Steemit Crypto Academy Season 3 Week 4 | Homework Post for Professor @reminiscence01 - Candlestick Patterns

Good night everyone. Back again on my blog page and tonight I will start this week in the Steemit Crypto Academy community by taking a class mentored by professor @reminiscence01 and in this post I will complete the homework given by the professor. There are three main questions to answer in this homework and let's answer them...

Q1.) In your own words, explain the psychology behind the formation of the following candlestick patterns

A. Bullish engulfing Candlestick pattern

B. Doji Candlestick pattern

C. The Hammer candlestick pattern

D. The morning and evening Star candlestick pattern

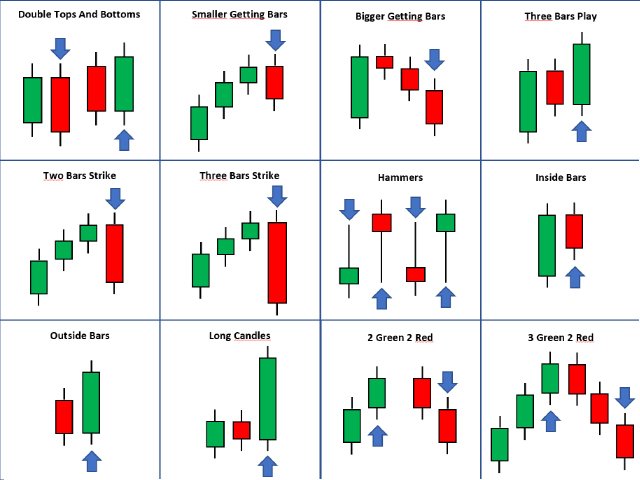

A good reading of Candlestick patterns on a chart is one of the things needed in technical analysis. Therefore, it is important for us to study it, including the market psychology behind it. And all that happens based on the law of supply and demand that occurs in the market. Here are four of the most common types of Candlestick patterns and the psychology behind them.

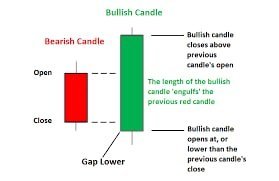

A. Bullish engulfing Candlestick pattern

Characteristic:

- Consists of two candlesticks, the first candlestick is red and the second is green.

- The height of the second candlestick successfully covered the height of the first candlestick.

- The closing point of the second candlestick is above the opening point of the first candlestick.

Psychology:

- Buyers are more dominant in controlling market prices.

- Indicates that a trend reversal will occur, from bearish to bullish.

- Demand is higher than supply so the price will move up.

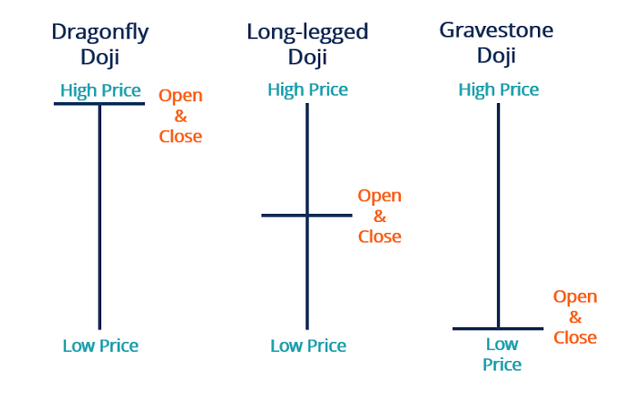

B. Doji Candlestick pattern

Characteristic:

- Consists of one skinny candlestick that looks like a line only.

- The opening and closing prices are the same.

Psychology:

- Indicates that the market is indecisive and doubtful.

- No one is more dominant in controlling market prices, both buyers and sellers.

- Not strong so most sellers and buyers will wait for the next candlestick to form because a reversal may occur.

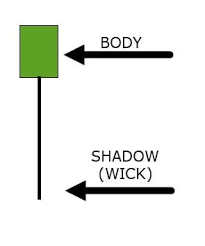

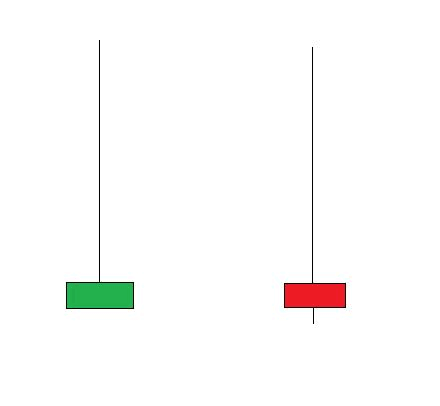

C. The Hammer candlestick pattern

Characteristic:

- Consists of one candlestick that looks like a hammer and looks like a small candlestick with a long tail.

- Opening and closing prices are on a scale that is not too far apart and even almost the same.

Psychology:

- The vertical axis that looks like a long tail indicates that initially the sellers tried to push the price down, but after that the buyers entered and made a strong resistance to the price.

- Buyers are more dominant in controlling market prices.

- If it appears at the support level, this indicates that a strong reversal will occur, from bearish to bullish.

- Demand is higher than supply so the price will move up.

In addition to the Hammer candlestick pattern, there is also an Inverted Hammer candlestick pattern which looks exactly like an inverted Hammer. Based on its psychology, the Inverted Hammer candlestick pattern is also inversely proportional to the Hammer candlestick pattern. At the resistance level, the appearance of the Inverted Hammer candlestick pattern can be a strong indication of a possible reversal, from bullish to bearish.

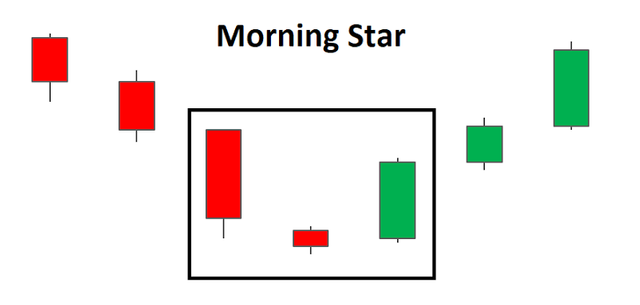

D. The morning and evening star Candlestick pattern

Morning star Candlestick pattern

Characteristic:

- Consists of three candlesticks.

- The first candlestick is a bearish candlestick, the second candlestick is a Doji candlestick, and the third candlestick is a bullish candlestick that engulfs the Doji candlestick behind it.

Psychology:

- Indicates the occurrence of a strong bullish reversal pattern and it actually gets stronger if it forms at a support level.

- In the first candlestick, sellers are more dominant in controlling the market price and the amount of supply is greater than the amount of demand.

- In the second candlestick, the seller started to weaken and was unable to push the price lower, causing a possible reversal from bearish to bullish.

- In the third candlestick, buyers are more dominant in controlling the market price to push the price higher and the amount of demand becomes greater than the amount of supply.

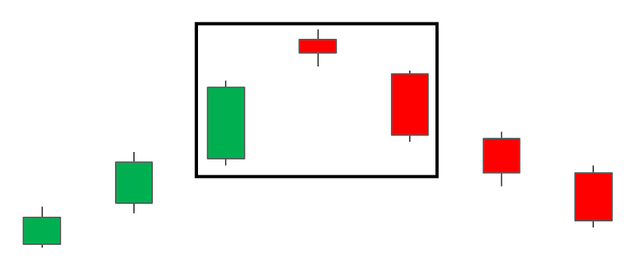

Evening star Candlestick pattern

Characteristic:

- Consists of three candlesticks.

- The first candlestick is a bullish candlestick, the second candlestick is a Doji candlestick, and the third candlestick is a bearish candlestick that engulfs the Doji candlestick behind it.

Psychology:

- Indicates the occurrence of a strong bearish reversal pattern and it actually becomes stronger if it forms at the resistance level.

- In the first candlestick, buyers are more dominant in controlling the market price and the amount of demand is greater than the amount of supply.

- On the second candlestick, buyers started to weaken and were unable to push the price higher, causing a possible reversal from bullish to bearish.

- In the third candlestick, sellers are more dominant in controlling the market price to push the price lower and the quantity supplied is greater than the quantity demanded.

Q2.) Identify these candlestick patterns listed in question one on any cryptocurrency pair chart and explain how price reacted after the formation. (Screenshot your own chart for this exercise)

There are various candlestick patterns that are formed on a chart, including the four types of candlestick patterns that I described above. After looking at several charts of various trading pairs, I finally managed to find the four types of candlestick patterns on the following charts. Let's see...

A. Bullish engulfing Candlestick pattern

After the Bullish engulfing Candlestick pattern occurred, the market became very bullish and there was a very significant price increase. This proves that a trend reversal has actually occurred, from bearish to bullish.

Based on the chart, it can also be seen that the trading volume in the market has increased dramatically. This condition indicates that the demand that occurs in the market is higher than the amount of supply so that prices continue to move up and buyers have greater dominance in controlling market prices.

B. Doji Candlestick pattern

There are two cases that I show in the picture. In the first case, the market experienced a bullish trend after the Doji Candlestick pattern occurred while in the second case it was the other way around and these are two very inverse things.

This proves that the market is in a state of doubt with very low trading volumes and no one dominates the market because most sellers and buyers decide not to enter the market and prefer to monitor the movement of the next candlesticks and then watch the market developments to make a right decision.

C. The Hammer and Inverted Hammer candlestick pattern

Hammer candlestick pattern

After the Hammer candlestick pattern occurs, the market becomes bullish for several weeks afterward. These conditions indicate that sellers are unable to push prices down so that incoming buyers manage to control market prices and make market prices rise so that market conditions change from bearish to bullish. The continued upward movement of prices also indicates that the quantity demand is higher than the supply.

Inverted Hammer candlestick pattern

After the Inverted Hammer candlestick pattern occurred, the market became very bearish due to oversold conditions after the resistance level was reached. These conditions indicate that buyers are no longer able to increase the market price so that the sellers are able to control the market price and make the market price decrease so that the market condition changes from bullish to bearish. The downward movement of prices also indicates that the quantity supplied is higher than the quantity demanded.

D. The morning and evening Star candlestick pattern

Morning Star candlestick pattern

After the occurrence of the Morning Star candlestick pattern, a reversal pattern actually occurred and the market went from bearish to bullish. From the three candlesticks, it can be seen that the changes occurred gradually, at first the seller was still able to control the market price, then the seller's power began to weaken and finally the buyer managed to take control so that the market condition changed from bearish to bullish. Prices continue to move up because the quantity demanded is greater than the quantity supplied.

Evening Star candlestick pattern

The market that was bullish once again becomes bearish after the Evening Star candlestick pattern occurs, the reversal pattern actually occurs and the market changes from bullish to bearish. From the three candlesticks, it can be seen that the changes occurred gradually, at first the buyers were still able to control the market price, then the power of the buyers began to weaken and finally the sellers managed to take control so that the market conditions changed from bullish to bearish. The price continues to move down as the quantity supplied becomes greater than the quantity demanded.

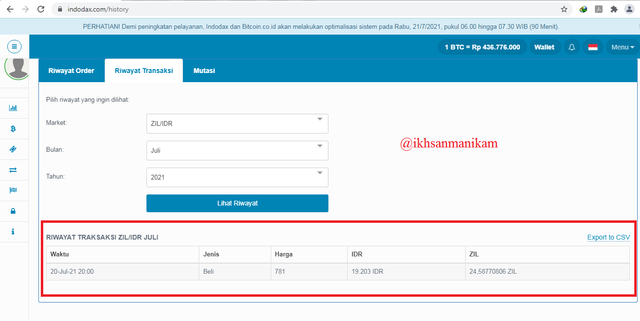

Q3.) Using a demo account, open a trade using any of the Candlestick pattern on any cryptocurrency pair. You can use a lower timeframe for this exercise.(Screenshot your own chart for this exercise)

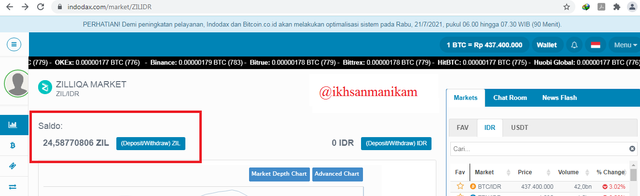

I decided to use the Indodax trading account because it is a trading account that I have used frequently in the last few days. For information, Indodax is one of the crypto exchanges from Indonesia and provides trading pairs using the Rupiah (IDR) currency.

After looking at several charts of various trading pairs, I finally chose to enter the ZIL/IDR trading pair to buy as much as 24.58770806 ZIL using IDR 19,203 capital.

The reason I chose to enter this trade was because I saw the appearance of the Morning Star Candlestick Pattern as shown in the picture above. As we know that the Morning Star Candlestick Pattern is a good pattern in trading because it has a high potential for a reversal pattern from bearish to bullish.

From this lesson, we can increase our knowledge in understanding candlestick patterns that often occur in the market and the market psychology behind it plays a major role in controlling price movements in the market. A good reading of a candlestick pattern is also a very important support in making a technical analysis so that we can make the right trading decisions, the right actions at the right time.

Hello @ikhsanmanikam , I’m glad you participated in the 4th Week of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

I enjoyed reading your work. Thank you for participating in this homework task.

Thank you for your warm review. I really enjoy your class.