Market Maker Concept - Crypto Academy / S4W6 - Homework Post for Professor @reddileep

Assalamualaikum and good morning semuanya, welcome to the Steemit Crypto Academy season 4. Today I will write a post about Market Maker Concept as a homework post for professor @reddileep and this is my eighth post this season. The professor has explained in depth the Market Maker Concept in the learning post that has been shared with this community and now it's time for students to finish the homework that has been given, there are five main questions that must be answered in this homework and I will try to answer them in this post. Let’s go...

Q1.) Define the concept of Market Making in your own words

The market will look more active if there are more traders interacting with each other in the market and this interaction occurs in the process of buying and selling cryptocurrency assets between sellers and buyers of course. When the amount of demand is greater than the supply, the market price will tend to rise and when the amount of supply is greater than the number of requests, the market price will tend to fall. Market prices that move up also indicate that buyers are more dominant in controlling market prices to push market prices higher and when market prices move down then it indicates that sellers are more dominant in controlling market prices to push market prices lower. All parties involved in the market will determine the market conditions of course.

Market makers can be said to be market creators because they play a major role in meeting market liquidity and determining the Bid Ask spread that occurs in the market. A number of institutions with large amounts of funds such as Whales can be considered as Main Market Makers because they can trade and buy cryptocurrency assets with large amounts of liquidity and they can control market conditions at any given time. To create liquidity in the market, Market Makers play an active role in buying all the assets in the supply column and can also sell them in large quantities so that they can place supply limits and demand limits according to their wishes.

With their power, they can manipulate the market to get a number of advantages and sometimes they can make some small traders feel disadvantaged because small traders' money tends to be drawn to big traders. Therefore, it is important for traders to understand and identify their movements by doing some technical analysis of course. All parties involved in the market have one main goal, which is to get as much profit as possible by buying at a lower price and selling at a higher price so that buyers tend to place orders at lower prices and sellers tend to place orders at higher price.

Q2.) Explain the psychology behind Market Maker. (Screenshot Required)

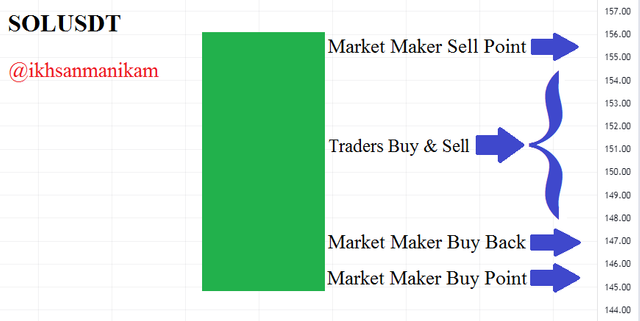

Overall, market psychology plays a big role and greatly influences market behavior of course. Also note that most of the psychology of the market actually tends to repeat itself and it is referred to as the Psychology Market Cycle. Using large funds and liquidity, Market Makers can create Bid Ask Spreads based on their planned bid and ask prices and manipulate the market to get the most of the profits while small traders lose out on the waves they create.

Market Makers are always looking for opportunities to manipulate the market in various ways and strategies. When Market Makers place Buy Orders at prices that tend to be higher they hope to encourage some traders to place Buy Orders at high prices and when all those orders have been executed en masse then the market price will tend to fall and then Market Makers will buy back the assets. the asset at a lower price to earn some profit. For example, a certain asset is sold for $63,000 and then bought back for $55,000 for a profit of $8,000.

Some traders sometimes go in at the wrong time and buy some assets at the peak of their cycle because they don't understand the market and they are afraid of missing the train so they end up getting caught up in FOMO and losing. Market Maker acts as the largest liquidity provider in the market and traders can trade for a number of advantages if they understand the market well and can read the movements made by Market Maker. Therefore, good analysis is also needed in every trade of course.

Market Makers are always trying to trap a number of small traders with the liquidity they create in the market and by doing so they can manipulate the market and influence the market price to take big profits. In the picture it can be seen that the Market Maker managed to dominate the market well based on the false signals displayed by the EMA indicator.

Q3.) Explain the benefits of Market Maker Concept?

- Market Maker is able to provide large liquidity in the market and maintain market liquidity so that the market remains liquid and the transaction process can always be active without the need for long waiting times and even large amounts of transactions can be made.

- With some experience and performing various analyses, traders can take advantage of the market manipulations carried out by Market Makers to take part in taking profits in the market.

- When Market Makers manage to manipulate the market and make the market price rise, they have indirectly succeeded in attracting a number of traders to invest and more and more involved in the market.

- With large liquidity, Market Makers also play a role in maintaining the price of an asset based on the Bid Ask price created so that the asset price does not easily fall into a deep hole.

Q4.) Explain the disadvantages of Market Maker Concept?

- Market Maker manipulates the market as they please and Market Maker's manipulation of the market can cause some traders to lose money, especially inexperienced traders. Indirectly it means that money from small traders can move to big traders and traders need to be aware of this with some analysis of course.

- Market Makers may not provide liquidity on an ongoing basis and when Market Makers see that a market cannot be profitable for them they will withdraw all the liquidity they have so that market conditions may deteriorate.

- When the Market Maker places a large number of Buy Orders and then a number of small traders seem to be able to respond to these conditions quickly then the Market Maker will buy the asset again at a price that tends to be lower causing the asset price to fall and traders need to be aware of this of course.

Q5.) Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

Moving Average (MA)

Moving Average or MA is an indicator that can be used to identify market trends based on the average price movement and traders can configure the MA line according to the strategy used. It is one of the most used indicators by traders and Market Makers will use this indicator to manipulate the market by creating false signals that can trap traders.

Generally traders will combine two MA lines of different lengths to identify the market and when the two lines cross then traders will see certain signals. For example, I will use the 50 MA line and the 100 MA line, when the 50 MA line moves from bottom to top to cross the 100 MA line it is called a Golden Cross which indicates that the trend has the potential to change from bearish to bullish so traders can catch it as a signal. to place a Buy Order while when the 100 MA line moves from bottom to top to cross the 50 MA line it is called a Dead Cross which indicates that the trend has the potential to change from bullish to bearish so traders can catch it as a signal to place a Sell Order.

Relative Strength Index (RSI)

The Relative Strength Index or RSI is a type of stochastic indicator that can identify the market based on two conditions, namely Overbought if the RSI value is above 70 and Oversold if the RSI value is below 30 so that traders can determine the best buy zone and the best sell zone. Overbought indicates that the market has the potential to change from bullish to bearish so traders can catch it as a signal to place a Sell Order while Oversold indicates that the market has the potential to change from bearish to bullish so traders can catch it as a signal to place a Buy Order.

With a large amount of funds, the Market Maker can provide a large liquidity in the market and traders can use it to gain a number of advantages if they are able to understand the market well and read the movements made by the Market Maker. Market makers can manipulate the market in various ways to get as much profit as possible and the movements they make affect the market so much that most of the small traders' money tends to go to the big traders. A number of small traders who lack experience are the main victims of their actions and therefore traders need to identify the market well, especially technically based on a number of technical indicators of course.