Trading Cryptocurrencies - Crypto Academy / S4W6 - Homework Post for Professor @reminiscence01

Assalamualaikum and good night everyone, welcome to the Steemit Crypto Academy season 4 community. Tonight I will write a post about Trading Cryptocurrencies as a homework post for professor @reminiscence01 and this is my seventh post in this season.

The professor has explained about Trading Cryptocurrencies in the learning post that has been shared with this community and now it's time for the students to finish the homework that has been given, there are four main questions that must be answered in this homework and I will try to answer them in this post.

Q1.) Explain the following stating its advantages and disadvantages: Spot trading, Margin trading, and Futures trading

A. Spot Trading in Advantages and Disadvantages

Advantages

Spot Trading is one of the most common types of trading investments in the cryptocurrency market. Usually traders will buy a certain number of cryptocurrency assets and then hold them for a while until the price goes up. When the price of these assets rises, traders will sell these assets to get some profit from the trade investments made. Traders can trade these assets at any time and these trades will be even better if done with a good trading strategy of course.

With Spot Trading, traders can buy a number of cryptocurrency assets with full ownership of course so that traders have full control over the assets they already have and traders can start investing without minimum capital restrictions. Sometimes market conditions do not match predictions, as usually happens during bullish conditions, with Spot Trading traders will avoid liquidation problems and traders can hold these assets until the market price rises again because the goal of trading is to get as much profit as possible.

Disadvantages

However, as we all know, the cryptocurrency market is very volatile and in some cases traders sometimes buy assets at high prices at the peak of the cycle, which creates a very high risk of course. In other cases, traders also sometimes do not hold their assets when market conditions worsen and then decide to sell their assets at a loss because the fear of losing more money has affected their minds. As we know that most market cycles tend to repeat themselves.

B. Margin Trading in Advantages and Disadvantages

Advantages

Margin Trading provides an opportunity for traders to buy more assets with relatively small capital because traders can borrow additional funds from third parties, namely exchanges or other traders. That way, traders can take advantage of opportunities in the market better and this is very beneficial for traders who do not have large capital of course. In this case, traders will use a certain amount of Leverage (such as 2x, 5x, 10x, 100x) to maximize profits.

Disadvantages

In addition to increasing profits, traders also have the potential to experience large losses and can even be liquidated because the potential amount of loss is always directly proportional to the amount of leverage used and the market sometimes moves in conflict. Please note that Margin Trading is a trade that is usually carried out by experienced traders and is not recommended for beginners because it carries a higher risk and may result in your account being liquidated when you experience large losses. To avoid liquidation, traders also have to pay a certain amount of funds that have been borrowed. Therefore, traders should always do a good analysis before making a trading decision.

C. Futures Trading in Advantages and Disadvantages

Advantages

In the Futures Market, traders can take advantage of the ups and downs of price movements that occur in the market, both on downward and upward price movements. With Futures Trading, traders can take advantage of various market conditions, both Bullish and Bearish of course because trading can be done from two directions. In the Bullish case, traders can buy the BULL Leverage Token while in the Bearish case, the traders can buy the BEAR Leverage Token and traders will also use a certain amount of Leverage so that traders can buy large contracts with limited capital relatively small.

In addition to doing a good analysis, the use of appropriate Leverage (such as 2x, 5x, 10x, 100x) also greatly determines the success of trading in this case because the use of proper Leverage is one of the keys to maximizing profits. That way, traders have the opportunity to get double profits from every trade made and can even reach 100 times. In addition, the Futures Market usually also allows traders to hedge so that it allows traders to be able to protect their assets if bad conditions really occur.

Disadvantages

In Futures Trading, traders cannot buy cryptocurrency assets as in the case of Spot Trading because in this case traders can only buy Futures Contracts whose prices are pegged to the original asset price. However, Futures Trading is a trade that is usually carried out by experienced traders and is not recommended for beginners because it carries a higher risk and may result in your account being liquidated when you experience large losses.

Q2.) Explain the different types of orders in trading and How can a trader manage risk using an OCO order? (technical example needed)

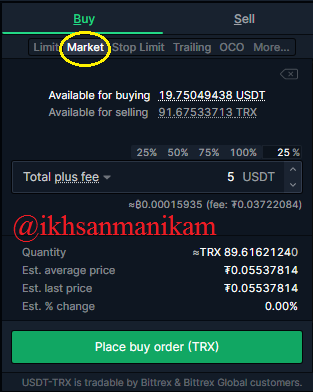

A. Market Order

This is the most instant order because this order is placed based on the latest market price, thus allowing an order to be fulfilled faster of course. By using Market Orders, traders can place sell orders or buy orders based on the current market price and usually Market Orders do not require a long waiting time in the buying and selling process because orders tend to be at the top of the Order Book so they tend to be executed faster. In the picture above it can be seen that the current TRX price is 0.05537814 USDT and I plan to place a Buy-Market-Order to buy a number of TRX using 5 USDT of capital, so the estimated amount of TRX that I will get from this order is 89.6162124 TRX.

B. Pending Orders

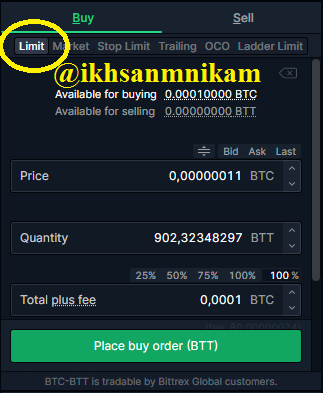

1.) Limit Order

This is an order that is placed based on a certain price so it requires waiting time because it may not be fulfilled immediately. By using Limit Orders, traders can place sell orders or buy orders based on a certain price and the placed Limit Orders will be entered directly into the Order Book to wait until the order is successfully executed when the price matches the order. After doing an analysis, traders will usually determine the best selling point or the best buy point and then decide to place a Limit Order based on the prediction. In the picture above it can be seen that I plan to place a Buy-Limit-Order at a price of 0.00000011 BTC/BTT to buy a certain amount of BTT using a capital of 0.0001 BTC so that the estimated amount of BTT I will get from this order is 902.32348297 BTT and when the BTT price drops to 0.00000011 then my order will be fulfilled.

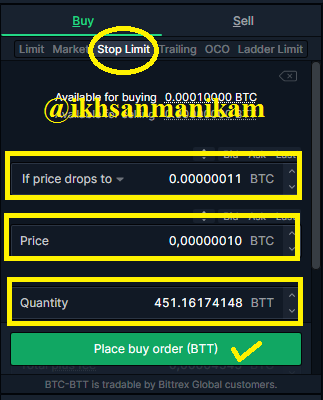

2.) Stop Limit Order

Stop-limit Order is a feature that combines Stop-loss feature and Limit-order feature so traders need to fill in Stop-price and Limit-price, Stop-price is your initial target price which can make your Stop-limit-Order into a Limit-order while the Limit-price is the price limit at which your Limit-Order will be executed. In the picture above it can be seen that I plan to place a Buy-Stop-Limit-Order to buy 451.16174148 BTT at a price of 0.00000010 BTC when the price drops to 0.00000011 BTC. When the price is reached, this order will be automatically entered into the Order Book for execution.

3.) OCO Order

OCO (One Cancels The Other Order) is an order feature that offers two interrelated order options because when one order is successfully executed the other order will be automatically canceled and this feature is very helpful for traders to take profits and also minimize risks in the market. OCO Order allows traders to place two orders in one order, namely Limit-order and Stop-limit-Order, so traders will have two choices because when one order is successfully executed the other order will be canceled automatically.

In the picture it can be seen that the WAVES/USDT trading pair is in an uptrend phase and the price seems to continue to move up. I predict that the market price will bounce back to reach the Resistance point that was previously reached so I will set my Sell-Limit-Order at 35 to take some profit of course. Sometimes the market moves not according to predictions and I need to minimize that risk of course, for that I will set my Sell-Stop-Limit-Order based on the support point that has been reached before, which is at 22.5.

Then I logged into my exchange account on the Bittrex platform to place an OCO Order. In the picture it can be seen that I plan to place an OCO Order with the details that my Sell-Limit-Order price is 35 and my Sell-Stop-Limit-Order price is 22.5. When the price of WAVES/USDT reaches 35, my Sell-Limit-Order will be entered into the Order Book and ready to be executed, while my Sell-Stop-Limit-Order will be canceled automatically. On the other hand, when the price of WAVES/USDT drops to 22.5, my Sell-Stop-Limit-Order will be entered into the Order Book and ready to be executed, while my Sell-Limit-Order will be canceled automatically. By applying good risk management and placing the right stop loss, OCO Orders really help traders in minimizing losses, of course.

Exit Orders (Stop Loss Order and Take Profit Order)

When the market price moves not according to predictions, traders can minimize risk and protect their trading capital by setting a Stop Loss Order that will be placed automatically based on a certain point of analysis that has been determined by traders before starting trading as a point of exit from the market if market conditions occur. worsened. While Take Profit Orders are the opposite of Stop Loss Orders, when the market price moves according to predictions, traders can maximize their profits by setting Take Profit Orders which will be placed automatically based on a certain point from the analysis results that have been determined by traders before starting trading as a point. exit the market if market conditions are favorable so traders can smile wider of course.

Q3.) Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange)

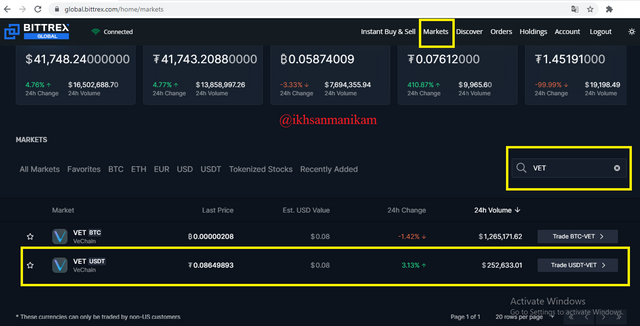

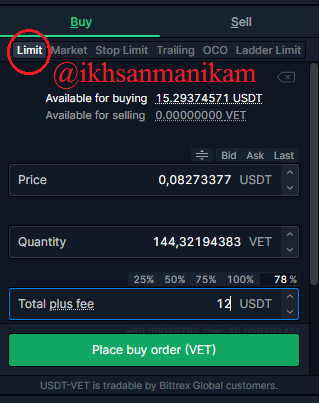

In this section I will place a Buy Limit Order using my trading account on the Bittrex Exchange platform to buy a number of Vechain VET coins using a certain number of USDT Tether coins and here are the steps.

- Once logged in, go to the Markets page on the Bittrex Exchange or visit https://bittrex.com/home/markets to view it. Then write the word VET in the search field and click on the VET/USDT trading pair.

- Then the VET/USDT trading page will appear and you can find the Buy and Sell column in the upper right corner. To make a VET purchase using USDT, you can select the Buy column of course.

- Then select the Limit Order feature and fill in the Buy Limit Order Form according to your wishes. I will buy some VET at a price of 0.08273377 using a capital of 12 USDT and that way the Order will be fulfilled if the VET price is at 0.08273377 and then I will get 144.32194383 VET of course. After filling out the form, click Place Buy Order to enter your order into the Order Book and wait for the order to be executed successfully.

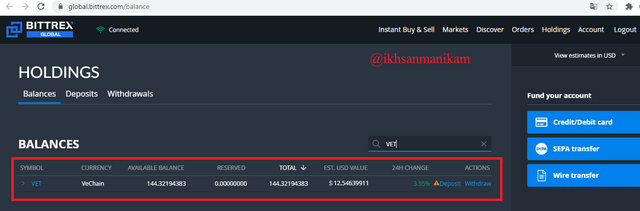

- After waiting for some time until the market price matches the order, I finally managed to get VET coins. This is proof that I have successfully purchased 144.32194383 VET using 12 USDT of capital.

Q4.) Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected: Why you chose the crypto asset, Why you chose the indicator and how it suits your trading style, and Indicate the exit orders. (Screenshots required)

Although last week I was not active in this community due to some work matters that could not be left behind, I still studied several classes given by the professors last week and one of them is about the Accumulation Distribution Indicator (A/D) which I will discuss in this question. Meanwhile, the cryptocurrency that I will choose is CELO coin because based on statistics it is known that this coin is in a positive trend with strong fundamentals, supported by a reliable development team, has a clear whitepaper and is currently classified as one of the top coins that have traded on many cryptocurrency exchanges. After studying it, this indicator is very relevant to my usual trading style, especially in the case of swing trading as shown in the picture.

In the picture it can be seen that I used technical analysis based on the Divergence of the A/D Indicator found in the CELO/USDT trading pair to help me decide the best exit. At first I identified that the Bullish phase might end because the overall price movement seemed to be moving up while the A/D Indicator line seemed to be moving down and this Divergence indicates that the Bullish phase is starting to weaken and may turn into Bearish later. Then I drew a trend line to connect several swing low points and in the picture it can be seen that currently the market price has broken the trend line and this gives a signal for me to place a Short Entry.

I decided to place a Short Entry with a Stop Loss point based on the previous high point (Peak Price) at 8.374 and the Risk/Reward Ratio I used was 1:1 so my Take Profit point was at 3.145 as shown in the picture above.

Highly volatile Cryptocurrency prices provide both opportunity and risk. Trading Cryptocurrencies is a great opportunity to invest and make a profit, but you also need to be aware that it also has risks that need to be considered of course. Therefore, you should do various analyzes before deciding to enter a trade and always apply good risk management of course. And don't forget to always use Stop Loss on each of your trades!

Traders can combine Fundamental Analysis and Technical Analysis and always consider using technical indicators that suit their trading style. Judging from the type of trade used in Trading Cryptocurrencies, it is better for novice traders to use Spot Trading because other trades tend to have a greater risk. Knowledge of the market is the main thing that traders need to understand and after starting to understand it, beginner tarders may be able to try using Margin Trading and Futures Trading with Leverage which tends to be low, of course, 2x or 3x is recommended.

Hello @ikhsanmanikam , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.