Steemit Crypto Academy Season 3 Week 5 | Homework Post for Professor @allbert - Psychology and Market Cycle

Hello everyone, how are you guys today? I hope you are always healthy. Today we meet again on my blog, with a different atmosphere and theme of course. Today I will try again to write in the Steemit Crypto Academy community. To start this week's course, I will take a class given by professor @allbert and this class discusses about "Psychology and Market Cycle". There are four main questions that must be answered in this homework and in this post I will try to answer these questions. Let's get started...

Q1.) Explain in your own words what is FOMO, wherein the cycle it occurs, and why. (crypto chart screenshot explanations needed)

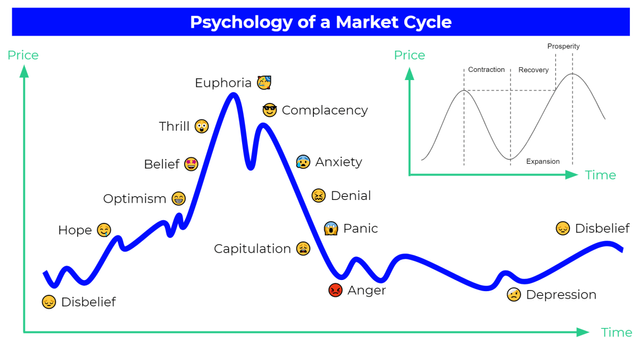

Fear of Missing Out or known as FOMO is a term that describes one of the emotional characteristics of the market that appears when a Bullish trend occurs. When a Bullish trend occurs and sees other investors start to reap their profits, some investors, especially novice investors will feel that they are afraid of missing the train and they want to get into the market as soon as possible.

Their minds begin to be influenced by a sense of “FOMO” and full of ambition, they think that they are not too late to participate because the market price seems to be increasing and they want to enter the market immediately without doing good technical considerations and finally they decide to enter the market at a bad point and it turned out that the entry point was really not right and they were too late.

It turned out that this point became the final part of the Bullish phase because some time later the market turned into Bearish and made their ambitions disappear. But they remain optimistic that the bullish phase will resume after seeing that the market is undergoing a slight correction, in fact the bearish phase has just started and the market price continues to move down. Eventually they realized that they were not getting anything from their “FOMO” investment, all they got was frustration and a loss of money. The investment goes to waste because of that emotional ambition.

FOMO that occurs in the Bullish trend phase usually starts from the “Belief” stage and ends at the “Euphoria” stage, as I show in the picture above. Initially the whales and smart investors had bought the asset at a low price and they held it for a while. Then the supply in the market began to decrease while the demand began to increase so as to encourage the Bullish phase.

At the start of the Bullish phase, the market price began to move up and began to attract public attention. A number of followers started investing in the “Belief” stage because they saw the changes in the chart. Then the public also began to participate and succeeded in pushing asset prices higher because of the purchases they made. Seeing that the market price continues to increase, more and more public participates and makes the market price even higher until it reaches the "Euphoria" stage.

In the stages of “Euphoria” to “Complacency”, the whales and smart investors start to withdraw their profits and decide to exit the market causing the start of the Bearish phase as supply in the market becomes greater than the amount of demand. Contrary to this, the public and a number of inexperienced investors still maintain their positions and they do not realize that this is the last stage of the Bullish phase and the beginning of the Bearish phase.

They maintain their position because they are still influenced by ambition and greed which assumes that market prices will rise again and continue to move up. But in fact the market price continues to move down and the Bearish phase actually occurs. They could only watch it with disdain and then they began to realize that they had made an investment that was affected by FOMO, but it was too late.

Q2.) Explain in your own words what is FUD, wherein the cycle it occurs, and why. (crypto chart screenshot explanations needed)

Fear-Uncertainty and Doubt or known as FUD is a term that describes one of the emotional characteristics of the market that appears at the time of the Bearish trend and this can be said as the opposite of FOMO. FUD is the fear that arises because you don't want to lose larger amounts of capital when you see that the market price continues to move down and does not match the expected expectations.

Then investors started to get influenced by the feeling of “FUD” and they wanted to get out of the market as soon as possible. Finally they decided to get out of the market by selling their assets at a loss to save the remaining capital they had. This happens because they have bought the asset at the wrong point and without considering good technical analysis. They may not even know where the Support and Resistance points are.

They already bought assets at the beginning of the bearish phase which was still far from the Support zone, then they began to be influenced by a sense of "FUD" because the market price continued to move down and finally they decided to sell these assets in the Support zone area which was the end point of the phase. bearish and usually be the beginning of the start of the Bullish phase. This is a completely wrong strategy because buying in the sell zone and selling in the buy zone. Backwards!

After selling these assets at a low point, it turned out that the conditions really changed and the starting point of the Bullish phase had just begun because some time later the market turned Bullish and they felt sorry for selling their assets. Annoyed, they finally realized that they had nothing to gain from their ridiculous investment and the fact that they too had suffered losses because they had entered at the wrong point.

In addition to market emotional factors, FUD that occurs in the Bearish trend phase is usually also influenced by rumors circulating and greatly affect the market, such as the tweets shared by Elon Musk. FUD usually starts from the “Anxiety” stage and ends at the “Capitulation” stage, as I show in the picture above. Bearish phase usually occurs after the whales sell their assets, causing the supply in the market to be greater than the demand and the market price will move down. This made a number of other investors start to feel afraid and want to get out of the market as well.

In the "Anxiety" stage they see that the market price continues to move down and does not match their expectations, so they start to worry and think about starting a move out of the market for fear of experiencing bigger losses. However, this actually causes the market price to decrease further due to the emergence of a bigger selling impulse in the market. Had they held on to their positions, perhaps this deepening of the chart decline would not have happened.

Due to the worsening market price decline and seeing that a number of other investors had also sold their assets, a number of investors who initially wanted to maintain their positions, also began to be provoked and decided to join in selling their assets because they were increasingly panicking seeing the current state of the market. continues to move down, this is what happens in the "Panic" stage. This also makes the market price fall even deeper and even reaches its lowest point until it reaches the "Capitulation" and "Anger" stages.

After the “Capitulation” stage, most of them have managed to get out of the market by selling all their assets at a loss because they are haunted by high fear and they come out full of anger and anger. They also experience depression because they think about the huge losses they have experienced. After some time, they began to realize that they had made a decision that was influenced by the FUD, but it was too late.

Q3.) Choose two crypto-asset and through screenshots explain in which emotional phase of the cycle it is and why. Must be different phases

Axie Infinity Shard (AXS)

In this first case, I will discuss about the AXS coin because this coin has been one of the trending topics for some time and has just managed to reach the ATH (All Time High) point. Besides having succeeded in attracting many investors to invest here, they have also succeeded in attracting many users to play the games they launched, so that the price of AXS coins skyrocketed and even now AXS coins are ranked 32 with a market cap of $ 2,561,553,885.96.

Based on the chart, it can be identified that the AXS/USDT trading pair is in the “Euphoria” stage and I predict that it will be “Going to Complacency” after successfully reaching “Peak Euphoria” a few days ago. The market price seems to be starting to move down as a number of whales started withdrawing their investment and exiting the market with some profits. This causes the supply in the market to be greater than the demand, thus pushing the price to start moving downwards.

Based on the chart, it can also be seen that the structure of the last candle has the potential to form the Evening Star Pattern and if it does, it indicates the start of the Bearish phase. Based on these conditions, then we should not need to enter the market for now because it is too risky, we just need to wait for the market conditions until it completely recovers and wait for the next opportunity because it is better for us. But for “FOMO” investors, they will assume that the market price will move upwards after a bit flat because they are still filled with emotional ambition and greed. Let's just wait!

VeChain (VET)

In the second case I will discuss about the VET coin which is currently ranked 23 with a marketcap value of $ 5,398,533,346.98. Based on the graph, it can be seen that the current VET chart is very different from the AXS chart and it can be said that this is an inversely proportional condition.

Based on the chart, it can be identified that the VET/USDT trading pair is in the “Depression” stage and I predict that it will “Going to Disbelief” after successfully going through the “Deep Depression” a few days ago. Currently the VET market price seems to be starting to move up due to various positive influences that are happening in the market. VET has also been accumulating well since some time ago because a number of whales and smart investors have seen that VET is at a support point and this is the best point for them to accumulate assets.

Based on the chart, it can also be seen that the structure of the last candle has the potential to trigger a Bullish phase which began with the formation of the Bullish Engulfig Pattern a few days ago as a reflecting point that could move the price up to the “Disbelief” stage. If this is actually achieved in the next few days, the potential for a Bullish trend to occur will be even greater and more investors will participate.

Based on these conditions and considering the Support point, this is of course one of the best entry points to buy VET and we should enter the market now because the first train may just be starting. By considering simple things like this, then we can enter the market without being influenced by the sense of "FOMO" and we can become smarter investors of course. But we still use "Stop Loss" to prevent the worst that might happen. Let's just wait!

Q4.) Based on the analysis done in question 3, and the principles learned in class, make the purchase of 1 cryptocurrency in the correct market cycle. The minimum amount of 5USD (mandatory), add screenshots of the operation and the validated account

Based on the explanation and reasons that I have given in question number 3, of the two coins of course I prefer to invest in VET because it is more realistic for now while AXS is very risky. Apart from the reasons I have mentioned above, VET has also proven to be one of the top coins backed by a great team of developers with an extraordinary vision and mission of the project and you can see it on their official website https://www.vechain.org. The project has progressed very well and has been widely accepted. Fundamentally, VET is also very good, based on the site https://coinmarketcap.com VET's fundamental score reaches 795 (Grade A) with a market dominance of 0.34%.

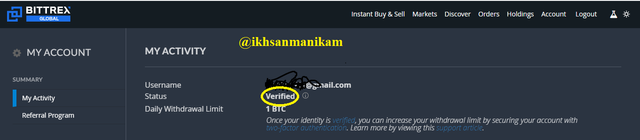

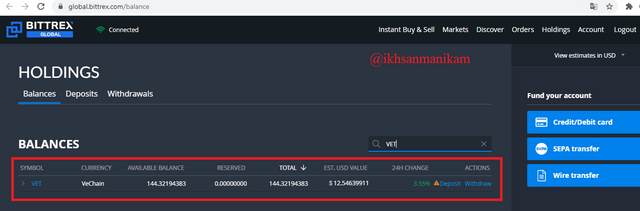

I will invest by buying a number of VET coins using one of my verified trading accounts and the trading account I chose to invest this time is the Bittrex account. Here is proof that my account has been verified on Bittrex Exchange.

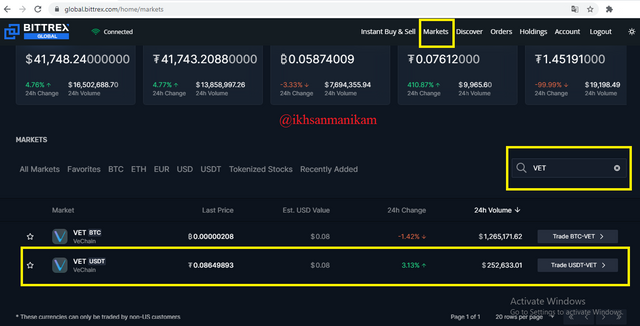

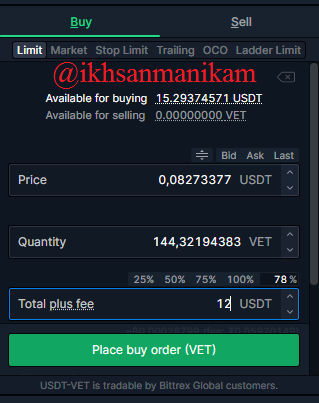

As an example, I will show the process of buying a VET coin using a capital of 12 USDT through the Bittrex Exchanges platform. Here are some simple steps to follow.

- First of all go to the “Markets” page on Bittrex. Then write the word “VET” in the search field and click the “VET/USDT” icon that appears in the search results section.

- Then the VET/USDT trading display will appear as below. In the upper right corner there are "Buy" and "Sell" columns. Select the “Buy” column to make a VET purchase using USDT.

- Fill in the "Buy" column according to your wishes. I made an order not far from the market price using the “Limit Order” feature.

- Because I made an order not far from the market price (0.08273376), my order didn't take long to fill and I finally managed to buy 144.32194383 VET. Here is proof that I have managed to buy it.

FOMO and FUD are two things that are emotional without considering strong technical analysis. These are two things that are not recommended in investing because they can make you a stupid investor with a very bad strategy and you will end up losing big. Therefore, we should always consider fundamental analysis and technical analysis before deciding to start an investment and don't let that emotional ambition influence your decision because it is very risky.

Don't let greed and fear control your ego and be a more patient person when in the market. Remember that the Support zone is the best buy point and the Resistance zone is the best selling point, make sure you always use Stop Loss in every trade you make and be a smart trader!

Hello, @ikhsanmanikam Thank you for participating in Steemit Crypto Academy season 3 week 5.

Thank you for this useful lesson my Professor, and thank you very much for grading me with full of score.

you deserve it mate. great job this week.