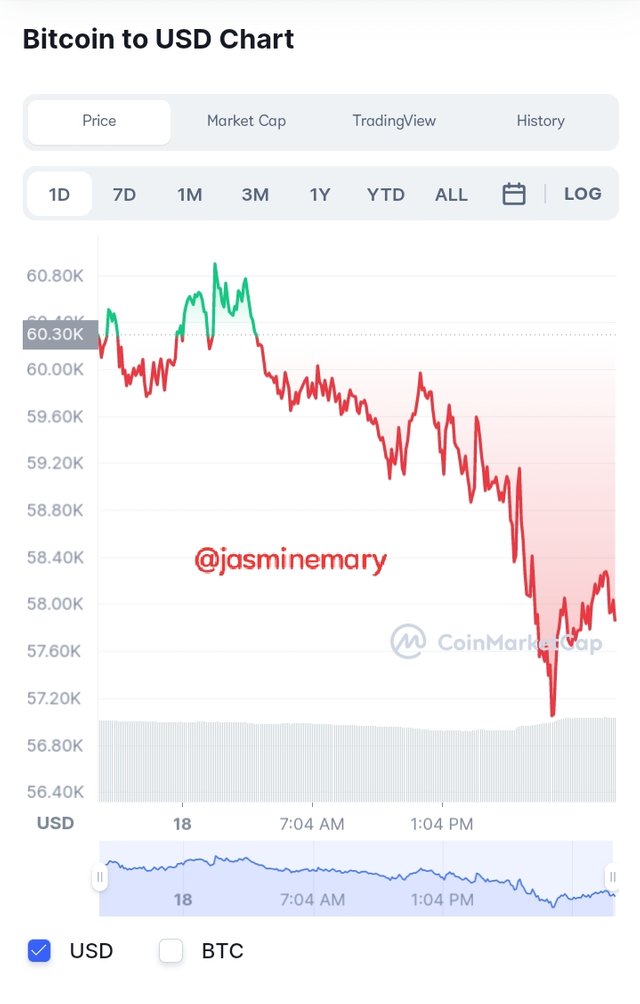

BTC chart

* Screenshot gotten from Coinmarketcap

* Screenshot gotten from Coinmarketcap

BUSD Chart

*Screenshot gotten from Coinmarketcap

*Screenshot gotten from Coinmarketcap

Looking at the two chart above we can see that the price of BUSD has been following the correlation with Bitcoin because their are digital currencies that is built using blockchain technology. The rise of Bitcoin is also the rise of BUSD and as well the fall of Bitcoin is also the fall of BUSD since they are both regarded as digital currencies.

Just in less than two years of launching, BUSD has debut to become one of the fastest growing crypto while allowing different utilities to be features like trading, lending and payments.

4.) What are futures trading?

In a very simple understanding, Futures Trading is a type of trading that allow traders/investing to speculate on the future value of any digital assets. In the crypto industry, future trading is a very unique form of trading that is different from spot trading in several ways. Trading of BUSD using futures trading doesn't require the one to purchase, sell or hold BUSD directly before participating. Rather, a traders/investors only watch out to purchase or sell a future contract inform of digital asset that is value at a specific period of time in the futures.

Leverage, is one of the main benefits of futures trading. Leverage is what permits traders to make use of better capital efficiency since it doesn't required traders to lock up the whole amount of their capital. This is because leverage boost both potential returns and risk, that are face by traders.

A trader who invest in futures trading has more opportunities and potential to grow his/her cryptocurrencies portfolio, putting his available leverage into a futures trades will easily increase his portfolio.

5.) What is the margin market?

Margin market is simply a type of market that make use of borrowed funds. In margin market the funds that are traded are funds that are borrowed from third party. In margin trading traders are allow to access capital that is higher by allowing their position to be leverage.

Margin market is perform when a trade is initiated,then the trader will then be required to remit a some percentage of the total value which is known as margin, that is related to leverage. Although margin market is used to open leverage trading which is describe in the leverage trading as funds that is borrowed. For instance, a trade is open at $500 at a leverage of 50:1 a trader would need to remit $50 of his capital before he can access the margin market. Margin market is one of the fastest way for a trader to make quick money since the funds are provided by other traders who earn interest from market demand for using margin funds.

6.) What happens to the cryptocurrencies of an exchange when they suffer from a hack or it turns out to be a fraud? Present at least 2 real life examples.

When the cryptocurrencies of an exchange is been hack or suffer from a hack or it turns out to be a fraud, it is the responsibility of the exchange to provide user with their 100 percent or 50 percent of their fund back. Although for the few cryptocurrencies exchange that has been hacked promise it's customers that their funds will be recovered over the losses of the company asset. Although, before such company which is faced with hacked will do is to make a public announcement on what has happened before it can shutdown it services.

A good example of such an exchange that promised to repay the losses of it customers is UPbit. UPbit which is known to be a popular Cryptocurrencies exchange in South Korean suffer a huge losses when hackers made off with 342,000 ETH which was valued at $51 million at the time of the hack which occured in November 27, 2019. In the statement when the update was released UPbit make a public as stated below:

“At 1:06 PM on November 27, 2019, 342,000 ETH (approximately 58 billion won) were transferred from the Upbeat Ethereum Hot Wallet to an unknown wallet,” the company said on November 27th.

Source

Although, after the company has announce the hacked, and promised it's customers that it will cover the losses of their funds using the company assets.

Another, example of a cryptocurrencies exchange that has suffer from a hack is Bitrue. Bitrue is a well-known exchange in Singapore which got hacked, losing $9.3 Million dollars in XRP and $2.5 Million dollars worth of Cardano (ADA) from it hot wallet which was officially announced on the Twitter page of the company on 26 June, 2019.

Based on the statement that was released by Bitrue, the company said that the attack was swiftly detected and the activities of the hackers was suspended from hacking the exchange. The company assures it's customers that "their personal funds are well insured", and that those that are affected by the hacked would have their personal funds replace by the exchange as soon as possible.

Reading from the two examples of an exchange that suffered from hacks which their both promised the returns of their customers funds it's and indications that is telling us that when a cryptocurrencies exchange suffer from hack our funds are secure since it is the responsibility of the company to secures the funds of its customers. This means that a customers may got his/her complete funds or half of the funds will be giving back to such a customers that fall victim.

7.) Conclusions

Binance USD (BUSD) has now become one of the most fastest Cryptocurrencies that is growing rapidly in the crypto industry, with a varieties of usage that comes with strict regulations. Without wasting much times, I sincerely appreciate professor @imagen, for his wonderful lesson that has sharpen by knowledge in some of the cryptocurrencies exchange and their coins..I am indeed grateful to you my noble professor.

Thank you for your time here......

Best Regards;

Cc:-

@imagen