Steemit Crypto Academy Season 3 Week 8 | Homework Post for Professor @yohan2on - Risk Management in Trading

Good evening everyone, let's start a positive activity today and today I will continue my writing activities in the Steemit Crypto Academy community. I started this week by participating early because this is the last week of Season 3. To start this week's course, I will first take a class given by professor @yohan2on and the topic discussed in this class is about “Risk Management in Trading” is very interesting of course because this is something that traders need to pay attention to before deciding to make a trade. Let's discuss it by trying to finish the homework the professor has given. There are two main questions that must be answered and developed in this homework, let's start...

Q1.) Define the following Trading terminologies;

- Buy stop

- Sell stop

- Buy limit

- Sell limit

- Trailing stop loss

- Margin call

(I will also expect an illustration for each of the first 4 terminologies listed above in addition to your explanation)

The order book is important when placing an order because the order book can also reflect market conditions and traders will enter their orders with various options. In this section we will discuss the types of orders that are commonly used as options trades by a number of traders, including the following.

Buy stop

Buy Stop is an order that will enter the order book to be executed when the price reaches a certain point which is above the current price. After doing analysis and prediction, traders will set the expected point to buy the asset and then they set a Buy Stop order to reach the expected point, the point is the price that is above the current price. When the market price rises and manages to touch that point, their order will be fulfilled. Usually this order is used by traders to join the train group in a bullish trend. And you can see it in the illustration above.

In the picture it can be seen that I initially saw the price of BNB in the $260 - $270 range and the asset was in a Bearish phase. I assume that after the Bearish phase ends, the asset price may potentially rise again. Therefore, I started to be interested in buying it, but I would really buy it if the asset manages to break through the resistance line as shown in the picture because this point can be identified as a confirmation point that has the potential to trigger a Bullish trend. That way, I will place a Buy Stop order to buy the asset at the point I expect it to without having to frequently monitor the chart.

Sell stop

Sell Stop is an order that is placed below the current price to prevent losing more money if bad conditions occur in the future. Usually traders will place this order since they are still in a certain position which is still not bad. Traders place this order as a precaution if the worst case actually happens, namely when the support line is successfully broken because the market failed to maintain its position and this is the case that often occurs in the Bearish phase. By placing a sell stop order, traders can prevent bigger losses of course.

To place this order at the right point, traders need to make an analysis like in the picture above. In the picture it can be seen that traders need to consider the support line as a reference in determining the sell stop point because traders can place a sell stop order at a point not far below the support line. When the support line is successfully broken, it can be identified as a confirmation point that has the potential to trigger a Bearish trend. That way, I will place a Sell Stop order to save my money by selling the asset at a point not far below the support line without having to frequently monitor the chart.

Buy limit

Buy Limit is an order placed below the current price with the aim of buying assets at a lower price so as to maximize the capital they have to buy assets in larger quantities. Based on the picture, it can be seen that I made an analysis of the DASH support line which is in the price range of $183 - $186 and I will only buy DASH in that price range, but the current price of DASH is still in the price range of $ 210 - $ 213. For that, I will place a Buy Limit order in this case so that I can buy the asset at a price of $ 184 without having to monitor the chart often and when the price actually moves to touch that point then my order will be fulfilled.

Sell limit

Sell Limit is an order placed above the current price with the aim of selling the asset at a higher price so as to maximize profits and earn more money. Based on the picture, it can be seen that I made an analysis of the UNI resistance line which is at $23 and I will only sell UNI at that price range, but the current price of UNI is still at $18. For that, I will place a Sell Limit order in this case so that I can sell the asset at a price of $ 23 without having to monitor the chart often and when the price actually moves to touch that point then my order will be fulfilled.

Trailing stop loss

This is an order feature that allows traders to profit gradually and prevent losses by placing orders at a certain percentage of the market price and adjusting the stop loss accordingly, so this feature will move based on that percentage to help traders earn profits and this feature can be implemented in Bullish or Bearish conditions, but if a trend reversal occurs, this feature will stop moving and when the market price moves not according to the expectations of traders then losses are limited and profits can be protected, this is a more strategic feature of course.

When the price moves as expected by traders with a predetermined percentage then traders will get some profit and this feature will lock in those profits. However, when the price moves not in line with the desired expectations, this feature will end the trade at the current price position.

Margin call

When creating an account with a Broker, traders will usually pay a sum of money which determines their equity so that the Broker can allow traders to trade. Then traders will deposit a certain amount of money as the minimum capital needed to be able to trade and this money is said to be the margin that will be held in traders' accounts. The free margin in a trader's account can be determined by calculating: the amount of margin is deducted by the amount of equity.

In certain cases, margin calls may occur to traders. This is a condition when the Broker contacts a trader through certain media because the trader does not have free margin in his account and the margin amount is below the threshold so he cannot trade and means the trader has to make an additional deposit. This case is usually experienced by traders who have traded all their capital and then suffered a loss which caused all their capital to be lost. The main purpose of a margin call is to protect traders from losses and traders will be called upon to resolve the margin issue.

Q2.) Practically demonstrate your understanding of Risk management in Trading;

- Briefly talk about Risk management

- Be creative (I will expect some illustrations)

- Use a Moving Averages trading strategy on any of the crypto trading charts to demonstrate your understanding of Risk management. (screenshots needed)

About Risk Management in Trading

Trading is a very attractive, profitable and risky investment option. The purpose of trading is to make a profit and no one wants to lose in the market, but the potential for loss is always there and this is what is called trading risk. However, all of these risks can be minimized with good trade management, good trading strategies, and good market analysis. Trading will look like “gambling” if traders don't use good risk management and trading will turn into “speculation” if traders use good risk management.

Risk management in this case is the various ways that traders use to control potential losses and in the world of trading you must realize that when you invest a certain amount of money to get more money then you also have to give up some of that money will decrease if the worst case really happens. With good risk management, traders will set a risk-to-reward ratio as one of the references in their trading so that they can protect their capital from potential losses and prevent losses.

Portfolio Management, Self-Control, and The 1% Rule

Based on mathematical principles in calculating an opportunity, then you should invest your money in several assets and never invest your money in only one asset because it is really very risky, preferably at least 4 or 5 assets. As an illustration, I will invest my money in assets A1, A2, A3, A4, and A5, while assets A1 & A2 may give me a loss, then I still have assets A3, A4 & A5 which may give me a profit. This is also one of the principles that need to be considered in minimizing the risk of loss. You also need to organize your portfolio in detail and structure it properly.

In addition, traders also need to have a good aspect of self-control and always use realistic logic of course. But sometimes traders will experience frustration and depression when they experience losses. With the concept of good self-control and good risk management, your logic will direct you to take the right steps to control your emotions and manage your losses realistically by setting a better future strategy. When I decide to invest then I will use an amount of money that does not affect my personal finances (ex: 1/12 of my salary) and I will not be frustrated if I lose it and I have considered it as risk capital.

In trade management, there is a term which is also known as “The 1% Rule”. This is the term used to describe that most traders will give up 1-2% of their capital lost in the case of an unprofitable trade in a really bad market. If you invest as much as $500 then you don't mind if you have to lose $ 5 - $ 10. That way traders can minimize losses so that the losses do not become more and I think this is a very realistic thought of course.

Stop-Loss, Take-Profit, and Risk-Reward Ratio

With good planning and strategy, of course, traders can minimize losses because one trader may not be able to control a very broad market, but every trader can identify markets with good strategies and are relevant to the trading style being carried out, such as conducting Fundamental analysis and Technical analysis using various trading indicators, then determining the Resistance zone and Support zone, and don't forget to always set the stop loss and take profit levels.

Another important element in the concept of good risk management is the use of “Stop Loss” and I think this is something that traders should use to prevent bigger losses. In addition to stop loss, traders also need to set the “Take Profit” level with a good strategy as a realistic target to achieve and never greed affects you. That way, you can set a good risk-reward ratio, such as 1:2 or 1:3 with details that you want a reward of 2-3 times. In the 1:2 case, if you buy the asset for $5 per coin, you will set your stop loss at $4.5 and take profit at $6. Trading indicators such as the Moving Average (MA) and Fibonacci Retracement are among the indicators that can be used as a reference to set stop loss and take profit points.

Basically stop loss is used to minimize losses, but sometimes traders place a stop loss at a point that is not ideal so that they will be "expelled" from the market early and then the market turns back. Traders must be very annoyed with conditions like this, for that traders should place a stop loss in the range of 5-10 pips above the last swing high point for Sell trade entry and 5-10 pips below the last swing low point for Buy trade entry. This is one of the main choices that are generally used by traders. Let's look at a case in the following illustration.

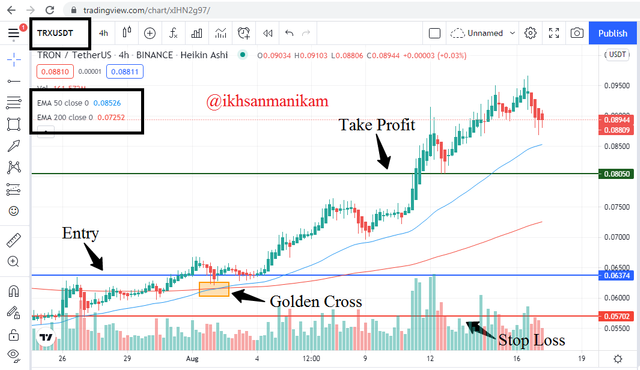

Trading Strategy based Risk Management using EMA

Based on the picture, it can be seen that the EMA 50 line moved from the bottom up and then successfully crossed the EMA 200 line, this condition is called a “Golden Cross” and the EMA 50 line will act as a strong support to encourage a trend reversal from Bearish to Bullish. Based on these conditions, I will enter the market to place a Buy Order slightly above the Golden Cross or Support zone at a price of 0.06374 and set a Stop Loss point at a position slightly below it at a price of 0.05702, while my Take Profit is at a price of 0.08050, so My ratio Risk : reward is 1: 2.5 and this is a realistic target plan in my opinion. Here are the details:

Buy Price = $ 0.06374

Stop Loss = $ 0.05702

Take Profit = $ 0.08050

Risk = Buy Price - Stop Loss = $ 0.06374 - $ 0.05702 = $ 0.00672

Reward = Take Profit - Buy Price = $ 0.08050 - $ 0.06374 = $ 0.01676

Rasio Risk : Reward = $ 0.00672 : $ 0.06176 = 1 : 2.5

So it can be said that I am willing to sacrifice $0.00672 to get $0.01676 if it is calculated based on the price per coin, while the total will be multiplied by the amount of Capital invested. Here is a breakdown of the total for the case, assuming that I invested $63.74 in Capital.

Total Coins = Capital : Buy Price = $ 63.74 : $ 0.06374 = 1000 Coins

Total Risk = $ 0.00672 x 1000 Coins = $ 6.72

Total Reward = $ 0.01676 x 1000 Coins = $ 16.76

By using Capital as much as $ 63.74, then I was willing to sacrifice $ 6.72 to get $ 16.76. The use of stop losses and setting a realistic take profit are two very important things for traders because they can maximize profits and minimize potential losses.

Risk Management is an important aspect that traders need to pay attention to because no one wants to lose money in the market. With bad planning and without good risk management, the potential for losses will be even greater and you may be frustrated if the worst thing happens to you. Trading without good risk management is "gambling", while trading with good risk management is "speculation".

In my opinion, good risk management is the main foundation that can strengthen your trading activities in the future and make you continue to survive in the trading world. A good trading strategy and good analysis will not work perfectly if it is not combined with good risk management, of course. Thank you professor for the interesting topic of learning this past week and closing this wonderful season with a meaningful. See you on the next season....

Hi @ikhsanmanikam

Thanks for participating in the Steemit Crypto Academy

Feedback

This is good content. Well done with your practical study on Risk management.